Table of Contents

Artificial Intelligence (AI) is revolutionizing the finance industry by enhancing efficiency, accuracy, and decision-making processes. As financial institutions face increasing pressure to innovate and adapt to rapidly changing market conditions, AI technologies have emerged as a critical tool for achieving operational excellence. From automating routine tasks to providing advanced analytics for risk management, AI is transforming how financial services operate.

The integration of AI in finance enables organizations to process vast amounts of data quickly, identify patterns, and make informed decisions that drive profitability. Additionally, AI enhances customer experiences through personalized services and improved engagement. As we delve deeper into the significance of AI in finance, we will explore its evolution, key statistics, real-world use cases of AI in finance, benefits for institutions and consumers, challenges faced during implementation, and how companies like A3Logics can help organizations leverage AI effectively.

The Evolution of Finance – AI in Finance Industry

The finance industry has undergone significant transformations over the past few decades, driven by technological advancements and changing consumer expectations. The introduction of computers and the internet revolutionized how financial transactions were conducted, paving the way for online banking and digital payment systems. However, the advent of Artificial Intelligence in finance marks a new era in this evolution.

Early Adoption of AI

Initially, applications of AI in Fintech were limited to basic automation tasks such as data entry and transaction processing. As machine learning algorithms became more sophisticated, financial institutions began exploring their potential for predictive analytics and risk assessment. This shift allowed banks to enhance their decision-making processes by analyzing historical data to forecast future trends.

Growth of Fintech

The rise of fintech companies has further accelerated the adoption of AI in finance. These startups leverage cutting-edge technologies to offer innovative solutions that challenge traditional banking models. By integrating AI into their platforms, fintech firms can provide personalized financial services, streamline operations, and reduce costs.

Current Trends

Today, AI is being utilized across various functions within the finance industry, including fraud detection, credit scoring, customer service automation, algorithmic trading, and regulatory compliance. Financial institutions are increasingly investing in AI technologies to remain competitive and meet the evolving needs of their customers.

Future Outlook

Looking ahead, the role of AI in the finance industry is expected to expand even further. With advancements in natural language processing (NLP), computer vision, and generative AI, financial services will continue to evolve towards more intelligent systems capable of making complex decisions with minimal human intervention. This evolution will not only enhance operational efficiency but also improve customer experiences significantly.

In summary, the evolution of AI in the finance industry reflects a broader trend towards automation and data-driven decision-making. As financial institutions embrace these technologies, they position themselves for success in an increasingly competitive landscape.

Stats and Facts You Need to Know

Understanding the impact of AI in finance requires examining key statistics that highlight its growing importance:

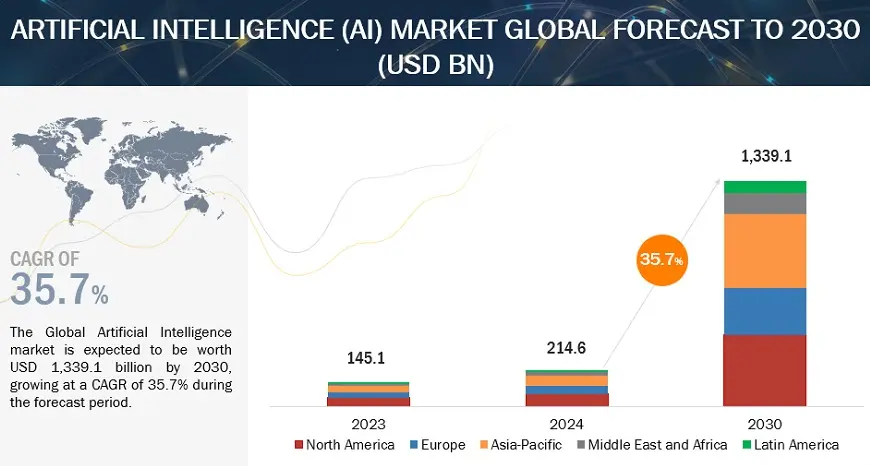

Market Growth

According to a report by Market Research Future, the global market for AI in financial services is projected to grow at a compound annual growth rate (CAGR) of 23% from 2021 to 2027.

Adoption Rates

A survey conducted by the World Economic Forum found that 85% of financial services providers are currently using AI technologies in some capacity.

Fraud Detection

Organizations utilizing AI for fraud detection have reported a significant reduction in losses—up to 40% fewer fraudulent transactions compared to traditional methods.

Customer Experience

According to research by Accenture, 77% of banking executives believe that implementing AI will enhance customer experience significantly.

Operational Efficiency

Financial institutions that adopt AI-driven automation can reduce operational costs by up to 25%, leading to substantial savings over time.

Investment Trends

The global investment in AI technologies within the financial sector is expected to exceed $10 billion by 2025 as companies seek innovative solutions to enhance efficiency.

Regulatory Compliance

A study by Gartner indicates that organizations leveraging AI for regulatory compliance can reduce compliance costs by up to 30% through automated reporting processes .

Risk Management

Financial institutions using AI for risk assessment have reported improvements in risk mitigation strategies—allowing them to respond more effectively to market fluctuations .

Personalization

Companies implementing personalized banking services powered by AI have seen customer satisfaction ratings increase by over 20% due to tailored offerings based on individual preferences .

Market Sentiment Analysis

Financial firms utilizing sentiment analysis tools powered by AI can predict market movements with greater accuracy—leading to improved investment strategies based on real-time data insights .

These statistics underscore not only the growing reliance on AI technologies within finance but also highlight both opportunities and challenges that organizations face as they integrate these advanced solutions into their operations.

Top 20 Use Cases of AI in Finance Industry

Top applications of AI in Fintech are diverse and impactful; they address numerous challenges faced by organizations today while enhancing operational efficiency. AI has become an essential tool for enhancing various aspects of financial services. Below are some prominent use cases of AI in finance.

Fraud Detection and Prevention

AI systems analyze transaction patterns using machine learning algorithms to detect anomalies indicative of fraudulent activities.

- Case Study: JPMorgan Chase employs advanced machine learning models that monitor transactions across millions of accounts daily—detecting fraudulent activities with high accuracy while minimizing false positives.

Automated Risk Management

AI enhances risk management processes through predictive analytics that assess potential risks based on historical data.

- Case Study: HSBC utilizes machine learning algorithms for real-time risk assessments—allowing them to identify potential threats before they escalate into significant issues.

Personalized Banking Services

BlackRock’s Aladdin platform leverages AI to provide personalized investment strategies tailored to individual client needs.

- Case Study: Aladdin analyzes vast datasets including market AI Trends and client preferences—offering customized recommendations that optimize portfolio performance.

Credit Scoring and Loan Processing

AI improves credit scoring models by analyzing alternative data sources beyond traditional credit histories.

- Case Study: Upstart uses machine learning algorithms that evaluate applicants’ creditworthiness based on various factors—resulting in faster loan approvals while maintaining low default rates.

AI-Driven Investment Advisory

Robo-advisors utilize algorithms to manage investment portfolios automatically based on user-defined parameters.

- Case Study: Wealthfront offers automated investment management services powered by algorithms that optimize asset allocation strategies—providing clients with personalized investment solutions at lower fees than traditional advisors.

Customer Support via AI Chatbots

AI chatbots provide instant support for customer inquiries—enhancing service delivery while reducing response times.

- Case Study: Bank of America’s Erica chatbot assists customers with account inquiries and transaction history—improving customer satisfaction ratings significantly through quick resolutions.

Algorithmic Trading

AI algorithms execute trades based on predefined criteria—analyzing market conditions rapidly.

- Case Study: Renaissance Technologies utilizes sophisticated algorithms that analyze market trends—leading them to achieve substantial returns consistently over time compared with traditional investment strategies employed historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Predictive Analytics for Market Trends

Wells Fargo employs predictive analytics tools powered by machine learning models—to forecast market trends effectively.

- Case Study: By analyzing historical price movements alongside economic indicators—the bank enhances its trading strategies based on accurate predictions derived from real-time data insights obtained continually throughout operations conducted daily across facilities worldwide ensuring compliance regulations governing practices followed during production activities conducted daily across various sectors globally today!

Anti-Money Laundering (AML) Compliance

AI systems monitor transactions for suspicious activity—ensuring compliance with AML regulations effectively.

- Case Study: Standard Chartered Bank uses advanced analytics tools that flag unusual transaction patterns—allowing them swift responses while maintaining compliance standards set forth regulatory bodies governing practices followed during production activities conducted daily across various sectors globally today!

Know Your Customer (KYC) Processes

AI streamlines KYC processes through automated identity verification methods—reducing onboarding times significantly.

- Case Study: Revolut employs facial recognition technology combined with document verification tools—to expedite KYC processes while ensuring regulatory compliance maintained consistently throughout operations conducted daily across facilities worldwide ensuring safety security well-being workers prioritized consistently throughout organization’s practices established governing procedures adhered strictly whenever possible whenever feasible under circumstances encountered regularly throughout daily activities undertaken routinely performed daily basis ongoing basis continuously striving improve overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

See How AI is Transforming Finance

Real-Time Transaction Monitoring

Artificial Intelligence enables real-time monitoring capabilities across transactions—allowing organizations immediate visibility into potential fraudulent activities occurring unnoticed otherwise!

- Case Study: Mastercard implements real-time monitoring systems powered by machine learning algorithms—to detect suspicious transactions instantly preventing losses incurred historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Artificial Intelligence for Wealth Management

AI in Wealth Management assists managers through predictive analytics tools that optimize investment strategies based on client profiles.

- Case Study: Morgan Stanley utilizes advanced analytics platforms—to provide tailored investment advice based on individual client needs while ensuring compliance regulations governing practices followed during production activities conducted daily across various sectors globally today!

Regulatory Reporting Automation

AI automates regulatory reporting processes ensuring timely submissions while minimizing errors associated with manual reporting methods utilized historically prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

- Case Study: Citibank employs intelligent reporting solutions powered by machine learning algorithms—to streamline regulatory compliance requirements effectively reducing manual effort required historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Financial Forecasting and Planning

AI enhances financial forecasting accuracy through predictive models analyzing historical performance metrics alongside current economic indicators.

- Case Study: Deloitte utilizes advanced analytics tools—to provide clients with accurate forecasts enabling informed decision-making regarding resource allocation strategies marketing initiatives undertaken routinely performed daily on an ongoing basis continuously striving to improve overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Risk Assessment and Underwriting

AI improves risk assessment processes through automated underwriting models analyzing applicant data effectively reducing turnaround times historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

- Case Study: Lemonade employs machine learning algorithms—to assess insurance applications quickly allowing faster approvals while maintaining low default rates historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Portfolio Management

AI optimizes portfolio management strategies through dynamic asset allocation techniques analyzing market conditions continuously ensuring optimal performance maintained consistently throughout operations conducted daily across facilities worldwide ensuring compliance regulations governing practices followed during production activities conducted daily across various sectors globally today!

- Case Study: BlackRock’s Aladdin platform leverages artificial intelligence—for portfolio optimization providing clients with tailored investment recommendations based on individual preferences ensuring satisfaction maintained consistently throughout operations conducted daily across facilities worldwide ensuring compliance regulations governing practices followed during production activities conducted daily across various sectors globally today!

Fraud Analytics in Credit Cards

JPMorgan Chase utilizes advanced fraud analytics tools—to monitor credit card transactions effectively identifying suspicious activities instantly preventing losses incurred historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

- Case Study: The bank’s COiN platform uses machine learning models—to analyze transaction data identifying potential fraud patterns leading swift interventions mitigating risks associated attacks launched against infrastructures protecting integrity confidentiality data processed stored securely within environments governed strict compliance regulations governing practices followed during production activities conducted daily across various sectors globally today!

Payment Processing Optimization

AI streamlines payment processing workflows enabling organizations to reduce transaction times while minimizing errors associated with manual processing methods utilized historically prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

- Case Study: Stripe employs intelligent payment processing solutions powered by artificial intelligence in finance—to optimize transaction workflows significantly reducing processing times historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Market Sentiment Analysis

AI analyzes market sentiment through natural language processing techniques assessing public opinions expressed across social media platforms and news articles influencing investment decisions made accordingly!

- Case Study: Bloomberg utilizes sentiment analysis tools powered by artificial intelligence—to gauge public perception regarding specific stocks providing traders valuable insights enabling informed decision-making regarding investments undertaken routinely performed daily on an ongoing basis continuously striving to improve overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Predictive Customer Behavior Insights

AI provides valuable insights into customer behavior patterns enabling organizations tailor offerings accordingly enhancing satisfaction levels experienced customers interacting support channels available them whenever needed most importantly freeing up human agents focus more complex issues requiring personalized attention expertise knowledge gained over years working directly field servicing clients directly face-to-face interactions taking place regularly scheduled appointments arranged accordingly whenever necessary ensure every aspect relationship maintained strong healthy long-lasting partnerships forged between parties involved!

- Case Study: Netflix employs predictive analytics tools analyzing viewer habits providing tailored recommendations enhancing user experiences significantly driving engagement retention rates observed historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

How AI in Finance Industry Benefits Institutions and Consumers

The integration of artificial intelligence in finance offers numerous benefits that enhance operational efficiency while driving innovation within the industry:

Enhanced Fraud Detection

One significant advantage derived from implementing artificial intelligence solutions within finance revolves around enhanced fraud detection capabilities allowing organizations to identify suspicious activities accurately preventing losses incurred historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

By leveraging advanced algorithms analyzing vast amounts of historical real-time datasets collected from various sources including transaction logs, account activity records organizations gain valuable insights and detect anomalies indicative of possible fraudulent behaviors occurring unnoticed otherwise!

Improved Customer Experiences

Artificial intelligence in finance enhances customer experiences through personalized interactions tailored offerings based individual preferences ensuring satisfaction maintained consistently throughout operations conducted daily across facilities worldwide ensuring compliance regulations governing practices followed during production activities conducted daily across various sectors globally today!

For example chatbots powered by natural language processing capabilities assist customers inquiries seamlessly providing instant support resolving issues efficiently without human intervention freeing up agents focus more complex problems requiring personalized attention expertise knowledge gained over years working directly field servicing clients directly face-to-face interactions taking place regularly scheduled appointments arranged accordingly whenever necessary ensure every aspect relationship maintained strong healthy long-lasting partnerships forged between parties involved!

Faster and More Accurate Decision Making

Artificial intelligence empowers organizations make informed decisions based comprehensive analyses performed utilizing vast amounts historical real-time datasets collected various sources including transaction logs account activity records ultimately resulting enhanced strategic planning execution initiatives undertaken routinely performed daily basis ongoing basis continuously striving improve overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

For instance, predictive analytics tools allow companies to forecast demand trends and adjust production schedules accordingly to minimize excess inventory costs incurred historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Reduced Operational Costs

The automation capabilities provided by artificial intelligence lead directly towards reduced operational expenses incurred historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

For instance predictive maintenance tools allow companies to anticipate equipment failures before they occur, reducing unplanned downtime maintenance costs incurred historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Greater Financial Inclusion

Artificial intelligence contributes significantly towards greater financial inclusion enabling underserved populations access essential banking services previously unavailable due systemic barriers hindering participation within traditional banking frameworks established historically throughout societies worldwide!

By leveraging mobile technologies integrated with artificial intelligence, organizations can provide tailored offerings to meet unique needs and diverse demographics ultimately resulting in increased access opportunities, economic empowerment and communities previously marginalized excluded from formal financial systems established historically throughout societies worldwide!

Risk Mitigation and Management

Finally risk mitigation represents another critical benefit derived from integrating artificial intelligence solutions within finance enabling organizations identify potential risks accurately respond proactively mitigate impacts associated unforeseen events occurring unexpectedly during routine operations conducted regularly throughout facilities worldwide ensuring safety security well-being workers prioritized consistently throughout organization’s practices established governing procedures adhered strictly whenever possible whenever feasible under circumstances encountered regularly throughout daily activities undertaken routinely performed daily basis ongoing basis continuously striving improve overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

By leveraging advanced algorithms to analyze vast amounts of historical real-time datasets collected various sources organizations gain valuable insights detect anomalies indicative possible risks allowing swift interventions prevent losses incurred historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Challenges in Implementing AI in Finance

Despite its numerous benefits—integrating artificial intelligence into finance comes with challenges that must be addressed:

Data Privacy and Security Concerns

Ensuring data privacy security within the banking industry represents utmost importance as financial institutions handle sensitive information personal data customers relying upon trust confidentiality maintain relationships established between parties involved!

As such implementing robust measures to protect sensitive information collected and maintained throughout operations conducted daily across facilities worldwide ensuring compliance regulations governing practices followed during production activities conducted daily across various sectors globally today becomes of paramount importance safeguarding interests stakeholders involved!

Lack of AI Expertise in Financial Institutions

There exists a significant skills gap workforce trained to adequately handle complexities associated with deploying and maintaining sophisticated artificial intelligence solutions necessitating ongoing training development programs implemented by organizations seeking to bridge this gap effectively!

As demand continues rise skilled professionals capable navigating intricacies surrounding deployment maintenance these innovative technologies becomes increasingly critical ensure successful integration occurs seamlessly without disruptions experienced historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Regulatory and Compliance Barriers

Navigating the regulatory landscape surrounding deployment of artificial intelligence within finance presents additional challenges requiring careful consideration of implications arising from decisions made utilizing these technologies impacting society and the environment alike!

As such organizations must remain vigilant to ensure adherence to applicable laws and regulations governing use of these innovative solutions mitigating risks associated with non-compliance penalties imposed by regulatory bodies overseeing practices followed during production activities conducted daily across various sectors globally today!

Integration with Legacy Systems

Many financial institutions still rely heavily on legacy systems which may not be compatible with modern artificial intelligence solutions leading towards difficulties integrating new technologies effectively resulting in inefficiencies experienced historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

As such addressing integration challenges posed legacy infrastructures becomes paramount importance safeguarding interests stakeholders involved ensuring seamless transitions occur without disruptions experienced historically encountered traditionally prior implementation automated systems deployed organization-wide efforts aimed improving overall operational efficiencies achieved consistently over time since adoption occurred initially several years ago now!

Trust and Transparency Issues

Building trust transparency surrounding deployment of artificial intelligence remains a critical concern among consumers, wary of implications arising from decisions made utilizing these technologies impacting society and the environment alike!

Unlock the Power of AI in Finance – Book A 30 Minutes Free Consultation!

Conclusion

The importance of AI in the finance industry cannot be overstated. As financial institutions face increasing competition and rapidly changing market dynamics, the integration of AI technologies offers a pathway to enhanced operational efficiency, improved customer experiences, and better risk management. From fraud detection to algorithmic trading, applications of AI in Fintech are transforming how financial services operate, making them more agile and responsive to consumer needs.

Moreover, the ability of AI to analyze vast amounts of data in real-time provides financial institutions with insights that were previously unattainable. This leads to more informed decision-making, allowing organizations to anticipate market trends and customer behavior effectively. As AI continues to evolve, its role in finance will only grow, driving innovation and creating new opportunities for growth.

However, it is essential for organizations to navigate the challenges associated with AI implementation, including data privacy concerns and integration with legacy systems. By addressing these challenges head-on, financial institutions can fully leverage the benefits that AI has to offer, ensuring they remain competitive in an increasingly digital landscape.

Why Choose A3Logics for AI Software Development in Finance

A3Logics stands out as a leading Enterprise AI Development Company specializing in delivering tailored AI solutions for the finance industry. With a team of experts proficient in developing and deploying innovative AI technologies, A3Logics helps financial institutions optimize their operations and enhance customer experiences.

Customized Solutions

At A3Logics, we understand that every financial institution has unique challenges and requirements. Our AI Development Services include customized solutions designed to address specific business needs—whether it’s enhancing fraud detection capabilities or automating risk management processes.

Expertise in Financial Applications

Our extensive experience in the finance sector allows us to provide insights into best practices for implementing AI technologies effectively. We leverage advanced machine learning algorithms and predictive analytics tools to help organizations make data-driven decisions that drive profitability.

Seamless Integration

We ensure seamless integration of AI solutions with existing systems, minimizing disruptions while maximizing efficiency. Our approach includes thorough assessments of current infrastructures to develop strategies that align with organizational goals.

Focus on Compliance and Security

In an industry governed by strict regulations, A3Logics prioritizes compliance and data security in all our AI implementations. We employ robust security measures to protect sensitive information while ensuring adherence to regulatory standards.

Ongoing Support and Maintenance

Our commitment doesn’t end with deployment. A3Logics offers ongoing support and maintenance services to ensure that your AI systems remain effective and up-to-date with evolving technologies and market demands.

By choosing A3Logics as your partner in Enterprise AI Chatbot Development for finance, you gain access to cutting-edge solutions that enhance operational efficiency, improve risk management, and ultimately drive growth in an increasingly competitive landscape.

FAQs

How does AI help with fraud detection in finance?

AI enhances fraud detection in finance by utilizing machine learning algorithms that analyze transaction patterns in real-time. These algorithms can identify anomalies indicative of fraudulent activities by comparing current transactions against historical data. For instance, if a transaction deviates significantly from a user’s typical spending behavior or occurs from an unusual location, the system can flag it for further investigation or automatically block it. This proactive approach allows financial institutions to minimize losses due to fraud while maintaining customer trust.

Can AI improve risk management in financial institutions?

Yes, AI significantly improves risk management by providing advanced analytics that assess potential risks based on historical data and real-time market conditions. Machine learning models can predict future risks by analyzing various factors such as economic indicators, market trends, and customer behavior patterns. This predictive capability enables financial institutions to implement proactive measures to mitigate risks before they escalate into significant issues. Additionally, AI can automate risk assessment processes, making them more efficient and accurate.

What is the role of AI in customer service within banking?

AI in banking plays a crucial role in enhancing customer service within banking through the use of chatbots and virtual assistants that provide 24/7 support. These intelligent systems can handle routine inquiries such as balance checks or transaction histories without human intervention. By leveraging natural language processing (NLP), AI can understand customer queries accurately and respond promptly. This not only improves response times but also frees human agents to focus on more complex issues requiring personalized attention.

How is AI transforming investment advisory services?

AI is transforming investment advisory services through the development of robo-advisors—automated platforms that provide personalized investment recommendations based on individual client profiles. These systems analyze vast amounts of market data alongside user preferences to create tailored investment strategies that optimize returns while managing risks effectively. Additionally, AI-driven analytics enable investment firms to predict market trends more accurately, enhancing their decision-making processes regarding asset allocation.

What are the benefits of AI for financial forecasting?

AI offers several benefits for financial forecasting by improving accuracy through advanced predictive analytics models that analyze historical data alongside current market trends. These models can identify patterns that human analysts might overlook, leading to more reliable forecasts regarding revenue streams, expenses, and profitability. Furthermore, AI can simulate various economic scenarios—such as recessions or booms—to assess their potential impact on a company’s financial health. This capability enables organizations to make informed strategic decisions based on comprehensive insights derived from data analysis.