Table of Contents

Blockchain technology has emerged as a transformative innovation disrupting established paradigms across diverse sectors. With its decentralization of trust and ability to securely record immutable transactions without intermediaries, blockchain technology lays the groundwork for the tokenized economy of the future. This tokenized future relies on the seamless flow of digital representations of real-world assets known as digital assets or crypto-assets. Digital assets stand to revolutionize traditional concepts of ownership, transfer of value and capital market participation with AI in Banking.

At the heart of this disruption is blockchain’s distributed digital ledger technology that facilitates the secure and verifiable recording of transactions. This technology helps address longstanding problems of lack of transparency, inefficiency and high costs plaguing traditional asset administration. Tokenization, the process of issuing blockchain-based tokens denoting rights to an asset, enables new models of ownership and commerce.

The future of tokenization is immense, as it facilitates fractional ownership of high-value goods and real estate. It enhances market operations by enabling seamless transactions and ushering liquidity into illiquid assets. Consequently, tokenization revitalizes underserved sectors and democratizes access to wealth creation opportunities worldwide. Understanding this tokenized future is critical for businesses and individuals alike seeking to leverage its transformational potential.

The Rise of AI in Banking

There is a general framework , first proposed by Iansiti and Lakhani, for understanding how groundbreaking Foundational Technologies achieve mainstream adoption – first in controlled settings, later across broader use cases of AI in banking as coordination challenges dissipate. Their analysis identified four basic phases of adoption across industries:

Novelty Phase

Characterized by initial pioneers exploring the technology. Adoption occurs in single-use environments, with crypto currencies enabling direct peer-to-peer transfers.

Customization Phase

Blockchain use expands to permissioned networks with known participants. Applications emerge in controlled business settings, proving technical feasibility.

Specialization Phase

Blockchain finds broader deployment in public permissionless blockchains. New decentralized business models emerge through dApps, tokenization and disruption.

Normalization Phase

Blockchain becomes commonplace technology reshaping entire industries. Its effects spread across socio-economic systems through decentralized autonomous applications of AI in banking.

Thus far, blockchain is emerging from Phase 2 experiments into Phase 3 mainstreaming through specialized applications like financial services. The pace will quicken as technical and social preparedness increases. Phase 1 crypto-focused applications of AI in banking still exist in parallel. Overall adoption appears following this predictable progression as technical hurdles clear and coordination complexities reduce. While Phase 4 widespread normalization is far ahead, blockchain’s inexorable spread signals its long term potential to fundamentally transform global systems.

The Changing World of Banking – Stats and Facts You Need to Know

The banking sector is undergoing a significant transformation driven by the integration of artificial intelligence in banking. This evolution is not merely a trend; it is a fundamental shift that is reshaping how banks operate, engage with customers, and manage risks. Here are some key statistics and facts that highlight the impact of AI in banking:

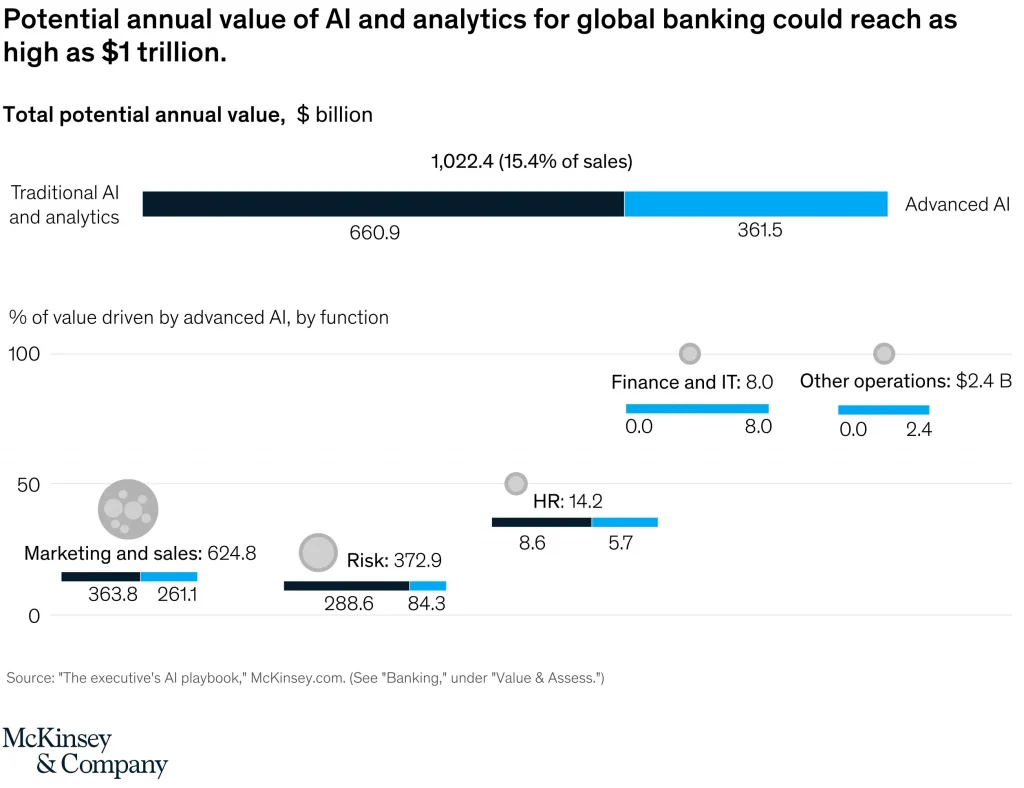

Growth Projections: According to a report by McKinsey, the potential value of AI in banking could reach up to $1 trillion by 2030. This growth is attributed to improved operational efficiencies, enhanced customer experiences, and better risk management practices enabled by AI technologies.

Adoption Rates: A survey conducted by Business Insider found that nearly 80% of banks recognize the potential benefits of AI and are actively exploring its applications of AI in banking. This widespread acknowledgment indicates a robust interest in leveraging AI to enhance service delivery and operational efficiency.

Fraud Detection: The financial sector has been increasingly targeted by cybercriminals, with AI playing a crucial role in combating fraud. AI algorithms can analyze vast amounts of transaction data in real-time to identify suspicious activities. For instance, Danske Bank implemented an AI-driven fraud detection system that improved its fraud detection capabilities by 50% while reducing false positives by 60%.

Customer Experience: The introduction of AI-powered chatbots has revolutionized customer service in banking. These virtual assistants are available 24/7, providing instant responses to customer inquiries and facilitating transactions without human intervention. This not only enhances customer satisfaction but also reduces operational costs associated with traditional customer service methods.

In summary, the integration of AI into banking is not just about adopting new technologies; it represents a paradigm shift that enhances operational efficiencies, improves customer experiences, and strengthens risk management practices.

Applications and Use cases of AI in Banking

Artificial intelligence has significantly redefined the banking industry through novel data-driven opportunities. By leveraging AI, banks are enhancing traditional practices with revolutionary applications that augment performance across core functions. Understanding prominent use cases of AI in banking is key to appreciating its strategic role.

AI has become indispensable for banking operations as institutions seek competitive advantages through intelligent data-driven solutions. Strategic integration of AI addresses burgeoning customer expectations while streamlining processes for better outcomes. Realizing AI’s full potential requires careful selection of viable opportunities aligned with institutional priorities.

This portion explores prominent applications demonstrating AI’s innovative impact on banking services, operations and risk management. Use cases span front-end customer experiences through backend operations, risk assessment and regulatory compliance. A closer examination illustrates AI’s practical implementation addressing unique banking industry dynamics and customer-centric objectives.

1. Cybersecurity and Fraud Detection

Fraud prevention stands paramount as cybercrime damages customer trust and inflicts financial losses. However, manual detection struggles with vast transaction volumes. AI leverages deep neural networks analyzing behavioral patterns to flag anomalies unavailable to humans.

One example sees Danske Bank implement a machine learning model improving fraud detection 50% while reducing false positives 60%. This automated system routes priority cases directly to analysts. AI safeguards account access by comprehending habits absent explicit programming. Its real-time dynamic risk assessment strengthens banking security defenses.

2. Enhancing Customer Experience

Personalized customer journeys require tailoring across touchpoints. But scale inhibits customization through human interactions alone. Chatbots harness AI to understand inquiries, access context and offer customized self-service. Barclays’ Amy chatbot answers routine account enquiries and guides transactions.

AI-powered robo-advisors generate investment strategies aligned with specific risk profiles and financial circumstances. AI assists with portfolio rebalancing and performance monitoring that scales globally. This delivers 24/7 investment guidance and financial education accessible on customers’ terms. AI fosters intuitive experiences that elevate engagement.

3. Chatbots and Virtual Assistants

Intelligent customer service tools address demands for prompt, convenient assistance. AI chatbots leverage ML algorithms trained on dialog corpora to engage users and resolve specific problems. They comprehend language subtleties to offer natural interactions.

Capital One’s Eno handles credit management, payments and security updates to address frequent customer service needs. Eno’s AI is designed to mimic human customer support agents in delivering responsive service 24/7. Chatbots reduce wait times and contact center workloads by automating repetitive issues.

4. Personalized Recommendations

Actionable recommendations require understanding user behaviors, preferences and financial situations in depth. AI analyzes customer profiles comprehensively, detecting patterns in spending habits, income sources and investment patterns.

AI-recommended savings deposit amounts optimize returns considering individual circumstances. Personalized investment suggestions advise suitable options considering financial profiles, goals and risk appetites. Tailored offers boost engagement by meeting consumer needs precisely.

5. Analyzing Customer Behavior

Understanding client behaviors drives customized service quality. AI detects usage patterns from transaction histories, web interactions and app functionality engagement. Algorithms identify recurrent habits, discretionary spending and budget constraints.

AI yields 360-degree visibility into spending, saving and lifestyle attributes. Personalized financial solutions emerge from deep customer behavior comprehension. Usage insights improve cross-sell opportunities by targeting services aligned with risk profiles and natural preferences.

6. Analyzing Market Trends

Accurate modeling depends on comprehending macrosocial intricacies. AI parses news releases, economic indicators, market commentaries and social media sentiments via natural language processing. Algorithms detect emergent themes in market discourse correlated with price shifts.

AI informs strategic portfolio adjustments by anticipating macroeconomic inflection points. Sentiment analysis gauges market views influencing short-term volatility for tactical trading timing. AI mitigates losses by predicting recessionary signals that portend stock market downturns or asset bubbles on the horizon.

7. Managing Investment Portfolios

AI augments portfolio management by providing continual strategic insights. AI weighs asset performances against macro variables, suggesting rebalancing opportunities to optimize risk-adjusted returns. Artificial intelligence classifies assets for inclusion or removal from model portfolios based on predictive analytics.

AI alerts when prices surpass intrinsic value indicators signaling overvaluation. Artificial intelligence monitors evolving sentiment gauges for defensive rotations as bearish outlooks intensify. AI recommendations automatically rebalance allocations based on personalized investment parameters like risk tolerance and liquidity needs.

8. Automated Loan Approvals

AI-powered loan decisioning expedites lending while enhancing precision. Algorithms ingest credit reports, bank statements, payslips along with environmental factors impacting creditworthiness. AI determines credit scores based on verified data attributes, not proxy metrics like credit utilization or annual income alone.

AI assesses character through transactional behaviors, comparing risk profiles to identify fraudulent applicants. Artificial intelligence alerts originate from AI loan detection of atypical consumption patterns indicating elevated default probabilities. Automated systems empower banks to accurately size and price loans for optimized returns.

9. Automating Risk Management

AI augments risk oversight through predictive analytics. Machine learning helps spot vulnerabilities by analyzing vast data volumes from news, economic indicators, earnings reports and market sentiment. Artificial intelligence detects anomalies hinting at potential investment, credit or operational risks for early corrective action.

AI supplements existing risk assessment tools with additional context from alternative datasets. AI spotlights issues human oversight could miss due to reliance on traditional metrics alone. AI’s continuous learning adapts risk models as environments evolve. Alerting anomalies strengthens risk preparedness across portfolios.

10. Competitor Analysis

AI enhances market intelligence by scrutinizing competitors’ customer interactions, service attributes, pricing models and strategic positioning. Sentiment analysis of news and social commentary provide competitive performance insights and emerging themes. AI quantifies market dynamics while maintaining anonymity.

AI detects opportunities by quantifying market shifts, pricing variances and service gaps between banks. Recommendations optimize competitive advantages with minimal risk. AI enhances competitor monitoring abilities through flexible natural language queries accessing diverse unstructured datasets.

Secure Your Bank’s Success with AI Innovations

11. Streamlining Regulatory Compliance

Banks face stringent regulations with compliance paramount for risk mitigation and reputation protection. However, manual oversight strains resources and introduces errors. AI can swiftly analyze regulations, automatically classify and tag documents, and monitor for anomalies or suspicious patterns faster and more accurately than humans.

AI streamlines regulatory documentation by ingesting new directives and cross-referencing existing processes to recommend real-time adjustments. Monitoring transactions in real-time, AI detects non-compliant activities and assesses entity-specific compliance risks earlier than traditional oversight. AI strengthens ongoing reporting quality.

12. AI-driven Contract Analysis

Reviewing complex legal agreements manually strains resources and delays processes. AI leverages NLP to extract contract metadata and recognize obligations, liabilities, and entitlements in real-time by processing natural language. Artificial intelligence identifies risks, issues and optimization opportunities that human oversight could overlook.

AI performs due diligence by cross-referencing agreement terms with external regulations and guidelines. Automated clauses comparison expedites negotiations while mitigating legal challenges. Banks gain precision and agility reviewing contracts essential for lending decisions, acquisitions and partnerships. AI streamlines contractual management.

13. Automated Financial Report Generation

Manually collating financial reports entails laboriously reformatting internal data for external audiences. AI combines data extraction with template population to generate financial statements automatically. Algorithms consolidate accounting ledgers, investment portfolios and annual business filings for customized regulatory, investor or public access reporting.

AI extracts accounting numbers, textual descriptions and visualizations for insertion into templates. Formatting follows prescribed statutory conventions. Banks gain real-time reporting while freeing staff for value-adding activities. Compliance stays on track with continual data-driven enhancements as financial positions evolve.

14. Identification of Upsell & Cross-sell Opportunities

Banks must proactively identify complementary financial products to strengthen customer relationships and drive incremental revenues. Traditional approaches lack the insight to pinpoint untapped opportunities. AI harnesses customer behavior analysis, surfacing new avenues for increasing average balances.

AI predicts optimal customer segments suited for specific offerings. Banks obtain visibility into additional needs across portfolios. Insights empower cross-functional collaboration, enhancing sales alignment around high-yield prospects. Targeted cross-selling boosts renewals while optimizing customer lifetime value.

15. Accurate Customer Churn Prediction

Customer attrition exerts detrimental impacts on revenues and growth. Early identification facilitates preventive retention measures. However, traditional techniques fail to anticipate upcoming attrition triggers. AI profiles behavior patterns, assessing future churn risks with unrivaled accuracy.

AI detects subtle patterns indicating imminent account closures, including transaction frequency fluctuations or web inactivity. Alerted, banks target communication at high-risk cohorts before defections materialize. Tailored retentive initiatives incentivize continued patronage. AI empowers proactive measures to surpass benchmarks and support sustainability.

16. Advanced Document Processing

Regulation demands processing numerous semi-structured records like statements, agreements and scanned receipts. Manual examination strains the workforce with repetitive tasks. AI leverages deep learning to automatically extract critical fields, abbreviating cycle times.

AI validates names, dates and numerical details against datasets. Extracted data populates forms for electronic submission to regulators. Automation shifts focus towards exceptions analysis. Document volumes pose no barriers as AI performs massively parallel extraction 24/7. Regulatory reporting gains newfound responsiveness and precision.

17. Automated Regulatory Reporting

Compliance necessitates generating standardized returns according to local mandates. Manual compilations introduce inconsistencies and delays amid frequent guideline modifications. AI swiftly ingests rule updates, retrofitting automated report generation.

Systems extract quantitative performance metrics and qualitative descriptions for placement into preconfigured templates. Formatting follows conventions while securely redacting sensitive fields. Regulators access live reporting portals for real-time oversight. AI strengthens accountability with continuing data-driven enhancements.

18. Debt Management

Manual debt collection burdens operations and risks non-compliance. AI streamlines processes end-to-end while safeguarding customer experiences. Behavioral data and alternative data optimize predictive models identifying optimal contact timing and strategies.

AI prioritizes overdue but recoverable accounts, balancing recovery rates with borrower well-being. Negotiation assistant algorithms craft affordable, temporary arrangements to limit defaults and write-offs. Through automation and behavioral expertise, AI improves recovery rates and mitigates compliance penalties.

19. Spend Category Analysis

Granular spend analysis delivers actionable customer and market intelligence. However, manual categorization from statements strains resources. AI deciphers expenses automatically through machine vision and language models, populating data warehousing.

Algorithms classify expenditures into intuitive groupings like utilities, food, travel based on metadata. Insights reveal evolving spending habits and opportunities. Marketing aligns offers to consumption areas demonstrating growth. Pricing reflects demand variations across categories. AI-powered spend analysis optimizes marketing strategy based on hard data.

20. Financial Robo-advisory

Advances in AI, cloud technology and FinTech promote robo-advisors reinventing investment guidance. Robo platforms automate portfolio construction matched to risk profiles,goals and market conditions. Custom algorithms steer asset allocations and trading tactics.

Intelligent virtual assistants offer 24/7 access to advice, transactions and personalized analytics dashboards. Combined with AI and big data, robo platforms optimize investment outcomes through vast compute power and diversification. Lower fees and accessibility further democratize finance, gaining significance for mass-affluent clients. Automated Investment tools empower intuitive AI in Wealth Management experiences for today’s audiences.

What are the Advantages of AI in Banking

1. Improved Cybersecurity and Fraud Detection

As cybercrime grows more sophisticated via AI techniques, banks require constant innovation to defend themselves and their customers. AI plays a pivotal defensive role through real-time anomaly recognition and prevention before attacks transpire. By enhancing authentication and monitoring for irregularities across interactions and transactions, AI fortifies security infrastructure and safeguards sensitive data integrity. Its predictive detection capabilities and continuous self-updating strengthen cyber resilience crucial in digital finance.

2. Enhanced APIs

Banks depend increasingly on application programming interfaces (APIs) for clients to integrate banking services across experiences. While expanding access, APIs introduce security challenges that AI optimizes through monitoring and added controls. AI also automates tasks like balance checking and payment initiation, speeding interface usage. Its role advances embeddable banking conveniences through improved APIs that protect sensitive data exchange across experiences.

3. Embeddable Banking

As digital lifestyle integration deepens, banking interfaces face competitive pressure to embed support for evolving financial requirements. AI-enabled conversational agents meet this demand by providing personalized assistance directly within customers’ experiences through engaging natural conversations. This level of integration enhances banking accessibility beyond conventional channels. Outcomes encompass expanded commerce participation and trust through embedded interfaces delivering well-timed guidance.

4. More Intelligent Customer Tools

AI-powered analytics spark innovative solutions facilitating efficient banking management. Conversational interfaces, predictive insights into spending habits and personalized budgeting leverage intelligence for 24/7 customer empowerment unbound from business hours. Enhanced support convenience reduces service costs while boosting engagement through intelligent tools fulfilling dynamic needs anytime.

5. New Markets and Opportunities

By fueling predictive analytics with elaborate consumer profiles, AI opens new markets and use cases of AI in banking that elevate service quality. Actionable client targeting pinpoints optimal partners and compatible complementary services. Personalized recommendations introduce customers to opportunities aligning personal situations.

Intelligent solutions expand services to meet evolving demands, cultivate loyalty and optimize customer lifetime value through data-driven relevance.

6. Smarter Credit Card and Credit Scoring

Access to credit remains elusive without assessing creditworthiness thoroughly. Traditional methods assessing limited data fail qualified candidates. Advanced AI evaluates behavioral patterns, alternative data revealing credit character. Granular risk scoring accurately recognizes inherent repayment abilities beyond demographics, upholding equal opportunities. Automated credit decision-making promotes financial inclusion through objective evaluations.

Addressing the Challenges of Adoption of AI in Banking

AI Governance

As banks increasingly adopt AI technologies, establishing effective governance frameworks becomes crucial for ensuring ethical use and compliance with regulations.

- Policy Development: Banks must develop clear policies outlining how AI systems will be used within their operations while addressing potential risks associated with bias or discrimination in decision-making processes.

- Oversight Mechanisms: Implementing oversight mechanisms ensures that AI systems operate transparently and adhere to established guidelines while allowing for regular audits and assessments.

Legal Uncertainty Related to Operations

The rapid evolution of technology often outpaces existing regulatory frameworks governing financial institutions’ operations.

- Regulatory Compliance Challenges: Banks must navigate complex regulatory landscapes while integrating AI in banking with new technologies into their operations without running afoul of compliance requirements.

- Adaptation Strategies: Engaging with regulators early during technology implementation helps mitigate legal uncertainties associated with adopting innovative solutions like AI-driven systems.

Explainability

One significant challenge associated with deploying machine learning models lies in their inherent complexity—often referred to as “black box” models—making it difficult for stakeholders to understand how decisions are made.

- Need for Transparency: Ensuring transparency around algorithmic decision-making processes fosters trust among customers while enabling regulators to assess compliance accurately.

- Developing Explainable Models: Investing resources into developing explainable models allows banks to provide insights into how decisions were reached without compromising predictive accuracy or performance metrics.

Difficulties in Controlling Outcome Accuracy

Maintaining high levels of accuracy across various applications remains a challenge as algorithms evolve over time based on incoming data streams.

- Monitoring Performance Metrics: Continuous monitoring is essential for evaluating model performance against established benchmarks while identifying areas requiring adjustments or retraining efforts due to shifts in underlying patterns within datasets used during training phases.

Prejudice from Model Bias

Biases present within training datasets can lead algorithms toward producing unfair outcomes when deployed across diverse populations or demographics—potentially resulting in discriminatory practices inadvertently embedded within automated decision-making frameworks employed by financial institutions operating under strict regulatory scrutiny regarding fair lending practices.

Future Trends for AI in Banking

Hyper-Personalization

Hyper-personalization refers to using advanced analytics techniques powered by machine learning algorithms aimed at delivering highly tailored products/services based on individual preferences/behaviors exhibited throughout interactions across multiple touchpoints within digital ecosystems operated by financial institutions today:

Tailored Products and Services

Banks will increasingly leverage customer data analytics combined with machine learning capabilities aimed at delivering customized offerings aligned closely with each client’s unique needs/preferences—ultimately enhancing overall satisfaction levels experienced during engagement processes undertaken throughout various stages associated with product/service lifecycle management initiatives undertaken across organizations today!

Personalized Customer Experiences

By utilizing real-time insights derived from behavioral analysis conducted across multiple channels (e.g., mobile apps/websites/social media), organizations will be able not only anticipate client needs proactively but also craft personalized experiences designed explicitly around those identified requirements—resulting ultimately leading towards improved retention rates among existing clientele!

Enhanced Fraud Detection

The future landscape surrounding fraud detection efforts undertaken within financial services will witness substantial advancements driven primarily through enhanced algorithmic capabilities enabled via ongoing investments made towards improving existing infrastructures supporting these initiatives:

Advanced Algorithms

Continued developments surrounding deep learning methodologies coupled alongside traditional statistical techniques utilized today will lead towards even greater accuracy levels achieved during fraud detection efforts undertaken across organizations operating within this space!

Real-Time Monitoring

With advancements made towards integrating AI in banking, IoT devices alongside existing transaction monitoring systems currently employed today—banks will be positioned better than ever before when it comes down proactively identifying potential threats posed against their operations!

Intelligent Process Automation (IPA)

Intelligent Process Automation represents an evolution beyond traditional robotic process automation approaches currently utilized today—leveraging cognitive computing techniques alongside existing automation strategies aimed at streamlining operational workflows across various departments/functions:

Streamlined Operations

By integrating intelligent automation solutions capable of not only executing repetitive tasks but also adapting dynamically based upon changing conditions encountered during execution phases—organizations stand poised to capitalize upon newfound efficiencies realized throughout entire value chains!

Decision Automation

As organizations continue embracing intelligent automation solutions capable of executing complex decision-making processes traditionally reserved solely to human operators—banks will realize significant improvements regarding speed/accuracy associated with critical business decisions made daily!

Robotic Process Automation (RPA)

Robotic Process Automation continues gaining traction among financial institutions seeking optimize operational efficiencies achieved through automation efforts aimed at reducing manual workloads encountered throughout various departments/functions:

Task Automation

By automating routine tasks traditionally performed manually across departments/functions—organizations stand poised to realize substantial cost savings achieved through reduced labor costs alongside enhanced productivity levels experienced throughout the entire workforce engaged daily!

Improved Efficiency

As organizations continue embracing RPA solutions capable of executing tasks autonomously—banks will witness improvements regarding turnaround times experienced during key business processes undertaken regularly!

AI-Driven Risk Management

Risk management represents one area where ongoing investments made towards developing sophisticated analytical capabilities powered via artificial intelligence in banking have begun yielding tangible results:

Predictive Analytics

By leveraging predictive analytics solutions aimed at forecasting potential risks encountered throughout various stages associated with lending/investment activities undertaken regularly—financial institutions will become better equipped to navigate uncertain market conditions encountered regularly!

Regulatory Compliance

As regulatory requirements continue evolving rapidly—financial institutions must remain vigilant regarding compliance obligations imposed upon them; leveraging advanced analytical capabilities powered via artificial intelligence provides organizations with necessary tools needed to ensure adherence standards established governing industry practices today!

AI-Powered Wealth Management

Wealth management represents another area where ongoing investments made towards developing sophisticated analytical capabilities powered via artificial intelligence have begun yielding tangible results:

Personalized Investment Advice

By leveraging advanced analytics techniques aimed at delivering tailored investment recommendations aligned closely with each client’s unique objectives/preferences—financial institutions stand poised to capitalize upon newfound opportunities realized throughout entire value chains!

How Can A3Logics Help in Your Journey to AI Driven Banking?

A3Logics stands out as an Enterprise AI Development Company specializing in providing comprehensive solutions tailored specifically toward helping financial institutions navigate complexities associated with integrating AI in banking operations effectively!

Our team comprises seasoned professionals equipped with expertise necessary to provide AI Development Services with innovative strategies designed to enhance overall performance metrics achieved throughout the entire organization!

- Customized Solutions: We offer bespoke solutions tailored specifically toward meeting unique needs faced by each client we serve—ensuring alignment between strategic objectives pursued alongside technological advancements leveraged throughout implementation phases undertaken collaboratively together!

- Expertise Across Domains: Our team possesses extensive knowledge spanning various domains—including finance/banking sectors—enabling us to deliver insights informed decisions made during critical phases associated with project lifecycles undertaken collaboratively together!

- Continuous Support: We provide ongoing support throughout the entire project lifecycle—from initial consultation stages through deployment phases ensuring smooth transitions occur seamlessly while minimizing disruptions experienced during implementation efforts undertaken collaboratively together!

- Focus on Innovation: Our commitment fostering innovation drives us continuously to seek out new opportunities to leverage cutting-edge technologies available today—including artificial intelligence—to deliver superior outcomes realized across all aspects related business operations undertaken collaboratively together!

- Proven Track Record: With numerous successful projects completed across diverse industries—including finance/banking sectors—we, one of the top AI Development Companies, possess proven track record delivering exceptional results achieved through effective collaboration partnerships established between clients served over years spent working together collaboratively toward achieving common goals pursued diligently throughout the entire engagement process undertaken collaboratively together!

Transform Your Banking Operation with AI – Book a Free 30-Minute Consultation Today!

Conclusion

The integration of artificial intelligence into banking represents a transformative shift that enhances operational efficiencies while improving customer experiences across various touch points encountered daily! As financial institutions continue embracing these innovative technologies—realizing substantial benefits derived from enhanced security measures implemented alongside personalized services delivered consistently over time—it becomes increasingly clear why investing resources toward further developing capabilities surrounding this area remains of paramount importance moving forward!

By addressing challenges associated with adoption effectively while capitalizing upon emerging trends observed within the industry landscape today—financial institutions stand poised to thrive amidst an ever-evolving competitive environment characterized by rapid advancements occurring regularly across sectors involved directly impacting lives individuals served daily!

FAQs

What is AI in Banking?

Artificial Intelligence (AI) refers broadly speaking to collection techniques/methodologies aimed at simulating human intelligence through computer systems designed to perform tasks traditionally requiring human cognition—including decision-making processes involving analysis/interpretation data collected from various sources encountered regularly throughout business operations performed daily! In context specifically related finance/banking sectors—AI encompasses range applications including but not limited to detecting fraudulent activities automating routine tasks enhancing overall customer experiences delivered consistently over time!

How does AI help banks in risk management?

AI plays a crucial role assisting banks manage risks encountered regularly throughout various stages associated with lending/investment activities undertaken daily! By leveraging predictive analytics techniques aimed at forecasting potential risks identified during analysis historical trends/data collected over time—financial institutions become better equipped to navigate uncertain market conditions faced regularly! Additionally—AI enables real-time monitoring transactions ensuring compliance obligations imposed upon organizations met effectively minimizing likelihood penalties incurred due violations observed frequently occurring industry-wide!

How is AI impacting the banking industry?

AI impacts the banking industry significantly transforming the way financial institutions operate and engage customers and manage risks encountered regularly! Through automation routine tasks enhancing security measures implemented alongside personalized services delivered consistently over time—banks realize substantial benefits derived increased efficiencies achieved reduced costs incurred throughout entire value chain involved delivering products/services offered clients served diligently over years spent working collaboratively together toward achieving common goals pursued diligently throughout entire engagement process undertaken collaboratively together!

What role does AI play in personalized financial planning?

AI plays a pivotal role facilitating personalized financial planning enabling banks to understand preferences/behaviors exhibited by clients served diligently over years spent working collaboratively together toward achieving common goals pursued diligently throughout the entire engagement process undertaken collaboratively together! By analyzing vast amounts data collected regarding spending habits/investment strategies employed historically—financial institutions become better equipped deliver tailored recommendations aligned closely individual objectives/preferences ensuring greater satisfaction levels experienced among clientele served diligently over years spent working collaboratively together toward achieving common goals pursued diligently throughout entire engagement process undertaken collaboratively together!

What are AI powered financial apps?

AI for Fintech Apps represent innovative solutions designed to leverage artificial intelligence in banking to enhance overall user experience delivered consistently over time! These applications of AI in banking utilize machine learning algorithms analyze vast amounts data collected regarding spending habits/investment strategies employed historically enabling users receive tailored recommendations aligned closely individual objectives/preferences ensuring greater satisfaction levels experienced among clientele served diligently over years spent working collaboratively together toward achieving common goals pursued diligently throughout entire engagement process undertaken collaboratively together!