Table of Contents

Blockchain technology has managed not to leave many industries unscathed. Beginning with it immediately was quickly catapulted to cause others to topple. Many payment, remittances, and foreign exchange systems have greatly been impacted by cryptocurrencies. The stock market investment system, startup loans, and venture capital in every scenario, no matter which companies succeed or fail-have been seriously shaken up by initial coin offerings. Many businesses, for example, food supply chains, have evolved thanks to blockchain technology.

Not even real estate is immune to the touch of blockchain technology. It has never been a norm to conduct the whole transaction of a valuable commodity, including real estate, online. A face-to-face meeting with different parties has long been one offline way to do business on matters concerning real estate. But through the blockchain, this is also possible. Smart contracts in blockchain platforms today have now allowed real estate and other assets to be tokenized for exchange, just as they allow cryptocurrencies like bitcoin and ether.

In this blog, we will learn all about the use cases of blockchain in real estate, including its benefits and challenges.

Key Stats of Use Cases of Blockchain in Real Estate Industry

- Forecasts indicate that the worldwide real estate blockchain market will expand from its 2021 valuation of $1.74B at a CAGR of 64.8% through 2028.

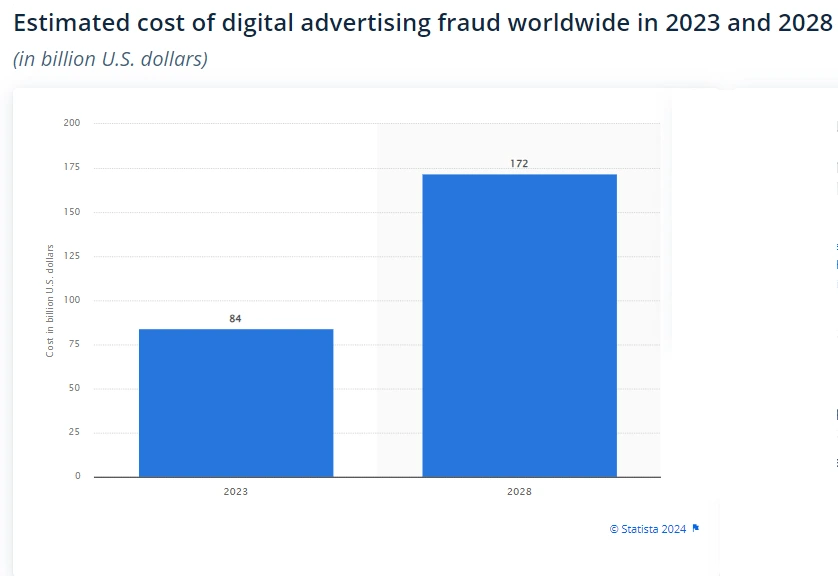

- Blockchain has the potential to save the real estate industry $160 billion in fraud-related costs annually by 2028.

- $3.4 trillion worth of real estate assets will be tokenized globally in 2024.

Top Use Cases of Blockchain in Real Estate Industry

Blockchain technology could transform the real estate market in various areas, including asset management, property registrations, etc. Here are a few Blockchain Applications in Real Estate.

Smart Contracts for Property Sales

Making a bet on real estate could be a risky choice. There is no guarantee you will earn any income after the property has been either rented or sold. Furthermore, if, for instance, you put your money into the construction of a project, then the construction process might not begin, and scammers may take the entire amount of cash.

Blockchain-based technology is known as a smart contract, but these scenarios are impossible. A smart contract development company can automatically perform the steps necessary to fulfill agreed-upon terms. No one party can control it, and every action is irrevocable. Therefore, the property investment processes performed in blockchain networks are safe since all shareholders get paid once the asset has begun to generate dividends on investments.

Additionally, smart contracts provide an opportunity for real estate investment platforms to attract new investors with various income streams. On a blockchain, every asset is distributed among as many investors as possible, which means that investors can contribute tiny amounts to finance real property.

Furthermore, investing in small amounts is more efficient because investors view investing little money as a safer option.

Blockchain-Based Property Titles

Use Cases of Blockchain in Real Estate has revolutionized the management of title and land registrations by creating tamper-proof, transparent documents of ownership. By storing property title information and ownership records in the blockchain system, this information can be easily accessible and verifiable, which significantly reduces the chance of disputes and fraud.

Fractional Property Ownership

Blockchain-powered tokenization is opening up new possibilities for fractional ownership. Asset owners can now trade their shares digitally, which allows those with limited funds to become investors. Based on the platform for tokenization, the required investment buy-in could be set at various levels, allowing greater participation. This can significantly lower the barriers to entering the real estate market and improve the liquidity of the assets.

Transparent Lease Agreements

Real property transactions typically involve several processors, which adds to the price of the home. Sometimes, it could take a few days or weeks to complete the transaction.

The blockchain application, with its native currency, can allow payments to be made instantly and be controlled by smart contracts.

For example, the title and payment could be exchanged simultaneously during sales. Additionally, payment plans may be specified and then automatically executed within a smart contract lease agreement.

The transactions are recorded in an unchangeable ledger that can be accessed anytime.

Ready to Innovate? Explore Blockchain Consulting Services Today!

Cross-Border Real Estate Transactions

Another Use Cases of Blockchain in Real Estate technology transcends geographical boundaries and allows property transactions to take place effortlessly across boundaries. With tokenization, investors can increase their wealth by acquiring properties in various countries without the logistics challenges that are typically associated with trans-border transactions. Global access opens new opportunities for Blockchain Applications in Real Estate investments and encourages international cooperation in the property market.

Automated Rental Payments

Blockchain helps simplify rental payments by automating renting through smart contracts. Tenants can pay rent using cryptocurrency or traditional currency using the smart contract that guarantees timely payments directly to the landlord. This means there is no need for intermediaries, which minimizes the time to pay and improves transparency.

Furthermore, blockchain provides a safe and unchangeable document of every transaction, making monitoring past financial transactions much easier. Tenants can schedule regular payments, and landlords can profit from lower processing expenses. Automating rental payments improves efficiency, accuracy, and confidence in property management, which improves relationships between landlords and tenants.

Mortgage and Loan Management

Blockchain transforms loan and mortgage management by streamlining applications, approvals, and repayment procedures. Through decentralized ledgers, blockchain offers transparent, secure, and tamperproof documents of loan contracts and payments. Lenders can use smart contracts to streamline verifications, scoring, and interest calculations, reducing paperwork and human errors.

Blockchain allows for the real-time tracking of payments, ensuring lenders and borrowers have the most current information. Furthermore, blockchain could assist in reducing mortgage investment costs by allowing multiple investors to be involved in one loan, thus increasing liquidity and decreasing risk for the mortgage industry.

Real Estate Investment Platforms

Blockchain is a key component of real estate investment platforms through tokenizing real estate assets. Investors can purchase fractional real estate ownership by purchasing tokenized shares, which provides more liquidity and fewer entry barriers for retail investors. This makes it easier for everyone to access real estate investments, as small-scale investors can invest in high-value projects.

Blockchain provides the security of transparent, secure, and mutable evidence of ownership, transaction history, and dividend distributions. Smart contracts automate the management of dividend pay-outs and profits, removing the necessity for intermediaries. Blockchain helps facilitate investments across borders by reducing barriers to currency conversion and ensuring compliance with international laws.

Real Estate Crowdfunding

Blockchain technology allows crowdfunding platforms and Real Estate Investment Trusts (REITs) to provide fractional rights to real estate properties for more investors. With tokenization, investors can buy digital tokens representing an ownership interest in the real property. They can then trade through blockchain-based platforms, offering flexibility and liquidity to investors. REITs and crowdfunding platforms can utilize blockchain technology to simplify the trading, issuance, and payment of securities issued digitally while reducing administration costs and fees for intermediaries.

Blockchain technology has great potential to transform the Blockchain Applications in Real Estate industry in various areas, including asset management, property registrations, and more. Utilizing blockchain’s decentralized, clear ledgers, real estate professionals can streamline their operations, cut costs, improve security, and create new possibilities for innovation and investment.

In the years to come, as blockchain technology continues to mature and become more sophisticated, its use within the property sector is set to increase, opening the way to an efficient, transparent, inclusive, and scalable real estate market.

Immutable Property Data Records

Most important Use Cases of Blockchain in Real Estate ensures that property information records are indestructible, which means they can’t be altered after being recorded. This ensures that property histories, ownership details, and transaction data are precise and secure from tampering. Storing these data on a decentralized ledger blockchain can prevent fraud, forgery, and manipulation of data, which are typical issues when dealing with real property transactions.

Immutable records can also ease the process of verifying property for buyers, sellers, buyers, and lenders, as the relevant information is readily accessible and reliable. This transparency speeds up due diligence, reducing the time and costs involved in checking the history of the property.

Title Insurance via Blockchain

Blockchain can simplify an insurance process for titles by establishing immutable and clear evidence of ownership. In the past, title insurance has required lengthy background checks to prove the owner’s identity and spot potential claims or disputes. Blockchain technology means that property titles are stored securely on a decentralized blockchain, making it easier to confirm ownership and identify inconsistencies.

This eliminates the requirement for third-party verification and lowers the chance of fraud and mistakes during title transfers. It also means that the process for obtaining title insurance is much faster, more efficient, and cost-effective for both the insurer and the buyer.

Deed Transfers

Property transfers are typically complicated and lengthy, with many intermediaries. Blockchain simplifies deed transfer by enabling digital recording and ownership transfer via smart contracts. When the conditions for sale are fulfilled, smart contracts will automatically assign the property’s deed to its new owners, resulting in an irrevocable record on the blockchain.

This eliminates the requirement to employ middlemen, such as notaries and escrow service providers, reduces transaction costs, and increases the speed of transfer. Blockchain-based deed transfers also reduce the possibility of fraud, providing a safe and transparent method of transferring property ownership.

Real Estate Identity Verification

Identity verification is vital for Blockchain Applications in Real Estate transactions to avoid fraud and ensure compliance with regulations. Blockchain will make this process easier by storing and confirming identity verification credentials. A decentralized ledger enables users to verify identities immediately without the need for intermediaries from third parties.

Blockchain guarantees that personal information sensitive to you, like financial information or legal documentation, is protected and restricted to only authorize individuals. By reducing the need for manual identity verification, blockchain not only speeds the process of completing transactions but also increases security and privacy, which makes Blockchain Applications in Real Estate transactions more reliable and efficient.

Land Registry Management

Property ownership is the core of democratic societies. This translates to the capability to effortlessly and firmly demonstrate and protect property ownership. This is accomplished by titling systems, also called “the property registry.”

However, real estate ownership is just as safe as a property registry. If the system doesn’t exist or is easily modified, people with the power to do so can take possession of those who don’t. Additionally, weak land registry systems are susceptible to hacking, and property ownership could be arbitrarily altered.

This can make a real estate investment very risky but also appealing.

Encryption, immutability, and decentralization benefit the land register on the blockchain, making arbitrary changes challenging to implement. Titles may be stored on the blockchain in not-fungible tokens (NFTs).

Tokenized Real Estate Assets

Tokenization, the process of converting Blockchain Applications in Real Estate assets into digital tokens stored on the blockchain, is revolutionizing real estate investment. The tokens represent a small fraction of the ownership, allowing investors to buy a portion of homes that they can’t buy outright.

Fractional ownership increases access to real estate investments and improves liquidity. Tokenized assets are easily traded via blockchain platforms, which provides sellers with a greater number of potential buyers and investors with the capacity to enter and exit positions rapidly.

Furthermore, the immutable ledger guarantees everyone’s security and transparency. Investors can easily check the ownership history of a property and other pertinent information regarding an asset that has been tokenized, helping to increase confidence and trust in their investment.

Property Auction Platforms

This is another Use Cases of Blockchain in Real Estate. Blockchain technology adds transparency and effectiveness to property auctions through real-time bidding, secure transactions, and automatic contract execution. Through smart contracts, auction conditions and the final transactions are enforced automatically without intermediaries. Blockchain ensures that bid history, as well as auction results and ownership records, are tamperproof and accessible to the public, which reduces fraud and tampering in auctions.

In addition, auctions across borders are more accessible because blockchain technology allows buyers worldwide to participate in cryptocurrencies. With improved efficiency and safety, Blockchain-based auction platforms are a great way to attract purchasers and vendors, thereby increasing the market’s liquidity.

Real Estate Supply Chain Management

Companies in the field of property development and construction usually oversee a variety of projects. This could be difficult to manage when many sub-contractors and supply chain procedures exist. Finances can be managed more efficiently using smart contracts that automate executing contracts. This is yet another innovative use case of blockchain in the real estate sector. Blockchain technology can streamline procurement procedures by utilizing reputation management and creating digital processes to simplify the management of projects.

Decentralized Real Estate Exchanges (DREX)

Decentralized Real Estate Exchanges (DREX) allow peer-to-peer property trading with no intermediaries and rely on blockchain technology to guarantee the security and transparency of transactions. DREX platforms can tokenize Blockchain Applications in Real Estate property assets, allowing purchasers and sellers to swap fractional ownership shares in properties.

Blockchain’s immutable data enhances users’ trust since transaction histories and ownership records are forever saved. Smart contracts streamline the process of transferring ownership and payments, making it easier to process transactions and reducing the amount of time and expense associated with conventional real estate transactions. DREX platforms can open the world of Blockchain Applications in Real Estate markets and provide an open and decentralized market where investors can trade assets quickly. This is another practical use case of blockchain in real estate market.

Regulatory Compliance and Automated Reporting

Blockchain compliance with regulatory requirements and reporting of real estate transactions by automating and verifying data collection. The smart contract can be programmed to ensure compliance with all laws, including the anti-money laundering (AML) and Know-Your-Customer (KYC) laws are met before the transaction is concluded.

Blockchain offers a clear and auditable transaction record, eliminating the need for manual reports and compliance inspections. This increases accountability and reduces mistakes in compliance documents. Automating these processes reduces expenses and also aids real estate companies in avoiding penalties and fines imposed by regulators.

Blockchain for Real Estate Carbon Credits Trading

Blockchain facilitates the transparent and efficient trade of carbon credits in the Blockchain Applications in Real Estate industry. Buildings can earn carbon credits by decreasing their carbon footprint, which are then traded through blockchain-based platforms. Blockchain guarantees that these credits are tracked and verified throughout their entire lifecycle, which prevents fraud or double counting.

In tokenizing carbon credits, blockchain enables real estate firms to buy, sell, or trade them in minutes, offering financial incentives to make investments in greener, more efficient structures. This encourages sustainability and creates an open, decentralized market for carbon credits in the real estate sector.

Blockchain Use Cases in Real Estate industry are diverse. These are just a few Use Cases of Blockchain in Real Estate.

Your Blockchain Journey Begins Here. Speak with Our Experts Now!

Blockchain in Real Estate: Challenges and Opportunities

Despite its potential for disruption to the market, blockchain technology is still a challenge to apply across the entire spectrum. At present, only the most modern and technologically proficient vendors can smoothly transition from traditional methods to blockchain-based interaction.

Shifts from Legacy Systems

While blockchain and real estate can develop together, blockchain applications are primarily linked to different industries. Those heavily dependent on traditional communication methods between parties will not change that fast. For instance, real estate is one of them.

Paper-based contracts and agreements and the use of old-fashioned systems remain the foundation of real estate transactions. The move to blockchain technology is costly and time-consuming. It will not be any less challenging to make an effort to transfer the decades-old documents of real estate leases to blockchain.

Lack of Regulatory Basis

If you are developing software for real estate services, it is important to be aware of the latest laws and requirements that govern the market. These laws and requirements differ from state to state and also between jurisdictions.

So, the Blockchain Use Cases in Real Estate sector must be in line with all technological advancements and developments, which are only possible with the assistance of industry experts.

Furthermore, the market dynamic could cause uncertainty when negotiating agreements or performing transactions using blockchain. I hope the growth of blockchain technology for real estate investment projects will prompt lawmakers to standardize procedures and rules for digitally-based interaction within this sector.

Privacy Concerns

Most people are unwilling to use smart contracts or blockchain transactions due to privacy issues.

Contracts typically contain sensitive financial information, so it is safer for parties to trust established agencies and vendors rather than trying to do it themselves and utilizing the latest technology.

Resistance to Change

The real estate market is among the oldest markets. The primary asset it has is invariably tied physically, and it’s difficult to change the entire market into digital. The biggest barrier to blockchain implementation is the resistance to changes.

The stakeholders are particularly reluctant and currently hold the most powerful market positions. Despite steady profits, they aren’t motivated to make radical changes. They avoid anything that might affect their financial position.

Benefits and Drawbacks of Blockchain in Real Estate

Blockchain technology can help in this industry’s digital transformation. Rather than using outdated methods, property managers can adopt secure systems. These methods document ownership and ensure transparency in processes.

Transaction Fluidity

Real estate transactions are susceptible to numerous risks. To safeguard stakeholders’ and financial information, several prevention measures have been incorporated into purchasing or selling property and performing transactions. Although these measures can reduce security dangers, they cannot eliminate them and can also add obstacles to ruining a deal.

Not all stakeholders want to dedicate time to performing various procedures to verify their credibility and compliance. Blockchain technology transforms this by removing most hurdles and other measures needed earlier to guarantee security.

Decentralization and Security

This advantage has led to increasing people using blockchain in a business context.

One of blockchain’s advantages is its ability to safeguard individuals’ data and capital through secure protocols. In addition, efficient methods of authentication ensure that access is granted only to verified users.

Cut Operation Costs

Blockchain Use Cases in Real Estate is a great way to reduce the cost of operations. In addition to eliminating intermediaries, sellers can also eliminate unnecessary costs, such as inspection fees and taxes, registration fees, and loan fees.

Data Transparency and Accessibility

No technology is more efficient at distributing data and facilitating its flow than the blockchain. This benefit is crucial for real estate transactions, an industry in which large transactions are conducted.

Digital assets can represent almost everything, from money to property ownership to works of artwork or contracts. Therefore, it is crucial that you ensure continuous access to these assets for the various stakeholders.

Commercial real estate blockchain permit continuous and transparent data distribution without the risk of disruption. With blockchain technology, users can access their information in real-time and have full transparency of all transactions.

Increased Transaction Volume

Blockchain technology can boost the efficiency of the real estate business. Instead of driving far distances to sign contracts, create agreements, or buy goods, people can transfer these activities to online mode.

The speed of transactions with blockchain leads to more transactions and deals that are completed quickly.

Access to Global Asset Distribution

Anyone interested in buying even the smallest portion of interest can take advantage of blockchain technology to make an encrypted and secure transaction.

A wide array of investment opportunities can help countries balance the real estate sector by appealing to foreign sellers.

This results in increased connectivity to the property market globally and a more balanced distribution of assets.

Drawbacks

Now let us have a look at some of the disadvantages of blockchain in real estate industry;

Regulatory Uncertainty

Blockchain technology is still new, and the regulations governing its use within real estate are ambiguous in many areas. The lack of clear guidelines could create compliance challenges and legal risks for sellers and buyers, making it challenging to integrate blockchain technology seamlessly.

High Implementation Costs

Blockchain technology requires significant investment in infrastructure, people, and system enhancements. For smaller real estate companies, transitioning to blockchain can be too expensive. This may limit their ability to benefit from blockchain technology.

Scalability Issues

Blockchain networks, specifically those that are public, such as Ethereum, have scalability issues that could result in delays in transaction times and increased costs during times of high demand. This could hinder the wide adoption of blockchain technology in real estate transactions, which must be processed swiftly and efficiently.

Complexity for Non-Technical Users

Blockchain technology is extremely complex, and figuring out how it functions is challenging for non-technical users such as property owners, buyers, and agents. This issue of user-friendliness could discourage adoption since people who are involved might prefer traditional, familiar methods.

Cybersecurity Risks

Although blockchain is extremely secure, its digital nature can create new security risks, especially when it comes to managing private keys and digital wallets. If keys are lost or stolen, they could lead to the loss of important assets, like real estate tokens, which could lead to financial loss.

How A3Logics Can Help You for Blockchain Development in the Real Estate?

Real estate is making the first step towards a decentralized digital environment, with leaders in the industry and government investigating and incorporating blockchain development for real estate. Blockchain technology in real estate provides new transparency and simplifies transactions.

Blockchain innovation doesn’t happen overnight, and A3Logics, a renowned Cryptocurrency Wallet Development Company, has a proven record of supporting companies around the globe by delivering top-quality blockchain development services supported by new technologies such as blockchain. A3Logics boasts a vast client base that successfully explores the possibilities of secure, decentralized applications with the assistance of an experienced team.

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your Software Journey Today!

The Key Takeaway

Leveraging blockchain in the real estate sector can enhance the business significantly. Numerous blockchain applications in real estate demonstrate how the technology can influence various aspects of the business and will improve the overall ecosystem.

The real estate business has entered a new century thanks to blockchain technology, which brings several benefits like accessibility, efficiency, and transparency. It is impossible to exaggerate the significance of incorporating blockchain into real estate operations, notwithstanding practical hurdles.

Blockchain technology is about more than just being ahead of the curve; it’s about embracing innovation with game-changing potential. Together, we can overcome these obstacles, but real estate agents and brokers must see the tremendous potential in blockchain technology and act swiftly to take advantage of it.

In a world where businesses continue to adopt new technologies, it is crucial to incorporate Use Cases of Blockchain in Real Estate by using latest technology into your current system. A3Logics is a trusted company you can count on to help you with blockchain development for Real Estate. A3Logics is the best-trusted firm, with decades of experience providing the most efficient blockchain used for transactions in real estate that will be more efficient, accessible, and secure than before.

FAQs

How can blockchain be used in real estate?

Blockchain technology can be utilized in real estate transactions to improve and protect various processes, such as title management, property transactions, and leasing. It allows for creating smart contracts that automate transactions when predefined requirements are satisfied, eliminating the need for intermediaries such as brokers and lawyers. Blockchain is also a transparent and immutable proof of ownership. This simplifies the transfer of title process and minimizes disputes.

What does blockchain mean for the future of the real estate market?

Blockchain is a technology that can potentially transform the real estate industry by making transactions more efficient, transparent, and less expensive. It may lead to more direct peer-to-peer transactions that do not require intermediaries, reducing fees and speeding closing times.

Token exchanges for property assets create new investment opportunities. They enable fractional ownership of property. This opens markets to more investors.

How does blockchain reduce fraud in real estate?

Blockchain can reduce the risk of fraud in real estate by offering a secure, unchangeable ledger of property and transaction ownership. Once data is stored on the blockchain, it can’t be altered to ensure the authenticity of the records.

It becomes difficult for fraudsters to create fake property deeds. Double-selling is prevented. Parties can verify property ownership and transaction authenticity.

Is blockchain in real estate safe?

Blockchain-based real estate transactions are believed to be secure because of the technology’s inherent transparency and decentralization. Blockchain’s cryptographic security guarantees that the information stored in the blockchain is invulnerable to tampering and hacking.

However, the security of Blockchain Applications in Real Estate is also dependent on how they are used and whether users are able to protect their wallets with digital encryption and private keys. Like any technology, proper education and techniques are vital.

What are some real-world use cases of blockchain in real estate?

A few instances of real-world blockchain applications in real estate comprise:

- Propy: A blockchain-enabled platform enables sellers and buyers to make international property transactions online, with smart contracts managing the entire process.

- Ubitquity: An Ethereum-powered blockchain platform that provides title management services to ensure property records’ transparency and security.

- Atlant: An Ethereum-based blockchain that enables tokenized real property ownership, which allows fractional property investments and trading through its platform.

- ShelterZoom: A platform that uses blockchain to manage real estate lease agreements and sales contracts safely and efficiently. These examples demonstrate how blockchain technology is integrated into real estate transactions to streamline, improve transparency, and provide new investment opportunities.