Table of Contents

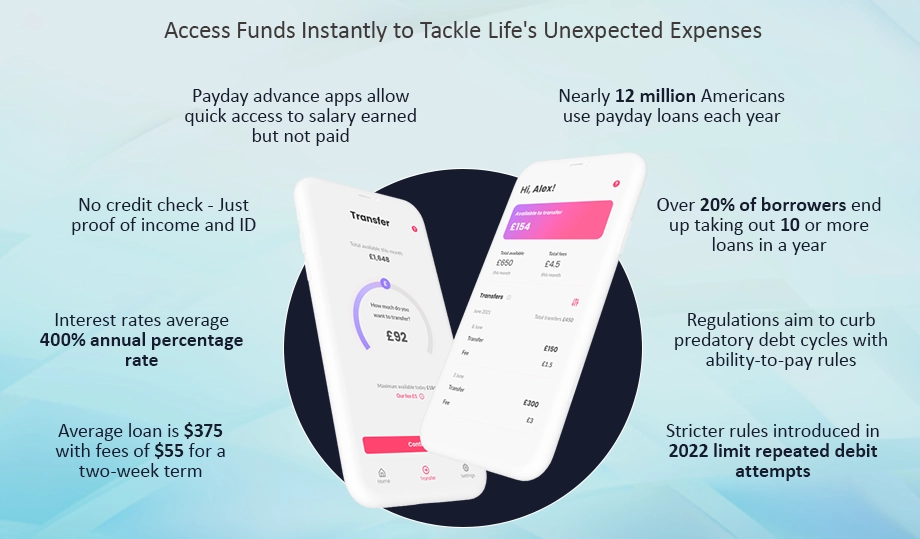

CNBC reported that about 60% of Americans live paycheck-to-paycheck. Traditional banks with their strict criteria often don’t cater to those in need of small, short-term loans. Payday advance apps are a great way to bridge the gap between paychecks.

Payday advances are short-term loans which allow workers to take a cut of their EarnIngs prior to the payday. With the increasing risk of economic instability the number of employees who depend on payday loans to manage their cash flows.

Many loan lending app development companies are now offering payday advance applications as a substitute for payday lenders that are predatory. Apps such as EarnIn have built a large client base by offering no-interest advance payments. According to research, more than 10 million Americans each year use payday advance services and the app segment has grown by over 50% per year. EarnIn itself has helped facilitate more than $15 billion in payday advances since its introduction at the end of 2013.

This post focuses on the 10 top payday advance applications in the US which are resembling EarnIn’s popularity. Here we will answer your questions about best cash advance apps development. If you are considering developing an app for payday loans or cash advances, take note!

Payday Advance Apps: Overview

Payday loans are characterized by high rates of interest and are available only for the duration of as low as 30 days. The principal usually amounts to your next paycheck. Payday loans capitalize on the need of the borrowers to get credit immediately by charging more than normal rates of interest.

Payday loans are unsecured because they don’t require collateral as per custom app development services expert. Due to their high price, many payday loans are an unsustainable debt-collection trap. It is difficult for consumers to clear the debt they’ve accrued. Think about other options, such as safe personal loans before applying for the loan.

Payday loan applications online are accessible from a variety of lenders. You may also apply online to get a loan with local lenders, which typically are small-sized lenders who have physical locations.

You’ll need an account at a bank and an official government ID for you to be eligible for the payday loans. Pay stubs from your paycheck can be used as proof of income. A payday loan’s principal is typically a percentage of your earnings.

Your wages could also be used to secure collateral. The lender will automatically receive some of your earnings to help repay the loan. When you apply your credit score, your capacity to repay the loan is not taken into consideration.

As per android app development companies, the rules required lenders to evaluate a borrower’s ability to repay the loan while still meeting their everyday living costs before they make a loan. The regulations obliged lenders to provide an advance notice to the borrowers prior to when they tried to withdraw funds from their accounts. The rules also stated that after two unsuccessful attempts, a lender is not allowed to attempt deducting money from the account once more without authorization.

How Does Payday Advance Apps Work?

Payday loans are usually due to be repaid on your next pay day, which can often be two or four weeks after borrowing as per on demand app development company.

Apps for payday advance are explained in detail below.

- You can collect the form from your lender bank or online portal

- Please fill out the form and submit with all the required information

- Prepare the documents required by your lender

- Wait for the approval of your loan from the lender

- The lender will ask for the required documents after loan approval

- Submit required documents like proof of income/identity/age/address/employment

- The loan amount will be credited after the documentation is verified.

EarnIn App: Synopsis

EarnIn is one of the best payday advance apps. It was created on the idea that people should get their money as soon as they have done the job. It lets you get money to borrow before you receive your paycheck.

Why would you not utilize a debit or credit card? Well. Credit cards can become costly very quickly. Rates of interest exceeding 20% are becoming typical.

EarnIn is an excellent alternative to credit cards since there is no monthly charge with no interest and no credit checks.

Pros and Cons of Payday Advance App

Here are the pros and cons of payday cash advance apps.

Take a look at some of the advantages and disadvantages of legit payday advance apps in detail.

Pros of Payday Loans

- Payday loans provide fast cash for the borrower. You can get money fast in an emergency.

- Payday lenders don’t usually run credit checks. If you have bad credit, you might still be approved for one.

- You have many options: The internet is full of payday loan lenders.

Cons of Payday Loan

- High fees: Payday loans are expensive. The typical fee ranges from $10 to $30 for each $100 borrowed.

- It may be difficult to repay. Because payday lenders do not look at your credit rating, you could be approved for a high-interest loan.

- Potential default: A lender may sell a borrower’s debt to a collection agency if they don’t repay their loan.

- Payday loans are illegal in some states. This is due to the high fees and tactics used to lure borrowers.

Top 10 PayDay Advance Apps in the USA

Below are top 10 payday advance apps in the USA as suggested by custom mobile application development company experts. Take a look.

1. Chime SpotMe

Chime, one of the best payday cash advance apps, is a neobank that operates exclusively online. It also lets you establish FDIC-insured accounts, even though Chime isn’t an ordinary bank. Chime does not charge overdraft or monthly fees and allows you to access your pay up to 2 days before.

SpotMe has one drawback, the fact that it needs Chime debit cards in order to function. It is also required to have an active Chime Direct Deposit account that’s been in good standing with at least a minimum of $200 in the past 34 days before you can utilize SpotMe. The date of repayment is the following payday which means there’s not much choice.

2. Varo

Varo provides online banking and the cash-assisted service. The pricing arrangement of this app has been designed to help you not pay more than you require. Varo will not charge any money if you take out a loan of between 20 and $20. If you take out a loan of up to $250 Varo charges an additional fee of $15 per loan. Varo offers you a variety of options in the time it takes to repay the loan provided it’s completed within 15-30 days. It’s fairly difficult to get into. You’ll need at least $1,000 of direct deposits into Varo. Varo account.

3. Empower

Empower, a fintech firm, also offers debit cards with no overdraft charges. It gives you instant cash advances, without any additional fees. Although Empower Cash Advance doesn’t offer instantaneous service, we have found that one business day can cover most emergency situations like P2P money transfer app. Empower’s high speed is not free. After the trial period, an $8-per-month subscription is required. Empower allows you to get your money in an hour. However, you will have to pay more for this convenience. Empower also requires that you repay the money on your next pay day.

4. Dave

Dave is an app for mobile banking that offers cash advances. Your checking account may not be anything special. It does have some unique uses. For example, it is cheaper to use the account for instantaneous loans. It is the same for its Goals account, as it’s just a regular savings account. Some of the services, such as Dave’s Side Hustle, are also worth mentioning. The app is designed to help you search for and apply for job openings. The site offers a good selection of jobs in a variety of categories, including temporary, gig, seasonal, flexible, part-time and gig work. Payday advance apps like Dave offer paid surveys as well.

While initially you may only earn a few cents, your EarnIngs will increase as you complete more surveys. You can get about $5 per survey. Dave Cash Advances is one of the top instant payday advance apps and it is unique in two ways: the large amount of money they offer and that you do not need to receive regular paychecks. Dave also tries to make sure that everyone can use it (in the US), without compromising on due diligence. You will be required to provide at least 60-days worth of bank history, pass fraud and identity checks, and have a Social Security number. Dave’s subscription cost is just $1 per calendar month, which is a lot lower than many other similar apps like EarnIn.

You’ll first need to have both an ExtraCash and a Dave checking account. You will also need to make monthly deposits of at least $1,000. Dave also offers near-instant cash advances, but you will have to pay an additional fee for them. The app will also automatically deduct money from your account at your next pay day. It will never put you in overdraft and you can ask for an extension up to 30 days.

5. MoneyLion

MoneyLion will ask for many details in return. You will need to link your bank account, and you must have a record of recurring income deposits. Your account must also be active for two months, and have a positive balance. MoneyLion offers a regular cash advance, but it is very slow. If you need your money instantly, you will have to pay an additional fee.

6. Brigit

Brigit, like EarnIn, is a cash advance app that offers loans up to $250 according to enterprise mobile app development experts. Note that limits are usually lower at first and then increase as you pay them back. Brigit’s Instant cash is free to use and does not require a credit check. The flexibility of the repayment schedule is a great feature. Brigit’s subscription costs $9.99 per month. This is a steep price, especially when compared with EarnIn’s $0 monthly fee. EarnIn is not the only EarnIn alternative that charges extra for instant transfers. However, because the processing time of the regular transfer is so quick, this cost is much less. Brigit’s Earn and Save feature is designed to help its users find work. It also offers a budgeting tool for free.

7. Even

Even offers one of the biggest cash advances available — up to half of your pay. Cash advances can be processed in a day. It can also offer the biggest cash advance available, as it allows you to borrow up to 50% your salary. Even is a popular app, but it has a few drawbacks. The first is that you have to wait for your employer to sign up before you can use its cash advance. The costs are not always disclosed. Some people may get a free membership because their employer will cover the cost. Others, however, might have to pay $8 per month. There are a lot of companies in the US who offer this service. Walmart is probably the largest. Even has many other useful features, including the ability to create a “rainy day” fund and tools that will help you better manage your budget.

8. Albert

Albert has a wide range of features, including cash advances up to $250. They start small and increase as you pay off previous loans. Albert allows you to borrow in three installments or all at once. Albert also gives you the opportunity to access your salary up to two days in advance of your actual paycheck. The first can take up to three days for processing, whereas the second is instant. Albert has some of its best features hidden behind a $15/month paywall.

Cash advances in the app are also not very easy to use. You will need a bank account that is active for at least two full months, and two consecutive months of income from your employer. Albert can guide you in the basics of investing, including how to create a budget and a savings account. If you choose to pay $15 per month, the most attractive part of this offer is the access to a financial adviser.

9. Axos

Axos is different from other similar apps like Cleo or EarnIn, which give you a payday loan. It gives you your pay early. In general, it takes several days for your money to appear in your bank account after your employer has deposited your check. It gives you your actual pay as soon as the employer deposits it. You can fill in any gaps by getting your pay early.

Axos, a bank online that offers early access to your salary, also has nearly 10,000 ATMs in the US. It does not charge overdraft fees and its checking account only requires $50. The means you will only receive the money a few extra days before you would normally. The app is not able to help you in an emergency if it’s earlier in the salary cycle. You’ll also need to pay $50 for Axos to open an account, and a direct deposit is required to use the service.

10. PayActiv

PayActiv is based on a similar philosophy to EarnIn – you can access your salary when it’s earned – but works similarly to Even. It is a service that requires that your employer sign up. PayActiv tracks your working hours and provides you with early access to pay. With PayActiv, you can receive up to 50% of the salary in advance. PayActiv offers budgeting tools and allows you to pay bills using the app. Financial Counseling is another feature of the app, giving you access to certified credit counselors. You can pay an extra fee to receive the money instantly. Normally, it will process your advance within 3 business days.

Steps To Develop Payday Advance Apps Like EarnIn

Explore the steps to develop PayDay advance apps like EarnIn as recommended by top mobile app development companies in USA.

Idea Brainstorming for Payday Loan App

Brainstorming is the key to this creative phase. Exploring innovative concepts is what Dave did, when he envisioned how to avoid overdraft charges. In this competitive environment, an original idea can be your ticket to success.

Answer the questions below to clarify your app idea. You will need to know the audience you are targeting, the platform it will be running on, as well as the main user interactions. Answer the following questions to help you clarify your app idea.

- Who is the target audience for your app?

- What platforms (iOS/Android/web) will you be able to use your app on?

- What actions can users take within the app? For example, applying for loans, repaying or accessing financial information.

- What makes your app different from other loan apps on the market?

Market and Competitor Research

This critical phase for legit payday advance apps development will allow you to explore and gain insights that can help shape the success of your own app.

You will gain the macroeconomic knowledge necessary to build a successful payday loan app. You will learn about demographics, regulatory issues, and growth trends.

- The market size and trends for payday loans, as well as demographics of the users.

- Your app’s intended solution, such as instant access to money or flexible repayment options.

- Payday loan regulations and the broader industry of payday loans in your target region.

Competitive Research

Competitive research provides insights into the ecosystem of eWallet app development. You’ll also be able to identify the unique selling points of direct and indirect competition, as well as their user-targeting strategies. What’s the point?

- Direct and indirect competitors, and their position in the market.

- What specific users they are targeting and what strengths and weaknesses their products and services have.

- Reviews and feedback from users highlighting the strengths and weaknesses of competitors.

Selecting Technology Stacks

Choose technologies that are compatible with the platforms on which your app will be run. Flutter is a popular technology that allows you to build apps for multiple platforms at once as per iOS app development companies.

The Flutter cross-platform app development solution saves you both time and money. Flutter’s digitalization of fintech is simplified by its sleek performance and beautiful UI/UX. Fintech app developers must have Flutter experience if you choose Flutter.

UI/UX Design

Designing user interfaces and experiences is more than simply creating screens and arranging icons. The UI/UX process for a payday loan app involves user research to understand the needs and pains of its target audience.

It is also important to create a persona of your audience, understand what they expect from your app and map a compelling user journey. Learn their frustrations with digital loan apps, and incorporate them into your app’s design. This can help your payday loan app stand out in the market.

Create an MVP

In this case, the Minimum Viable Products is a simplified version of an app for payday loans. This helps validate your app concept in the market by limiting it to only the essential features. You can create a first version of the app, which is more affordable and quicker to develop. This will help you attract investors or share the first versions with users.

Test & Release

Test and release the app after finalizing your designs. Perform thorough technical testing to identify bugs and issues. Perform user acceptance testing to make sure the app is meeting your audience’s expectations. After testing, launch the app to the public. Continue to monitor user behavior and iterate over time.

Features To Consider For Payday Advance Apps Like EarnIn

Let’s now talk about the unique features that make apps Like EarnIn stand out on the fintech scene. These features are not just nice-to-haves, but absolute necessities that can make or ruin your payday loan app.

Lightning-Fast Approvals

The Formula 1 of lending is the payday loan app. These apps are built to be fast, with near-instant approval. Dave, for instance, uses AI to anticipate users’ needs, and then offers advance payments to cover unplanned expenses. In today’s world of on-demand, speed is a must.

Flexible Repayment Terms

Payday loan apps understand that there is no one size fits all. EarnIn, for example, allows users to spread out their repayments across several months. What makes this game-changer so revolutionary? It is a game-changer because it respects real-life financial fluctuations, and can be a lifeline to those who do not want to be bound by rigid deadlines.

Smart Money Management

Fintech app development is not a luxury anymore; it’s an absolute necessity. Brigit is not just about loans, but also about teaching the user how to navigate through the financial maze, and avoid debt traps. This feature is not just a nice-to-have; it’s also a financial GPS to keep users on track.

Overdraft Prevention

Dave is a financial superhero that predicts when a user’s account balance will plummet and provides a financial parachute. Dave, a payday loan app that offers a financial parachute to users who are about to experience an overdraft fee, ensures they never have them.

User-Centric Approach

Payday cash advance apps like EarnIn don’t just make money, they also make lives easier. Take EarnIn, for example. It transforms users into ambassadors, with cash rewards for referring friends. This user-centric strategy creates a win/win situation.

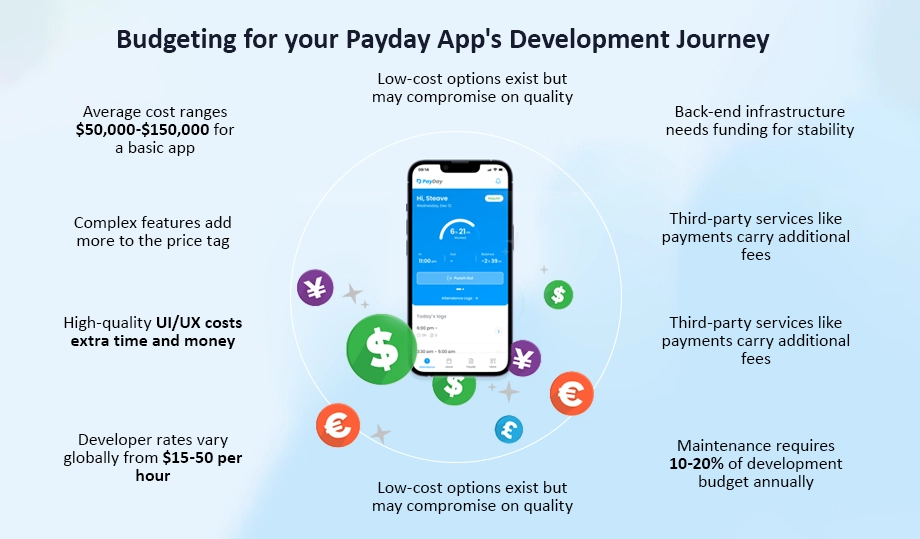

Costing of Payday Advance App Development Service

Let’s now talk about numbers. EarnIn’s app can be developed at a cost that is as variable as the stock market. Imagine it as a rollercoaster ride for your financial journey. You’re likely to be looking at an average of $50,000-$150,000.

Factors that Influence the Cost of Developing a Payday Loan App

App Complexity: Simple can be sweet, but complex is compelling. The more features you add to your app, then the higher the cost.

UI/UX design: A sleek, high-quality app comes with its own price.

Rate: The development rate is a key factor to consider when determining your budget, whether you are hiring app developers or outsourcing the project. The rate varies around the world, and it is higher in the USA. It’s no wonder that Fortune 500 companies and startups prefer to hire app developers with low pricing like India.

Back-End infrastructure: The back end is the unsung hero who keeps your app running smoothly and prevents it from crashing. The technology used to build the infrastructure will determine how much it costs. You must upgrade your app to stay relevant and competitive in the digital finance age. Maintenance costs vary depending on whether or not you add new features, fix bugs, and/or make the app compatible with new OS versions.

Third-Party Service: Money apps like EarnIn development Services provided by third parties, such as SMS notification, email services or payment gateways are charged extra.

It’s clear that developing a payday app is not just about coding. It’s also a financial adventure. While planning your budget, you should consider the unique needs of your app and make strategic decisions so that you can hit the jackpot while not breaking the bank.

Final Thoughts

You just read a guide that explains how to build a payday loan application like EarnIn. You now know that the key to a successful payday app is not just coding skills, but also a deep understanding of fintech, its regulations and user needs.

A3Logics, one of the top companies providing mobile app development services in USA, can help. Our team of developers, designers and project managers is dedicated to customizing solutions even programming languages for app development. Fintech solutions are designed to align with business goals, support your vision and exceed user expectations.

We are known for our ability to produce results quickly without compromising on quality. We make your app more competitive by using agile development methods. This ensures that your app is relevant to the market dynamics.

FAQs

What is EarnIn?

EarnIn App allows users to get a payday loan by allowing them to borrow a portion of their unpaid but earned wages.

What is the cost of developing a payday loan app like EarnIn?

Costs for developing loan apps like EarnIn such as EarnIn range between $50,000 and $150,000, depending on features and complexity.

What are the benefits of using apps like EarnIn?

EarnIn is a useful app for users who need to access funds quickly between paychecks in order to cover unexpected expenses.

What are the major regulatory challenges that payday loan apps face?

Payday advance apps are subject to regulatory challenges, including disclosure requirements and interest rates. They also face the challenge of ensuring that they don’t exploit consumers who are vulnerable.

What are the most popular programming languages and frameworks for fintech app development today?

Fintech apps are often written in Java, Swift or Kotlin, and they can be built using frameworks such as React Native, Flutter or Xamarin. These languages have cross-platform capabilities that are important for mobile-first solutions.