Table of Contents

In today’s era of digital advancement, AI provides a more effective, personalized, and data-driven approach toward wealth management. AI in wealth management is making a difference. Subtly but surely, in the financial atmosphere. The fantastic invention of science fiction may not be true, but it surely is one of the strong tools that can change the way people and organizations deal with their money and investments. We are experiencing automation and data-driven changes in the management of wealth, hitherto relying on close ties among people and well-informed financial AI investment advisors. Indeed, AI systems are a rich source for wealth managers and investors because of the advanced risk assessment, portfolio optimization, and decision-making capabilities they offer.

AI is changing how that value is created and delivered in the wealth management industry. Can you imagine a financial advisor who not only can process volumes of information in minutes but also adapts in real-time to changing market conditions and proposes an investment mix tailored to precisely suit your tolerance for risk and financial goals? AI streamlines wealth management, from onboarding to tax optimization, enhancing advisor capabilities and offering clients personalized, affordable solutions. This article delves into core aspects of AI in wealth management, focusing on the perspectives of industry evolution and benefits accruing to investors and wealth managers, and most importantly, on applications that AI is used for in the realm of wealth management.

Defining Wealth Management

One essential component of financial services is wealth management, which provides professional guidance and assistance to help people manage their money wisely. This all-inclusive strategy includes legal, tax, estate, and financial advice. Wealth management AI is your single point of contact and collaborates with tax professionals, estate planners, and accountants in developing an integrated wealth plan for your individualized needs. In this multilayered, personalized solution, the optimization of your financial security is enhanced; you are now empowered to make relevant decisions to safeguard your financial future.

Maximize your wealth with AI-driven insights.

The Role of AI play in Wealth Management

Wealth managers use AI to make informed investment decisions and react quickly to changes in the market. Predictive analytics in finance helps find investment possibilities and efficiently manage risks. It also enhances risk evaluation, guaranteeing that investment plans correspond with the unique preferences and financial goals of each client. Money managers may provide customized advice to their clients, enabling them to achieve their goals and expand their money, thanks to AI-enhanced client data analysis.

PwC estimates that by 2027, the assets under management of robo investing would have increased to an astounding $5.9 trillion, more than twice as much as they were in 2022 i.e $2.5 trillion. A growing number of investors are pursuing individualized indexing, especially those who want to maximize tax benefits and have an interest in factor-based investing, algorithmic portfolio creation, and ESG strategies.

Approximately 40% of investors in the institutional investing space intend to deploy money to customized indexing solutions. Conversely, about 50% of asset managers are getting ready to add customized indexing options to their portfolios.

According to PwC’s projections, by 2027, direct indexing’s assets under management should have more than tripled to a staggering $1.47 trillion, or around 1% of all AUM. Concurrently, it is anticipated that actively traded exchange-traded funds will witness an astounding rise. Ascending from $4.6 billion to $1.1 trillion. By 2027, this growth will represent 7.5% of the worldwide ETF market.

Wealth management strategies and the ways AI can help

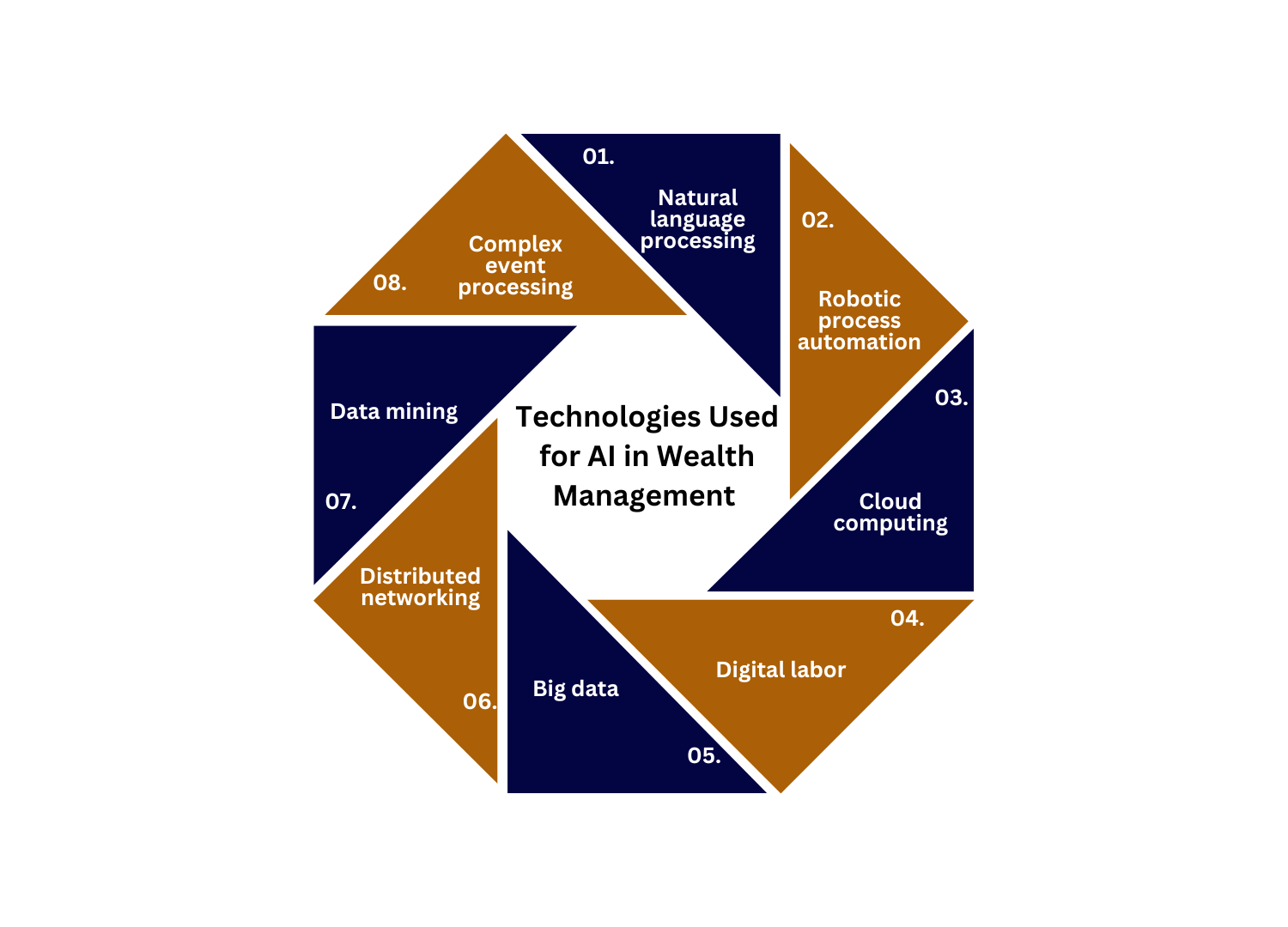

AI in fintech is a major factor in improving several wealth management functions, such as tax accounting, asset allocation, financial planning, and asset management:

Let’s examine every one of these:

- Financial planning:

AI algorithms will go through one’s financial information and review it to provide specific advice on investments and budgeting. The suggestions will make AI-powered financial planning more accurate, taking a more client-oriented approach, since it would factor in one’s spending habits, risk tolerance, and short- and long-term goals regarding finances.

- Asset allocation:

By continuously observing market conditions, evaluating risks, and making recommendations for modifications, AI-powered financial planning can optimize asset allocation techniques. These systems take into account the client’s changing financial goals and guarantee an equitable and risk-appropriate distribution of investments.

-

Asset management:

AI in wealth management for asset management assists customers in choosing wisely among their investments. They offer real-time insights by analyzing a large quantity of financial data and market patterns, which helps asset managers choose stocks, bonds, and funds that are in line with their clients’ objectives. AI also helps with risk management and portfolio rebalancing.

-

Estate Planning:

AI in wealth management can facilitate estate planning by keeping track of assets, debts, and beneficiaries in an organized and manageable manner. It’s a valuable tool for managing estate planning tasks.

-

Tax accounting:

Using the client’s financial transactions and investments as a basis, AI-driven tax accounting software can find deductions and chances for tax savings. It assists clients in optimizing their tax payments and streamlines the computation of tax returns. A digital wealth management platform is capable of managing intricate investment tax computations and determining how they will affect the client’s overall tax obligation.

AI improves productivity, gives data-driven insights, and allows for a more individualized approach to financial decision-making across many asset management domains. As a result, clients can make more informed decisions and possibly achieve better financial results.

AI in the Field of Wealth Management

AI in wealth management is seeing a shift thanks to generative AI, which is also improving investing techniques. This cutting-edge AI is changing the game by using its special capacity to produce fresh, human-like content from preexisting data patterns. This ground-breaking technology increases productivity and accuracy while providing previously unheard-of degrees of personalization and customer interaction. Here, we examine a few fascinating application scenarios that highlight the flexibility and promise of AI use cases in wealth management.

Chatbots

Thanks to generative artificial intelligence and deep learning technology, chatbots in the financial services industry have developed into increasingly sophisticated tools that do more than just offer necessary client help. Conversational AI is becoming more advanced thanks to this class of AI that can recognize patterns in current data and generate new ones. These artificial intelligence wealth management chatbots can have convincing conversations with humans by using techniques such as natural language processing, understanding, and generating.

RBS used “Luvo,” a generative AI-powered chatbot, to expedite their customer support procedure. Due to Luvo’s capacity to converse naturally with humans, response times were shortened and overall customer satisfaction was greatly enhanced. Customers may also receive individualized investment possibilities depending on their financial situation and past interactions.

Portfolio Management

The application of Generative AI is not limited to chatbots; it is also transforming portfolio management. These Fintech AI models can assist investors and asset managers in determining the best wealth management tactics by sorting through mountains of past financial data and creating many investment scenarios. They take into account crucial elements like investment horizons, expected returns, and risk tolerance.

Reputable investment management company Vanguard has included artificial intelligence in portfolio management. Vanguard was able to maximize portfolio performance and boost returns on investments by utilizing Fintech AI to forecast market volatility and modify investment strategies accordingly.

Compliance Supervision

In compliance management, wealth management AI is quickly establishing itself as a valuable ally, especially in the intricate realm of financial regulation. This technology is excellent at comprehending and interpreting pertinent laws and regulations. It can also perform comprehensive analyses of a business’s existing compliance status. With generative AI, creating thorough reports as well as writing contracts and reports becomes a smooth process.

Generative AI was used by JPMorgan Chase for compliance management. AI was utilized by the bank’s COIN (Contract Intelligence) platform to evaluate legal papers and extract pertinent terms and data points. This demonstrated AI’s effectiveness as a compliance officer by reducing errors and the amount of time spent reviewing documents.

Forecasting and Financial Analysis

Financial analysis, forecasting, and AI-driven investing are progressing due to generative AI, like the newest tools from ChatGPT, and CodeGPT. It can automatically identify complex patterns in vast amounts of historical data and display them as charts. Predictive analytics in finance may now provide insights on future asset prices, economic indicators, and wealth tech trends thanks to these capabilities. CodeGPT is an essential tool for financial strategy since it can simulate several scenarios with the correct optimization.

Consider BlackRock’s Aladdin, for instance. Similar to CodeGPT, this AI platform offers investors operational support and risk analysis. It enhances decision-making by analyzing large amounts of financial data to identify future trends and anticipate possible risks.

Financial Advisor Services

Financial services are entering a new age because of generative AI. Large volumes of financial data from reports, records, and statements can be analyzed by it, and it can then compute pertinent metrics using this information. AI in wealth management enables it to forecast the possible results of different financial plans and tactics. In addition to creating detailed financial goals and providing feedback on these plans, generative AI in wealth management can also serve as a customized financial counselor.

The robo-advisor Betterment uses generative AI to provide users with individualized financial advice. The platform uses artificial intelligence (AI) to evaluate the user’s financial information and then generates personalized recommendations and tactics. By providing affordable, individualized financial advice and increasing accessibility to AI in wealth management has completely transformed the wealth management sector.

Insurance

AI in wealth management to simplify the process of evaluating and customizing insurance plans. Algorithms powered by AI examine customer data to determine the best insurance plans and levels of coverage. Additionally, by streamlining the processing of claims and premium payments, these systems increase cost-effectiveness. Additionally, AI regularly reviews and modifies insurance portfolios to conform to evolving financial objectives and life situations. In the end, artificial intelligence wealth management for the insurance industry improves long-term financial planning and risk mitigation.

Charity Donations

How to use AI in wealth management? So, AI can be used by wealth managers to evaluate the philanthropic goals, values, and financial holdings of their customers. AI systems can evaluate the possible drawbacks of different philanthropic approaches while taking tax and market swings into account. AI in wealth management assists wealth managers in making informed decisions that minimize risks and maximize the impact of charitable giving by modeling various scenarios and assessing the impact of donations on overall financial health. Thanks to AI-driven investing and management, enables clients to match their generosity with their principles while retaining financial stability.

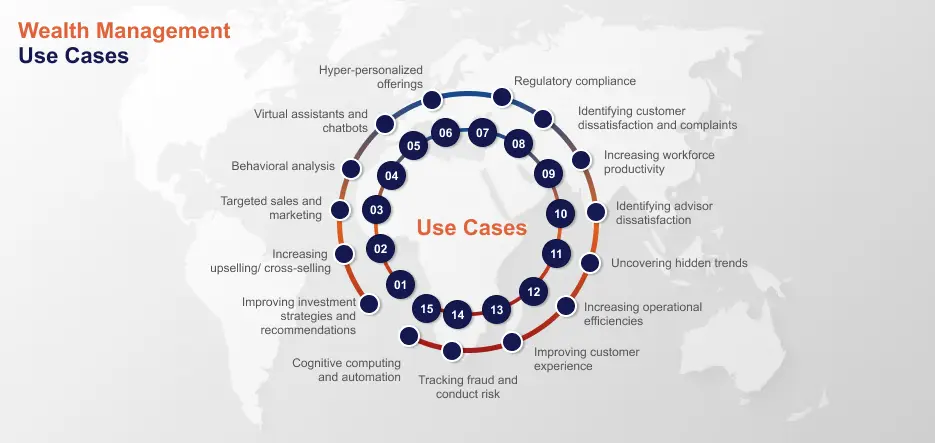

These use cases demonstrate how AI technologies are making the task of wealth management more productive, and better in terms of interaction with customers, and regulatory, as well as topical, and can give customized, data-driven solutions. Infusing proper AI into operations will enable better process refinement and value addition for a wealth management company.

Exchange Trade Funds

Like individual stocks, Exchange Trade Funds are investment funds traded on the stock exchange. They track the performance of a bond, index, commodity, or even a basket of assets like stocks or bonds. An ETF simply allows any investor to have a piece of such a broad range of assets without having to buy each of those assets on their own.

AI in wealth management robustly underpins Asset Management, especially in the optimization of ETFs. To come up with the best mix of ETFs that will support the client’s requirements, AI algorithms go through vast arrays of details, properly considering the risk tolerance, financial objectives, and market conditions of the client. The results can also be used to maintain constant surveillance on the ETF portfolio in question so that the result stays in line with a client’s goals. The consequence in this case is AI-powered insights that reduce trading costs, raise returns, and build personalized ETF-based portfolios based on the specific needs of each investor. In this way, AI in wealth management enhances the efficacy and efficiency of various ETF-based asset management techniques.

Retirement

The advanced risk management capabilities associated with AI make it highly essential for retirement planning. The benefits of AI in wealth management may yield customized retirement plans based on the analyzed financial information by the clients, their investment portfolio, and retirement objectives. These algorithms can factor in various variables, such as life expectancy, inflation rates, and market volatility while modeling a wide range of scenarios to assess potential risks to retirement funds. AI in wealth management can also suggest changes in strategy and proactively notify for actions to ensure long-term financial security. The major benefit that AI could bring to retirement planning is more accurate and flexible methods of retirement planning, thus helping the wealth manager to better assist his clients in the management of risks towards achieving their retirement goals.

Optimize your investment strategies using cutting-edge AI technology

The Best Ways to Use AI Wealth Management Software

Careful planning and execution are necessary. Especially when implementing fintech wealth management and financial planning solutions. The following guidelines can help to guarantee a smooth integration:

Onboarding and Education of Clients

Give your clients easily comprehensible educational materials regarding the AI tools in use. Provide onboarding meetings to clients so they can maximize the technology and learn how to comprehend insights given by AI.

Adaptive Risk Assessment

AI in wealth management may dynamically modify risk profiles in response to shifting market conditions and unique situations. This guarantees that risk evaluations stay precise and in line with clients’ changing financial circumstances.

Workflows for Human-AI Collaboration

Create processes that allow financial professionals to easily incorporate AI advice into their decision-making. To guarantee a good working relationship between AI systems and human expertise, clearly define roles and responsibilities.

AI Decisions’ Interpretability

Increase the interpretability of judgments made by AI by utilizing strategies like explainable AI. This promotes trust and confidence in the technology by assisting clients and financial experts in understanding the reasoning behind Fintech AI recommendations.

Adaptable AI Models

Create AI models that may be tailored to each client’s specific needs and preferences. This degree of personalization guarantees that the financial plans produced by Fintech AI closely match the unique financial goals of the clients.

Automated Verification of Compliance

Incorporate artificial intelligence techniques for automated compliance audits to make sure investment plans and financial plans follow applicable laws. This lowers the possibility of non-compliance and strengthens the financial planning processes as a whole.

Ongoing Model Observation

It is recommended to monitor AI models continuously to identify and correct any performance slippage. To keep Fintech AI models accurate and relevant, update them often depending on fresh data and market trends.

Cybersecurity Precautions

Make cybersecurity a top priority by putting strong defenses in place to shield AI systems from danger. Protect client data, financial data, and Fintech AI algorithms to keep the wealth management platform secure and intact.

Combining Legacy Systems with Integration

Make sure the financial institution’s legacy systems and machine learning solutions integrate seamlessly. This integration reduces interruptions during the installation stage and improves workflow productivity.

Entire Client correspondence

Provide clients with clear channels of communication regarding the role that Fintech AI will play in their wealth management. Inform clients regularly about new features, system improvements, and the advantages of AI-powered solutions.

Comparing Traditional Wealth Management and AI Wealth Management

There is a wealth of difference between traditional and AI in wealth management. In this section we will take a look at the differences between traditional wealth management and AI in wealth management:

| Aspect | Traditional Wealth Management | AI-Based Wealth Management |

|---|---|---|

| Client Onboarding | Manual, time-intensive processes require extensive paperwork and complex verifications. | Automated and efficient onboarding with AI handling document verification and risk assessment. |

| Portfolio Creation | Relies on human expertise and manual research. | AI-driven portfolio creation and optimization through data analysis and algorithms. |

| Advisory Services | Dependent on financial advisors for client interaction and personalized advice. | AI provides data-driven insights and personalized recommendations, often at a lower cost. |

| Transparency | Varies based on advisor communication and practices. | AI ensures consistent transparency with clear fee structures and product information. |

| Portfolio Rebalancing | Manually conducted by financial advisors based on their assessments. | AI uses algorithms and real-time market data for frequent and precise portfolio adjustments. |

| Risk Management | Managed by human advisors with varying expertise. | AI leverages advanced predictive analytics and algorithms for proactive risk management. |

| Efficiency | Time-consuming, manual processes with potential for human error. | Highly efficient, with AI automating routine tasks and providing rapid data analysis. |

| Personalization | Based on the advisor’s knowledge and the depth of client engagement. | AI enhances personalization by analyzing large datasets to tailor strategies and advice. |

| Scalability | Limited by manual processes and advisor availability. | AI enables scalability, allowing firms to efficiently serve a larger client base. |

| Costs | Often higher due to manual labor and operational overhead. | AI-based management reduces costs, offering services with lower fees. |

Difficulties with Using AI in Wealth Management

Navigating this revolutionary landscape in wealth management requires an understanding of the advantages, difficulties, and subtle implications of artificial intelligence. Let’s examine the challenges and possible dangers of AI in wealth management as we delve into this complex field:

- Data Availability and Quality: AI’s reliance on data makes errors and inaccuracies problematic.

- Interpretability and Explainability: AI’s lack of transparency can hinder compliance efforts in regulated fields.

- Adherence to Regulations: Strict regulations and AI in asset management often face legal hurdles.

- Cybersecurity and Data Privacy: One of the primary concerns with the use of AI in fintech is security. How to secure confidential customer information and defend against future cyberattacks.

- Integration with Legacy Systems: Technical challenges arise when integrating AI with legacy systems.

- Over-Subscription to AI: AI should not replace human judgment entirely.

- Ethical Aspects and Bias: It is crucial to make sure AI models are devoid of biases and adhere to ethical norms, particularly when handling delicate financial issues.

- Lack of Talent and Expertise: Finding AI talent is challenging.

- Client Adoption and Trust: AI wealth management faces challenges due to concerns about human interaction and personalized care.

- Cost and ROI Issues: Wealth management companies may have financial difficulties in determining the return on investment from AI adoption as well as the original investment.

AI’s role in wealth management in the future

AI in wealth management has a bright future full of opportunity and change. The following AI trends in wealth management may be seen as prospective developments in the way AI affects wealth management in the future:

-

Explainable AI:

The need for “explainable AI,” or technology that can clearly explain the thinking behind investing advice, will only increase as AI algorithms get more sophisticated. Decisions made using AI will need to be more transparent, according to authorities and clients.

-

AI-powered environmental, social, and governance (ESG) and sustainable investing:

Artificial intelligence will help clients align their investments with ESG goals. AI helps identify sustainable investment opportunities by evaluating ESG factors.

-

Artificial intelligence (AI)-enhanced regulatory compliance:

AI can automate compliance with evolving financial regulations.

-

Hyper-personalization:

As a result of AI’s capacity to analyze enormous volumes of data, investing strategies will become more individualized, taking into consideration each client’s particular preferences, life events, and even current financial circumstances. AI-driven cybersecurity will shield private financial data and thwart online attacks as wealth management systems grow more digitally connected.

-

Emotional and behavioral finance AI:

By evaluating and controlling the emotional components of investing, AI in wealth management may assist clients in making more sensible choices when markets are volatile.

Global reach: AI will allow wealth management companies to reach a wider audience worldwide, utilizing data from many marketplaces to present customers with a wider range of well-informed investment options. These prospective developments underline the significance of transparency, sustainability, security, and highly customized services while highlighting the expanding role of AI in asset management. It is anticipated that the sector will change as AI in wealth management advances and customer expectations change.

Empower your Financial advisory practice with AI. Leverage our development expertise

Conclusion

AI integration in wealth management signifies a revolution in the sector. The various wealth management use cases for AI, such as risk assessment, retirement planning, and charitable giving, highlight the technology’s broad range of uses. Wealth advisers may now offer high-quality services at lower costs thanks to artificial intelligence, which also improves risk management, personalization, and the client experience in general. The field of asset and AI in wealth management is changing as a result of these advancements, and artificial intelligence has the potential to advance and simplify financial plans for advisors and their clients.

As we move forward, let’s not forget that the true power of AI in wealth management is found in its capacity to increase financial inclusion. AI is breaking down barriers and enabling everyone to access professional guidance, regardless of experience level.

With the superior AI consulting services from A3Logics, you may revolutionize your business processes, improve decision-making, and maintain your competitive edge. Our team of professionals is prepared to assist you with integrating artificial intelligence, and customizing solutions to match your unique requirements.

FAQs

What is AI wealth management?

The use of artificial intelligence and machine learning algorithms in wealth management. Especially for investment management, financial advice, and portfolio optimization results in AI-automated wealth management. It makes decisions based on big data insight and offers tailored financial strategies.

How does AI improve wealth management?

AI really creates efficiency in wealth management, as it automates routine tasks, interprets huge amounts of information in less than a second, provides real-time insights, and presents customized investment strategies more effectively. This translates into better process efficiency, cost reduction, and smarter decision-making.

Is AI-Powered Wealth Management Safe?

The answer simply is yes, AI-powered wealth management is safe and secure. Advanced security measures and encryption are used to protect client data, while algorithms minimize the risks. You need to look into a reliable service provider, with strong policies in data protection.

How does AI ensure personalized financial advice?

AI does all that by analyzing big data on market trends and individual client preferences for personalized recommendations. Once the AI understands the client’s persona, then it can devise strategies that will work best for them.

What are the cost efficiencies of AI-based wealth management?

Normally, AI-driven wealth management has lower fees compared to traditional wealth management. Since it automates most of the tasks that were performed manually, this cuts down labor costs and operational expenses which are passed down to the client.

Can AI replace human financial advisors?

AI can free up financial advisors to focus on high-value work. Human judgment and expertise remain critical to major financial decisions.