Streamline Your Banking Operations Today!

Discover how our custom Banking CRM software services can enhance customer relationships, automate workflows, and boost productivity. Contact us now!

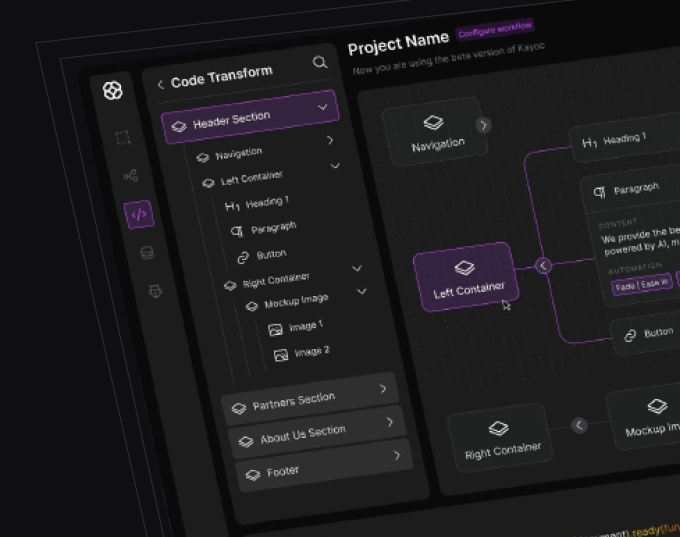

Transform Your Banking Operations with Next-Generation Banking Customer Relationship Management Software Solutions

A3Logics provides end-to-end CRM services that are customized for the banking sector. The systems we build help to improve efficiency, provide better services for customers, and contribute to the success of financial institutions. Our banking CRM software development services help banks track and optimize their relations with clients and facilitate several processes. The team at A3Logics has wide experience in the banking sector, and we provide reliable, sustainable, and compliant CRM solutions that meet the ever-evolving needs of the sector.

Our banking CRM consulting services involve reviewing the existing CRM systems, the business needs of the bank, and the customer experience to develop the best CRM strategies. We develop clear and specific plans that will help in the implementation and the integration with the current systems for future expansion.

We create custom banking CRM solutions from scratch or modify existing platforms to fit the client’s needs. Our team develops effective and secure CRM systems for banking activities based on the most advanced technologies.

ur mobile banking CRM applications enable the staff to view customer data and perform approval of transactions from anywhere. We create applications for iOS and Android operating systems with focus on their responsiveness.

We rigorously test banking CRM applications to ensure they meet security, performance, and reliability requirements. Functional testing, security assessment, and load testing are used to determine the problems that may occur when the software is deployed.

Our migration services help to transition from old and outdated systems to newer and more efficient CRM systems. To ensure that the information remains accurate and consistent during the data processing, we clean, map, and transfer the data.

We offer continuous maintenance, updates, and timely problem-solving for the banking CRM systems that we develop. Our affordable solutions include technical support and system check-up services at regular intervals.

Discover how our custom Banking CRM software services can enhance customer relationships, automate workflows, and boost productivity. Contact us now!

Seamless connectivity with your entire banking technology ecosystem

Internal AI Agent Integrated CRM

Internal AI Agent Integrated CRM

AI Chatbots & Virtual Assistants for Customer Care

AI Chatbots & Virtual Assistants for Customer Care

Robotic Process Automation (RPA)

Robotic Process Automation (RPA)

Automated Data Entry & Processing

Automated Data Entry & Processing

Personalized Marketing Automation

Personalized Marketing Automation

Voice & Sentiment Analysis

Voice & Sentiment Analysis

Hyper Automation Workflows

Hyper Automation Workflows

Smart Dashboards & Reporting

Smart Dashboards & Reporting

The banking CRM solutions with AI agents provide the necessary information to the employees during the customer interaction. We offer automated suggestions and decision-making support to increase efficiency across the organization. Employees do not spend their time searching for the data but focus on the valuable discussions.

In banking CRM, we incorporate virtual assistants that help in responding to common questions and offering account details. Automated support is provided for basic transactions, which helps to decrease the call center load. Complex issues are escalated to human agents where needed seamlessly.

RPA is used to perform routine tasks such as data entry and document handling. Report generation is carried out based on set time intervals and other specifications. This leads to elimination of human error and increases the speed of processing the various tasks.

We use NLP to scrape information from forms and financial statements without the need for manual intervention. The customer data is automatically captured in the CRM system, hence eliminating the possibility of entry errors. This means that our automation reduces the time taken in onboarding processes due to automation of routine tasks.

AI learns the customer’s behavior and the pattern of the transactions to determine the financial needs. We deliver the right offers through the right media at the right time. Recommendations are unique to the financial position and circumstances of a person. Our marketing automation provides tailored recommendations to the customers.

Customer analytics is employed to investigate the level of satisfaction and dissatisfaction of customers and other related concerns. The sentiment analysis in our model identifies areas that require improvement in the service delivery and potential products to offer. These insights can be used to better target the audience in future communications.

.We provide an end-to-end automation solution that combines robotic process automation, machine learning, and business process management. There are complicated banking processes that run automatically and independently with little or no human interaction and at the same time ensure quality services. Our solutions improve loan origination, credit decision-making, and account management through efficient workflows.

Management reports and performance indicators are prepared and presented by our AI analytics for further analysis. We offer forecasts that can predict trends which are likely to affect business outcomes in the future. These are dynamic dashboards that can be customized to fit the user’s role and the type of information that they want to receive.

Heimler’s Journey From Blind Spots to Business Clarity – A3logics Unleashes the Power of Live Intelligence

Discover More

Redefining the Future of Lending – Cred Fintech’s Monumental Transformation with A3logics

Discover More

Revolutionizing Credit Risk – How A3logics and Heimler Redefined Trust and Precision with Machine Learning

Discover More

Transforming Risk to Opportunity – A3logics and Heimler Revolutionize Credit Risk Modelling

Discover More

Leverage the power of market-leading CRM platforms customized for banking requirements

We integrate Zoho CRM to cater to loan processing, accounts management, and financial services. Our industry-specific modules are fully compatible with the existing banking systems and processes. The implementation timeframes are still shorter than in fully customized solutions.

Our banking CRM implementation services for Microsoft Dynamics offer strong customer relationship management and process automation. We have integrated reporting tools that guarantee analytics and compliance with financial regulations. These solutions are highly adaptable to the growth of the business and the changes in the requisite needs.

Salesforce has a large ecosystem that is expanded through AppExchange. We have a deep understanding of how to adapt Financial Services Cloud for banking CRM. Our industry-specific features cater for retail banking, commercial lending and wealth management.

Our Netsuite CRM solutions link accounting and customer relationship solutions. We offer business intelligence solutions through a single integrated banking solution. Mid-sized banks and credit unions are able to take advantage of enterprise-level features.

Comprehensive capabilities designed specifically for banking institutions.

The solutions developed by our team of experts in banking CRM provide 360° views of customers to enable more intimate relationships with the clients. With the help of our automated communication and personalization of the recommendations, the satisfaction and loyalty will rise. Integrated customer experiences across all the touchpoints in the banking industry ensure that the customer’s experience is always smooth.

The integrated processes and automated procedures of our systems minimize the problem of departmentalization and shorten the time required for processing. While the operating cost is reduced, there is an improvement in the productivity of the staff at the organization. Despite the fact that there is little human interaction with the customers, the service quality standards are still high.

Cross-selling is done based on the customer needs and their behavior patterns that are obtained from the data analysis. Your teams can provide the ideal financial products at the right time through preferred channels. This is due to the enhanced targeting and the application of various strategies that are likely to help in the conversion rates.

We carry out automated checks, documentation, and reporting as a way of enforcing compliance to the set regulations. Policies are applied systematically at every point of interaction with the customers in regard to banking regulations. Thus, risk of penalties and reputational damage is reduced by proactive compliance.

We provide the right experience that is digital-first and personalized to the expectations of the new-age customers. The differentiation of services generates market opportunities in the competitive financial markets. Customer relations are built through timely and appropriate communication and offers that appeal to them.

We specialize in custom CRM software solutions tailored for banks and financial institutions. Let’s build a smarter way to manage your customers. Talk to our team today!

Ensuring your CRM adheres to global and regional financial regulations.

To address the concern of cardholder data, we have adopted measures such as encryption, access controls, and network monitoring. We ensure compliance with all the requirements such as having secure communication networks, cardholder data protection, and security code testing.

We implement privacy by design with data minimization, purpose limitation, and user consent management. Customer data protection features give information about the data collected and used in the CRM throughout the process.

Our CRM has provision for audit trails, separation of duties and other financial controls that are mandatory under SOX. We guarantee proper financial reporting with the help of transaction check and approval processes integrated into the software.

We maintain records and have adequate features for supervision of electronic communication to ensure compliance. Customer interaction documentation complies with the financial advisor regulation at all the stages of the system.

We offer rich data inventory and categorization tools to help you find the personal information stored in the CRM. It is a best practice to have a clear privacy policy to inform clients on how their information will be collected and used.

All of our banking CRMs have laid down information security policies, and the regularity of vulnerability assessment. This continuous improvement process guarantees that security controls adapt to the new threats and needs.

Custom-built CRM systems designed for banks to automate operations, enhance customer engagement, and drive growth. Consult now!

Our proven methodology ensures successful implementation and adoption.

Specialized expertise that delivers exceptional results:

The financial technology specialists at A3Logics understand banking operations and regulatory requirements thoroughly. We bring customer expectation insights from extensive experience with various financial institutions. Our industry knowledge ensures relevant solutions for specific banking challenges.

We employ modern technologies to power innovative CRM solutions designed specifically for banking needs. Our AI, machine learning, and cloud infrastructure create competitive advantages. Mobile platforms extend CRM capabilities beyond traditional banking environments.

Our banking CRM software development practices prioritize data protection and regulatory compliance at every stage. We implement multiple security layers to safeguard sensitive customer information from unauthorized access. Regular security updates address emerging threats in the financial sector.

As a leading banking CRM software development company, we use structured approaches to minimize risk and control costs throughout the project lifecycle. Our methodology adapts to each institution’s unique operational requirements. Experience from numerous implementations informs our best practices.

Our relationships extend beyond initial implementation through continuous improvement initiatives. We provide regular updates that incorporate emerging technologies and changing market conditions. Our strategic guidance helps banking clients navigate evolving industry challenges.

Our distributed teams provide cost-effective solutions without quality compromises. We combine onshore client engagement with offshore development resources. We deliver enterprise-quality solutions at competitive price points. Our round-the-clock support options accommodate global operations when needed.

A3logics redesigned the logistics software of a mobile app solutions company’s end customer. The project included creating a comprehensive solution with reporting features, order tracking, and system updating.

“Their distinct flexibility and their strong communication were the project’s main assets.”

A construction technology company hired A3logics for custom software development. They created a construction digital platform that allows users to see project areas, distribute resources, and share data.

“Their software has proven essential in the construction sector.”

A3logics created and implemented a custom logistics software solution for a wealth management platform. This included developing features and integrating real-time tracking and data analytics functionalities.

“They ensured our collaboration went well by providing timely items and responding quickly to our requests.”

A3logics created and executed a personalized Generative AI system that featured chatbots for customer service, prediction algorithms, and AI-powered data analysis tools.

“Their technical expertise and reactivity were excellent.”

A3logics has developed an administrative management system for a health testing company. The product is designed to handle operations such as consultant matching, time reporting, and compensation management.

“The collaborative team we’ve worked with has shown great flexibility and excellent project integration.”

A transportation company hired A3logics to create a custom software program for freight activity tracking. The team also created invoicing tools and a driver-tracking system connected to a dispatch system.

“Their thorough inquiry and engagement with our team reflect their commitment to understanding our requirements.”

Key factors include user count, custom module requirements, integration complexity, data migration volume, and compliance needs. Additional considerations include mobile capabilities, AI implementation, and process automation requirements.

Marketing Head & Engagement Manager