Fintech App

Development Services

Development Services

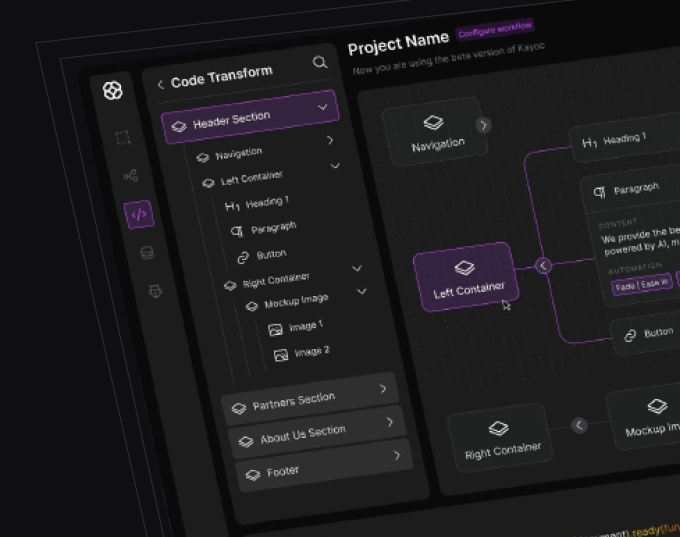

Heimler’s Journey From Blind Spots to Business Clarity – A3logics Unleashes the Power of Live Intelligence

Discover More

Redefining the Future of Lending – Cred Fintech’s Monumental Transformation with A3logics

Discover More

Revolutionizing Credit Risk – How A3logics and Heimler Redefined Trust and Precision with Machine Learning

Discover More

Transforming Risk to Opportunity – A3logics and Heimler Revolutionize Credit Risk Modelling

Discover More

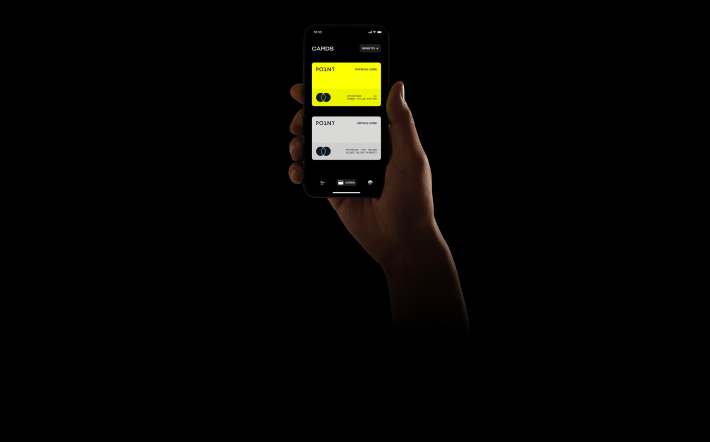

As a leading fintech app development company, we help startups, banks and financial institutes transform digital experiences for customers and modernize operations. We deliver highly secure, scalable and customizable fintech mobile and web applications backed by robust APIs to automate processes and disrupt the industry with new age financial solutions. Let’s connect!

We can assist banks in developing fully featured mobility solutions enabling users to view statements, transfer funds, block cards, pay bills and avail loans on mobile. Our apps facilitate paperless KYC, integrate nodal banking platforms seamlessly for universal account access. Compliant with security standards like ISO, our process adopts Ui/Ux design principles.

We design and develop data-driven insurance mobile applications for policy management, claims intimacy programs and agent community portals. Leveraging digital documentation, insured individuals can self on-board with e-signatures, auto-fetch health records and modify plans on the go. Integrated with IoT, such apps raise wellness engagement via rewards.

Whether personal finance management or robo advising wealth tech, we craft highly intuitive fintech solutions automating planning and tracking across asset classes. APIs help sync transactions from banking and link accounts while interactive dashboards empower hands-free investing through goals-based strategies.

We architect tailor-made solutions leveraging leading technologies – be it blockchain based loyalty programs facilitating rewards redeem, marketplace crowdfunding platforms connecting donors and startups or virtual wealth tech applications powered by augmented analytics of real user portfolios. So, you can have all fintech applications with A3Logics by your side.

Through our expertise creating highly secure payment interfaces, we develop digital wallet apps for seamless P2P transfers, crypto investing and online checkouts. Integrated with industry leaders like Visa, Mastercard, our wallet apps also boost brick and mortar sales on mobile POS optimized for SME acceptance across all segments.

We design paperless stockbroking apps integrated with real-time market APIs, supporting research tools, paper trading and watchlists for seamless investments. You get the apps powered by fundamental/technical analysis and such interfaces allow stock screeners, order placement, portfolio management and investment tracking from anywhere.

With deep know-how of decentralized currencies and networks, we build secure non-custodial as well as custodial crypto exchange and wallet applications enabling diverse trade and investments. Strategically integrated with Payment gateways for on/off ramps, such interfaces guarantee compliance, robust security and scalability.

Our wealth tech offerings include data-backed goals based fully digital robo advising hubs and mobile investment dashboards. Advanced algorithms craft risk-calibrated portfolios which are rebalanced periodically based on changing market dynamics. Such solutions boost client satisfaction through tech enabled active investing.

We, at A3Logics, help you with the architecture of diversified peer-to-peer lending marketplaces facilitating direct loans between individuals and businesses through participatory financing. Integrated with robust risk assessment models, such platforms promote shared financial growth in a compliant digital framework.

Leveraging cutting-edge innovations, we have the required expertise and experience to help financial app development lead with agility.

Distributed ledgers such as blockchain can facilitate decentralized banking apps by streamlining financial activities on a shared record platform without intermediaries. We develop smart contract-driven DeFi solutions on ledgers like Ethereum for bank less finance.

RPA integrated with process automation saves operational costs. We incorporate bots within fintech workflows to extract data from legacy systems, trigger approvals and reconcile accounts freeing resources for value-added tasks.

Besides powering cryptocurrency exchanges, our blockchain experts craft customized ledgers with confidential transactions for trade finance networks, supply chain provenance and regulatory reporting platforms through private/consortium permissioned networks.

With expertise in immersive technologies, we create virtual/mixed reality prototypes to test buy-side advisory and education products. Spatial workspace apps enable remote collaboration and virtual events for the distributed workforce of tomorrow.

Integrating IoT into insurtech applications collects user vital signs from wearables to underwrite policies dynamically based on real-time wellness behavior. Connected object networks also assist lending based on asset performance tracking.

Our data scientists apply self-learning algorithms to derive predictive insights from user profiles and transactions. Intelligent chatbots streamline customer services. Sentiment analytics uncover cross-sell opportunities through goals and feedback analysis.

Infrastructure agility of cloud-native systems accommodates spikes in fintech traffic. Microservice-based containers ensure responsiveness and Serverless cloud capabilities optimize resource utilization for cost efficiency and automated scalability.

We understand the importance of security in the fintech domain. Our developers are experts in implementing robust security features like data encryption, authentication and authorization to protect sensitive financial data.

Our team of Fintech experts comes with experience in developing diverse solutions for this industry. With in-depth knowledge of latest technologies and financial concepts, we can translate strategies into results-driven fintech products.

We craft fintech solutions using flexible frameworks that can seamlessly integrate new features to scale with your evolving needs. Our agile approach also helps accommodate changing market conditions and regulations with ease.

A3logics redesigned the logistics software of a mobile app solutions company’s end customer. The project included creating a comprehensive solution with reporting features, order tracking, and system updating.

“Their distinct flexibility and their strong communication were the project’s main assets.”

A construction technology company hired A3logics for custom software development. They created a construction digital platform that allows users to see project areas, distribute resources, and share data.

“Their software has proven essential in the construction sector.”

A3logics created and implemented a custom logistics software solution for a wealth management platform. This included developing features and integrating real-time tracking and data analytics functionalities.

“They ensured our collaboration went well by providing timely items and responding quickly to our requests.”

A3logics created and executed a personalized Generative AI system that featured chatbots for customer service, prediction algorithms, and AI-powered data analysis tools.

“Their technical expertise and reactivity were excellent.”

A3logics has developed an administrative management system for a health testing company. The product is designed to handle operations such as consultant matching, time reporting, and compensation management.

“The collaborative team we’ve worked with has shown great flexibility and excellent project integration.”

A transportation company hired A3logics to create a custom software program for freight activity tracking. The team also created invoicing tools and a driver-tracking system connected to a dispatch system.

“Their thorough inquiry and engagement with our team reflect their commitment to understanding our requirements.”

Marketing Head & Engagement Manager