Blockchain tech facilities are making significant contributions to the world of all sectors. It is important for all to make use of the respective technologies and enhance their transaction process that is free of all errors and bugs. In fact, it saves time and makes a big difference in terms of delivery. This is why the demand for Blockchain in Finance is rising significantly. The primary reason being it is known for providing a perfect platform that not only enhances the transaction but builds trust that leads to even more growth and opportunities.

So, if you are thinking about investing in the field of blockchain for trade finance betterment, then you have certainly landed on the right page. We are here to help you with the best of understanding related to all the aspects in terms of blockchain in finance. Read on as we cover use cases of blockchain for trading and how it is going to completely streamline operations and bring in several benefits. We ensure that you get to understand how blockchain consulting services for your finance solutions can be a master stroke.

Table of Contents

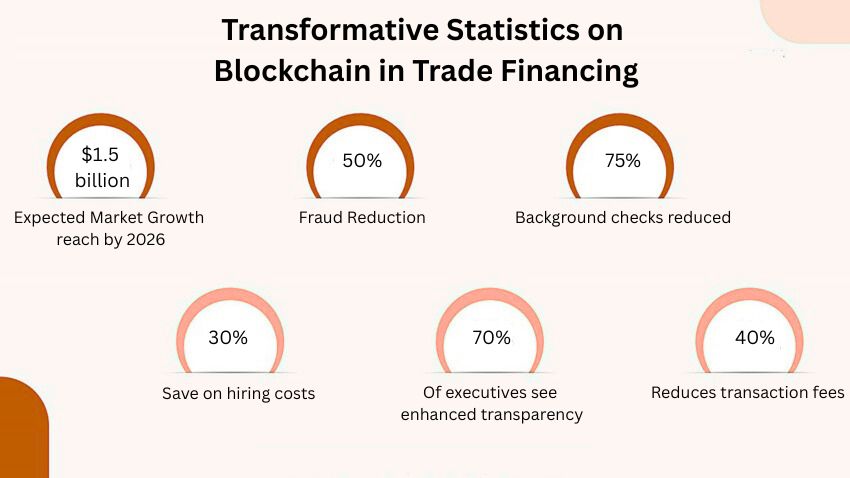

Statistics About Blockchain for Trade Financing

Before moving to the use cases of blockchain for trading, it is important that you understand the numbers that we have in store for you. These numbers can help you understand the impact blockchain tech facility has made in the finance industry and how it is changing the solution delivery.

- The global market for blockchain in trade finance is projected to reach USD 1.5 billion by 2026.

- Deloitte found that 85% of organizations believe that blockchain can significantly reduce fraud.

- A report from IBM states that implementing blockchain can reduce the time taken to process letters of credit by up to 75%.

- Companies utilizing blockchain for trade finance can save up to 30% on administrative costs.

- 70% of executives believe that blockchain will enhance transparency across supply chains.

So, these are the numbers that highlights how the blockchain facilities in finance is going to enhance the overall sector and pave the way for several benefits. It is important that you learn more about it through use cases as it gives you all the clarity you need to proceed ahead. Check it out.

Key Use Cases of Blockchain in Trade Finance

Below are several prominent use cases of blockchain for trading or trade finance, showcasing their practical applications through real-world case studies.

Blockchain for Letters of Credit

Letters of credit (LCs) are essential instruments in international trade that provide security to both buyers and sellers. However, traditional LC processes are often cumbersome and prone to delays due to manual paperwork and multiple intermediaries involved.

Blockchain for Invoice Financing

Invoice financing allows businesses to access funds based on outstanding invoices before customers pay them. However, traditional invoice financing methods often involve lengthy verification processes that delay access to capital. This transparency accelerates the approval process while reducing the risk of fraud associated with manual invoice submissions.

Blockchain for Supply Chain Transparency

Supply chain transparency is crucial for businesses seeking to ensure product quality and compliance with regulatory standards. Blockchain provides an immutable ledger where every transaction related to a product’s journey, from production to delivery, is recorded securely. This capability allows stakeholders to trace products back to their origins quickly while verifying their authenticity at every stage.

Blockchain for Trade Financing Asset Tokenization

Tokenization refers to converting physical assets into digital tokens on a blockchain network. In trade finance, tokenization allows companies to represent various assets, such as commodities or invoices, digitally on a secure ledger. This process enhances liquidity by enabling fractional ownership and easier transferability between parties involved in trading activities.

Real-Time Auditing and Reporting

Blockchain enables continuous transaction tracking, eliminating the need for periodic audits. Its immutable ledger ensures transparency and accountability, reducing risks of fraud. Organizations can access real-time data, streamlining compliance and improving operational efficiency. This capability enhances trust among stakeholders while cutting down costs associated with traditional audit processes.

Cross-Border Payments

Blockchain facilitates direct peer-to-peer payments, bypassing intermediaries that typically cause delays and high fees. By leveraging cryptocurrencies, organizations can ensure instant, low-cost transfers across borders. This improves cash flow, prevents payment disputes, and strengthens relationships between trading partners by ensuring timely transactions.

Document Verification

Blockchain secures the authenticity of trade documents through distributed ledger technology. It ensures that documentation such as invoices or letters of credit is tamper-proof and easily retrievable. This reduces risks of fraud, enhances trust among parties, and simplifies compliance with regulatory requirements.

Real-Time Tracking of Goods

Integrating blockchain with IoT and AI enables real-time tracking of shipments. Stakeholders can monitor the movement of goods across supply chains with accurate data. This improves logistics efficiency, reduces delays, and fosters transparency in trade operations.

Digital Trade Receipts

Blockchain supports the issuance of digital trade receipts by securely recording transaction details on an immutable ledger. This reduces paperwork, accelerates processing times, and ensures the integrity of financial records for both exporters and importers.

Global Trade Networks

Blockchain creates decentralized global trade networks where participants can share data securely in real time. This fosters collaboration among stakeholders, reduces inefficiencies in trade processes, and enhances transparency in international commerce.

Trade Finance Ecosystem Integration

Blockchain integrates various stakeholders in the trade finance ecosystem—such as banks, insurers, and logistics providers—on a single platform. This streamlines processes like credit approvals and risk assessments while reducing redundancies and enhancing efficiency.

Trade Financing Credit Insurance

Blockchain improves trade credit insurance by creating immutable records of policies and claims. This ensures transparency in agreements, reduces disputes over coverage terms, and minimizes risks for insurers and policyholders.

Faster Settlement

Smart contracts on blockchain enable automated settlement of transactions once predefined conditions are met. This eliminates manual reconciliation processes, accelerates payment cycles, and reduces operational costs for all parties involved.

Smart Contracts in Trading

Smart contracts automate tasks like order placements and payments while ensuring compliance with agreed terms. By reducing human intervention, they prevent misunderstandings or disputes and improve overall trading efficiency.

Commodity Trading

Blockchain enhances commodity trading by providing a transparent record of transactions and automating processes through smart contracts. This reduces inefficiencies, improves traceability, and ensures fair pricing mechanisms.

Global Trade Agreements

Blockchain simplifies the execution of global trade agreements by securely recording terms on a shared ledger accessible to all parties. This minimizes conflicts over contract terms while ensuring compliance with international standards.

Secure Data Exchange in Trading

Blockchain ensures secure data sharing between trading partners by encrypting sensitive information on a decentralized ledger. This protects against cyber threats while fostering trust among participants in the trading ecosystem.

How Blockchain Streamlines Trade Finance Operations?

Now if you are thinking about how blockchain will be able to streamline the financial operations, then the below pointers will help you with all the clarity. Check it out.

- Blockchain enhances efficiency in trade finance by automating processes like documentation and approvals, reducing the need for manual interventions. Smart contracts enable faster settlements by automatically executing transactions when conditions are met, streamlining operations and saving time.

- The technology improves traceability by providing real-time visibility into the movement of goods and services across supply chains. This transparency promotes accountability and ensures that all stakeholders can monitor transactions seamlessly, reducing errors and disputes.

- Blockchain ensures auditability by recording every transaction immutably on a distributed ledger. This creates a permanent, tamper-proof audit trail, simplifying compliance with regulations and enhancing trust among participants.

- Cost savings are achieved through blockchain by automating workflows and reducing reliance on intermediaries. This minimizes operational expenses, lowers transaction fees, and eliminates inefficiencies associated with traditional paper-based processes.

- Collaboration is enhanced as blockchain provides a secure platform for multiple parties to share data without compromising sensitive information. This fosters trust, protects intellectual property, and strengthens partnerships among stakeholders in the trade finance ecosystem.

The Benefits of Blockchain for Trade Finance

Integrating blockchain technology into trade finance presents numerous advantages that enhance operational efficiency while improving customer experiences significantly overall! Here are some key benefits:

- Blockchain provides enhanced security by using an immutable ledger that ensures sensitive data cannot be tampered with or accessed without authorization. Cryptographic encryption safeguards transactions, reducing risks of fraud and cyberattacks.

- Transparency is improved as blockchain creates a shared ledger accessible to all stakeholders. This allows participants to verify transactions in real time, fostering trust and accountability across trade finance operations.

- Decentralization eliminates reliance on a single point of failure by distributing data storage and processing. This makes systems more resilient to attacks or malfunctions, ensuring uninterrupted operations.

- Efficiency increases as smart contracts automate processes like approvals and payments. This reduces manual intervention, streamlines workflows, and minimizes delays in trade finance activities.

- Blockchain ensures data integrity by maintaining unaltered, trustworthy records. This reliability enhances the accuracy of predictive models and decision-making processes in trade finance.

- Cost reductions are achieved by eliminating intermediaries and automating administrative tasks. This lowers transaction fees, reduces overheads, and simplifies operations for all parties involved.

- Regulatory compliance is simplified with blockchain’s transparent record-keeping. Organizations can easily demonstrate adherence to data privacy and usage regulations, reducing compliance-related complexities.

- Collaboration is enhanced as blockchain enables secure data sharing among multiple parties. Sensitive information and intellectual property are protected while fostering trust and cooperation in trade finance projects.

- Scalability is supported by blockchain’s ability to handle growing volumes of transactions without compromising security. Businesses can expand operations efficiently while safeguarding sensitive information.

- Blockchain fosters innovation by enabling new product development, service delivery models, and customer engagement strategies. Its flexibility opens opportunities for creative solutions in trade finance and beyond.

Challenges of Blockchain Technology for Trade Finance

While integrating blockchain technology into AI applications presents numerous advantages, it also poses several challenges requiring careful consideration before implementation begins! Below are some key obstacles faced:

- Data privacy is a major concern when integrating blockchain with AI, as sensitive consumer information must be handled securely. Strict compliance with data protection regulations is essential to safeguard individual rights and maintain trust between brands and users.

- A lack of skilled professionals with expertise in both blockchain and AI technologies creates a significant barrier. Organizations must invest in training and hiring talent to effectively operate and maintain these advanced systems in competitive industries.

- High implementation costs deter many organizations from adopting blockchain-AI solutions. The expense of deploying sophisticated systems often outweighs perceived benefits, requiring careful cost-benefit analysis before investment.

- Integrating blockchain with legacy systems presents challenges in ensuring compatibility with existing infrastructure. Seamless transitions require meticulous planning and execution to avoid disruptions while implementing modern technologies.

- Algorithm bias poses ethical challenges in automated decision-making, potentially leading to unfair outcomes based on demographics. Transparency and accountability must be prioritized to ensure fairness and uphold ethical standards.

The Future of Blockchain in Trade Finance

As we look towards future prospects surrounding integration advancements emerging trends expected influence growth trajectory significantly over coming years ahead here are some anticipated developments shaping landscape ahead:

- The future of blockchain in trade finance will see increased adoption across industries as organizations recognize its potential for enhancing security, transparency, and efficiency. Demand for innovative solutions will continue to grow.

- Ethical practices will gain more focus, with frameworks developed to ensure the responsible use of blockchain-AI technologies. Fairness, accountability, and adherence to ethical principles will drive their adoption across sectors.

- Collaboration among stakeholders will foster diverse perspectives and robust frameworks for innovation. Engaging multiple parties will promote shared goals, driving progress in the integration of these technologies.

- Sustainability initiatives will leverage blockchain and AI to implement eco-friendly practices. These efforts will create positive impacts on communities while aligning with global environmental goals.

- Regulatory compliance will remain crucial as scrutiny over emerging technologies increases. Transparent operations recorded on public ledgers will ensure accountability and build consumer trust in the responsible use of these innovations

How A3Logics Can Help You Implement Blockchain for Trade Finance?

We at A3Logics have been in this field of service for long and have assisted many with their specific needs of blockchain for trade finance. So, if you are thinking about what makes us the best name in the business, then the below pointers can help you with all the aspects. Check it out.

- A3Logics offers customized solutions tailored to address the unique needs and challenges of each client. By understanding specific requirements, the team ensures maximum value is delivered in every engagement, fostering long-term success and collaboration.

- Expert consultation services are provided to guide clients in implementing innovative strategies. A3Logics’ consultants assist in navigating complexities, offering strategic direction to help organizations achieve their goals effectively and drive sustainable growth.

- Ongoing support and maintenance services ensure smooth operations for all implemented solutions. A3Logics provides continuous updates, troubleshooting, and performance optimization to sustain long-term success across all initiatives.

- The integration of new solutions with existing systems is handled seamlessly by A3Logics. Their expertise minimizes disruptions during transitions, ensuring compatibility with current infrastructures while maximizing operational efficiency over time.

Conclusion

So, the rise of blockchain technology for trade finance is certainly there to enhance the transaction process that will pave the way for growth and opportunities. Our professionals will understand every aspect of the business and then assist you with the blockchain development facilities that will boost transparency, security, and efficiency.

So, if you are looking for the experts to help you with all the challenges you are going to face with the infusion of blockchain then, you must not hesitate and connect with the experts at A3Logics. Being the top dApp Development Company, we are going to help you reduce costs, improve compliance, and boost trust among stakeholders through secure and transparent processes.

So, connect now and have our blockchain development services experts do the job for you!