Table of Contents

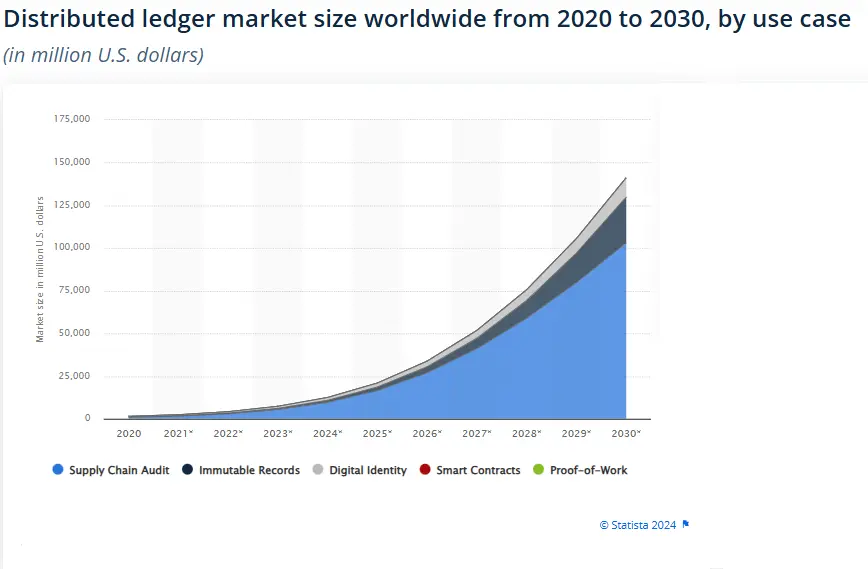

Blockchain technology has emerged as a revolutionary platform that is changing the landscape of asset management. By providing a distributed and decentralized digital ledger for recording transactions, blockchain brings unprecedented security, transparency and efficiency to asset management systems.

This transformative technology plays a pivotal role in digitizing assets and streamlining processes to enhance value for asset holders and managers alike. In the US, firms across industries are exploring innovative blockchain-based solutions to transform how they administer both physical and digital assets.

This post aims to provide a comprehensive understanding of blockchain in asset management through key applications of blockchain in asset management, benefits, emerging regulations and the vital role of smart contracts. It also examines how leading blockchain development services providers like A3Logics can assist US firms in effectively integrating this powerful technology with their existing asset management infrastructure.

Now we are going to take a look at the different use cases of blockchain In asset management in the next section. Read on.

Use Cases of Blockchain In Asset Management

Below are the different forms of use cases of blockchain In asset management. Check it out:

Trade Finance and Working Capital Management

Blockchain enables the automation of processes like Letters of Credit, improving transparency, reducing costs and mitigating risks for all parties involved in international trade. The Marco Polo network facilitating trade between Europe and Asia is a notable example of how blockchain improves trade finance.

Supply Chain Management

Blockchain in Supply Chain brings accountability, integrity, and accessibility to supply chain data through an immutable decentralized record that can track each step of production and transportation. Major brands like Walmart have implemented blockchain tracking for food safety and sourcing, showcasing the transformative potential of this technology.

Agricultural Commodity Trade

Platforms like Agricultural Market Information System facilitate trade of crops by securely recording transactions, quality certifications and logistical parameters on distributed ledgers for agricultural commodities.

Diamonds and Luxury Goods

The technology secures provenance details and authenticates high-value assets in industries like diamonds and luxury goods through permanent digital certification of origin, quality and ownership history on the blockchain.

Capital Markets Post-Trade

Activities like clearing, settlement and asset servicing can leverage blockchain to validate ownership and automate back-office processes for seamless asset transfers in capital markets. Finality and other consortia are pioneering such applications of blockchain in asset management.

Securities Lending

Smart contracts automate securities lending agreements. Manage collateral requirements transparently and settle transactions near-instantly while mitigating counterparty risks for the financial ecosystem.

Private Equity and Venture Capital

Blockchain facilitates tokenization of ownership in privately-held companies. This enhances secondary market liquidity for alternative asset investors while easing capital raising. US startups like DRW are leveraging this emerging model.

Real Estate

Platforms enable fractionalized ownership of properties through asset tokenization, streamlining transactions, automating processes like rent collection and resolving issues such as title clearance more efficiently.

Art and Collectibles

Blockchain brings trust and transparency to provenance verification, aiding pricing discovery and facilitating fractional sales of valuable artworks and collectibles through permanent digital certification of origin and ownership history.

Insurance

Blockchain improves claim processing, enhances underwriting quality and automates several back-office activities. Startups are pushing applications for health, life and cyber insurance offerings through the technology.

Investment Management

By automating middle/back office procedures and enabling new billing/pricing models, blockchain streamlines operations in asset servicing, fund accounting while reducing costs for fund managers.

P2P Lending

Decentralized blockchain-based platforms connect lenders directly to borrowers, eliminating intermediation costs and inefficiencies, thereby lowering rates for retail lending.

Wealth Management

Blockchain supports streamlined financial planning, portfolio rebalancing, tax estimation and automated processes for HNW clients of wealth advisors with potential cost savings.

Energy Commodities Trading

Blockchain enables non-physical or paper-based trading of energy derivatives while bringing transparency, security and new market access through decentralized applications of blockchain in asset management.

Infrastructure Asset Management using Blockchain

The Nasdaq Linq platform demonstrates how blockchain brings transparency and liquidity to markets for infrastructure assets while lowering associated financing costs through tokenization of ownership.

So, these are few of the use cases of blockchain In asset management. Now let’s understand the role of smart contracts in the below section. Read on.

The Role of Smart Contracts in Blockchain Asset Management Using Blockchain

Smart contracts are computer programs stored on blockchain that can execute contractual clauses like asset transfers automatically based on predefined conditions or rules. Their core functions in blockchain-enabled asset management systems include streamlining processes, codifying contractual obligations, validating transactions independently and programmatically enforcing agreements.

In trade finance for example, smart contracts connect all parties involved, trigger payments automatically upon delivery confirmation eliminating delays. Similarly, they can automate asset servicing activities like interest calculation, distribution of capital gains or enforce collateral requirements transparently for lending.

In Supply chain management for high-value goods, smart contracts validate product authenticity and quality standards throughout the journey. They secure genuine ownership records that are digitally signed and time-stamped on distributed ledgers.

As a Smart Contract Development Company, we recognize that smart contracts enhance security, reduce intermediation risks, and remove inefficiencies by automating the fulfillment of contractual terms for all on-chain transactions and asset transfers. The predictability, self-execution, and permanent record-keeping attributes of smart contracts establish trust among participants while increasing process efficiencies in the asset management industry.

Benefits of Blockchain for Asset Management

Building on the inherent attributes of distributed ledgers and incorporating mechanisms like tokenization, cryptocurrencies, smart contracts and decentralization. Blockchain delivery transformative benefits to participants in the asset management sector including:

Improved Security: Byzantine fault tolerant consensus protocols, transparent transaction history and cryptography ensure all digital interactions are immutable, non-repudiable and resistant to external tampering or internal collusion.

Enhanced Transparency: The distributed nature of blockchains guarantees a single, synchronized version of the truth providing visibility into asset properties, transactions, and contractual obligations in real-time across the network.

Reduced Costs: Automated processes cut out intermediaries, lower transaction fees and eliminate paper-based record keeping through streamlined, non-physical operations leveraging blockchain.

Increased Liquidity: Tokenization of assets enhances their divisibility, portability and ability to fractionalize ownership allowing for new capital raising and secondary market trading models.

Superior Auditability: The permanent, cryptographically validated transaction record maintained on distributed ledgers presents an accurate, time-sequenced documentary trial eliminating the need to rely solely on individuals, institutions or centralized databases.

How Blockchain Provides Security in Asset Management?

Hackers, glitches and internal faults can all compromise the sanctity of centralized databases. However, blockchain architecture fortifies digital assets against these security vulnerabilities through its inherent consensus-driven features:

Decentralization

Blockchain networks have thousands of nodes globally validating transactions in a decentralized manner without any central authority. This ensures that even if some nodes go offline due to technical faults or attacks, the information continues to be stored in multiple copies across the network maintaining resilience. As no single entity controls the ledger, the risk of system manipulation is nullified.

Immutability

Once a block of transactions is added to the blockchain and validated, it becomes a permanent and irreversible record. Altering any transaction in the past requires coordination across a majority of nodes to update the hashes. Since each block contains the hash of the previous block, modifying old transactions affects the hashes in all future blocks too which is computationally infeasible. This provides superior historical accuracy for auditing.

Anonymity

In blockchain, user information is not linked to real identities but represented though unique alphanumeric wallet addresses. Only wallet addresses and transaction validations are visible publicly, protecting individual privacy. Additional layers like ring signatures and zero-knowledge proofs can further obfuscate transaction trails preserving user anonymity amidst transparency of the underlying network.

Public Ledger

All blocks and their linked hashes are visible publicly on the distributed ledger. However, only after a majority of nodes reach consensus can blocks be added, eliminating single point controls. This transparency deters fraudulent activities as any attempts at manipulation will be detected. Asset records continue to be available immutably even if some nodes crash, strengthening reliability.

At A3Logics, we leverage blockchain security mechanisms through private and consortium blockchain networks along with zk-SNARK zero-knowledge proofs. And multi-signature protocols to deliver exceptionally fortified digital asset management platforms for enterprises globally.

Regulatory Landscape for Blockchain Asset Management in the US

US regulatory treatment of the blockchain and digital assets landscape has evolved with bipartisan support over the past decade. While some legal clarity remains pending, the following developments indicate a favorable approach:

SEC guidance clarifies that not all digital assets are considered security tokens. The Commodity Futures Trading Commission introduced a digital commodity definition.

The Office of the Comptroller of the Currency verified national banks’ ability to provide custody services. FinCEN extends anti-money laundering regulations to peer-to-peer exchange operations.

Leading US states like Wyoming adopted pioneering blockchain legislation setting guidelines for decentralized autonomous organizations and utility tokens while ensuring technological freedom.

The US Chamber of Digital Commerce engages regulators and lawmakers, advocating balanced reforms enabling innovation. Leading industry participants issue thoughtful compliance recommendations for blockchain businesses.

The 2020 executive order urged coordinated government efforts to drive blockchain development enabling digital transformation. Major banks rolled out stablecoin projects with regulatory sandboxes supporting responsible growth.

While uncertainties remain on issues like tax framework, security token listing and data privacy. US moves to integrate transparent digital asset oversight signal long term viability of the sector within prudent risk management guardrails.

How Can A3Logics Assist You in Integrating Blockchain with Asset Management Systems?

Leveraging our deep expertise in both blockchain product development and digital transformation advisory. A3Logics leverages a tailored four-phase approach to integrate blockchain with legacy enterprise asset management infrastructure:

Discovery Phase

In this initial phase, A3Logics experts understand the client’s current operations, pain points, asset types, regulatory needs through interviews. Workshops are conducted to clarify objectives like provenance, liquidity etc. As-is processes are mapped and target state is outlined with stakeholders. This helps assess integration complexity and identify focus areas.

Planning Phase

Architects design optimal tech infrastructure with necessary permissions, integrations and tooling. Interfacing traditional databases seamlessly with permissioned blockchain networks is planned. Smart contract logic, APIs, client integrations etc are planned for modular integrated development. Scalability, network topology, consensus algorithms are selected based on asset type, volumes and regulatory needs.

Build Phase

Experienced developers structure code on ecosystems like Ethereum, Hyperledger etc. Data models, workflows and integrations are developed as per design. Specialized tooling is created for unique asset management using blockchain needs like provenance tracking, fractional ownership etc. Smart contracts are audited and tested rigorously. Regular sprints ensure issues are resolved and code is deployment-ready.

Implementation Phase

Post development, change management experts conduct knowledge transfer and training. Shadow period is used to identify process refinements. Monitored gradual mainnet migration happens with real but limited volume. Response automation and monitoring tools are configured. Governance models are created based on regulations with legal assistance. Contracts are managed and issues are quickly resolved post-implementation.

Transform Your Asset Management with Blockchain – Book a Free 30-Minute Consultation!

Final Take

In conclusion, blockchain technology is revolutionizing the asset management industry by digitizing ownership records, enhancing transparency and facilitating new forms of value exchange globally. Creative applications of blockchain in asset management like tokenization are uncovering limitless ways assets across classes can be fractionalized, securely managed and traded.

Jurisdictions that embrace responsible innovation through prudent yet progressive policies will attract the innovators and businesses exploring this transformative sector. Meanwhile, the confluence of decentralized networks and legacy infrastructure will see fascinating synergies emerge, with blockchain augmenting operational dexterity across geographies and asset types.

As industry heavyweights as well as nimble startups progressively execute visionary integration blueprints. The full potential of this transformative technology to optimize trillion dollar asset management value chains becomes increasingly evident.

If you desire to know more, or invest in anything related to it, then connect with the top DeFi development company named A3Logics now!

FAQ’s

What is blockchain asset management?

Asset management using blockchain refers to the application of blockchain technology to the administration of financial and physical assets. It involves using distributed ledgers and smart contracts to securely record asset transactions, ownership details and related data in order to streamline processes while enhancing transparency, traceability and security of assets.

What are digital assets and how do they differ from traditional assets?

Digital assets exist primarily in electronic form and typically have no physical substance. They can be easily transferred and are authenticated using blockchain technology. Traditional assets on the other hand exist physically as tangible goods or property. While physical assets can also be tokenized into digital assets on blockchain, not all digital assets represent physical assets.

What is tokenization, and how does it impact asset management?

Tokenization is the process of converting rights to an asset into a blockchain-based digital token. This allows dividing assets into smaller fractions or combining multiple assets into a single tradable unit. Tokenization enhances liquidity, accessibility and transfers of assets using blockchain platforms. It provides new financing and investment options in asset classes.

What types of digital assets can be managed using blockchain?

Blockchain supports the management of a wide range of digital assets like cryptocurrencies, digital collectibles, digitized real estate, financial instruments, securities, digital media, supply chain records and even carbon credits. Essentially any asset that can be assigned ownership details and transaction records can potentially be managed as a digital asset on blockchain.

How do blockchain and asset management work together to improve transparency?

Blockchain maintains a tamper-proof public record of asset transactions over time. This level of visibility into ownership history and related activities enhances transparency and trustworthiness in asset transactions. The consensus-driven validation mechanism removes reliance on centralized intermediaries and single points of failure, instead distributing trust across network participants for streamlined asset administration.