With the introduction of AI in crypto trading, the pace, as well as the accuracy levels of crypto traders, have become 10 times more powerful. If you, too, want to deploy AI in your crypto trading venture, then it is the right time to invest in an AI crypto trading bot. Here, you will get complete guidance on how to start.

Table of Contents

What Is an AI Crypto Trading Bot?

Crypto AI trading bot is a tool, smart enough to fully automate your crypto trading with complete efficiency and intuitiveness. It is powered by AI, which makes it able to analyze a vast amount of data, recognize its repetitive patterns, as well as execute trading actions through pre-fed criteria and its own learning capabilities.

This integration of AI in the crypto trading bots is making crypto trading even more advanced. These unique trading bots take the current market patterns and constantly test them with the historical data they have for strategizing their next trading move. Also, they continuously monitor and modify their trading operations with time and this dynamic adjustment significantly improves the chances of profitability-grabbing opportunities.

The Next Big Thing in AI Crypto Trading Bots

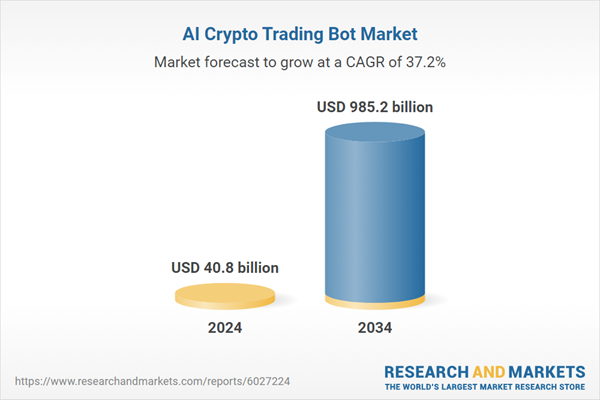

The global crypto trading bot development company market value will rise at an unthinkable 37.2% CAGR rate and reach 985.2 billion USD by the year 2034. The jump is unthinkable, as in 2024, the market size was only 40.8 billion USD. AI crypto coins like Dawgz AI are already making remarkable records. The next big thing you can expect can be something related to quantum computing or real-time sentiment analysis, etc.

Why Should You Use an AI Crypto Trading Bot?

Using an AI crypto trading bot thus can genuinely improve your overall trading experience. The best thing about these bots is that by using them, you can fully keep your emotions and, therefore, reckless decisions aside and trade smartly with knowledge and precision.

Nonetheless, by using these AI bots, you can handle multiple trades at a time with constant revisions of trading strategies. The first-paced market of cryptocurrency demands such an insightful and instant move. Therefore, without timely adapting and upgrading your crypto trading with AI bots you may fall behind this rapid race.

How Does an AI Crypto Trading Bot Work?

These AI bots typically use algorithms as well as machine learning abilities to scrutinize the preexisting market data to make insightful predictions and execute trades accordingly. Apart from the historical data and ongoing market trends, these bots can even take notes from news sources to determine the most effective trading action.

Here, the users set the rules according to their preferences and risk-taking abilities. The user can also help the bot in strategizing initially and adjusting its trading actions with the evolving market conditions. These well-programmed bots then provide maximum returns to the users by minimizing the chances of loss as well as the frequency of manual interventions.

Choosing the Right Programming Language for Your AI Crypto Trading Bot

The efficiency of the crypto trading bot, however, depends a lot on the programming language you choose. Mainly a crypto bot trading platform uses the most popular programming languages like Python, Java, or C++.

Among these, Python is still the best choice among developers because of its ease of use and variety of tools. Python is widely regarded as one of the best languages for building such trading bots, owing to its simplicity, vast libraries (such as Pandas, NumPy, and TensorFlow), and such an active community globally.

Essential Features Your AI Crypto Trading Bot Must Have

If you have some interest in developing your trading bot for cryptocurrency by now, it’s time to understand the features that you must include. The below features together will elevate the performance of your AI bot and make it stand out in the highly competitive crypto trading field;

Real-time Market Analysis

For any crypto trading bot, market data analysis in real-time is crucial. The crypto market keeps on fluctuating, with prices altering in milliseconds. With a bot that possesses real-time market analysis, you can decide on opportunities when they arise, and you will be in a position to make timely and profitable decisions. This is crucial in decision-making and not losing opportunities.

Automated Trading Execution

A crypto AI bot executes trades automatically, making buy or sell transactions depending on predefined strategies. Automated trading ensures efficiency and consistency without human involvement. This eliminates human mistakes and emotional influence in trading and guarantees the trades are executed as per the defined plan irrespective of market conditions or time.

Risk Management Protocols

A suitable risk management protocol should be used in crypto trading as due to the uncertainty the market may turn very volatile. The features of risk management would include stop-loss orders, take-profit limits, as well as position sizing strategies. Using these features in the application of the bot confirms that losses are minimized when it goes against the market and gain maximization in cases of positive trends.

Backtesting and Performance Evaluation

It is essential to test the performance of your AI Crypto Trading Bot using backtesting prior to deploying it. Backtesting is conducted by executing the bot on historical data to subject the bot to varied market conditions for testing purposes. Backtesting ensures fine-tuning of strategies and algorithm adjustments in order to enhance the possibilities of profitability. On the other hand, ongoing monitoring of performance is critical to achieve efficiency optimization in the bot and match evolving market trends.

Multi-Exchange Integration

Crypto exchanges are diversified on different platforms, and being able to trade on other platforms is an advantage. A Crypto AI Trading Bot can execute multiple exchanges, and it gives you leverage on various prices and liquidity. It also opens the door to diversification of trading strategy and exposure to numerous cryptocurrencies with no representation on one platform.

Customizable Trading Strategies

All the traders like to follow their own way of trading in the market. The crypto trading bot has to be adaptive in terms of this individualized strategy. You might be a scalper, swing trader, or long-term investor. But your bot has to be capable enough to trade in every other way that you choose. Strategies have to be tailored so that they assist in boosting profit according to one’s risk appetite and market situation.

High-Frequency Trading (HFT) Capabilities

High-frequency trading (HFT) is a method of making a gigantic number of orders within fractions of a second. When training HFT, your AI crypto trading bot will need to analyze and make trades at an extremely high rate. This is necessary for tapping infinitesimal price fluctuations that continue to occur in the crypto markets.

Cross-Market Analysis

A very efficient crypto trading bot should also be capable of scanning several markets at once. This means learning about a variety of cryptocurrencies, their rates of exchange, and trading pairs at the same time. Cross-market analysis gives a broader view and can be used to spot arbitrage opportunities where assets can be bought in one market at a lower price and sold in another market at a higher price.

Sentiment Analysis & News Integration

The cryptocurrency market is affected by news and sentiment. The ideal Crypto Bot Trading Platform would include sentiment analysis so that it can analyze the market mood. With social media trend analysis, news feeds, and public opinion, the bot can make wiser decisions. It enables it to capitalize on profit from market movement caused by social sentiment or news.

Multi-Layer Security & Encryption

Security is paramount while handling cryptocurrency exchange. Your AI crypto trading bot must incorporate multi-layer security, from encryption mechanisms to user data and secure API keys for exchange communication. Adding two-factor authentication (2FA) could also provide an added layer of protection, guarding your wealth from unauthorized access.

Smart Arbitrage Trading

Arbitrage trading takes advantage of differences in prices across exchanges. Assume you can purchase an asset for less on one exchange and sell it for more on another. Your AI Bot should be able to monitor prices across exchanges and automatically trade whenever there is an arbitrage situation. This functionality will then help you take the maximum potential of profit by grabbing advantages from minor price discrepancies across markets.

Step-by-Step Guide to Develop an AI Crypto Trading Bot

Now that you understand what features you want during your cryptocurrency trading bot development, it is just the right time to go deep inside the exact development process. Here is the step-by-step guide that you can follow;

Step 1: Define Your Trading Strategy

The first step of your AI crypto bot development will be not with the technicalities but with sheer brainstorming. You will need to define your trading strategy well to the developer, and for this, you need to ask a few questions yourself. What type of trader are you, or do you want to focus on short-term gains or long-term benefits? Does scalping excite you, or do you want to adopt it to mean reversion? Based on the answers to these questions, set your strategy, and this will be the key to training the bot.

Step 2: Choose a Programming Language and Development Environment

The next step is to select the most suitable programming language for your AI bot. You can go with the flow to choose Python due to its simplicity and extensive library. However, you can also take a mix of technologies for your unique crypto bot design. For this, you can rely on JavaScript, C, or even Perl, depending on the complexity level of your bot. Moreover, the development environment needs to be favorable with the correct set of tools that support real-time data collection, analysis, and integration.

Step 3: Gather and Preprocess Data

Data is the bloodstream of any AI bot. Without significant data backing, you cannot simply rely on the decisions of these bots. For this, you will have to feed both the past data relevant to crypto trading as well as the most recent trading trends to your model. You can get help from Kraken, Binance, Coinbase, and other such APIs to source real-time data for your AI bot. However, before feeding data, make sure to keep it unbiased and simple for the bot to analyze

Step 4: Build Your AI Model

There are basically three types of AI models, and you can choose anyone out of them. It can be the simpler decision tree model, the deep learning neural network model, or the most advanced reinforcement learning model. If you have to make simple operations using the bot, go with the first option. But for analyzing market sentiment or for constant self-refinement, you will need advanced models. As the cryptocurrency field itself is so advanced, you cannot simply go without choosing the advanced AI models.

Step 5: Integrate with a Crypto Exchange API

For the ultimate execution of trades, your bot needs to connect with a cryptocurrency exchange. This alone happens by the exchange of APIs. The exchanges have their own API documentation. They provide information about the endpoints to place an order or retrieve your balances. So, API authentication is crucial, and while you do so, make sure you do it with secure API keys.

Step 6: Implement Risk Management

Implementing risk management protocols is another vital step as you deploy your bot for real-world crypto trading. Use the varied risk management tools and set your stop-loss levels, define your position size, and also decide to tick on maximum drawdowns, as this will limit the chances of your potential losses significantly. Your settings on risk management criteria will help the bot to trade within your risk tolerance.

Step 7: Backtest and Optimize Your Bot

Backtesting is another crucial step that you must take before deploying your bot for dealing with crypto. Backtest simply means to run the bot against the historical market data and check its efficiency under various market conditions. After analyzing the results and their efficiency, therefore, you can identify areas of improvement and modify your strategy, if needed.

Step 8: Deploy and Monitor Your Bot

Tie up with a reputable and uprising AI development company to complete the above steps of your AI bot development. Once it is thoroughly tested, deploy it for live-action. However, you will have to monitor its performance regularly, especially in the initial stage. Make the necessary adjustments to make the bot even stronger.

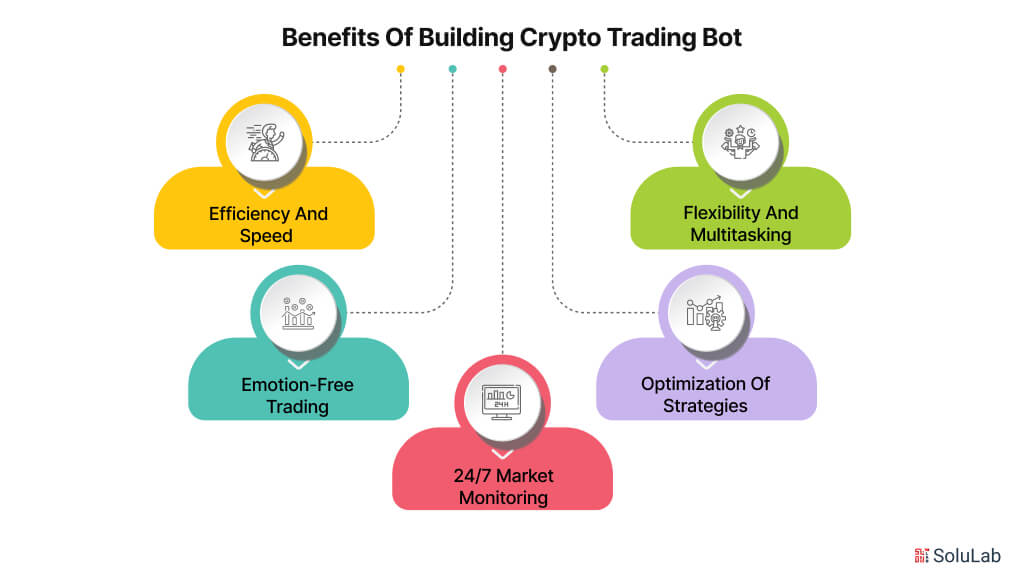

Key Benefits of Building an AI Crypto Trading Bot

There are several benefits of letting the bot take over your trading decisions. Let’s discuss the most prominent among them here;

- Bots can seamlessly operate diverse trading operations at a time, saving you from the constant monitoring.

- Bots make decisions based on facts, not on the basis of emotions or greed.

- With AI bots, you can venture into trading even when you are sleeping. Bots make sure you never miss a chance at profit.

How is A3Logics Developing Cutting-Edge Crypto Trading Bots with AI?

All set to hit the floor of crypto trading with your own understanding of AI bots? Trust A3Logics as it is the most efficient enterprise AI chatbot development company. They have a specialized team to develop the most advanced AI bots for crypto trading. With more than 20 years of experience in custom tech solutions 250 plus skilled enthusiasts, they can offer you the most intuitive AI bot and blockchain development services for fully automating your trading process.

Conclusion

Developing your own AI crypto trading bot can be an exciting as well as rewarding venture. With the support of the right crypto trading bot development company, you can aspire to get the right set of tools, features, as well as futuristic strategies to develop your custom AI bot. So, follow the steps-by-step guide and make your personal AI-powered crypto bot and maximize your trading benefits.