Table of Contents

A money lending app, which originated in the field of financial technology, is an electronic tool that helps people in a variety of financial situations—from auto loans to mortgage payments—by streamlining the borrowing process.

Ventures into the realm of Payday Advance Apps Like EarnIn and Brigit present a revolutionary method that allows consumers to obtain loans from any bank in their nation with ease. By using this digital platform, you can avoid borrowing from friends or family and avoid making in-person trips to banks, loan brokers, and other financial institutions.

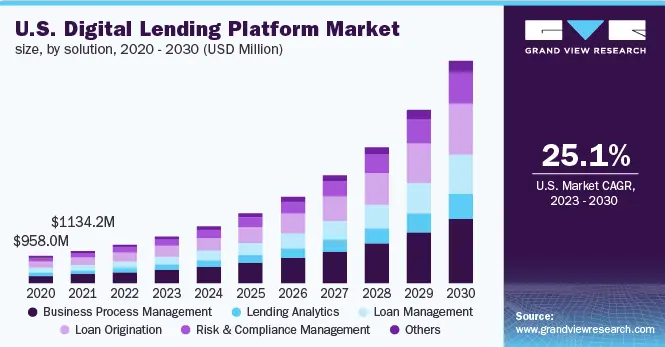

With apps like Brigit, which give consumers easy access to short-term loans and financial support, convenience has come to be associated with these services. The data show a fantastic growth trajectory for the digital lending platform business, which is expected to reach compound annual growth rate (CAGR) of 26.5% from 2023 to 2030. Amidst the expanding FinTech environment, which is projected to surpass $31,503 billion in market capitalization by 2026, the possibility of developing an app such as Brigit becomes progressively appealing.

Obtaining cash in an emergency has never been easy. This has changed thanks to apps like Brigit, which let users apply for loans right away. The introduction of financial apps for money lending represents a significant shift in the fintech industry. Fintech app development is an excellent potential for businesses to take advantage of, given the present surge in demand for money lending applications. An outstanding illustration of a well-designed money-lending app is Brigit. We’ll look at the features you need to incorporate, the cost of development, and the processes a firm must take to establish a money-lending app in this article.

Payday loans, with their roughly 400% annual percentage rate and tendency to trap consumers in a debt cycle, are not to be confused with cash advance applications, which are far safer. Apps for cash advances frequently shield you from overdraft fees and prohibit more advances before repayment. However, the costs associated with subscriptions, expedited fundraising, and suggested tips can mount up.

Get a Free Quote from Our Expert App Developers Today!

Contact Us

What is Brigit?

A fintech app called Brigit assists users in managing their money and preventing overdraft fees. In order to predict whether users want overdraft fees, the app analyzes their bank account balances and purchasing behaviors. The money apps like Brigit enables users to apply for a 24-month loan and provides a credit builder service. It promises to safeguard the loan in deposit accounts, and when the user’s loan term is up, their deposits settle the Brigit loan balance, enhancing their credit history.

With that in mind, seek help from the Fintech app development company, if you too wish to create an app similar to Brigit. The Fintech software development company’s expertise, abilities, and understanding of the financial sector will be useful to you as you design a financial tracking software.

Brigit’s Features

Opportunities for Additional Cash

Apps Like Brigit go above and beyond by perhaps providing more money, depending on your buying habits and income. This tailored strategy improves the app’s usefulness and fits different financial situations.

Automated Alerts

By sending out automatic alerts before your balance gets close to zero, Brigit removes the element of guessing from financial management. Bid farewell to the uncertainties around account balances.

Interest-Free Credit

The fact that money apps like Brigit doesn’t charge interest on loans of money is one of its best qualities. It stands out because of its distinctive product, which provides consumers with an affordable answer to their immediate financial demands.

Repayment Extensions

Apps Like Brigit are aware of how unpredictable life can be. Brigit provides extensions if you require a little extra time to repay, giving you flexibility based on your financial situation.

Key Steps for Creating an App Similar to Brigit

Now that you know what the Brigit app is and how other apps like Brigit work, let’s go over a few steps to get you started on the path to creating other apps like Brigit. Building a similar application involves careful strategy, development, and implementation, according to the USA mobile app development business. The important actions that you should think about are as follows:

1. Perform Market Analysis

To create payday apps like Brigit, one must first understand the needs and difficulties of the user. It will assist in developing applications that satisfy user needs and offer a strong substitute. Additionally, you should look at the features, cost, and user reviews of the fintech apps that are on the market as these will give you the edge over your competitors. Explore the market to learn about the features, goods, and user experiences that are now available. Examine all app reviews—positive and negative—to glean insightful information, spot emerging patterns, and compile data on the most popular features.

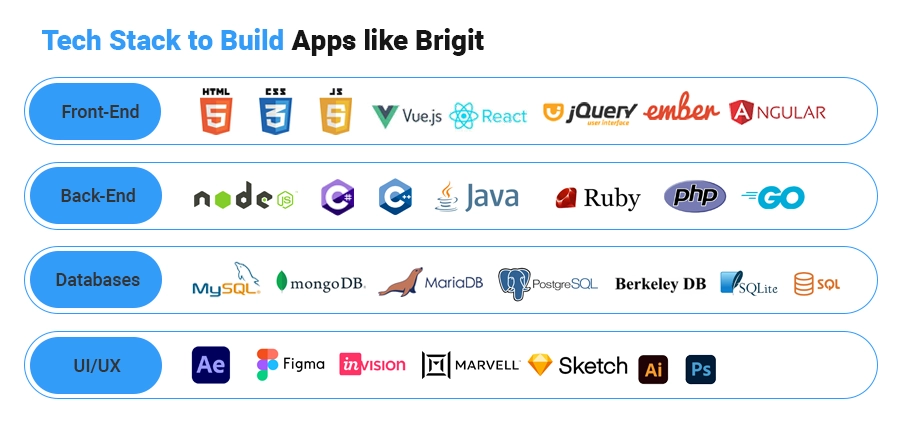

2. Select the Right Tech Stack

Now that you’ve done some market research, it’s time to select the ideal tech stack to develop payday apps like Brigit. Here, you can receive assistance from an On Demand App Development Company that is well-versed in the tech stack that will work best for your app development. To guarantee the best possible performance, maintainability, and scalability for your project, hire a fintech app development company, to select the right backend and front end technologies.

3. UI/UX Design

The success of your software depends greatly on UI/UX. To improve user satisfaction and retention, it would be beneficial to design your app’s interface with accessibility and usability. Employ Android or iOS app design agency to create visually beautiful and user-friendly applications. User testing, wireframing, and prototyping all contribute to improving the app’s design. This is to ensure that it meets users’ needs and preferences.

4. App Development

Develop the essential functionality, such as account management, transaction tracking, user authentication, and more, after the design is complete. Be sure you follow best practices and pay close attention to detail when developing the features. To respond to changing requirements with flexibility, you should work with Android or iOS app development companies that can adhere to agile development practices.

5. Quality Control and Testing

You need to test your loan apps like Brigit now that it’s ready before releasing it to the public. Since this step confirms the functionality of the app, it cannot be completed without working on app development. Mobile app development companies USA is recommended to finish this stage since they are skilled in finding and fixing any issues with your financial software.

6. Launch and Promotion

The success of your app depends on its launch and promotion since they aid in user tracking and traction. Creating a well-thought-out launch strategy and focused marketing initiatives are required for various promotional channels, including social media, content marketing, and app store optimization. Developing loan apps like Brigit with the assistance of a custom mobile app development company will optimize visibility and user acquisition.

7. Maintenance and Scale

This is the last phase, where it’s critical to keep your software performing well and scale it to meet an increasing user base. You must update your app in this case. Hire fintech app developers to provide frequent updates that address security flaws, add new features, and correct bugs in your Brigit like apps so that it stays competitive and concurrently fulfills customer needs.

Must-have Features of a Fintech App Like Brigit

What could propel your app’s success? The features! Your loan apps like Brigit may benefit from the feature you add, but you must use it wisely. If you’re a top mobile app development company in the US, you want to give your money apps like Brigit features top priority.

- Register/Log in

With an emphasis on user experience and comprehensive verification to protect financial interests, make sure that the registration procedure is quick and easy for both lenders and borrowers.

- Dashboard

Provide both borrowers and lenders with a user-friendly dashboard that provides simple navigation and rapid access to key features.

- On-demand Operations

Create a Brigit like app that gives users fast access to money when they need it, providing them with flexibility and convenience.

- Repayment Options

The construction of the credit borrow app must enable a variety of replayer options catered to the financial circumstances and personal preferences of customers.

- Instant Notification

For real-time awareness, incorporate a rapid notification function with your app that notifies users about balances, transactions, and account activists.

- History of Billing and Payment

Provide a simple means for both parties to view their entire loan history, including requests, applications that are still being processed, approved transactions, and denials.

- Transactions and EMIs

Create a section where borrowers may examine pending payments, verify the status of their loans, and keep track of their EMIs.

- Transfers and Withdrawals

Provide borrowers with a range of choices for transferring or withdrawing approved loans, including PayPal, transfers to designated cards, and withdrawals into pre-selected bank accounts. Give lenders the same freedom to manage their investments and profits.

- Analysis of Bank Accounts

By utilizing this tool, individuals can improve their awareness of their finances and make informed decisions to reach their financial objectives. You will benefit from all of the features listed above in order to create a successful app. On the other hand, adding sophisticated functionality to your app could raise the entire cost of developing mobile apps.

Advanced Features to Include in App like Brigit

It’s essential to incorporate standard or required functions into your financial apps, such as Brigit. Concurrently, you need to consider how to differentiate the app from its many competitors already present in the market. Thus, you may include the following additional special and sophisticated features in your application:

1. Investment Advice

You may incorporate a function that helps consumers understand where to invest and build long-term wealth into the app. Apps Like Brigit will offer investing advice and instructional tutorials to help users decide what, how, and when to invest. Predicting the app’s recommendations and guidance on the basis of user’s risk-free ultimate goals and financial targets. Furthermore, the customers may choose to provide an investment platform where users may invest their savings in securities like stocks, bonds, mutual funds, and so forth.

2. Financial Advisor Driven by AI

By incorporating a financial advisor driven by artificial intelligence into the app, customers will be able to receive personalized suggestions through machine learning algorithms. This will support understanding and upholding spending patterns and financial objectives. This feature helps customers obtain sufficient information to make informed financial decisions and manage their budget so that it pays off.

3. Donations to Charities

Through charitable giving, users can contribute a portion of their loan or savings to a cause or charity of their choice. With the use of this technology, users might potentially receive a tax benefit while also giving back and changing the world. Apps Like Brigit may partner with multiple nonprofit organizations and causes to offer users a range of ways to donate.

4. Collective Credit

A feature called a group loan enables friends and relatives to combine their resources and support one another financially when needed. For those without good credit or those who can’t get traditional credit sources approved, this option is extremely helpful. Users have the ability to create groups and invite friends and relatives to join. The organization as a whole is accountable for loan repayment when one member applies for one.

5. Lending with Social Impact

Those who choose to invest their loan amount in small enterprises in underserved communities can do so through Social Impact Loans. This will allow for great social impact in addition to financial support. It helps small businesses expand and gives users the opportunity to positively impact their communities. Users of the application can pick where to invest their savings from a variety of investment alternatives. Make sure to request that the developers incorporate this function as it is not the fundamental one.

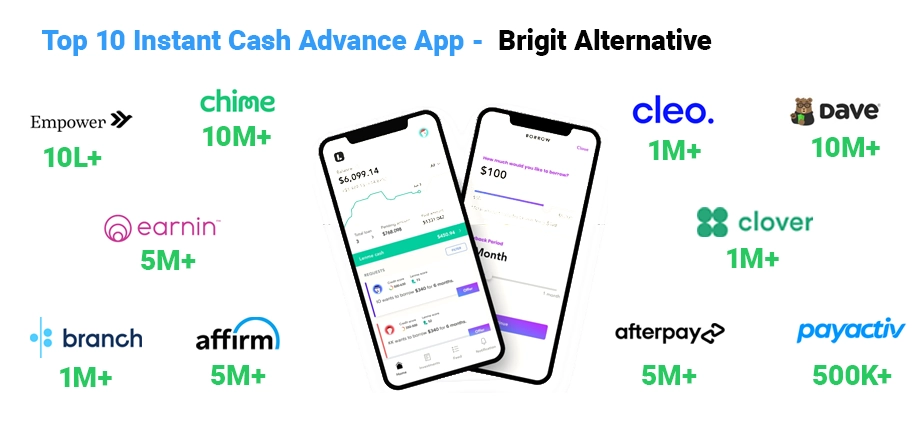

Alternatives of Money Apps like Brigit

Without a doubt, Brigit is the Best Cash Advance Apps 2025. In addition, users have the option to replace this software with another by using alternatives to cash apps like Brigit.

Cleo

With the help of Apps Like Cleo , you may seek cash advances of up to $250 if you meet certain requirements and start out with amounts between $20 and $70. The program also provides free personal financial management services. To request cash advances for free, you can contact Cleo’s customer support via email. However, using the app requires a subscription to one of its membership tiers, with the lowest tier costing $5.99 per month. To fund the advance the same day, Cleo charges an express fee that starts at $3.99.

Empower

Apps Like Empower can advance their cash up to $250. They do not impose Credit checks, fees, or interest. To determine how much a user can borrow, it is done by determining their earned income account and other account activities. Users of this application will be eligible for a two-day early payout program.

In order to get the cash advances, users must activate their Empower Card. There is a $8 monthly subscription fee, users will receive numerous benefits such as free ATM withdrawals and cash-back rewards.

Even

It’s an instant cash app like Brigit that’s well-known for giving needy borrowers access to money on demand. Even the application, which has partnered or integrated lending with thousands upon thousands of firms. The program only requires a $8 subscription fee, even though there are no interest fees. Additionally, it assists users in creating budgets from salary to paycheck and provides alerts for impending bills. It is important for you to understand that the employer is only accessible to specific players. Especially to those who have partnered with the application’s partners. The InstaPay feature, which allows users to deposit a specific sum into their accounts. They work in collaboration with more than 18,000 organizations.

Klarna

Our online shopping habits have been revolutionized by Buy Now Pay Later Apps Like Klarna. It lets you shop at the stores of your choice without having to pay the entire cost at once. Alternatively, you can pay the full sum thirty days later or spread it out over a few weeks or months. Klarna is a popular choice among consumers who like to spread out their payments. This is better to manage their budget but still want the convenience of making an immediate purchase because of its flexibility.

MoneyLion

Users of apps like MoneyLion may easily and quickly borrow, invest, save, and earn money—essentially becoming all-in-one mobile banking apps. With the help of its revolutionary “Instamart Feature,” it gives consumers instant access to cheap cash advances and early paychecks. It enables customers to take out a zero-interest, no-credit check loan of up to $250 from their subsequent paycheck.

Moneylion applications are favored in the industry thanks to their lack of a minimum balance prerequisite. Standard transfers, foreign transactions, mobile check deposits, and card replacements are all free of charge from the company.

Dave

You can borrow a little amount of money through the Apps like Dave to pay for bills in the interim until your next salary arrives or to prevent overdrawing your bank account. Dave customers must register for an ExtraCash account in order to be eligible for an advance. The software also helps users discover side gigs to supplement their income and includes a savings account.

How Much Does It Cost to Create a Brigit like App?

The average cost to build instant cash apps like Brigit is $30000, if you want to build something similar to Brigit. The cost estimate for iOS and Android app development companies will rise in response to client requests for additional features, integration of cutting-edge technologies, add-ons for AI technology, and more. This price may increase to $65000 or higher based on a number of variables, including

Affecting Factors for Development Cost

You should be aware that there are additional aspects besides the projected cost of Hybrid mobile app development that influence the price of Brigit like app development, like:

The Development Team’s Cost

The price of developing instant cash apps like Brigit varies with the size of the development team. The cost of development will inevitably rise if you recruit more developers, particularly highly qualified ones.

Complexity of the Project

The cost of developing a mobile app will rise in tandem with the app’s increasing complexity. An application like Brigit will therefore become more sophisticated. Especially in terms of functionality, design, architecture, and concept, which will raise the cost of development.

User Interface

User engagement and retention will rise with a well-thought-out UI/UX. For this reason, hiring some skilled and experienced designers may end up costing much more than you had anticipated.

Deployment Strategy

The price of development apps like Brigit is significantly impacted by deployment platforms. Your choice of Android will have a different price. Aside from this, the costs charged by android app development agencies for Android apps will vary. Should you decide to use both platforms for deployment, the price will go up.

Backend Infrastructure

The cost may vary depending on the API used to exchange data between the database and the application.

Hiring App Development Firms and App Developers

To make your concept a reality, think about working with qualified app developers or trustworthy custom app development agencies. Hiring experts in the field of fintech app development will guarantee that your loan lending app is implemented successfully and meets user and company requirements. Work together with a custom app development agency, to keep ahead of the curve in the ever-changing world of financial technology and overcome the challenges of app development.

It is a great moment to go digital. Especially if you have experience in banking sector and a strong infrastructure to support these services. Using an app can be a better option if you enjoy using the money you earn to lull yourself to sleep. At A3Logics, the top mobile app development company in the US we assist you in creating an app that satisfies all of your personal and professional demands. We give you the right direction and assistance to enter the industry with a team of knowledgeable and creative developers. Make the best choice possible by getting free consultation from our app development team.

Conclusion

To sum up, developing instant cash apps like Brigit requires a methodical approach that blends cutting-edge functionality, user-centered design, and a deep comprehension of the ever-changing financial market. Hire app developers or work with a reliable On Demand App Development Company, to guarantee the smooth development and launch of your money lending app. Working together with seasoned experts in the fintech and custom mobile app development services simplifies the technical intricacies and improves the general performance and quality of your application. The fintech sector is expanding at a never-before-seen rate, enabling consumers to access banking services through their smartphones. Nevertheless, obtaining a loan was still a difficult, expensive, and time-consuming process, which is now resolved by platforms and money apps like Brigit. Users of the platform can receive an advance paycheck to help with unforeseen bills. They charge you a little monthly fee to operate the business. However, there is no interest rate on the money you borrow.

FAQs

What are the main regulatory barriers to creating this kind of app?

Understanding that creating an app like Brigit entails navigating intricate financial regulations and data protection laws is necessary in order to establish a similar app. It is imperative to comply with data privacy laws. Specifically CCPA and GDPR as well as industry standards like the Payment Card Industry Data Security Standard (PCI DSS). You can contact legal experts to ensure adherence to these regulations.

What are the main financial considerations when creating an app similar to Brigit?

To build an app like Brigit, significant expenses include the following: the development team, the technology stack, the complexity of the project, the design and user experience, security precautions, account linking and integration, quality assurance and testing, legal and regulatory compliance, and continuing maintenance. Setting aside money for promotion, acquiring new users, and running expenses is also crucial.

What are the things to keep in mind before hiring app developer for a project?

Make sure you thoroughly examine your needs and review the developers’ and company’s portfolio before hiring the best app developers for your project. Be aware of the technologies they use and the tasks they have completed. Remember to compare rates as well in order to receive the greatest offer.

Which Apps for Cash Advances Are Free?

While there are fees involved with each app, some simply generate money from suggested tips. Earnin or MoneyLion will give you a free advance if you choose not to tip. Additionally, Chime provides account holders with fee-free overdrafts with just a suggested tip. Payactiv provides multiple ways to receive a free advance. Your company has to be a partner for this to happen. You can receive a free $20 advance if you match the requirements and have a Varo bank account.

What’s the Best Alternative for a Payday Loan?

The ideal payday loan substitute is determined by your wants and financial circumstances. Getting a loan from friends and relatives is usually the best option. This is because it has no conditions and could not even cost you anything. For repaying the loan, a personal loan or credit union payday alternative loan would be a better option. These applications can provide you a little amount that you pay back with your next paycheck.