Table of Contents

Introduction to Blockchain Technology in Mortgages

You probably know what Bitcoin and other cryptocurrencies are. Cryptocurrencies like Bitcoin make use of a highly secure technology known as blockchain. A lot of people assume that blockchain and cryptocurrencies are the same thing. However, blockchain isn’t just used for finances.

Blockchain for mortgages can automate a mortgagor’s area because it lowers the cost of the mortgage process and makes it more efficient. Now, by offering a decentralized safe, transparent mortgage procedure, blockchain technology is revolutionizing the mortgage sector. Through this method, it becomes possible to store all details related to a mortgage in a tamper-resistant ledger in a secured manner, including details on borrower, property, and payment history. More importantly, blockchain facilitates the carrying out of contracts and may even become a substitute for third-party escrow and title services.

Although there are many advantages to these advancements, home loan originators may face difficulties implementing this technology. Let’s examine blockchain use cases in mortgage.

Statistics About Blockchain for Mortgages

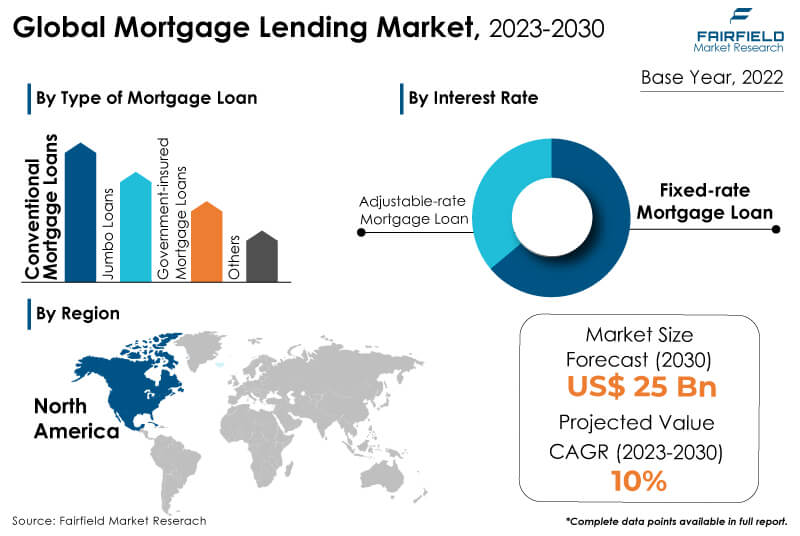

- Global mortgage lending market to rise high at a significant pace of 10% CAGR during 2023 – 2030

- Mortgage lending market size to reach a market value of around US$25 Bn by the end of 2030

- Blockchain technology allows for more than two times faster loan processing when applied in lending.

Use Cases of Blockchain in the Mortgage Industry

The mortgage industry has been some of the financial and real estate sectors’ most traditional parts as it is usually shrouded in complex, time-consuming, and often opaque processes. Blockchain in mortgage has transformative potential. This is because it addresses challenges by streamlining operations, enhancing security, and improving transparency. By using blockchain for mortgages, institutions can develop highly efficient, secure, and customer-centric systems that will definitely work to benefit all stakeholders.

1. Improving Title Management and Verification

Title management is a critical aspect of mortgage transactions, often plagued by inefficiencies, manual errors, and fraudulent activities. Blockchain applications in mortgages provides a secure, immutable ledger for recording title deeds, ownership history, and other pertinent details. This ensures faster verification and reduces disputes. And it eliminates the need for costly third-party intermediaries.

Blockchain in Finance can maintain a transparent and tamper-proof record of title ownership. This enables lenders and buyers to access accurate information instantaneously.

2. Streamlining Property Transactions

Property transactions often involve multiple parties, including real estate agents, lawyers, lenders, and title companies. Blockchain use cases in mortgage simplifies these processes by providing a decentralized platform for securely sharing and verifying data in real time.

Blockchain technology in mortgage eliminates redundant paperwork and reduces the time required for transactions, allowing property deals to close faster.

3. Streamlining Mortgage Document Verification with Blockchain Technology

Verification of mortgage documents has always been a tedious process, very much requiring much cross-validation and proof. By which, blockchain’s use to safely store a document, shared over a decentralized network guarantees faster and more reliable verification.

By maintaining an immutable record of documents, blockchain use cases in mortgage, eliminates the risk of document tampering, thereby reducing errors and delays.

4. Enhancing Security and Fraud Prevention in Mortgage Applications

Mortgage fraud remains a significant concern, with fraudulent applications and identity theft leading to financial losses. Blockchain applications in mortgages enhance security by providing robust identity verification systems and ensuring that all transactions are cryptographically secured.

Smart contracts on blockchain for mortgage industry can verify borrower credentials, income details, and credit history. This helps in preventing fraud and ensuring accurate data validation.

5. Improving Transparency in Loan Servicing and Payment Processes

Loan servicing often lacks transparency, leading to confusion for borrowers about their payment schedules and outstanding balances. Blockchain’s distributed ledger provides a transparent view of payment histories, loan terms, and interest calculations, ensuring clarity for both borrowers and lenders.

These blockchain use cases in mortgage enhances transparency, improves trust and reduces disputes between parties.

6. Using Smart Contracts to Automate Mortgage Approvals

Smart contracts are self-executing contracts with terms that are directly written into code. The mortgage industry may focus on using smart contracts for approval processes. using pre-defined conditions related to credit scores, the income threshold, and an appraisal of the property.

7. Blockchain and Mortgage Underwriting: Ensuring Accuracy and Speed

Underwriting is one of the most critical and time-consuming stages of the mortgage process. Blockchain use cases in mortgage can improve underwriting accuracy by providing access to verified borrower data and property details in real time.

Automating data sharing through blockchain applications in mortgages reduces human errors, accelerates the underwriting process, and enhances decision-making efficiency.

8. Decentralized Platforms for Peer-to-Peer Mortgage Lending

Blockchain in the mortgage industry enables decentralized platforms for peer-to-peer mortgage lending. This allows individuals to lend directly to borrowers without the need for traditional financial institutions. These platforms create a more inclusive financial system, catering to underserved markets and non-traditional borrowers.

9. Simplifying Title Transfers and Ownership Records with Blockchain

Blockchain applications in mortgages simplify the transfer of property titles and ownership records. This is done by providing a digital ledger that tracks ownership changes in real time.

These blockchain use cases in mortgage eliminates the need for manual processes, reducing administrative burdens and ensuring a seamless transfer of property rights.

10. Reducing Administrative Costs with Blockchain-Driven Mortgage Processing

Administrative tasks such as document preparation, verification, and communication are resource-intensive in the mortgage industry. Using blockchain for the mortgage industry automates these tasks, significantly reducing operational costs.

Lenders can reinvest these savings into offering competitive rates or improving customer service.

11. Preventing Foreclosures with Blockchain-Powered Risk Management Tools

Tools based on blockchain systems can analyze borrower data and track financial trends to identify early risks. Such tools will enable lenders to have real-time insights into borrower behavior, thereby preventing foreclosures due to proactive measures such as loan restructuring or payment reminders.

12. Blockchain-Based Mortgage Payments: Making Transactions More Efficient

Blockchain for mortgages enables faster and more efficient mortgage payments through cryptocurrencies or tokenized assets. Borrowers can make payments securely, and lenders receive funds instantly, bypassing traditional banking delays.

This system is particularly beneficial for cross-border transactions, where traditional payment methods can be costly and time-consuming.

13. Revolutionizing Commercial Real Estate Financing

Blockchain in the mortgage industry is also transforming commercial real estate financing. It is done by enabling fractional ownership and tokenization. Investors can purchase tokenized shares of a property. Making it easier to invest in high-value assets without the need for large capital outlays.

Benefits of Implementing Blockchain for Mortgages

Businesses that use blockchain technology in mortgage gain improved efficiency in how their financial transactions are distributed and carried out. Additionally, they establish shared ecosystems that improve cooperation with suppliers, partners, customers, and government agencies.

Expedited Approval Process

Borrowing today involves dealing with numerous intermediaries in the legal, financial, real estate, and governmental spheres. The loan originator adds a layer of waste to every step of the process, which you ultimately pay for. The whole cycle-including pre-approval to closing-can take two months on average for each application.

The blockchain in the mortgage industry has the ability to replace this model of reliance on middlemen with a decentralized record system that offers a verifiable history of every transaction.

Another one of the major blockchain use cases in mortgage is that a lender’s system can use the blockchain ledger to validate information because each record is linked to the ones that come before and after it. A new data entry will be added to the chain after verification, making the transfer visible.

Lenders could verify identification documents and property valuations using Distributed Ledger Technology (DLT) without requiring the assistance of a third party. This blockchain use cases in mortgage change may result in quicker settlement and approval.

Enhanced Transparency

Blockchain technology in mortgage addresses both of the Treasury’s proposals by bringing all market players together on a single platform through Distributed Ledger Technology (DLT). Lenders may enable the blockchain to serve as a custodian by recording, exchanging, and executing loan data on it. This would guarantee transparency by automating the loan validation and payment procedures.

Blockchain applications in mortgages also help investors navigate an unchangeable audit trail and produce forecasts based on verifiable, real-time data. Businesses and investors would be more capable of making wise judgments if they had access to a thorough view of loan-level data across marketplaces.

Unparalleled Security

Nowadays, the majority of the mortgage loan-origination protocol is based on paper paperwork, which creates many privacy and security concerns. Every time documents pertaining to mortgages are created, duplicated, or distributed, the chance of being exposed to private and personally identifiable information increases.

Furthermore, even antiquated digital systems cannot adequately address the inherent risks of manual errors and delays in the current document-oriented system, which call for strict chain of custody management. The security of your data is essentially only as strong as the lender’s server, even in cases when the lender uses electronic technology.

Blocks are progressively added in a linear fashion inside a blockchain’s structure, with the most recent block being placed at the end of the chain. Because of this setup, it is quite challenging to change the content of any block without getting the consent of the entire network.

A malicious actor would have to change every block connected to the manipulated one in order to avoid discovery, which is a task that gets harder to do as the network gets bigger.

Furthermore, each participant may only access the parts of the ledger that pertain to their activity thanks to the use of cryptography, making it nearly impossible for someone to obtain another person’s personal information without authorization.

Given the significant safety and privacy flaws in the conventional house loan process, blockchain use cases in mortgage combines decentralization, cryptography, and consensus processes and positions it to provide unmatched security capabilities.

Simplified Verification

When you apply for a loan, the lender will usually review all of your original property paperwork, including title deeds, no-objection certificates, and other ownership information.

Surveyors are also hired by lenders to perform technical price analyses in order to establish the proper loan amount. These actions add financial and legal middlemen to the verification process, making an already drawn-out administrative process even more difficult and time-consuming.

Blockchain for mortgages offers a way around the paper-based bureaucracy that characterizes traditional lending institutions because of its private key capabilities.

Your digital signature, which is created using private keys that are nearly hard to forge thanks to the power of cryptography, is required for transactions and information on the blockchain. Lenders may use the ledger to verify ownership because every transaction you do on the blockchain is safely connected to your identity.

Important data, including a property’s address and value, can be stored on blockchain technology and accessed, verified, and processed instantly by lenders.

Additionally, the approval process will be able to run automatically thanks to the integration of smart contracts with verification and approval criteria.

Increased Adaptability

The main source of the issue is the discretionary pricing structures used by large lenders, which frequently work to their advantage and are challenging to contest in a market with little competition.

Peer-to-peer lending involving networked investors may become more popular as a result of the adoption of blockchain technology in mortgage industry. This change may encourage competition among lenders, which would eventually help borrowers by offering more options, better services, and cheaper rates.

Improved Client Experience

Borrowers of loans frequently give priority to key elements that guarantee a positive experience. Flexible repayment plans, interest rates, reduced overhead costs, expedited approvals, and streamlined documentation processes are important examples of these.

Blockchain’s immutable audit trail makes it easier to verify, record, store, and reevaluate documents. Furthermore, increased competition among lenders may result in a greater range of interest rates and repayment alternatives for borrowers as blockchain for mortgages opens the door for peer-to-peer lending.

Challenges and Limitations of Blockchain in Mortgages

The blockchain for mortgage industry offers numerous benefits in paying mortgages. However it has its own drawbacks. Let’s take a closer look at some of the challenges and limitations of blockchain in mortgage industry.

Regulatory Uncertainty

The absence of clear legal frameworks for blockchain in mortgage industry creates compliance challenges. With an uncertainty about how existing regulations apply to decentralized systems.

High Initial Implementation Costs

Developing and deploying blockchain infrastructure demands significant investment. IT can be in the form of technology, integration, and training. Making it difficult for smaller institutions to adopt.

Resistance to Change

Traditional mortgage systems are deeply ingrained in the industry. Moreover stakeholders may resist transitioning to blockchain. This can be due to concerns about job security, investment costs, and unfamiliarity with the technology.

Scalability Issues

Blockchain networks may struggle to process the high volume of mortgage-related transactions in real-time, leading to delays and increased costs as systems scale.

Interoperability Challenges

Mortgage processes involve various entities using different systems, and blockchain’s success depends on seamless integration across these diverse platforms, which is not yet standardized.

Data Privacy Concerns

Blockchain’s transparency can conflict with privacy requirements for sensitive mortgage data, posing risks of non-compliance with regulations like GDPR.

Lack of Industry-Wide Adoption

Uneven adoption rates across the mortgage industry hinder blockchain’s potential, forcing many organizations to maintain hybrid systems that reduce efficiency.

Technical Complexity

Blockchain applications in mortgages require specialized knowledge in smart contract design, system integration, and network maintenance, which may not be readily available.

Cybersecurity Risks

Despite being secure, blockchain systems are not immune to cyber threats such as wallet hacking, smart contract vulnerabilities, and phishing attacks targeting decentralized platforms.

Limited Consumer Awareness

Borrowers often lack understanding of blockchain’s benefits, leading to skepticism and slow acceptance of blockchain-based mortgage solutions.

Real-World Examples of Blockchain for Mortgages

Numerous businesses have already built dependable blockchain-enabled mortgage solutions by utilizing blockchain technology in the mortgage sector. From creating credit identities and scores to enabling lending, to the role of Blockchain in Insurance, these solutions cover a broad spectrum of tasks under one roof. Let’s look at some of the real world examples of the blockchain use cases in mortgage lending.

Synechron

Through limited automation, Synechron seeks to streamline the lending process for both parties while offering improved value throughout. These remedies are effective at speeding up the process, but they don’t address the underlying problem, which is a complex, multi-layered procedure.

Homelend

Homelend is adopting blockchain technology in mortgage wholeheartedly. Its Peer-to-Peer (P2P) network connects lenders and borrowers directly, removing several processes from the process, including underwriting and legal, and replacing them with machine learning and artificial intelligence. This method can cut the pre-qualification and approval process’s duration in half.

Figure

Figure combines blockchain for the mortgage industry with artificial intelligence to make it easier for members to obtain home loans and credit lines. Borrowers can obtain house loans in a matter of minutes utilizing Figure’s Crypto Mortgage Plus platform. Borrowers are given payment alternatives and a video conversation with a notary to ratify all documents after completing a quick application and being pre-qualified.

Liquid Mortgage

Direct communication between lenders and borrowers is promoted by the Liquid Mortgage platform. Borrowers are given access to a single blockchain platform that helps them manage and track payments while encrypting their data. At the same time, lenders gain from real-time transaction data and smart contract capabilities.

Viva Network

A decentralized crowd-lending platform from Viva Network promises to do away with middlemen and promote a more transparent home loan market. These platforms make use of the resilience of ledger technology to provide a framework supported by accountability and the inability of fraudulent conduct because of smart contracts. The usual friction that comes with mortgage applications is greatly decreased by this method.

After learning in-depth information about the businesses using blockchain for the mortgage industry, let’s go forward if you’re thinking about investing in next-generation technologies to make the shift to digitalization.

The Future of Blockchain in the Mortgage Sector

Distributed ledger technology and Blockchain development services, have the ability to completely transform the mortgage market. It can be done by improving the process’s efficiency, security, and transparency.

Secure Record-Keeping: By offering an unchangeable and decentralized record of mortgage transactions, blockchain technology in mortgage lowers the possibility of fraud, mistakes, and data manipulation.

Expedited Procedures: By utilizing DLT and smart contracts, mortgage procedures including escrow management, title transfers, and loan servicing may be automated and expedited, which lowers expenses and minimizes delays.

Better Data Sharing: By enabling safe and effective data exchange between lenders, borrowers, and other stakeholders, blockchain-based platforms can improve cooperation and lessen the need for middlemen.

How A3Logics Can Help You Implement Blockchain for Mortgages?

A3Logics specializes in the implementation of blockchain-specific solutions tailored to the needs of the mortgage industry. Having expertise in developing smart contracts, secure ledger systems, and bringing about integration with various applications, we help streamline processes related to title management, document verification, and loan servicing. Our blockchain and smart contract development company promotes transparency, reduces administrative costs, and enhances security. Mortgage businesses can operate more effectively by leveraging blockchain solutions from A3Logics. Partnership with blockchain consulting services like A3Logics gives one the opportunity to gain access to the best of cutting-edge technologies, expert consultation, and end-to-end support to transform his mortgage operations and stay competitive in this fast-changing market.

Conclusion

The world is always changing and progressing toward success. Although the blockchain technology in the mortgage sector is still in its infancy, it is already trending and spreading its arms to reach a potential height of success and change the fundamental flaws of the mortgage industry, guiding it to success and reaching areas that the current trends in the industry haven’t yet discovered. Nevertheless, it is a significant step because using blockchain for the mortgage industry requires a lot of work and time. Although the blockchain system as a whole is extremely secure, it is not impregnable and must be addressed for any security breaches that might coexist with it.

Many individuals are unaware of the potential effects that blockchain technology has had and will have on the contemporary world. Along with that comes reluctance to adopt more modern and fashionable approaches in order to meet different demands. However, the mortgage sector will need time to flourish, just as the internet became a necessity for individuals after encountering several obstacles in its early stages. People are finding it easier to obtain loans for a variety of uses thanks to these new decentralized platforms. Lenders will also experience considerable time and cost benefits.