Table of Contents

Apps like AfterPay have revolutionized the way we shop and manage our finances in today’s fast-paced online environment. Afterpay is a popular app that allows consumers to buy items easily and split payments into manageable amounts.

If you’re a budding entrepreneur, or a business, who wants to tap into the growing market of BNPL apps like Afterpay, you have come to the right place.

This blog will guide you through the steps necessary to create your own BNPL App, similar to Afterpay. It will highlight the key features and the banking app development costs, as well as other aspects.

So, let’s begin.

Overview Of Apps Like Afterpay

AfterPay is the app you need for stress-free online shopping. They strive to make quality products and the newest trends affordable for everyone, without compromising their budget. Discover a community that embraces the AfterPay lifestyle. AfterPay offers a more flexible and smarter way to shop, whether you are a tech lover, a home decor enthusiast or a trendsetter.

As per mobile app development companies USA experts, AfterPay can be used in thousands of shops. It gives you endless options for shopping. Select AfterPay at checkout. Divide your total into equal four payments payable every two-weeks. Once your item is approved, you can take it home immediately.

Afterpay like apps is an online service that lets consumers make purchases, and then pay them off in installments. In recent years, Afterpay and other similar apps have gained in popularity among young consumers. Apps like Afterpay work by registering for a BNPL account. Often, this involves providing personal details, like name, email, and financial information. To manage installment payments efficiently, it’s crucial that users understand the terms and condition of these services as well as their financial capability.

What is the BNPL Model, and How Does It Work?

Buy Now Pay Later (BNPL) allows customers to purchase items online or in-stores immediately and pay over time. This is a short-term finance that allows you to pay in small amounts over time.

The introduction of this financial solution has seen a significant increase in e-commerce websites. This mobile application consulting services helps to attract more customers who are ready to buy to your site.

Most people who use credit cards know this concept, so it’s easy for them to grasp. For those who do not know what a “credit card” is, we will tell them that it is a way to live out our childhood fantasy of being able to buy items without having to pay for them.

You heard right!

The Buy Now, pay Later option is similar to a credit card, and people are willing to invest because they can pay later. The technology allows customers to buy online without paying the full price. This Buy Now, Pay Later app like Afterpay is the best because it allows customers to pay by installments and is free of interest.

Why You should Build Apps like Afterpay

In recent years, Buy Now Pay Later (BNPL), or ‘Buy Now and Pay Later’ apps, have revolutionized the FinTech sector. Cash advance apps like Empower and Klarna, which offer interest-free payment plans to customers, have become extremely popular among Gen Z and millennials. More retailers and merchants are embracing BNPL to increase sales. This article will examine the top 10 reasons for building apps like Afterpay in USA by 2025.

1. Untapped Market Opportunity

The BNPL industry is still growing and has a great deal of potential. The global BNPL transactional value is expected to increase from $120 billion to $300 billion by 2026. This growing market presents a great opportunity for BNPL startups. BNPL is becoming more popular among customers who are looking for affordable purchases.

By building a BNPL application, entrepreneurs can capitalize on an untapped market. Best apps like Afterpay can be designed to offer customers unique features or a better experience. The BNPL market will remain competitive, but new entrants can gain a lot if they are able to disrupt the space with technology-enabled solutions.

2. Growing Customer Demand

BNPL purchases have grown in popularity exponentially among millennials and Gen Z. These digital natives are more likely to choose traditional credit overspending now and paying later. They prefer flexible payment plans without interest or fees.

Over 50% of millennials, Gen Z and Gen X customers plan to use BNPL at some point in the future. The demand for BNPL will continue to grow as young customers with no credit history gain financial stability. By building a BNPL application, startups can address this growing need with products that are tailored to young budgets.

3. Increase Sales for Merchants

Offering BNPL to merchants across various industries, such as fashion, electronics and furniture, can boost sales by a significant amount. Studies show that checkout conversion rates can increase by 30% or more when BNPL payment is used instead of other methods.

According to a custom mobile app development services expert, deferred payment plans can be used for almost any purchase. From apparel to electronics, to vacations. BNPL developers can work with merchants to implement these plans. This will increase sales for retailers and earn them transaction fees. The mutually beneficial dynamic encourages more merchants to support BNPL’s mobile wallets and apps.

4. Market Disruption Opportunity

Despite the fact that established players such as Affirm, Klarna and others dominate the BNPL market today, there are still opportunities for disruption. New apps that disrupt can focus on customer pain points, expertise in vertical markets, or technological innovation.

A BNPL app that caters exclusively to healthcare costs, for example, could be a success. A BNPL app that streamlines cross-border payments could fill a gap. New apps will gain traction if they disrupt underserved segments, or address pain points with superior UX/UI.

5. Underbanked Customer Segment

Insufficient credit history or bankruptcy are among the reasons why a large segment of consumers prefer alternatives to credit cards. Students and recent graduates who are starting out in their careers may also have difficulty getting approved for traditional credit lines. BNPL addresses the needs of customers who are underbanked.

A BNPL application that focuses on the underbanked market could be a success. Flexible payment plans that do not require hard credit checks can help to finance first-time home buyers. Special products for students, recent graduates or those who have thin files allow you to reach out to a previously ignored customer base.

6. Partner with Influencers

BNPL has caught on among social media influencers, who promote the payment option to followers. New BNPL startups can target wealthy customers by partnering with popular creators within specific niches.

Influencers drive new users by promoting featured products and welcoming codes. By partnering with 3-5 influencers in the first year after a new BNPL launch, you can gain early traction via targeted word-of-mouth marketing. The benefits of building loyal influencers relationships are also beneficial when scaling up.

7. Loyalty Reward Program

New BNPL apps offer more than just deferred payment. They can also integrate loyalty programs to reward repeat customers. Each purchase could be converted into loyalty points, which can then be redeemed for upgrades, discounts or cashback.

Reward programs encourage repeat purchases and usage through loyalty programs as per top iOS app development companies. Power users are interested in incentives that maximize their benefits. A robust loyalty program built into the app keeps customers engaged in between purchases. It distinguishes the experience from basic payment plans offered by competitors.

8. Simplified Onboarding

Many people are discouraged from signing up for financial services because of the frustrating onboarding process. Conversions are boosted by building a BNPL application that simplifies the user experience.

More users are encouraged to sign up with a simplified process that requires minimal data input, offers social logins via one tap and activates accounts in minutes. The experience is further enhanced by simplified ID verification, flexible payments during checkout and instant approvals. By delighting users right from the beginning, you can create advocates for life.

9. Customized Repayment Triggers

Repayment defaults can impact conversion metrics as well as approval rates. The new BNPL app can help optimize this process by providing tailored triggers and reminders for repayment.

Users are kept on track by sending emails, text messages or push notifications personalized with the purchase amount and payment due date. The frequency of reminders can be adjusted per user, based on their past behavior. Brand reputation is enhanced by proactively avoiding defaults.

10. Rich Analytics Dashboard

Actionable insights empower BNPL companies. Analytics is still underutilized. By offering partners and merchants a rich analytics user interface, new apps can gain.

Business can be optimized with detailed transaction views, customizable reporting and real-time tracking of performance. Analytics can also help with better retention and targeting strategies. The democratization of powerful analytics strengthens user trust and value partnerships.

Apps like Afterpay: Features

Payment apps like Afterpay offer a variety of features to cater both to consumers and merchants. These features add to the convenience, flexibility and appeal of the Buy Now, Pay Later (BNPL). Following are some of the features that you will find in apps such as Afterpay.

User Registration

Consumers can create a user-friendly and seamless account by providing personal details and financial information.

Merchant Integration

Integration with online and offline merchants provides users with many options to make purchases.

Real-Time Approval

Users can get instant approval at the point-of-sale, so they can make purchases immediately without having to wait for a long credit check.

Payment Flexibleness

Splitting the cost of an item into two-weekly installments that are free from interest.

Automated Payments

Automatic deductions are made from the linked payment method of the user on the scheduled dates. This reduces the need for manual processing.

Transparent Fee Structure

Transparency in fees is ensured by a clear disclosure, including late fees and penalties.

How to Build Apps like Afterpay?

Afterpay is a great example of an app that involves many steps. These include planning, conceptualization, development, testing and deployment. Here is a guide to help you develop a buy-now, pay-later (BNPL) application as per the top fintech app development companies.

Market Research

Consider demographics, shopping behaviors, and the types of merchants they frequent. Consider their demographics, their shopping habits, and which merchants they visit.Competitor analysis: Analyze other BNPL apps, such as Afterpay, to determine the strengths, weaknesses and key features.

Compliance with Legal and Regulatory Law

Make sure you comply with the financial regulations and the data protection laws of regions where you intend to operate. Legal experts can help you navigate regulatory requirements for payday advance apps like EarnIn.

Technology Stack

Select a stack of technologies based on the expertise of your team and your app’s scalability needs. This can include backend technologies and databases as well as frontend frameworks.

Testing

Test thoroughly, including unit, integration, and user acceptance tests. Ensure that the app runs seamlessly on various devices and platforms.

Deployment

Depending on the platform you are targeting, either deploy your app through app stores (e.g. Apple App Store or Google Play Store), or distribute it via other channels.

Marketing & Promotion

Use social media to leverage other digital marketing channels. Collaborate with retailers for joint marketing.

Monitoring

Update the app regularly to include new features, security patches, and improvements as per mobile app development services USA experts.

Steps to Develop Apps like Afterpay?

From initial planning through to deployment, developing apps like Afterpay is a multi-step procedure. Here is a guide to the complete process as per blockchain development services expert.

Define Objectives & Requirements

The first step of custom mobile app development is to clearly define your app’s goals. You need to be clear of objectives. Understanding your target audience, the key features and the market that you want to serve is essential.

Market Research

Research the market thoroughly to identify challenges and opportunities, as well as understand the competition.

Legal and Regulatory Considerations

Comply with all financial regulations and data protection laws in the region where you intend to operate.

Wireframing and Conceptualization

Create wireframes or mockups of the app to help visualize its user interface (UI), and user experience (UX). This will help you refine the design and functionality of your app.

Implementation of Security

Use robust security measures to safeguard user data and financial transactions. Encrypt data for transmission and storage.

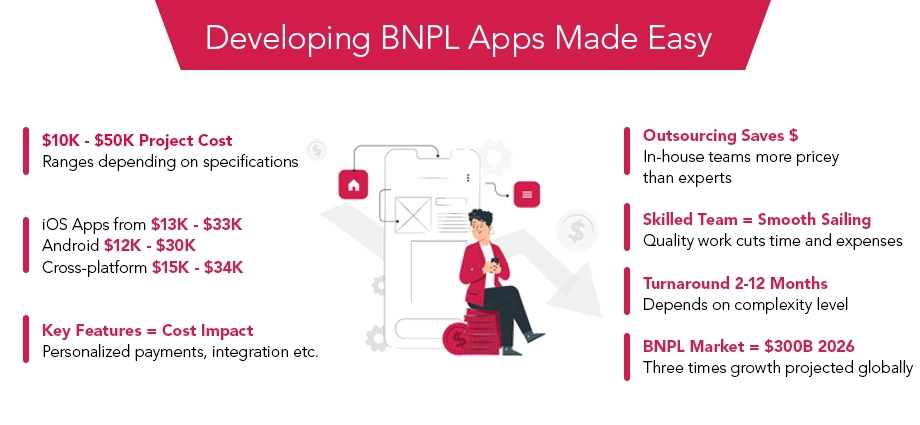

Cost Breakdown of Developing a Buy Now, Pay Later Application

Depending on the specifications of the project, you may pay between $10,000 and $50,000 for professional enterprise mobile application development services to create a BNPL Platform. The obvious question now is whether or not people will pay attention to the expanded window of this cost range.

The fact is, app development can be affected by a variety of factors and inclusions.

Before you choose the best company to develop your mobile app, it’s important to understand the costs and the factors that influence them.

Here’s a breakdown of the costs for various types BNPL applications and the estimated timeframe for completion:

Factors Influencing the Cost of Development a Buy Now, Pay Later Application

It is now time to gain an understanding of what factors influence the price of BNPL apps.

App Development Platforms: Choose Wisely

If you are seeking cash advance apps like Dave development solutions, the first and most important factor of consideration is the choice of platform. Also, to choose the best platform, businesses must consider their target audience.

The project cost and turnaround time are longer when you want to create an app for Android and iOS. Cross-platform design is a good alternative. However, you will not be able to customize the interface to any particular platform.

After you’ve gathered insights into your target audience’s preferences, the next step will be to determine how pricing differs when it comes to choosing the best app development platform. The pricing for the different development platforms would be as follows:

- Developing BNPL apps costs on iOS platforms range from $13,000 up to $33,000 per platform.

- Costs for developing a BNPL Android app range from $12,000 up to $30,000.

- Developing a cross platform application for BNPL startups range from $15,000 to $34,000.

Consider the following factors when choosing your BNPL platform: the target audience, the available resources, the business goals, the budget, and so on. It is important to take your time when choosing the platform.

Choosing the Key Features for a BNPL App

Next, you need to decide which features are most important for your buy now pay later apps like Klarna. You must match the features of an application such as AfterPay when you develop it.

With the BNPL App, you can offer users a seamless and secure payment experience.

Here are some important features to consider when building an app like AfterPay as per Android app development companies. Also, these features not only enhance the capabilities of a BNPL application, but also increase the cost of development.

1. Offer Personalised Payment Schedules and Credit Limits

Your customers can choose their preferred payment schedules as well as the credit bureau they want to use.

2. Third-Party Integration Capability with Online Retailers

Integrate your platform with eCommerce platforms from third parties to ensure that your customers use your BNPL service. Also, this will enable users to take advantage of your simple financing options just like popular apps in USA.

3. Analytics and Reporting Features

This feature allows you to track important information such as customer behavior, payment trends, financial performance and more.

4. Automated Payment Scheduling and Reminders

This is a very important feature, as it allows the customer to schedule their payments automatically without any manual input. Automated reminders ensure that customers don’t miss their payments.

Here are a few features that make BNPL apps more effective. There are other factors that affect the cost of development. These include:

- Fraud detection & prevention

- Pay in-store

- Customers can chat with chat support.

- Credit score tracker

- Multi-language support

- Payment options

- Loyalty program, etc.

So, you can add an infinite number of features to your BNPL application. With each feature you choose or include, the development cost will increase. Choose your features carefully.

How can A3Logics Help you to Build an App like Afterpay?

The cost of BNPL application development can be influenced by the third most important factor, which is the choice of the right team. A3Logics can assist with cost-effective development of apps like Afterpay.

Also, the right team will help you save money when it comes to app development. They can help you save a lot of cash, whether it’s on UI/UX, features or complex development.

The right professionals can help you develop monetisation plans for BNPL applications that your competitors use, such as After-Pay. Many people think that hiring a BNPL development company like A3Logics can be expensive because they have large teams and more resources.

But, outsourcing your app development needs to company like A3Logics can help you separate your requirements between professional team members. This will reduce the development cost per hour and speed up the turnaround.

Also, you will need to hire a project manager and business analyst, as well as front-end & back-end developers, UX/UI designers, QA analysts, in order to ensure that your project is developed with the highest quality. Hiring a large team of developers in-house is more expensive than outsourcing.

Choosing the right mobile application development services from A3Logics can influence the overall cost of the project. A professional and productive team could help you lower the cost of development. They can help you with everything right from costing to programming languages for mobile app development.

Conclusion

It is a significant undertaking to build a BNPL app like AfterPay. This requires expertise in financial technology, user experience design and regulatory compliance. Also, the end product is a valuable tool in the e-commerce world today, as it meets the demand for flexible payment options. A platform like this not only provides consumers with greater payment options, but it also gives retailers an increased customer base and sales opportunities. A3Logics, the best mobile app development company in USA, can help you develop your BNPL App. Connect now!

FAQs

How long does it take to build an app like Afterpay?

The development of an Afterpay app for Buy Now Pay Later takes between 4 and 9 months. The time required to develop a BNPL application varies depending on its complexity and features.

Typically, a BNPL app takes several months to create. Also, you can consult a company that specializes in mobile app development to find out the exact timeline.

What are the benefits of creating an app like Afterpay?

Creating an Afterpay app offers many benefits, including tapping into the growing BNPL (Billing by PayPal) market, generating income from merchant fees and user interest, fostering loyalty among customers, and offering a convenient solution for financial shopping.

What are the advanced features to build an app like Afterpay

Consider integrating features such as AI-driven credit assessment, personalized recommendations, virtual cards to be used in stores, advanced fraud detection and loyalty programs that offer tier-based rewards. So, these features improve the user experience, security and competitiveness of the Buy Now, Pay Later market.

How can you monetize an app like Afterpay?

Consider these revenue streams to monetize an application like Afterpay:

- Charge merchant fees to retailers for using the BNPL services.

- User Interest: Earn dollars when users choose to pay interest for delayed payments.

- Charge users late fees for missing payments

- Data Analytics: Charge retailers a fee for insights and data that will help them improve their sales strategies.

Promoting Brands: Earn fees by collaborating with brands on promotional activities.