Table of Contents

Are you thinking about investing in creating apps like PayPal? We have the answers for all your queries and questions. Today the demand for digital wallets is getting up in every segment. So, if you are thinking about making the most out of it, we are here to assist you with all the answers related to eWallet app.

Digital payments have revolutionized how people send and receive funds worldwide. With innovative fintech solutions, consumers globally now transfer money with ease through their phones.

To cater to this digital payment demand, several P2P money transfer apps like Zelle have emerged that let users conveniently manage finances and transactions right from their devices. Some of the most popular digital wallet brands enabling payments include PayPal, Google Pay, Apple Pay and Samsung Pay, among others.

These platforms have garnered widespread popularity for seamlessly facilitating money transfers at low costs, especially cross-border remittances. Individuals and businesses seeking advanced payment app features to meet evolving user needs often develop digital wallets ‘apps like PayPal’. This comprehensive guide outlines the core components of building a successful money transfer app and estimated cost of developing eWallet money apps like PayPal.

What is an eWallet app?

An electronic wallet or eWallet refers to a digital platform that facilitates online fund management, money transfers and bill payments right from one’s smartphone. Similar to a real wallet storing cash and cards, an eWallet securely stores payment cards, bank account details, gift cards, loyalty programs and coupons virtually. Users can send and receive funds through such apps while tracking transaction histories, setting budgets and managing other financial aspects digitally.

These eWallet apps like PayPal to receive money operate as a standardized payment interface for consumers and merchants. The mobility, features and seamless integration of digital wallets into daily lives have significantly accelerated commerce digitization globally. Some key advantages of eWallet apps like PayPal over traditional cash or cards include instant money transfers, cashback rewards, billing and invoicing capabilities along with enhanced security of financial data.

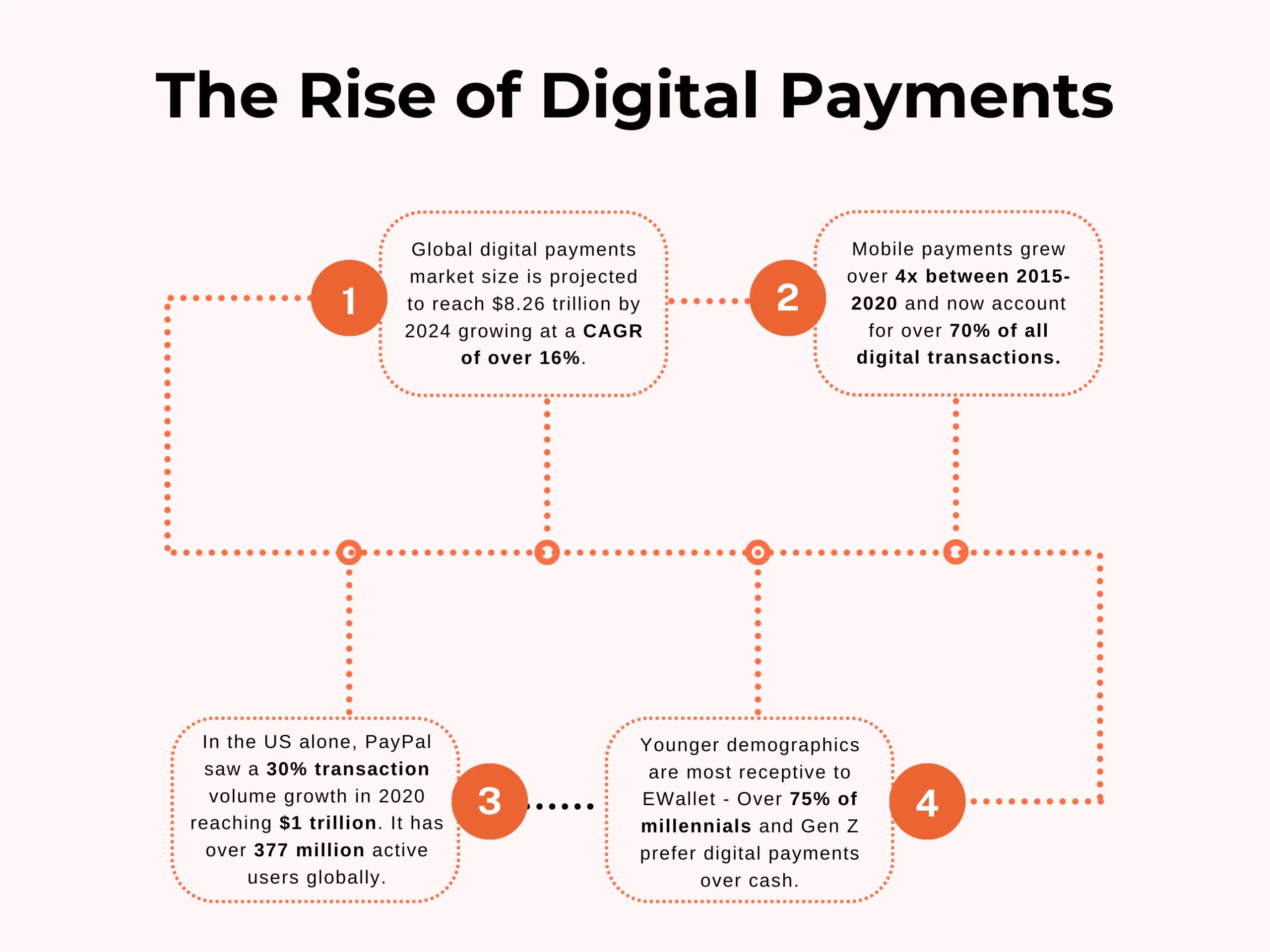

Growth of Digital Payment Apps Like PayPal

Digital wallets have considerably disrupted legacy payment methods. Some fascinating stats indicative of the enormous growth of leading money transfer apps:

- PayPal reported $25.4 billion revenue in 2021 with 426 million active accounts worldwide.

- Apple Pay handles over 2.5 trillion dollars annually in contactless transactions globally as per 2021 estimates.

- Google Pay recorded transaction volumes of $500 billion on an annual run rate basis. It processes over 1 billion transactions monthly.

- Samsung Pay reached 25 million registered users since its 2021 launch and is reported to grow by 10 million by 2025.

- Venmo, a PayPal company facilitated over $240 billion worth of total payment volume in the third quarter of 2021, a whopping 47% rise.

As younger generations embrace ‘cashless’ lifestyles and transaction convenience, fintech solution adoption will explode further. Markets anticipate eWallet usage to quadruple by 2024-25 as the ‘cash apps like PayPal’ model revolutionizes finances globally.

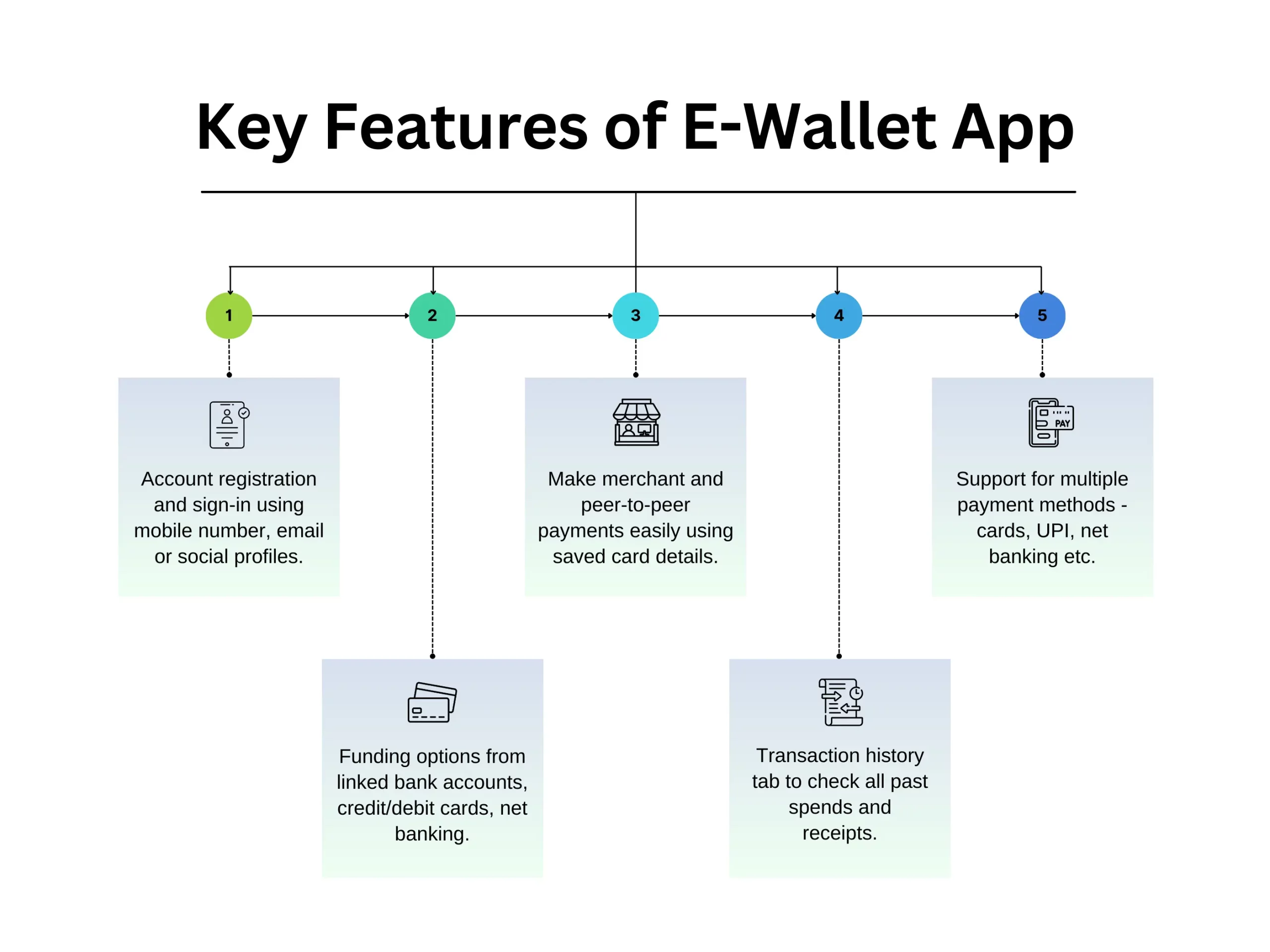

Key Features of Popular EWallet Apps like PayPal

Success of popular eWallet apps is attributed to their easy-to-use features appealing to a wide target base. We review some standard e-Wallet app features:

- Account registration and sign in using credentials or biometric authentication for ID verification and security.

- Multiple funding sources addition including bank accounts, debit/credit cards, net banking and digital receipts/gift cards. This enables quick, easy transfers between accounts.

- Fast, secure making and receiving payments online, in-store through QR codes or tapping phones directly to pay bills, shop, donate or pay friends.

- Comprehensive view of all transactions along with downloadable and printable payment receipts and invoices.

- Wide payment methods acceptance as digital currency, crypto, local currency transfers supported through automated currency conversion at optimized exchange rates.

- Setting usage limits and parental controls along with advanced security features like location-tracking and login approvals further enhancing user experience.

Estimated Cost to Develop an EWallet Apps Like PayPal

Building a customized E-wallet app like Google Pay entails developing intuitive user interfaces along with core backend functionalities and integrating advanced security protocols.

1. Basic Features App

- User registration/login

- Funding source addition

- Send/request/split payments

- View transaction history

- Wallet balance tracking

- Basic security

Cost estimate: $20,000-$40,000

Completion timeline: 3-5 months

2. Mid-Level Features App

- All basic features

- 2-3 additional funding options

- Split expense tracking

- Rewards/cashback programs

- Referral bonuses

- Multiple payment options

- Advanced security

Cost estimate: $60,000-$80,000

Completion timeline: 6-8 months

3. High-End Customized App

- All mid-level features

- Admin dashboard integration

- Loyalty programs

- Push notifications

- Location-based services

- Offline capabilities

- Custom payment integrations

- White-label option

Cost estimate: $100,000-$150,000

Completion timeline: 9-12 months

The cost and timeline for ‘apps like PayPal to send money and receive as well’ may further vary as per additional modules, complexities involved, targeted platforms, ongoing technical assistance and post-launch support. Team strengths and organizational expertise to contribute.

Core Features to Include in Apps Like PayPal

Cash advance apps like Cleo depend on key features to enable seamless payments and fund management between users. Let’s explore the essential components incorporated by leaders like PayPal in detail:

Account Registration and Sign In

The initial user onboarding experience holds great importance in a money transfer app. A user-friendly yet secure signup process helps new users establish accounts on such ‘apps like PayPal’ with ease.

Registration entails basic KYC elements collection like full name, date of birth, contact details for ID verification aligned to anti-fraud measures. Complex sign-ups frustrate users while exposing security loopholes if not properly implemented by expert mobile app development agencies.

Sign-in options provide prompt access with options like username-password, biometrics and third-party logins assuring better user experience for quick funds movement. Regular account activity validations via two-factor authentication enhances security as well. Best cash advance apps and brands focus intensely on registration streamlining user journeys for frictionless digital wallet set up.

Funding Sources

Once signed in, people seek adding multiple payment modes for instantly depositing money using their preferred channels. A seamless payment source addition interface saves users time and effort, boosting payments in optimal cashless modes.

For instance, PayPal users gain single click functionality to add debit/credit cards, net banking, UPI, digital wallets, e-receipts and gift cards all from within the app itself. Advanced integration of loyalty points transfer from other platforms further simplifies the process.

Customers value such money apps facilitating payment from any accepted funding mode without restrictions. The availability of localized, multiple transaction options plays a huge role in driving conversions for global ‘payment apps like PayPal’.

Making and Receiving Payments

Central to any e-wallet relevance is enabling easy peer-to-peer money transfers without glitches. Users stay loyal to wallets enabling instant, assured fund movement without additional charges – making such activity the primary engagement driver.

Applications should offer payment methods customized to unique regional transactional habits. For India, supporting UPI, Rupay Cards complements mainstream debit/credit card and net banking modes used globally. Frictionless QR based payments via taps, swipes or payment links further enhances merchant payment acceptance at physical locations across geographies.

Users seek wallet apps delivering prompt, confirmation email/SMS based payment receipts for transaction safety. Advanced features like ‘request cash’ and ‘cash to cash’ transfer capabilities assist convenient money pooling among groups as well. This strengthens stickiness, even among less tech-savvy users otherwise reluctant to transition to digital payments.

View Transaction History

Accountability represents a foremost customer need addressed by easy access to previous payments records. Detailed transaction history availability through intuitive user interfaces makes past order tracking simple for all user types across modes.

Tools enabling CSV file generation and download aids bookkeeping compliance for Tally and accounting software integration. Search filters aid pinpointing receipts by type, amount or date for reference as well. Default categories clarify spend purpose, while custom tagging retains related financial records together as users sees fit.

Overall, the value extended through features and proactively enriched utility determines user commitment levels to prominent wallet applications. Hence, design studios thoughtfully weave these components considering evolving technological enhancements to drive engagements with advanced ‘apps like PayPal’.

This covers some of the important foundational features underpinning leading digital wallets successful in meeting cross-industry payment objectives. Advanced programming skills blend innovation to these building blocks for catering evolving marketplace complexities proficiently. The outcome strengthens Fintech competitiveness by optimizing user experiences through customized Fintech app development serving diverse needs.

Optional Features

Additional features beyond core wallet functionalities can upgrade the overall user experience manifold. They augment apps like PayPal, driving enhanced engagement and monetization when thoughtfully implemented. A closer look at some optional modules:

Budgeting and Expense Tracking

Customized personal finance management benefits customers seeking organized spend visibility. Category-based expense breakdowns help track expendables, utilities, investments accurately through intuitive tagging on mobile app development platforms.

Users gain spending analytics through customizable pie-charts, line-graphs etc. Automated savings planning capabilities based on past trends aid setting and achieving money goals proficiently. Budget overrun alerts maintain financial discipline. Overall, such functionality develops greater accountability curbing unwarranted costs, facilitating increased discretionary incomes over time.

Various custom mobile app development agencies integrate budget insights contextualizing affordability for routine or lump-sum planned outflows. This eases financial decision making while cultivating improved money habits for long-term wealth creation. The utility inspires regular wallet usage, increasing user lifetime value often overlooked as an optional feature.

Split Bills

Social settings routinely demand splitting costs among payers, yet equally sharing bills remains an irksome chore. Wallet innovators solve this annoyance through smart splitting abilities in their customized mobile applications.

Features include automatic calculation of amount to be paid factoring expenditure details, number of sharers etc. Users gain one-click expense allocation options and payment request sending functionalities via integrated expense manager modules. The integration helps set customized sharing policies and schedules for recurrent spends like monthly rent, WiFi bills etc., ensuring seamless cost dispersal in peer networks.

Users find it a deeply convenient way to maintain financial equilibrium while socializing strain-free courtesy bill splitting built into their preferred payment interfaces. It further optimized user experience in unique experiential ways, strengthening loyalty that may become a USP for such advanced ‘apps like PayPal’.

Rewards Programs

Digital wallets commonly employ rewards points that accrue based on transaction volumes assisting users earn extra value. A loyalty program’s design however, greatly impacts its usage and popularity with different user traits. For instance, some wallets enable customers to redeem these points against future eligible payments or exchange them for partner offered merchandise like electronics, fashion and more to drive deeper engagements.

Tailored reward rules also appeal to customers – they may earn bonus on birthdays or achieve priority access to popular events through status tiers attained. Gamification further motivates participation and brand affinity with leaderboards for top earners or contests. An engaged, incentivized customer base encourages viral growth benefiting partner ecosystems. Advanced mobile app development can craft appropriate loyalty programs actualizing their true potential.

Loyalty Programs

Such programs nourish stronger bonds with recurrent customers and merchants, optimizing consumer lifetime value. Streamlined enrollment interfaces on in-app dashboards facilitate one-click merchant signups, expedite rewards issuance and tracking.

Centralized rewards management on merchant portals aids seamless redemption, boosting footfalls. Strategic partnerships across complementary verticals multiply loyalty program outreach through cross-promotions. Integrated customized functionality harnesses the flywheel effects of such loyalty programs far better than any one size fits all solution could, amplifying retention for payment apps going forward as well-established brands like PayPal already recognize.

Users gain personalized perks across multiple brands through a single consolidated wallet interface that makes membership uniquely rewarding. Merchants likewise explore higher engagement and first-party customer data access that bolsters offerings, accelerating ROI through cost-effective loyalty programs. Successful implementation demands nuanced planning with cross-industry experts however, considering industry specific complexities and regional traits. This holds the key to deriving optimized long-term outcomes.

Referral Programs

As network effects take root, expanding reach through incentive-based user acquisition strengthens popularity of digital wallet adoption. Simple, hassle-free sharing interface enable users to generate customisable referral codes or links to distribute freely via preferred networking routes.

In turn, wallet holders earn rewards equivalent to a certain percentage of referred contacts monetary spends through the app or on signups, creating an active peer-to-peer feedback loop. Accumulated credits get redeemed against bills, rewards store or exchange marketplaces over time in an enjoyable gamified format.

Customizable campaigns tailored to user profile attributes like locations or demographics boost targeting for higher ROI. Advanced analytical dashboards for administrators centralize program performance tracking, yielding actionable insights for ongoing improvements in customer engagement strategies given the competitive dynamics among ‘apps like PayPal’. All factors considered, introducing optional capabilities augment the core offerings comprehensively when incorporated judiciously.

So, supplementary features described deliver compelling value adds beyond core digital wallet functionalities when fused astutely based on user traits and market tendencies. Advanced mobile application testing procedures ensure seamless integration while load, security and third-party compatibility testing guarantee performance excellence across platforms. Overall, it strengthens a digital wallet proposition providing greater flexibility, control and rewards to spending, spending and saving habits of users through feature-rich, versatile applications. This undoubtedly uplifts chances of user loyalty and retention over competing fintech solutions.

Things To keep In Mind While Investing in EWallet App

With the rapid growth of the fintech and digital payments industry worldwide, eWallet apps are gaining tremendous popularity. This creates a huge market opportunity for aspiring entrepreneurs. However, successful eWallet app service requires comprehensive planning and expertise across various domains. This guide outlines crucial aspects to consider when investing in eWallet app projects.

Payment Processing

Seamless payment acceptance is core to any wallet app. Partnering with leading payment processors helps scale supported payment options.

Partnering with Payment Gateways

Integrating SDKs from trusted gateways like PayPal, Stripe boosts payment acceptance across countries while complying with their policies.

APIs for Different Payment Methods

Offering digital wallet services demands supporting diverse local and international cashless modes including net banking, UPI, cards and more through specialized APIs.

Compliance with PCI DSS Standards

Adhering to Payment Card Industry Data Security Standard benchmarks secures sensitive user financial data as mandated for payment handlers.

Security and User Authentication

Security is the topmost priority for any digital wallet app handling highly sensitive financial transactions, just like PayPal. Users need to trust that their credentials and money are safe before adopting an app like one built by custom app development services. Some of the core security features we recommend incorporating are:

Encrypted Data Storage

All user data including login credentials, payment records must be stored in an encrypted format using bank-grade encryption standards. As one of the top mobile app development companies in USA, we’ll make sure the backend database is not vulnerable even if breached. The custom app will encrypt every single data field for maximum protection.

Secure Login

Strong login authentication methods like two-factor authentication provide that extra layer of assurance users demand these days. The android app development agency or iOS app development companies will implement robust sign in screens involving password + OTP/email linkage to deter unauthorized access attempts.

Two-Factor Authentication

For a payments app, enforcing 2FA during high-risk actions like changing passwords, fund withdrawals are a basic security hygiene. We’ll enable app users to get transaction verification codes on their registered device/email to complete sensitive processes. This doubles down on user identity verification.

Privacy Policy Compliance

As an On Demand App Development Company, we recognize privacy as users’ top concern. Our payment wallet app will be designed fully adhering to privacy laws of key regions. The policy published will transparently disclose data usage in a manner that instils confidence. Users need to trust how their data moves and is used.

A well-secured wallet app backed by these features assures users of protection for their financial transactions just like with famous apps PayPal. Security is non-negotiable for a venture involving money transfers.

Integration with Other Platforms

Seamless integration with other popular online platforms has proven effective in amplifying any app’s reach and usability. Here are some of the prime integrations we recommend for wallet apps:

Social Login

Most mobile app development services in USA offer one-touch social logins nowadays. Enabling sign ups using familiar accounts like Google, Facebook can dramatically boost conversions. Users prefer such frictionless on-boarding processes.

Bank Connectivity

Partnering with banks opens doors to direct account linking for quick fund loads/withdrawals. Strategic tie-ups help verify credentials and inject credibility too. Our developers leverage APIs to enable such integrations.

eCommerce Checkouts

Integrating the wallet into online shopping carts enables it to be used at checkout, driving more transactions. Consumers are keen to pay using a single tap like with PayPal when shopping online.

CRM Syncing

Syncing user profiles and activity history to an in-house CRM optimizes post-purchase engagement. Using behavioural triggers, customized communications based on wallet usage is possible. This aids retention.

By thoughtfully integrating with dominant online platforms, any app built by our custom mobile app development company can achieve an exponential boost in reach from day one. These partnerships fuel the network effects critical for payments services. A well-integrated wallet app enjoys strong virality.

Testing and Quality Assurance

Exhaustive testing detects flaws to deliver polished, scalable solutions.

Unit Testing

Code module testing spots issues at developer level before further development.

Integration Testing

Testing module interactions identifies interface/performance issues early-on.

Security Testing

Penetration/vulnerability testing identifies application weak points for reinforcement.

Third Party Dependency Testing

Ensures seamless functioning of external integrations with version upgrades.

Maintenance and Support

Post-launch support establishes enduring user trust and retention.

Software Updates

Periodic upgrades integrating latest technologies/features sustains competitiveness.

24/7 Customer Support

Multi-channel quick assistance handles user queries/problems immediately.

Payment Updates

Seamless integration of emerging digital payment preferences extends preferred modes.

Security Updates

Applying the latest patches for discovered vulnerabilities safeguards backend infrastructure.

Marketing and Business Model

Clearly defined commercialization strategy scales ROI on investment.

Pricing Plans and Models

Competitive subscription or freemium monetization based on key product metrics.

User Acquisition Strategy

Targeted campaigns across optimum digital networks drive installation rates.

Partnerships and Affiliations

Business tie-ups with complementary verticals multiplies reach and user base.

Promotion Strategy

Consistent promotion through blogs, vlogs, events and referral programs boosts visibility.

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your App Journey Today!

Final Thoughts

Building an eWallet app is a capital and resource intensive endeavour given the sensitive financial data it handles. Careful planning, development with robust security architecture and long-term support is key for success. With the digital payments market still having significant headroom to grow, well-executed eWallet apps have scope to gain steady user base and merchant acceptance over time to achieve scale and monetization. If you are looking for a top iOS and android app development agency to help you with the same, then you can trust the experts at A3Logics. You get all the assistance you need without any kind of hassle. Good luck!

FAQs

Q1. Which type of app is in highest demand – basic, mid-level or high-end eWallet feature-rich apps?

Ans. Mid-level digital wallet apps with 8-10 features offering moderate functionality are seeing higher demand as this strikes a good price-value balance for users and delivers the core desired capabilities.

Q2. What programming languages are commonly used for eWallet app?

Ans. Popular programming languages used include Java, Kotlin, Swift and Objective C for native iOS and Android apps. RESTful APIs, PHP and Node.js also power web and hybrid app versions. React Native, Flutter and Xamarin enable cross-platform app development.

Q3. What is the average development timeline expected for each type of app?

Ans. Basic apps with 5-7 features can be built within 3-5 months averagely. Mid-level variations require 6-8 months typically. Custom high-end wallet apps involving additional modules generally need 9-12 months for proficient development on average.

Q4. What backend database and payment gateway integrations are essential?

Ans. Core relational database integration like MySQL is needed. Additionally, payment gateway SDKs from PayPal, Stripe, Braintree, Razor pay etc enable multiple payment acceptance optimizing monetization.

Q5. How much does it cost typically to maintain such an app post-launch?

Ans. Annual app maintenance budget ranges from 15-25% of the total eWallet app cost depending on the nature of enhancements, support level and other value-added services required after launch.

Q6. Why does one need an eWallet App?

Ans. An eWallet or digital wallet app refers to a mobile application that allows users to store and manage payment information for various online transactions. Using an eWallet app, one can link their bank accounts, debit/credit cards to make contactless payments for purchasing goods and services. EWallet serves as an alternative to cash while offering added benefits like receipt storage, funds management, loyalty programs etc.