Table of Contents

The integration of AI and machine learning into financial services is rapidly transforming the global fintech industry. As technology continues to advance at an exponential pace, various fintech app development companies are leveraging these novel technologies to create futuristic digital banking and investment solutions for users. The adoption of intelligent technologies like artificial intelligence, big data, and blockchain is helping fintech app development services build applications with advanced capabilities to deliver hyper-personalized experiences. Pioneering startups as well as established players are developing next-gen fintech apps focused on goals like automated investment advice, risk management, predictive analytics, effortless expense tracking, and so on.

From 2024 to 2032, the fintech market is expected to grow at an annual rate of 16.8%, reaching a projected value of over $917 billion by 2032. AI assistants are being incorporated into financial software to offer on-demand support to users through advanced conversational interfaces. With AI and ML at the core, the future of fintech app development seems profoundly innovative and intelligent.

Fintech Apps: How It Is Making All The Differences?

Fintech apps are digital platforms that deliver traditional financial services with more advanced features through the integration of innovative technologies like artificial intelligence and machine learning. As these technologies continue to evolve at a rapid pace, various fintech app development company services are leveraging them to build next-generation apps with human-like capabilities.

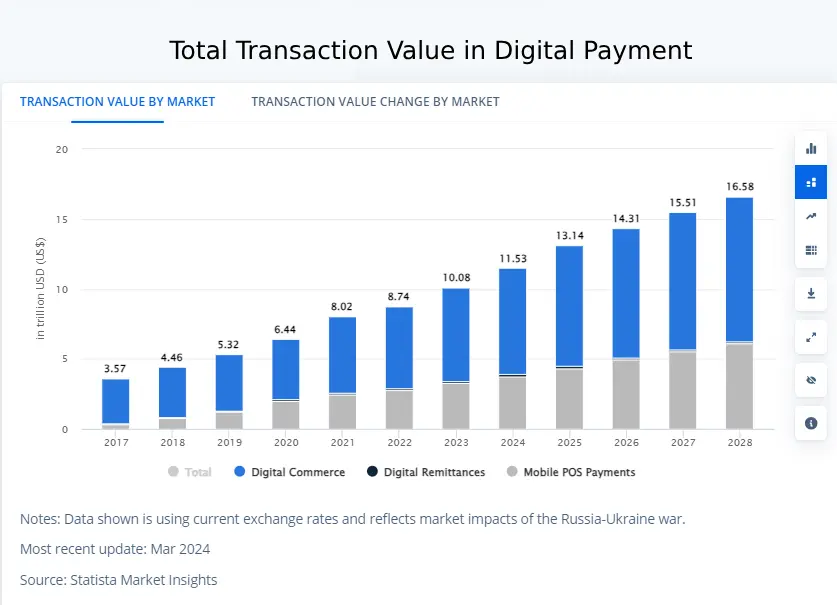

Total transaction value in the digital payments market is projected to rise to US$16.59tn by 2028. AI and ML are empowering fintech apps with the ability to analyze user data and behavior in real time to deliver hyper-personalized experiences. For instance, robo-advisors are using these technologies to generate intelligent investment portfolio recommendations specific to an individual’s financial goals, risk appetite, income sources, etc. Similarly, accounting apps for self-employed professionals are incorporating AI to automate tedious expense tracking, bookkeeping, and invoice creation tasks.

A key example is the popular accounting app Wave which leverages machine learning to intelligently scan receipts, match purchases to the right expense categories, and auto-populate tax documents with minimal human effort. AI assistants are also being embedded into financial management apps like Mint to offer virtual assistance to users for tasks like bill payment reminders, and budgeting suggestions.

Additionally, AI is revolutionizing digital lending with the ability to instantly assess large applicant profiles and identify hidden risks. This helps fintech lenders approve or reject applications in real time while traditional banks take days. Top mobile app development companies are incorporating advanced AI and deep learning models into lending software to enable accurate credit scoring and minimize risks of defaults.

In summary, the fusion of AI/ML with fintech is unlocking many possibilities across underwriting, trading, payments, and wealth management. As these technologies continue to evolve, they will transform many aspects of personal finance and banking by empowering users with autonomous and smart financial tools.

How Fintech Apps Work?

While traditional banking systems rely more on manual processes, fintech apps like MoneyLion leverage cutting-edge technologies to deliver automated, on-demand experiences. Here is a quick overview of how various fintech apps function:

Digital Lending

Fintech loan apps use advanced algorithms and alternate data sources like education, employment, and social media profiles to instantly pre-approve or reject applications based on creditworthiness. They can bypass lengthy bank approvals.

Personal Finance Tracking

Budgeting, expense, and bill payment apps connect to bank and credit accounts to aggregate spending data which is then analyzed using AI/ML to offer spending insights, detect anomalous charges, and recommend ways to save more.

Investment Apps

Robo advisors create and manage personalized investment portfolios automatically based on user profiles and market conditions without human fund managers. AI investing app development assesses risks and returns efficiently.

Insurtech Apps

Usage-based insurance apps track user driving patterns and calculate premiums accordingly. AI risk assessment models are leveraged for underwriting customized policies at lower costs.

Digital Payments

Mobile payment platforms facilitate contactless peer-to-peer money transfers, bill splits, purchase settlements and cross-border remittances in real time using blockchain networks and open banking APIs.

Crowdfunding Apps

Equity and donation crowdfunding platforms allow businesses and individuals to raise capital online by issuing shares or collecting donations from a large network of individual investors/supporters.

Chatbots and Virtual Assistants

AI chatbots for fintech answer common customer queries, provide financial recommendations, and automate basic tasks using natural language processing capabilities.

While the backend utilizes innovative technologies like AI, ML, and Blockchain – the front aims to offer a seamless and intuitive interface for conducting various financial operations on the go conveniently. Top banking app development companies focus on crafting intuitive app workflows and experiences.

Unlock the Future of Fintech with AI

What Features Make Fintech Apps Advantageous?

- Personalized User Experiences – Advanced ML algorithms power hyper-personalization by understanding user behavior, needs, and contextual habits to deliver only relevant products, tips, and services.

- Spending Optimization and Budgeting – Expense tracking, budget planners, savings goals and analytics help manage finances better with control and visibility over inflows/outflows.

- Consolidated Financial Overview – The aggregation of accounts from multiple institutions onto a single interface provides a unified picture of assets, liabilities, net worth, and trends over time.

- Automated Wealth Management – Robo advisors efficiently handle goal-based portfolio creation, rebalancing, and wealth management using algorithms without manual fund manager intervention.

- Paperwork Elimination – Digitization of financial documents like bills, invoices, receipts, and contracts eliminates physical paperwork and retrieves records instantly as needed.

- Alternative Data Evaluation – Apps analyze non-traditional data sets like education level, and lifestyle parameters for making critical decisions related to loans, insurance underwriting, etc.

- Real-time Underwriting – AI-powered instant approvals/rejections accelerate the traditionally lengthy application processes for loans, and credit cards based on profiling hundreds of attributes.

- Easy Accessibility – Users can conduct transactions 24/7 from any device instead of visiting branches during restricted hours or waiting on call. Geographical limitations are overcome.

- Lower Cost of Services – Fintech bypasses overheads of high street banks and offers competitive interest rates, negligible fees, and usage-based premiums by operating virtually through a software-driven model.

- Advanced Security Features – Biometrics, tokens, and encryption solutions protect accounts and transactions from unauthorized access, and data breaches with safety ranked as the top priority by reputed fintech app development companies.

Ways AI and Machine Learning Are Revolutionizing Fintech Apps

Intelligent Virtual Assistants

Artificial intelligence is empowering fintech apps with intelligent virtual assistants that can understand user queries in natural language to provide personalized guidance. Leveraging technologies like NLP, various FinTech custom software development companies in the USA are developing conversational AI capabilities within banking apps, investment tools, and insurance platforms. Powered by machine learning models trained on massive user data sets, virtual assistants can fetch customer-specific account details and transaction histories to resolve issues faster. They also offer tailored recommendations for improving finances, achieving savings goals, and selecting optimal investment products based on individual risk profiles. Top artificial intelligence app development companies are creating next-gen chatbots with abilities to learn continuously from interactions to deliver increasingly human-like assistance over time. When coupled with visual design thinking, such AI can deliver exceptional customer experiences.

Automated Underwriting

Artificial intelligence is revolutionizing loan underwriting with powerful ML algorithms capable of evaluating larger and more diverse datasets than traditional statistical modeling techniques. Various fintech apps are leveraging advanced ML to efficiently assess massive applicant profiles and instantly pre-qualify them. They can analyze thousands of data parameters including educational qualifications, career benchmarks, and lifestyle patterns extracted from social media in real-time to estimate risk scores. This ability to understand nuanced multi-dimensional factors enables more informed lending/insurance decisions. It also facilitates customized origination of financial products tailored to specific customers and circumstances. Several FinTech software development companies in the USA are actively developing underwriting automation solutions compliant with responsible AI practices. Custom app development services too are bringing these benefits to banking apps for more inclusive digital transformations.

Personalized Recommendations

AI’s ability to detect hidden patterns enables personalized recommendations within FinTech platforms. As users transact over long periods, deep learning models continuously build multi-dimensional profiles reflecting financial behaviors, goals, and attitudes to different risk types. Algorithms then identify subtle correlations to surface suitable new services, providers, and tips for improved savings or spending. Leveraging such insights, AI is empowering investment apps to recommend low-risk funds meeting individual objectives. It nudges insurance customers towards well-fitting add-on covers too. Top financial software development companies in the USA are partnering with leading AI labs to craft robust personalized recommendation engines factoring contextual elements. Conversely, customizable experience layers ensure users maintain full autonomy over decisions. When applied judiciously with explainable approaches, such AI stands to augment human experts in wealth management while enhancing customer engagement.

Predictive Analytics

Fintech apps leverage predictive analytics to forecast financial requirements, outflows, and budget shortfalls in advance. Deep learning models interpret user account details, transaction patterns, and open banking data feeds to establish baselines of normal spending under various categories over time. Algorithms then identify subtle divergences indicating anomalies like unexpected charges or seasonal underspending habits. They also recognize periodic cash requirements like insurance premiums and tax installments. Together with open APIs offered by financial institutions and third parties, predictive engines continuously receive updates to refine projections. Capable of presaging shortfalls ahead, these AI solutions empower customers toward improved financial discipline through timely alerts, and customized tips. Several artificial intelligence app development companies are developing such predictive capabilities compliant with regulations for banks, and insurers alike. They also ensure model fairness boosting trust in algorithmic determinations.

Robo-Advising

Algorithmic investment tools are dramatically improving through robo-advising powered by reinforcement learning algorithms. Intelligent bots created by top AI investing app development firms study decade-long trades and read news/reports simultaneously to identify patterns across lakhs of securities over split-seconds. They gauge investor risk profiles, time horizons, liquidity needs from interactions and questionnaires to auto-generate bespoke portfolios meeting goals. Robo-advisors then continuously monitor chosen equities, bonds, and funds through vast proprietary datasets and public streams. Leveraging these, bots proactively rebalance holdings regularly, and minimize taxes from capital gains without manual oversight. Advanced fintech platforms seamlessly integrate such robo-services to deliver cost-effective, optimized online wealth management. They also provide well-rounded client dashboards projecting returns alongside periodic performance reviews maintaining transparency. When coupled with human advisory support, such AI ensures responsible, goal-based investing tailored to modern lifestyles.

Activity Monitoring for Fraud Detection

AI’s ability to recognize anomalies enhances fraud detection, and risk control within fintech ecosystems. Advanced behavioral analytics models developed by hybrid app development services continuously study individual account transactions, login patterns, device locations, and other associated metadata in real-time. Algorithms then identify transactional irregularities arising from unauthorized access and tampering systems indicative of potential fraud. Leveraging unsupervised machine learning techniques, these specialized models are programmed to detect subtle inconsistencies within huge volumes of data impossible for humans to manually examine. Detected risks are promptly escalated through the banking app for prompt fraud alerts. Equally, centralized AI notifies the originating institutions about compromised details. Capable of spotting even sophisticated attacks at nascent stages across geographies, such intelligent monitoring secures accounts while bolstering user trust in digital banking and payments crucial for FinTech’s growth.

Document Digitization

To facilitate easy access and retrieval, computer vision and natural language techniques enable automated digitization of paper records. Powered by deep convolutional networks and OCR, intelligent scanners rapidly extract key information from cheques, account statements, and application forms after de-skewing and pre-processing images. Customized AI from software development companies intelligently classifies document categories, and segments different fields discriminating characters amid noise with high proficiencies. Leveraging these computer vision skills, bots automatically populate digital user documents and transactions eliminating manual data entry. Advanced natural language models concurrently parse contents, and match entities to corresponding fields. Advanced fintech startups seamlessly integrate such AI-driven digitization modules within banking apps and ERPs for convenient paperless record-keeping aligned with data protection laws. This expands operational efficiencies, augments back-office capabilities and lowers costs.

Advanced Risk Modeling

Actuarial science gets a boost from AI improving several core areas like underwriting, claims handling, and risk adjustment. Top FinTech solutions integrate advancements like natural language processing, computer vision, and advanced deep learning networks to modernize legacy statistical techniques. Custom AI models identify important non-traditional factors like educational qualifications, lifestyle parameters, and social media behaviors that influence adverse selections. Algorithmic faculties segment complex multi-variate consumer profiles into homogeneous risk groups factoring nonlinear interactions versus traditional techniques. These nuanced risk insights power more transparent pre-qualifying decisions and fraud detections at origination. Post disbursal, predictive algorithms identify rising default probabilities early through mass surveillance. Established banks are outsourcing such futuristic EDI in finance technology skill development to emerging enterprises speeding up digital transformations. When responsibly engineered with socioeconomic safeguards by specialized banking app development companies, AI promises healthier Insurance marketplaces.

Real-time Market Analysis

Algorithmic trading is being revolutionized through market sentiment analysis, predictive quote forecasting techniques based on deep neural networks, and natural language processing models. High-frequency trading systems developed by leading custom mobile application development company services now scan news reports, social media, and financial blogs extracting critical insights within nano-seconds. Sophisticated bots gauge collective investor perceptions towards any instrument, or sector through social analytics on millions of data points like tweets, and forum comments providing multi-dimensional views beyond basic price/volume indicators. Market-moving events are simultaneously identified, and assessed for short/medium term impacts. Advanced predictive models powered by reinforcement learning then autonomously place trades across exchanges reaping profits from transient mispricings detected amid noise through unstructured data screening impossible for humans. When governed responsibly by hybrid fintech platform accountability features, such real-time AI-empowering algorithmic strategies aim for transparent wealth generation aligned with financial regulations worldwide.

Steps to Develop Fintech Apps

Developing a feature-rich fintech app involves stringent testing and iterative design requiring significant investments from fintech software development services in the USA. Here are the key steps involved:

- Define Functionality: Outline core features like expense tracking, personal finance management, lending, and robo-advisory to focus development. Use artificial intelligence and machine learning solutions to offer advanced capabilities.

- Design Interfaces: Create wireframes and prototype the UI using tools like Figma, and Adobe XD based on target users and fintech services trends. Get early feedback from users.

- Select Tech Stack: Programming languages like Java, and Kotlin and frameworks like Flutter to build hybrid, cross-platform solutions. Include API integrations for open banking, and payment processing.

- Build Backend: Develop APIs to fetch, store, and process financial data on secure servers using encryption, and authentication. Integrate machine learning models for recommendation engines, and predictive analytics.

- Develop Screens: Code frontend interfaces aligned with wireframes leveraging cross-platform frameworks. Include authentication, customization, and settings screens.

- Testing: Rigorously test features, security, and performance on various devices and operating systems. Get beta users to identify bugs before the production launch.

- Embed AI Capabilities: Integrate intelligent conversational interfaces, robo-advising engines, algorithms for fraud detection, and risk assessment leveraging customized artificial intelligence and machine learning technology.

- Integrate External APIs: Connect with credit bureaus, and data sources for underwriting, and verify user identities by partnering with leading FinTech services providers and banks.

- Deploy and Launch: Release the app on app stores after addressing all tests and feedback. Continuously updated with new features based on customer requirements.

- Track Analytics: Monitor usage, crash reports, and support requests to further optimize the platform. Use insights for future product roadmap and custom enhancements.

Costing of Fintech Apps

The cost for building a FinTech app depends greatly on various factors such as features, target platform, technical complexity, timeline involved, and choice of top mobile app development companies. On average, building a minimum viable product could range between $50,000 to $100,000 but complete advanced solutions may exceed $1 million. Here is a broad cost breakdown:

- Design and Wireframing: $5,000-$10,000

- Programming time: $50-$150/hour

- Minimum features app: 500-1000 hours = $25,000-$150,000

- Backend Development: $10,000 – $50,000

- Artificial Intelligence Integration: $15,000 – $50,000

- Machine Learning Model Development: $30,000 – $100,000

- Testing and Debugging: 15-25% of development costs

- UI/UX, Graphics Design: $5,000 – $15,000

- Integration of APIs and external services: $5,000 – $20,000

- Launch, Maintenance and Support: 10-15% annually

- Ongoing improvements: $10,000 – $50,000/year

Additional costs may include quality assurance, project management, and database development. Banking app development may cost 20-30% higher due to compliance burdens. Selecting established custom mobile app development companies from the USA having financial expertise helps fast-track projects to launch quicker at lower total costs in the long run.

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your App Journey Today!

Final Thoughts

To summarise, AI and machine learning are massively transforming the FinTech industry with personalized products, predictive capabilities, and many automation opportunities across activities like underwriting, risk-modeling, wealth management, and fraud detection. As these technologies continue advancing rapidly, future-ready FinTech apps will deliver intelligence, speed, and seamless experiences elevating customer satisfaction.

Top enterprise app development companies are applying deep learning, neural networks, and computer vision for analyzing documents, customer profiling, and market sentiment. Simultaneously, technologies like blockchain, decentralized finance, internet of things are opening newer avenues for developing next-gen B2B solutions or elevating existing ones.

Individual entrepreneurs and FinTech startups should leverage low-code/no-code platforms to quickly experiment and launch MVPs at lower fintech software development costs while focusing on validation. Established players must speedily adapt too to fend off competitive threats.

Developing specialist AI talent while outsourcing non-core activities to top fintech software development companies in the USA reduces risks, and cost overruns and accelerates innovation. Regulators also need to address ethical and transparency challenges posed by black-box algorithms to build public confidence in AI. If tapped judiciously with insights from experts providing artificial intelligence and machine learning solutions, these technologies could massively boost financial inclusion and literacy, and bring greater transparency and efficiency needed for driving future growth on a global scale. Success lies in pursuing continual innovation responsibly.

FAQs

Q1. What is the process for fintech app development?

Development includes planning, designing, development, testing and deployment. Key phases involve defining objectives, wireframing, selecting a technology stack, developing features, integrating APIs, testing on devices, and user acceptance testing before the security audit and launch.

Q2. How do fintech apps use AI and ML?

Popular applications include robo-advisory, predictive analytics, intelligent virtual assistants, automated underwriting, and fraud detection using deep learning models trained on user data to offer hyper-personalization and automation.

Q3. What are the popular types of fintech apps?

Popular categories are lending apps, investment and wealth management apps, mobile payment apps, budgeting and financial tracking apps, crowdfunding apps, InsurTech apps, and blockchain apps among others. Each has a tailored experience for customers.

Q4. What is the average cost of developing a fintech app?

It can range from $50,000 for an MVP to over $1 million for full-fledged solutions depending on features, customizations, technical complexity, choice of top mobile app development companies, and timelines involved. Regular maintenance and support also cost 10-15% annually.

Q5. What are some top fintech companies globally?

Leading players include PayPal, Stripe, Square, Robinhood, Ant Financial, Sofi, Credit Karma, Avant, Klarna, Tipalti, Transferwise, Remitly, Revolut, Coinbase, Gemini, N26, etc. but many new startups are also innovating rapidly to disrupt the industry.