Table of Contents

In the past, the investment industry was heavily reliant on the manual process and intuition. Analysts trawled through market reports and spreadsheets to make decisions based on past data. However, today, the landscape of investing has drastically changed. The explosion of live data generated by world events and rapid digital communication has increased the pace of market activity and complexity. As a result, conventional methods struggle to keep pace with the velocity and quantity of data, creating a significant challenge for investors.

Incorporating AI-driven strategies is changing the way that investing decisions are made. AI algorithms can handle massive data sets from multiple sources at an unprecedented rate and accuracy. They also can analyze vast volumes of structured and unstructured information, giving an overall view of the market.

AI investing could automate complex processes, decrease errors, and provide insights beyond conventional strategies. This change allows for better-informed and strategic investment decisions. It increases the capacity to adapt to changes in the market’s dynamics immediately. Using AI to manage your investments is essential if you want to improve your organization’s efficiency and capitalize on new opportunities.

This blog explores AI’s significance for investment management and will discuss the top use cases of AI in investing.

Key Statistics of AI for Investment Analysis

AI is rapidly transforming the investment landscape, with many professionals in the investment industry adopting it for strategy development and research. From quantitative-focused investors to broader wealth management sectors, AI’s influence continues to grow.

- 90% of managers are either currently using or planning to use AI in their investment processes. 54% of managers have already incorporated AI, while 37% plan to adopt it soon.

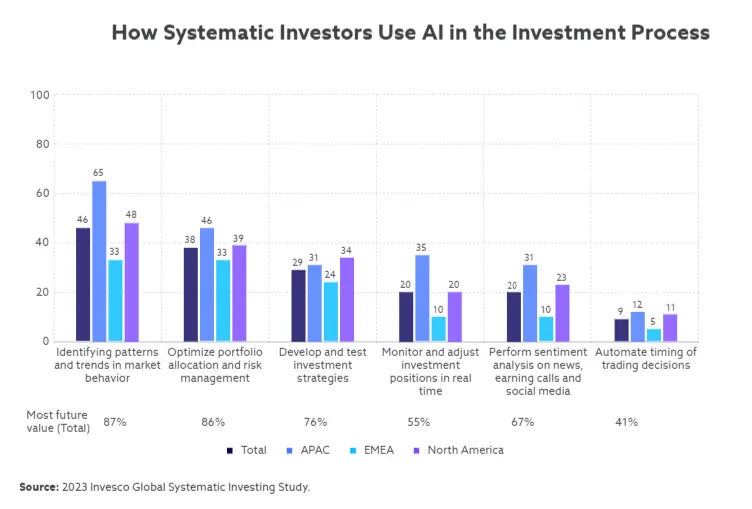

- Only 29% of systematic investors currently use AI to develop and test investment strategies, but over 75% anticipate using AI for this purpose in the near future.

- Analysts predict a CAGR of 35.6% from 2021 to 2025, signaling continued expansion in AI’s role within wealth management.

AI for Investment Management: Use Cases

More and more firms are recognizing the advantages of artificial intelligence, and the incorporation of AI into investment management is becoming more common. So, with that in mind, in this section we will explore the popular use cases of AI in investing, so let’s have a look.

Predictive Analytics for Stock Market Trends

AI helps investment managers identify potential trends in the stock market. It can identify patterns in data using machine learning algorithms and massive datasets, including market behavior, historical data analysis, and other economic indicators. To predict future prices, these models constantly monitor real-time data, including news articles, earnings announcements, and geopolitical developments.

AI provides a radical new way of processing large volumes of information quickly and accurately. It offers investors a competitive advantage in predicting stock market trends by leading to more informed, data-driven decision-making than the investing community has ever had access to. It provides this predictive capability to help mitigate risk and maximize returns by identifying opportunities or early warning signals of market downturns.

Automated Portfolio Management

AI-driven automated portfolio management offers a dynamic, data-enhanced approach to investing. AI systems use ML algorithms to continuously monitor and adjust portfolio allocations in real-time according to changing market conditions, risk tolerance, and unique investment objectives. These systems can process huge amounts of financial data and help distribute assets while minimizing risks.

AI can automate tasks, such as portfolio rebalancing and trade execution efficiency. Thus, it offers adaptive and economical investment management over time by automating portfolio management for institutional and retail investors.

Risk Assessment and Mitigation

Artificial intelligence for investing is taking investment management to another level by processing and analyzing complex datasets, improving risk assessment, and effectively identifying potential risks. Machine learning models evaluate historical performance, market volatility, and economic indicators to predict future risk levels across various assets and portfolios. These AI systems can also simulate different market scenarios to assess the potential impact of external factors like interest rates or political changes.

With precise and timely risk forecasts made possible by AI, investors can preemptively modify their strategies to hedge against losses, optimizing a favorable risk-reward ratio. Furthermore, AI capabilities can improve risk management by automating actions responding to unprecedented market changes.

Robo-Advisors for Retail Investors

Robo-advisors powered by AI have revolutionized investment management for retail investors by providing low-cost, accessible, and personalized financial advice. These AI systems use algorithms to assess individual investors’ financial goals and investment horizon, creating tailored portfolios that meet specific needs.

As AI keeps learning from market trends and investor activity, robo-advisors automatically balance the portfolio accordingly. This technology democratizes access to high-quality investment strategies, empowering individuals with tools traditionally available only to high-net-worth clients. Robo-advisors offer a scalable solution for managing investments, reducing human bias, and lowering fees.

Sentiment Analysis in Investment Decision-Making

AI-based sentiment analysis enables investors to understand possible market sentiment by analyzing unstructured data from news articles, social media, earnings calls and financial reports. Natural Language Processing (NLP) algorithms can sift through millions of documents and identify the general sentiment for a given stock, asset, or even entire market sector.

By evaluating investor sentiment, AI for investment management provides insights into potential price movements and market trends before they become widely recognized. Fundamentally, this near-real-time data can improve decision-making by allowing investors to react in real-time to market sentiment changes, further improving trading strategies and taking advantage of new-found opportunities.

Algorithmic Trading Models

AI models have changed the way trades are executed in financial markets. Machine learning allows them to analyze thousands of market variables in real-time. Price trends, volume changes, economic data, these algorithms can track it all and make split-second decisions. The ability of AI to evolve and automate not just response, but also strategy based on past performance makes high-frequency trading possible where both returns are maximized while risks are effectively minimized. Algorithmic trading removes emotional biases from trading, speeds up execution, and ensures trades are fueled at the optimal time and price by eliminating human interference.

Take Your Investments to the Next Level with AI

Personalized Investment Recommendations

By examining individual investors’ profiles, preferences, and financial goals, AI can provide fast and tailor-made investment recommendations. It analyzes historical investment patterns, risk tolerance levels, and expected returns to suggest optimal asset allocations tailored to each investor.

Instead of static data sets, AI for investment can alter recommendations according to market conditions, personal status, or financial objectives. Such systems use big data with predictive analytics to generate actionable ideas to help investors make more educated decisions that better correlate to their goals over the long term. With customized recommendations, one will ensure that investments are suitable and flexible, providing a tailored way for wealth management.

Asset Price Forecasting

AI’s predictive models play a key role in forecasting asset prices. They use historical data, economic factors, and machine learning techniques to estimate future price movements. AI systems analyze vast datasets, including market trends, earnings reports, and macroeconomic variables, to create predictive models that can accurately forecast price fluctuations.

These forecasts help investors make strategic decisions on asset acquisition or divestment, allowing them to buy undervalued assets or sell before a downturn. By continuously refining algorithms based on real-time data, AI ensures that price forecasts are continually updated, enabling better timing and risk management in investment decisions.

Liquidity Management and Prediction

Next, use cases of AI in investing is that AI tools are widely used for liquidity management and prediction, allowing investors to utilize an efficient cash flow management model and maintain proper levels of liquidity. Machine learning algorithms detect liquidity requirements using transaction volumes, market conditions, and asset performances as input data. It allows investors to ascertain when and how much cash they might need in order to make future investments or take any amount of money out of the fund.

Similarly, AI-driven systems can also help identify possible liquidity risks enabling firms to take precautionary measures well ahead of times when liquidity shortages may occur. AI enables automation of liquidity forecasting, improving the decision-making process and lowering the chance of sudden liquidity crises, allowing investors to remain prepared.

Quantitative Asset Allocation

AI-driven quantitative asset allocation strategies rely on advanced statistical and ML models to determine the optimal mix of assets for a portfolio. These algorithms sift through past data, market volatility, and asset correlations to pinpoint the most efficient portfolio compositions. Investors can use AI to design portfolios that are optimal with respect to the trade-off between risk and return, without relying entirely on human intuition.

As market conditions change, AI constantly adjusts the asset allocation to ensure portfolios are always optimized. This approach not only improves the accuracy of investment decisions but also allows for more precise diversification, helping to maximize long-term returns while minimizing potential risks.

Revenue Forecasting for Companies

AI is increasingly used in revenue forecasting, helping investment managers predict a company’s future financial performance. AI models can produce more accurate and dynamic revenue forecasts by analyzing historical financial data, market trends, consumer behavior, and economic conditions. ML algorithms can detect intricate patterns and relationships that traditional forecasting methods might miss, providing more nuanced insights into a company’s growth potential. Armed with these predictive insights, investors can better evaluate organizations’ financial well-being and future performance to make smarter choices about investing in shares, mergers, or acquisitions.

Key Benefits of AI for Investing

Using artificial intelligence for investing offers various advantages; it allows a more sophisticated understanding of market conditions and helps make informed decisions about investment strategies.

Improved Efficiency

AI boosts efficiency by automating routine tasks like data collection, analysis, and reporting. This automation frees up valuable time for investors to focus on high-value business activities, such as developing strategies and making decisions. Consequently, firms get faster turnaround times and higher productivity with a more refined workflow, which leads to improved resource utilization and a high operational pace.

Enhanced Decision-Making

AI enables investors to make better decisions by providing access to comprehensive data and powerful analytics tools. By processing complex information quickly, AI uncovers hidden trends and correlations, offering deeper insights that guide strategic choices. This allows investors to make data-driven decisions, leading to better portfolio performance and optimal asset management.

Better Risk Management

AI enhances risk management within Enterprise Risk Management Software by continuously analyzing multiple variables in real-time, such as market trends, economic indicators, and asset behavior. These insights help investors find early signs of potential risks and take remedial action on their portfolios. Using AI, investors can predict market changes and be proactive so the risk from unforeseen events is reduced and portfolio stability is ensured.

Improved Accuracy

Yet another unique strength of AI for investment analysis is its ability to process large datasets with a high degree of accuracy and consistency. Unlike manual methods, AI systems continuously refine their algorithms, improving their reliability. This results in deeper insights and ensures that investment decisions are based on solid data-driven information, helping to eliminate expensive mistakes.

Source:- cfainstitute.org

Source:- cfainstitute.org

Core AI Technologies in Investing

The world of investment management is changing fast due to the integration of cutting-edge AI technologies. Such innovations change how investors process data, manage risks, and make decisions. Let’s explore some of the most advanced AI technologies shaping the future of AI for investment management.

Quantum Machine Learning (QML)

QML, or quantum machine learning, combines quantum computing with machine learning techniques, allowing faster and more efficient data processing. In investment, QML can process massive data sets much more quickly than classical computers to detect market trends, optimize portfolios and enhance risk analysis. Utilizing quantum algorithms allows investors to better understand complex financial models and make more informed decisions.

Explainable AI (XAI)

Explainable AI focuses on making AI decision-making processes more transparent and understandable. In investing, XAI allows investors to gain insight into how models arrive at specific predictions, such as stock price movements or portfolio adjustments. This level of transparency creates confidence in AI-driven strategies and allows asset managers to communicate the output of models effectively with clients, minimizing potential regulatory risks.

Computer Vision

A Computer Vision Solution is used in investing to analyze visual data such as financial charts, satellite imagery, and even scanned documents like earnings reports. Image processing can identify trends, analyze market situations, and detect anomalies. Investors can use computer vision for real-time market analysis, asset evaluation, and uncovering insights from visual content that may impact investment decisions.

Natural Language Processing (NLP)

Natural Language Processing helps investors extract insights from unstructured text data, including news articles and earnings reports. NLP algorithms can analyze sentiment, identify market-moving information, and gauge public opinion about stocks or industries. This aids in making informed decisions, predicting market trends, and staying ahead of news events that might influence investment opportunities.

Steps For Implementing AI In Investment Strategies

Implementing AI for investment analysis involves several key steps to ensure that the technology is effectively integrated into decision-making processes. Here’s a structured approach:

Define Clear Objectives

The first step in implementing artificial intelligence for investing strategies is to set clear objectives. Determine whether the goal is to optimize portfolio returns, automate trading, enhance risk management, or improve market analysis. Understanding your goals enables you to choose the right AI technologies since they may not work for certain business processes or challenges within the investment process.

Gather And Prepare Data

Data is the foundation of AI, so gathering high-quality, relevant data is crucial. Collect historical market data, financial reports, and economic indicators. Data cleaning and preprocessing are performed to remove inconsistencies and make the data into an appropriate format, as AI models expect. Training AI algorithms to produce accurate, data-driven investment decisions requires a strong dataset.

Select The Right AI Models

You need to choose the right AI model for success. Depending on the use-case objective, investment firms may opt for machine learning models for making predictions, natural language processing to perform sentiment analysis, or reinforcement learning to work on optimizations. The model chosen must be suited to the investment strategy and nature of the data analyzed, ensuring that it accurately addresses the problem.

Train The Model

To train AI models, feed them large historical datasets so AI models can identify patterns and make predictions accordingly. This involves selecting features, choosing an algorithm, and tuning parameters. Continuously retraining models with fresh data enhances their precision and increases the ability to make better predictions based on real-time scenarios.

Test And Validate The Model

Once the AI model is trained, it’s essential to validate its performance. This step involves back testing using historical data to evaluate how well the model predicts market movements or investment outcomes. Ensuring that the model performs well under various market conditions before live implementation reduces the risk of poor investment decisions based on unreliable predictions.

Integrate AI Into The Investment Workflow

To maximize AI’s potential, it must be seamlessly integrated into the existing investment workflow. This could involve automating portfolio adjustments, using AI for market trend analysis, or creating automated trading strategies. The integration process should aid AI in decision-making, augment human expertise, and ensure AI is well embedded into investment processes and tools.

Monitor And Optimize Performance

Once the AI system is live, continuous monitoring is essential. Continuously assess the model’s performance and update it according to market changes. Optimization reinforces AI’s relevance, accuracy, and flexibility, empowering it to keep pace with changing market dynamics and investment objectives.

Ensure Compliance And Transparency

AI in investing must adhere to regulatory standards and maintain transparency. Implement Explainable AI (XAI) techniques to ensure decision-making processes are understandable and can be audited. In turn, this builds trust with investors and regulators, as transparency allows stakeholders to understand the decision-making process behind AI models in order to ensure that strategies adhere to financial regulations.

Continuous Learning And Adaptation

Financial markets are ever-changing, and AI models must evolve with them. Keep updating models with new data and adding things like reinforcement learning so that it learns from the system where it did something wrong or right. Such persistent adaptation ensures AI never misses the ever-changing shifts of the market, making it more capable of deciphering more accurate predictions and giving higher investment returns.

Challenges In Using AI For Investing And How To Overcome Them

Using AI for investing has many benefits. However, it also brings several challenges that need to be tackled. Let’s explore the challenges of AI in investing and the solutions that can be used to address these.

Data Accessibility

Accessing complete and reliable information for AI models can be difficult due to silos of data and the limited data sources. The problem is made more difficult by regulatory privacy and security concerns that hinder sharing data and integration across various platforms. To overcome this challenge, collaborate with data providers and implement tools for data integration to combine and organize data from many sources. Increase accessibility to data by implementing data-sharing agreements and open platforms for data.

Talent Acquisition

Finding skilled and experienced professionals with expertise in AI and finance can be challenging, especially with growing competition across different sectors. Retaining the top talent can be difficult due to the need for required skills and abilities. Concentrate on training and upgrading existing employees. You can also expand your recruitment process to incorporate an expanded talent pool. The development of a comprehensive program, as well as offering appealing rewards, can help increase the retention of professionals with a high level of knowledge.

Data Quality Issues

Data inconsistency and accuracy could negatively impact AI models’ efficiency. Integrating data from different sources could create more quality issues. To ensure quality, implement strong data governance procedures and protocols for data cleaning. Use AI-powered tools to validate data and improve data quality continually. Perform regular audits to enhance data integrity.

Data Bias

Systematic biases in data could lead to bias in AI forecasts and choices, exacerbating existing inequality and inaccuracy. Use diverse data sources and bias detection tools to identify and correct any biases. Regularly conduct audits and revisions on AI models to ensure the accuracy and fairness of your models.

Industries Benefiting From AI-Driven Investing

Using AI for investment analysis across various industries has become increasingly popular thanks to its capacity to handle large volumes of data, discern patterns, and provide predictive insights. Here are some of the top industries that benefited from AI-driven investing:

Finance

The finance industry is one of the biggest beneficiaries of AI-driven investing. AI models can process extensive market data to forecast trends, optimize portfolios, and execute trading strategies. Decision-making is much quicker since machine learning algorithms identify patterns and anomalies in real time. Moreover, artificial intelligence mitigates risks by analyzing market changes and delivering potential opportunities.

The fintech revolution has brought personalized wealth management to the masses. Robo-advisors offer personalized wealth management at scale, making financial services more accessible. By using the power of AI, financial institutions can improve efficiency, reduce human error, and provide more accurate forecasting, leading to improved investment outcomes and a competitive edge.

Real Estate

AI is revolutionizing investment strategies in the real estate sector, enhancing property valuation, market analysis and investment decisions. By assessing property values and predicting price movements, AI tools analyze historical trends, neighborhood development around a property, and demographic data. Predictive analytics helps investors identify emerging markets and potentially profitable investment prospects.

AI-powered systems also streamline property management tasks, including lease tracking, maintenance scheduling, and tenant communications. By automating processes and enhancing data analysis, artificial intelligence for investing helps real estate investors maximize returns, reduce risks, and optimize portfolio management, leading to smarter, data-driven investment decisions.

Healthcare

AI in healthcare is revolutionizing investing by providing deeper insights into medical advancements, healthcare startups, and pharmaceutical companies. These AI models process massive datasets ranging from clinical trials, patient data, and industry trends to forecast the chances of success for new therapies or medical technologies.

AI helps investors determine whether a healthcare company has growth potential, how best to mitigate risk, and even identify market trends. Furthermore, it can automate the management of health portfolios, rearrange asset allocation, and assist in tracking regulatory developments. AI also provides a distinct competitive advantage in data-driven investment practices as the healthcare sector becomes more data-intensive.

Retail

AI enhances investment strategies in the retail industry by enabling better market forecasting, customer behavior analysis, and supply chain optimization. Using AI, investors can spot upcoming retail trends, analyze individual company performance, and determine future demand for different types of products.

AI tools help scan consumer behavior, social media trends, and purchase trends to give you real-time insight into what kind of product or service is likely to perform. For retail investors, AI enhances stock-picking strategies by identifying profitable retail brands or growth markets. With AI’s data-driven approach, investors can improve decision-making, reduce risk, and gain a competitive edge.

Entertainment And Media

In entertainment and media, AI for investment management shapes decisions by analyzing content consumption patterns, audience preferences, and emerging trends. Investors use AI to help determine whether a film, TV show, or digital content will succeed based on factors like social media sentiment, audience ratings, and patterns from past releases.

AI is also helpful in optimizing media portfolios by providing insights into high-return media content and production companies. AI tools also come into play with streaming services to create customized recommendations, allowing marketers and business professionals on the back end to further streamline offerings for a larger audience.

The Future Trends Of Artificial Intelligence For Investing

AI for investment management has rapidly evolved, capturing widespread attention through groundbreaking trends. These trends transform the investing landscape, enabling more precise decisions, faster execution, and personalized strategies. Let’s explore the emerging AI trends that are reshaping investment practices.

Generative AI and GPT Models

Generative Pre-Trained Transformers (GPT), like OpenAI’s ChatGPT, are revolutionizing investing by providing instant access to vast amounts of financial data and insights. They create human-level text and provide recommendations on market conditions, stocks, and portfolio strategies. While they can use historical data to give predictions, investors should exercise caution and verify the information before acting on AI-generated advice, ensuring the accuracy and relevance of the insights in real-world contexts.

AI-Powered Voice Technology

Voice technology is increasingly integrating into investment platforms, enhancing security and functionality. Voice authentication, replacing traditional passwords, ensures secure access to sensitive financial data. Moreover, voice-activated AI assistants allow investors to buy and sell stocks, get market news, and manage their portfolios through voice actions. Investors can use voice commands to receive sentiment analysis or news summaries, providing a professional tool for quick decision-making in rising and falling markets.

AI for Wealth Management

AI in Wealth Management is changing the landscape by allowing investors to adopt customized investment strategies. Advanced algorithms can analyze a huge volume of financial data using historical data and help wealth managers provide personalized portfolio recommendations. With the constant advancement of AI, wealth managers will lean heavily on these intelligent systems to provide personalized and data-centric solutions for creating better long-term outcomes for their clients.

AI and Domain-Specific Data

AI’s future potential lies in its ability to leverage domain-specific data. Investment firms, enterprises, and governments use proprietary data to enhance AI models, tailoring them for more relevant insights. By all means, generalized AI models are good, but true actionable insights arise with mini-custom models that embed specific financial, industry, or proprietary data. Efficient data pipelines and the use of both structured and unstructured data will allow businesses to optimize AI systems for ultra-specific investment approaches.

How A3Logics Can Help You Implement AI for Investment Management?

Incorporating AI to manage investments can greatly improve decision-making, simplify investment optimization, and improve customer engagement. By tackling issues like accessibility to data, shortages of talent, and system biases, companies can harness AI’s transformative power.

AI adoption not only improves the operational process but also provides important insights. It allows investments to adapt to changes in the market. Continuously staying up to date with technology advancements is crucial to keep an edge in the market. As one of the most reputable enterprise AI development company, A3Logics is instrumental in developing and implementing AI strategies that help businesses discover new possibilities and get impressive outcomes. Contact our experts today to hire our artificial intelligence development services and open possibilities for innovations in accuracy, precision, and decision-making ability.

Transform Your Investment Strategy with AI – Book A 30 Minutes Free Consultation!

Conclusion

Integrating AI into investment operations revolutionizes how investors analyze data, make decisions, and oversee portfolios. AI-powered technologies provide the unprecedented capability to analyze vast amounts of data, find patterns, and produce valuable insights in a variety of investing sectors, including financial markets, healthcare, real estate, and more. AI investing allows investors to be more educated and based on data, thereby improving the performance of their portfolios while minimizing risk.

AI in investing has created a fundamental change in the investment world. It provides investors with sophisticated instruments and knowledge to manage an increasingly complicated and changing market, ultimately leading to better outcomes and delivering value for all parties. Furthermore, AI technologies continue to develop, bringing new opportunities to innovate for enterprise AI chatbot development company and disrupt the investing landscape. As AI capabilities increase and its use rises, investors can benefit from greater efficiency, precision, and higher investment profitability.

AI for Investing: FAQs

What is AI in investing?

AI in investing refers to using artificial intelligence technologies to gain insights into finance and investing trends, anticipate market movements, and pursue investment decisions. Using advanced algorithms and data analytics, AI can detect patterns, optimize portfolios, and make better decisions. It allows investors to make better and quicker decisions while reducing human bias and errors.

How does AI improve investment strategies?

AI enhances investment strategies by processing large amounts of data quickly, identifying trends and anomalies that human analysts may miss. Using predictive analytics, it forecasts market movements, optimizes asset allocation, and provides recommendations to investors. This data-driven approach improves decision-making, reduces risks, and increases investment management efficiency.

What are some examples of AI technologies in investing?

Machine learning, natural language processing (NLP), and algorithmic trading are a few examples of AI technologies for investing. Machine learning models predict stock prices and optimize portfolios, while NLP helps analyze financial news and reports.

What is the role of machine learning in investment analysis?

Machine learning in investment analysis helps by training algorithms to identify patterns in historical financial data. It can predict upcoming market trends, overall risk indicators and suggest best investment strategies. As the machine learning model updates itself based on new data, its accuracy improves, providing investors with better insights and recommendations.

Can AI help in risk management for investments?

Yes, AI plays a crucial role in managing risk by analyzing voluminous amounts of financial data to assess potential risks. It can identify market volatility, predict downturns, and optimize portfolio diversification to mitigate risks. AI-powered tools continuously monitor and adjust investments to help investors avoid significant losses while managing risk exposure effectively.

What are the limitations of AI in investing?

AI for investment has limitations such as dependency on historical data, which may not always predict future market conditions accurately. Additionally, AI systems can be biased if trained on incomplete or flawed data. Furthermore, AI cannot fully replicate human intuition or handle unpredictable market events, such as geopolitical crises or unforeseen global shocks.

How does AI handle data privacy in financial markets?

AI systems in financial markets must comply with strict data privacy regulations. AI systems employ various techniques to ensure that sensitive data is secure, such as encryption, anonymization, and secure data storage. Besides, AI applications help to restrict access to personal data and make sure that only the authorized personnel can view or process sensitive financial information.