Table of Contents

Over time, healthcare costs have risen dramatically. The average yearly expense of healthcare in 1960 was $150 per person. It is currently closer to $13,000 per person and still rising. Open enrollment or benefits enrollment was announced by the insurance companies to limit liability and keep the insurance pool healthy. In case, open enrollment was allowed all year round people would only buy insurance when they fell ill.

During open enrollment, employees and individuals revisit, evaluate, and modify their current benefits or enroll in a new one. For example, starting enrollment can be an excellent opportunity to review your life insurance policy. You can even start a new health savings and spending account. Or maybe update your health insurance to reflect changes in your changing medical needs. Understanding how open enrollment and EDI solutions are important to making informed decisions, especially about your insurance coverage and benefits. Below, read more about how open enrollment and EDI solutions work.

What is open enrollment?

Each year during employee benefits open enrollment, workers in small businesses are provided an opportunity to: renew, change, or sign up for group health insurance for the upcoming year. This is an important time for employers and employees to assess and understand the good number of health benefit options available and to make wise, healthy, personal, and far-seeing choices so that the plans they opt for fulfill their obligations and requirements.

It is the responsibility of small business owners to convey all necessary information about the health insurance plans they offer and their changes, options, and respective costs during Open enrollment for health benefits. Workers are then in a position to study their options, ask questions, and make the necessary changes in their coverage.

Usually, this is an annual event whereby workers have a chance to choose. Mostly, the days are limited, for example, one or two weeks, to make a selection. Here, small business owners need to ensure that their staff know the open enrollment period, have enough information to make informed decisions, and have tools and support to take them through the process.

Types of Open Enrollment

Open enrollment options are mainly of two types- Active open enrollment and passive enrollment. Let’s discuss the two options in depth-

Active Open Enrollment

Employees who participate in an active enrollment program are required to actively complete the enrollment process annually and choose to accept or decline all available benefits. Employers who are making benefits, open enrollment announcements, or making modifications to their current plans should always use active enrollment. Using an active benefit enrollment platform gives you the chance to share important information while also encouraging staff members to verify that beneficiary and dependent information, as well as demographic data, are current.

Active Enrollment Benefits

- Employees are required under active enrollment to examine and choose their benefits again at least once a year. This makes it possible to guarantee that each employee’s benefit choices are suitably adapted to their current circumstances.

- Employers now have a greater chance to inform their staff about new benefit alternatives and plan modifications. Employees are more inclined to analyze and reevaluate their alternatives if their business is implementing something like an HDHP with an HSA.

- Opportunities to enhance the accuracy of your data, including emergency contact details, beneficiaries, and eligible dependents, are offered by an active enrollment strategy. For instance, you might find that dependents, ex-spouses, or other people are no longer eligible for benefits under your plan while examining eligible dependents.

- Employees who completed an active enrollment were three to five times more likely to choose voluntary benefits, according to a MetLife survey.

- A participant who is actively enrolled has a higher likelihood of discontinuing unnecessary perks and switching to more desirable ones.

- Additionally, active Open enrollment options guarantee that benefits that are legally ineligible for passive treatment are not disregarded. Contributions to 401(k)s and HSAs are modifiable during the plan year, however, Dependent Care and Medical FSAs are not eligible for rollover elections or modifications because they are “use-it-or-lose-it” accounts.

Drawbacks to Enrolling Actively

- HR and benefits teams must invest more time and energy in active enrollments. Small teams or organizations with little funding may find this difficult.

- Employees risk losing their coverage for the entire year if they fail to make their benefit elections during employee benefits open enrollment.

Passive Open Enrollment

Employers use passive enrollment, also known as auto-enrollment, as a simplified approach to benefits enrollment to guarantee their workers’ continuous coverage of benefits. By automatically enrolling employees into their current plans or the closest equivalent, this approach removes the possibility that coverage may lapse as a result of non-participation during the enrollment period. Although this model is straightforward, it is important to recognize that there could be a drawback: workers may fail to update their personal information, consider changing plans, or improve their knowledge of the open enrollment process. These mistakes may cause issues along the road.

Pros of Passive Enrollment

- It’s just simpler for both the business and the employee to use passive enrollment. By checking a “re-selecting” box, workers relieve employers of some administrative work.

- It saves employees the trouble of evaluating their plan options and benefits again by allowing them to roll over their benefits from the prior year.

- Enrolling staff members automatically in choices from the prior year can help keep them from losing insurance due to inactivity.

- All parties save time by using passive open enrollment options.

Cons of Passive Enrollment

- If vital employee data is not regularly reviewed, it can quickly become out of date. Examples of this type of data include personal information and benefit information.

- Changes to plans, benefits, and new initiatives are frequently disregarded. This can lead to far lower participation rates in HSAs, voluntary products, and high-deductible plans.

- Workers are less likely to update and reevaluate their coverage in light of their changing demands, and they are also less inclined to discontinue coverage that they may no longer require.

Are you confused about selecting the best open enrollment option?

Reach out to A3Logics. Our experts will help you select a suitable open-enrollment option

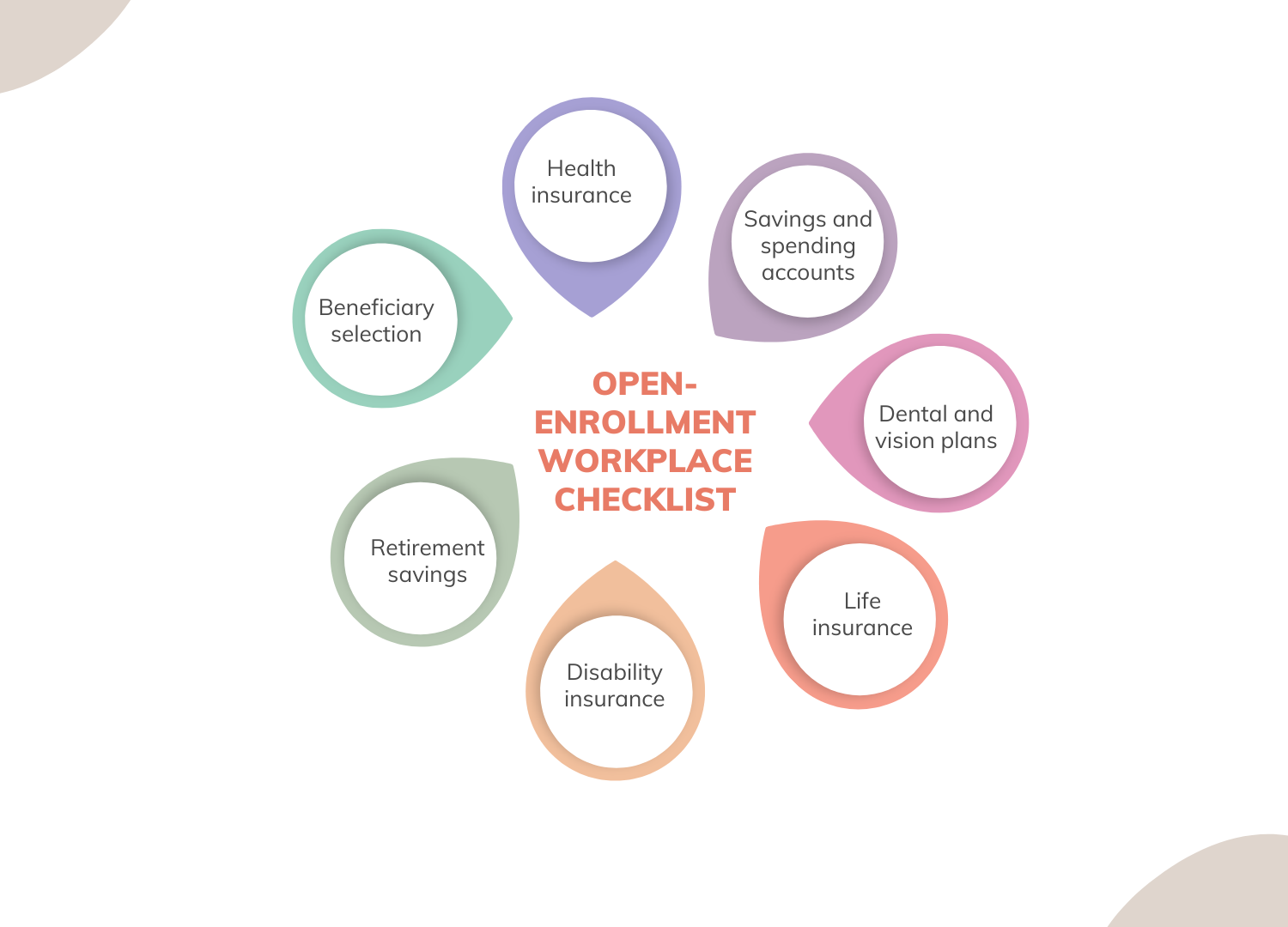

What is included in Open Enrollment?

As many as 80% of all Americans spend less than an hour researching one of their most important annual decisions: their health coverage. About 90% of Americans will choose the very same health plan they had the prior year during open enrollment. No matter if their health has changed; because after all, man does not like hassles. During open enrollment options, you can select individual options. Specifically for health; dental; and vision insurance that best suits your needs. You may also want to take advantage of a tax-benefit opportunity to save through a flexible spending account or a health savings account.

Health care

You can select a package of health insurance claims that meets the needs of you and your family during open enrollment. The packages may consist of the following:

A Preferred Provider Organization is an arrangement. Under this, a third party, such as an employee benefit enrollment company, makes arrangements with a network of health providers. The aim here is to furnish care at a discount to you, the insured. This means that you pay nothing when you visit a provider within the network. However, you still get coverage when you visit an out-of-network provider.

Traditional health insurance claims typically have higher premiums, full coverage for preventive care, and lower deductibles and out-of-pocket maximums that increase annually and are required by the IRS. Compared to a High-Deductible Health Plan or “HDHP,” these usually carry higher premiums. They pair with a health savings account to cut expenses and offer even more tax advantages.

HMOs are types of health plans with a smaller network of providers but with lower deductibles and premiums. Commonly, an HMO will have a network of providers confined to a single organization or even geographic area.

Dental and Vision

You will also have the opportunity to select supplementary plans such as dental and vision. Like health insurance claims, you can likely select among a large number of plans with various associated costs and those costs will buy you into different provider networks and levels of service. Vision plans may include an allowance for new glasses or contact lenses, perhaps up to an annual maximum.

You can save quite a sum of tax-free money in HSAs or FSAs, two tax-advantaged accounts, to pay for allowances you usually spend on medical costs. They both help you save on the cost of medical care, but their prerequisites are different.

HSA

You can use a financial account that is tax-exempt to save money for and pay for qualified medical expenses. A high deductible health plan is a requirement for qualification to use this type of account or this term account. And because HSAs are portable and funds will never expire, customers can take them with them when they change jobs and employee benefit enrollment companies, while the rest of the amount is carried forward every year. The cap on annual HSA contributions is determined by the IRS.

FSA

A Flexible Spending Account is offered by your employer, and it can be used with any health plan. For medical supplies, medical expenses, and other services, workers can pre-tax money from paychecks into the accounts to pay for those. These three types differ in their uses:

- FSA for Healthcare

- FSA for Dependent Care

- Specialized FSA

Employees have a calendar year to use their FSA funds. Annual contribution caps for FSAs are set by the IRS.

Disability Insurance

The most prevalent disability plans sponsored by employers are short-term disability and long-term disability; however, disability insurance covers also paid leave, workers’ compensation insurance, and even long-term care insurance.

Long-term care health insurance claims are intended to pay for chronic illness and disabilities treated outside of a hospital in which an individual cannot care for himself anymore because of the protracted nature of his sickness or disability.

Critical illness and supplemental policies pay a stated sum upon diagnosis of an illness as defined in the health insurance claims. These are commonly called “cancer” policies but may include such things as kidney disease, heart attack, stroke, and others.

The statutory workers’ compensation plan covers virtually all employees who are injured on the job. It also covers those who suffer from an occupational illness.

Life Insurance

While several types may be available, group-term life insurance is the most common type provided. Particularly as an employee benefits enrollment by employers. Term insurance is life insurance that only applies for a pre-decided period. If it is offered through an employer’s plan, it is usually continued for as long as the person remains employed.

Most group-term life insurance policies specify coverage based on a multiple of an employee’s salary or some other defined amount. In some cases, employees can purchase life insurance in increments based on age.

Apart from the Group life assurance, you can give the following other insurance:

Group accidental dismemberment and death

Known throughout the industry as “AD&D,” this benefits enrollment pays out to an employee’s beneficiary. Especially in the event of a death or loss of limb function due to an accident. For example, losing one arm and leg would lead to a portion of benefits being paid out for this coverage.

Accident insurance for business trips.

This insurance pays if an employee passes away while on business travels.

Split-dollar life insurance

When an employee passes away, this life insurance pays the beneficiary. However, it also reimburses the company for the premiums paid. The health insurance claims have a significant investment component and are funded by both the business and the employee.

Mental Health Benefits

According to a WebMD survey on employee wellbeing from 2021, 60% of respondents stated their companies were not providing them with “enough support towards good mental health.”

Of those surveyed, seventy percent stated they would like to have on-demand access to coaches or programs to deal with stress, anxiety, and depression. Additionally, more than fifty percent of them stated they require direct assistance and direction when it comes to taking care of an elderly relative or a young child.

Benefits for mental health insurance claims to take into account are:

An element of telemedicine, apps, and/or online addiction and substance abuse treatment programs

Employee Assistance Programs (EAP): Provides free, private assessments, brief counseling, referrals, and follow-up services to staff members experiencing personal or professional issues. EAPs can also provide legal services, help with identity theft restoration, eldercare assessments, childcare support, and other services.

Chosen Benefits

Services that an employer provides at a reduced group cost that are wholly or partially funded by the employee are known as voluntary benefits enrollment. Among the voluntary perks are:

- Programs for Employee Assistance (EAPs)

- Programs for wellness

- Benefits of financial wellness include budgeting, retirement planning, financial planning, and investment guidance.

- Pet health insurance

- Insurance against travel accidents

- Adaptable work schedule and locales

Retirement Benefits

Since retirement plans can frequently be changed year-round, retirement benefits enrollment is frequently disregarded during open enrollment season. However, now is a good time to remind staff members about their retirement planning initiatives. Whether it is creating a 401(k) plan or raising pre-tax contributions. Moreover, employees over 50 are eligible to make catch-up contributions up to a specific annual maximum.

Benefits of Registering for Benefits

Employee benefits open enrollment has several benefits for both businesses and employees.

Regarding Employers

These are a few competitive benefits for employees:

Recruitment and retention of employees

Offering extensive perks can help a business attract new hires and keep its present workforce.

Strategies for attracting and keeping talent may take competitive advantages into account.

Morale and happiness among employees

Raising job satisfaction and morale among employees can be achieved by offering a range of benefits enrollment that are customized to meet their needs. Positive work environments and more employee productivity could result from this.

Well-being and health

A healthier workforce can be facilitated by wellness initiatives and health insurance claims. Healthy workers might use fewer sick days, be more attentive to their jobs, and produce more.

Benefits of taxes

Contributions to health savings accounts and retirement plans are two examples of employee benefits enrollment that may provide tax benefits to both companies and employees.

Adherence to the law

Employers can fulfill their legal responsibilities and stay out of trouble by providing benefits enrollment that go with rules and laws.

An edge over competitors

A comprehensive benefits enrollment company gives firms a competitive advantage in the labor market. It sets them apart from rivals and establishes them as the employers of choice.

For Employees

In this section, we will take a look at the various benefits that employees can draw from open enrollment options.

Health insurance

Having health insurance claims makes it easier for workers to control the costs of medical care. These include doctor visits, prescription drugs, and other preventative care.

Monetary stability

Benefits like retirement plans, life insurance, and disability insurance allow employees to be future-ready. It also enables them to be in a more financially secure state.

Work-life balance

Other benefits of enrollment software that enhance the welfare of employees are paid time off, flexible scheduling, and options for family leave. These facilitate work-life balance.

Career Advancement

Employees’ professional growth is supported by educational aid programs and training possibilities, which improve their abilities and career prospects.

Savings on taxes

Employees may receive tax benefits from some benefits, including contributions to flexible spending accounts and retirement plans, which could result in tax savings.

Programs for employee assistance (EAPs)

EAPs provide tools for handling problems in one’s personal and professional life. While it helps in advancing mental health and wellbeing.

Customization

Through benefit enrollment, employees can customize their benefits to meet their specific needs and make sure their coverage is appropriate for their situation.

How to select a platform for enrolment in employee benefits?

Employers and employees may be impacted by the choice of employee benefits enrollment platforms. The following important factors will assist you in choosing the best configuration for your company:

Recognize your needs

Think about things like your workforce size, the intricacy of your benefits enrollment packages, and any particular requirements to pinpoint your organization’s needs and goals.

Usability

Select a platform that is easy to use for both staff members and administrators. The enrolling procedure must be simple, straightforward, and accompanied by clear instructions.

Combining HR systems with integration

Make sure that the benefits enrollment platform integrates seamlessly with the time and attendance, payroll, and other HR administration tools that you currently have in place. Processes can be made more efficient and require less manual data entry thanks to this integration.

Options for customization

Seek a platform that enables benefit plan modification according to the various needs of your employees. There should be a range of plan alternatives and coverage levels available to employees.

Mobility on a mobile device

Think about using a mobile-friendly platform in the mobile-first world of today. This enables staff members to use tablets, or cellphones to access and finish the enrollment process.

Features of communication

Select a platform that makes it easier for managers and staff to communicate effectively. Email notifications, alerts, and reminders regarding crucial enrollment dates are examples of communication tools.

Instruments for decision support

Certain benefits enrollment software include decision support tools to assist employees in making well-informed decisions regarding benefits. Calculators, learning materials, and interactive instructions are a few examples of these tools.

Observance and safety

Verify that the benefits enrollment platform complies with all applicable laws, rules, and industry standards. These should include those about data security and privacy. Sensitive employee data should be safeguarded by security procedures.

Analytics and Reporting

Seek a platform with extensive analytics and reporting capabilities. HR professionals can use this to analyze data, keep an eye on enrollment trends, and decide which benefits to offer.

The ability to scale

Select a benefits enrollment company that can expand to accommodate your company’s expansion. It ought to adjust to shifting benefit requirements and workforce fluctuations.

Reputation and assistance of vendors

Examine reviews, testimonials, and client references to learn more about the reputation of a seller of benefits enrollment platforms. To ensure you make the right choice, assess the degree of training and customer service provided by the vendor.

Expense factors

Recognize the platform’s pricing structure, taking into account setup, subscription, and other fees, as well as the total cost and return on investment.

Training and assistance for employees

Assess the platform’s capacity to offer personnel assistance and instructional materials throughout the enrollment process. FAQs, guides, and live assistance services are a few examples of this.

Mechanism of feedback

Select employee benefit enrollment companies that enable surveys and staff feedback. This can assist in evaluating the enrollment process’s efficacy and pinpointing areas in need of development.

Conclusion

To human resources professionals, the timing and conditions of open enrollment options can be a really busy time of the year. However, the planner can make the process much easier by doing the preparatory work year-round. This involves speaking with plan administrators, researching other companies’ plan options, surveying employees properly, and providing proper materials and communication.

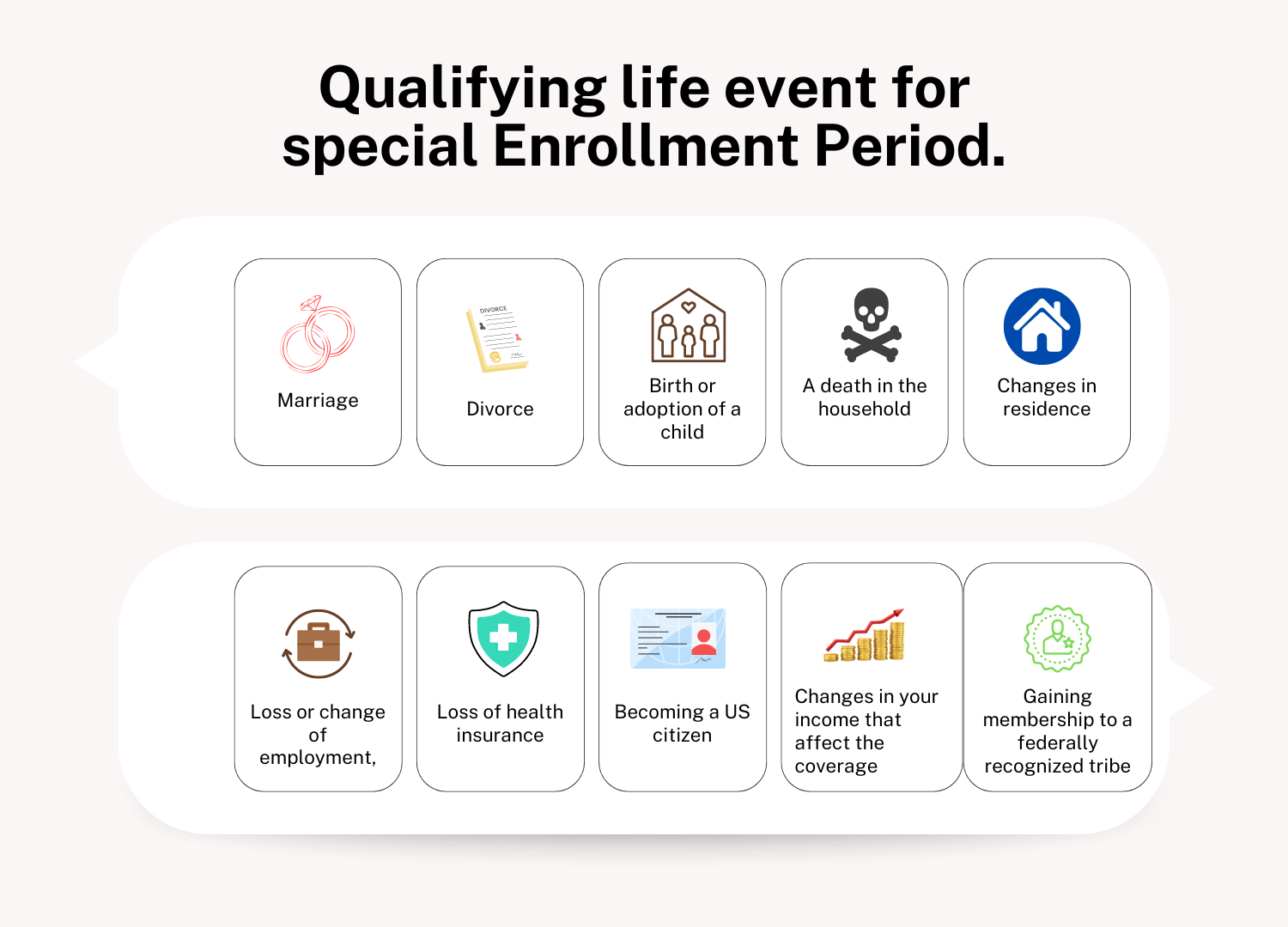

Unless you have a qualifying event, an Open Enrollment may be your only opportunity to enroll in a health plan or make changes. If you miss the open enrollment period and do not have health insurance, then short-term health plans or healthcare-sharing ministries may be able to hold you over until you can enroll in an ACA-compliant health plan. Medicaid and CHIP are additional open enrollment options if you qualify. They are always open for registration.