Table of Contents

The rapid growth of the popularity of e-Wallet app is a sign of a significant change towards cashless transactions within the constantly evolving technological world of finance. Electronic wallet programs, also known as eWallets have grown into vital devices that are revolutionizing how we conduct the financial world as mobile phones are becoming more integrated into our everyday lives. In this look at the eWallets’ frontier, we will break down the fundamental factors that make an app from a useful tool into a truly amazing user experience.

e-Wallet App Like Google Pay is a pleasure to use, can be used with ease and provides a way to navigate the complexity of digital transactions without difficulty. The demand for cashless solutions that are non-platform neutral has made interoperability between platforms crucial instead of an option. Making sure that users have a great experience begins by completing the onboarding and registration process, which is a blend of simplicity and security with cutting-edge technologies like biometric authentication as well as social logins to social media.

As the fintech app development services continue to evolve at a rapid pace, e-wallet app firms are realizing the importance of building feature-rich products to attract more users and drive adoption. This article aims to discuss some of the essential features an e-wallet app must have in order to become truly popular among its target audience.

eWallet: Things You Must Know About It

Due to the rapid growth of online and digital transactions, electronic wallets have become an integral part of our lives. However, how much do you have to know about this electronic wallet? Here are a few points to be aware of in regards to electronic wallets as per mobile application consulting services experts.

An eWallet is the digital form of wallet that lets users conduct financial transactions and make payments online. Similar to a physical wallet that can store cash and credit cards, an eWallet holds payment details as well as bank account information and balances that is used for online shopping or transfer funds, pay bills and more with one tap on your phone.

Some of the major participants in the eWallet market comprise or including the developed apps like PayPal, Google Pay, PhonePe, Amazon Pay and many more. The eWallets are designed by the most reputable mobile app development firms using the latest technologies, including APIs, blockchains, and blockchains. They are very secure.

Some key things to know about eWallets include:

Security measures like OTP authentication, encryption, user verification ensure safe and seamless transactions.

Users can link multiple payment options to the eWallet like debit cards, net banking, UPI to enable easy transactions at merchants. This is handled using APIs for smooth integrations.

In addition to funds transfer, eWallets offer other financial services too like bill payments, online shopping, booking travel/tickets, investments and more for an integrated experience.

Reward points and cashback incentives encourage users to use their eWallet more frequently through partnerships with banks and merchants established by ewallet app.

Customer support through multiple channels aids quick issue resolution for a superior user experience. Live agents are available for urgent queries.

Analytics provide actionable insights into spending patterns to devise engagement strategies and optimize services.

Stringent KYC processes ensure only verified individuals open eWallets as per regulatory guidelines followed by experts.

This provides an overview of key eWallet features. Investing in a well-crafted solution designed by experts can drive greater financial inclusion.

Don’t Miss Out on the Must-have Features for a Successful e-Wallet App

Market Trends And Stats For eWallet App

The global digital payments industry has been witnessing significant rise with growing internet and smartphone adoption worldwide. eWallets have emerged as one of the most popular payment instruments riding this digital wave. Here are some key industry trends and stats as per the top custom mobile application development company:

- Reports by top market research firms estimate the global digital wallet market size to reach $8.8 trillion by 2025 growing at a 22% CAGR.

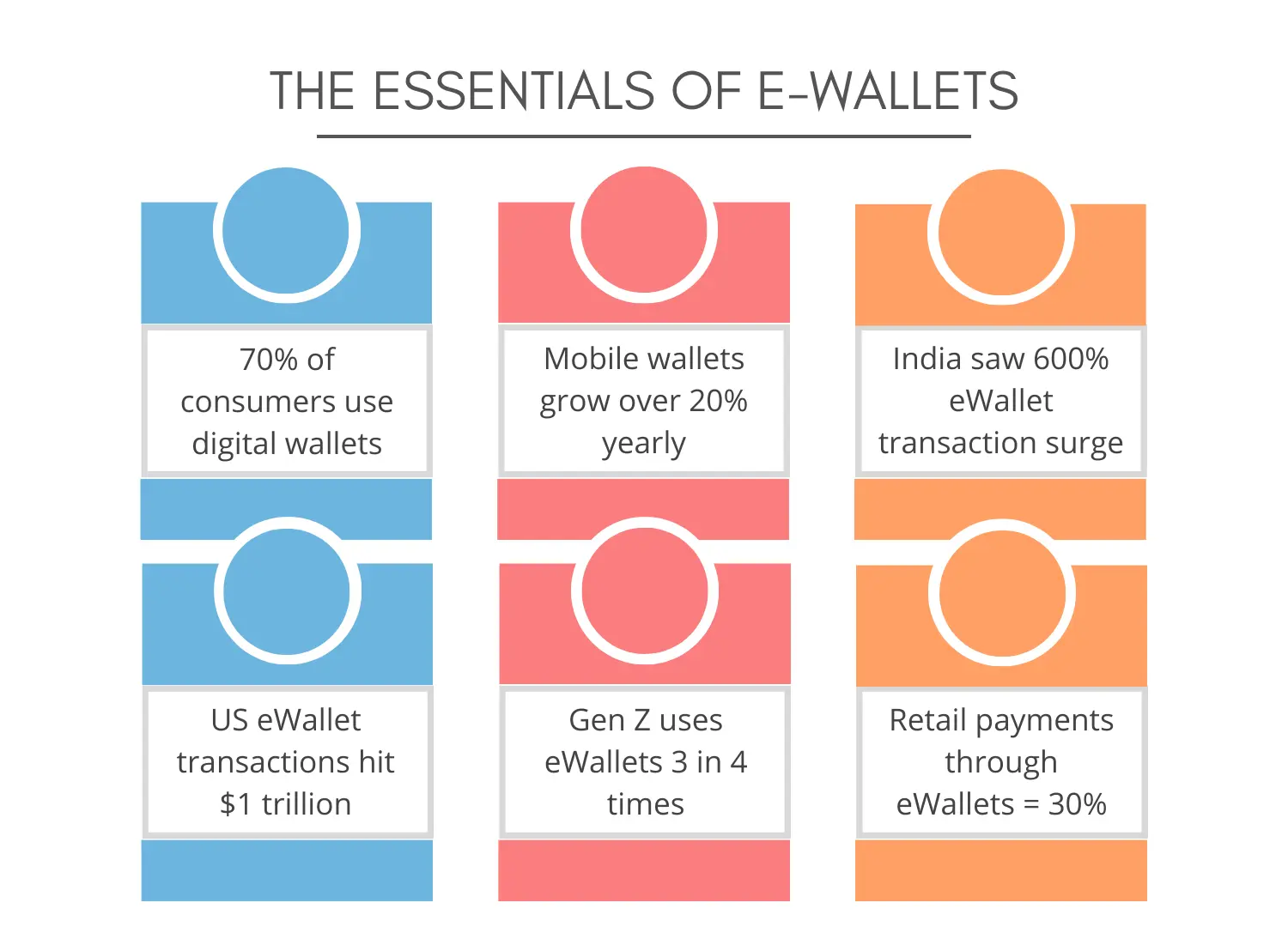

- As per data, over 70% of consumers now use some form of digital wallet for payments compared to just 30% a few years ago reflecting increased acceptance.

- Mobile wallets specifically are growing faster than any other payment type at over 20% yearly. By 2023, mobile payments are projected to account for more than half of the $6 trillion digital payments market share.

- Developing nations are a major growth driver. India saw a 600% eWallet transaction surge last year led by UPI due to promoted usage by the government and apps developed by leading firms.

- In the US, eWallet usage grew by 105% in 2021 with total transactions crossing $1 trillion. Over 50% of the population now actively uses digital wallets.

- Younger demographics, especially Gen Z have embraced eWallets the most with 3 in 4 individuals using them regularly for convenience and incentives.

- Online retail spending through eWallets has grown three-fold globally over the past decade and now makes for over 30% of total retail payments.

- Newer technologies such as blockchain, AI and custom mobile app development are vastly improving service standards and security.

These insights highlight the upward trajectory of eWallets and untapped market potential that top mobile app development companies in USA can capitalize on by building cutting-edge, localized solutions.

Why You Must Invest In eWallet App?

With digital becoming the primary medium of transactions, investing in an eWallet has become a necessity rather than choice for both individuals and businesses. Here are some compelling reasons to leverage best ewallet app:

- Tapping into the multi-billion dollar digital payments industry that is witnessing exponential 22% yearly growth driven by global megatrends.

- Gaining first-mover advantage and capturing target audience that is increasingly adopting eWallets for daily monetary requirements over cash.

- Providing a unified efficiency, transparency, and security of digital over cash.

- Integrating seamless payment capabilities can turbocharge overall commerce operations by facilitating easy checkouts, recurring billing, international transactions and more.

- Building loyalty and engagement through a robust loyalty program integrated with partner platforms. Users get incentives to retain regular usage.

- Enabling new revenue streams through value-added financial services like wealth management, insurance, peer transfer, bill payments, utility top-ups etc.

- Analytics provide comprehensive insights into customers, spending patterns, opportunities areas for well-informed marketing campaigns.

- Speed to market and ongoing product iterations are smoother with on-demand product development teams of experienced custom mobile app development companies.

- Attribution of marketing campaigns is clearer for optimization through a dedicated mobile point-of-presence.

- Staying ahead of regulatory changes is easier by partnering with firms abreast with complex nuances across global jurisdictions.

- Cost savings vis-à-vis in-house dev process; experts deliver quality solutions rapidly within estimated budgets for tangible ROIs.

Investing in a well-designed, feature-rich eWallet delivers immense benefits across business growth, customer experience, and market dominance. Partnering with a reputed enterprise app development company can make the difference.

Essential Features For Your eWallet App

Below we discuss all the aspects of essential features that you must have in your custom mobile app development services. Take a look:

Security Features

Security is of utmost importance for any financial app handling users’ funds and sensitive data. An e-wallet blockchain app development company needs to integrate robust security measures across all aspects to gain users’ trust.

Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security on top of standard username-password login for e-wallet apps. It requires users to confirm their identity using a second factor in addition to their login credentials. Common second factors include One-Time Passwords (OTPs) sent via SMS, authentication apps, or security keys/fobs. 2FA makes account access much safer even if passwords get compromised. All popular e-wallet apps like Paytm, Google Pay, etc. support 2FA for added protection of users’ funds.

Secure Transactions with Encryption

Encryption ensures complete safety and privacy of financial transactions performed on an e-wallet app. Sensitive data like account numbers, balances, transaction details, etc. must be encrypted using robust algorithms during transmission and storage. The app should also support end-to-end encryption for peer-to-peer money transfers between accounts. Leading blockchain development companies generally implement MITM (Man in the Middle) attack prevention, AES-256 encryption, and other robust mechanisms.

User Authentication and Authorization

Proper user authentication and authorization protocols are equally important for security. Only verified users must be allowed to log in and access key features. The company needs to integrate biometrics, knowledge-based verification and IP blocking for sign up and login, along with role-based access control for user authorization. Profile and device management features also help securely handle SIM swaps and lost device scenarios.

User-friendly Interface

A seamless and intuitive user experience is critical for e-wallet app adoption and retention. The app interface should be easy and logical.

Simple and Intuitive Design

The interface of an e-wallet app must follow universally accepted design guidelines and patterns for financial services. It should be uncomplicated with an obvious call-to-action and navigation. Large fonts, plenty of white space, and minimal distracting elements make operations fluid on various devices. Customizable fonts and themes also appeal to different users. Experienced fintech app development companies A/B test designs rigorously.

Customizable User Settings

Allowing users control over the app experience boosts engagement. They must be able to modify settings related to notifications, security PINs, preferred debit/credit cards, currency formats, etc. Dark mode compatibility improves usability too. The settings screen is also ideal for support options and account details.

Easy Navigation

A flawless navigation structure is paramount for user retention. The dashboard, menu, sub-menus, and action pages should be logically organized for quick access. Features like searchability, collapsible menus, and home button make complex operations intuitive. Enhanced navigation speeds, and the user experience improves engagement.

Payment Options

Integrating multiple payment gateways and options significantly widens an e-wallet app’s appeal and use cases. It allows consumers to pay and get paid flexibly as per iOS app development companies.

Integration with Multiple Payment Gateways

Popular online and offline payment methods boost transactional volumes. Leading App Development companies integrate top gateways like PayPal, Stripe, Razorpay, Instamojo, Paytm, UPI, and so on, covering majority population segments. Advanced APIs help add new providers seamlessly.

Support for Different Currencies

As cross-border payments grow, supporting international currencies bolsters global appeal. Apps integrate real-time currency conversion and notifications about exchange rates. Features like multi-currency wallets enable users to receive and send funds worldwide quickly and securely.

Option to Add Multiple Payment Methods

Allowing users to add debit/credit cards and net banking details gives them flexibility. Saving preferred payment options within profile expedites online/offline checkout from any merchant. Partnerships with banks facilitate linking accounts instantly as well. Users appreciate cashless deposits and withdrawals at ATMs/retailers too.

Looking to Develop Your e-Wallet App?

Loyalty and Rewards Program

Giving rewards and incentives in Fintech software ROI solutions, motivates users to stick with the app for longer and engage more actively. It also adds a fun element.

Incentives for Frequent Use

Earning loyalty points and cashbacks proportionate to transactions and spending frequency through the app sets healthy engagement benchmarks. Features like leaderboards for top users drive competition amongst customers in a fun way.

Points System for Purchases

Accumulating loyalty points on shopping at partner merchants fuels spend volumes. Users redeem the points for bill payments, money transfers, shopping discounts, gifts, and more to maximize their wallet’s utility.

Integration with Partner Brands and Businesses

Building a wide-reaching merchant ecosystem to facilitate rewards earning strengthens the value proposition. Advanced APIs enable seamless syncing of loyalty programs for customers’ convenience. Partner programs boost app growth via user referrals too according to Android app development companies.

Integration with Other Apps and Services

For one-stop financial needs, e-wallet apps must integrate popular third-party services. Pre-built connectors expedite such collaborations.

Integration with Banking Apps

Syncing bank accounts within the app profile streamlines funding and withdrawals. Users can instantly load e-wallets using net banking facilities and transfer balances between wallets-accounts. Banks leverage such partnerships to improve services digitally as well.

Integration with Social Media Platforms

Social payments via the app gain more acceptance and coverage. Users send/request money from contacts across major networks like Facebook, WhatsApp, Instagram, etc. It boosts peer-to-peer transactions amongst users in an enjoyable way.

Option to Pay Utility Bills through the eWallet App

Paying multiple household bills for electricity, gas, DTH, mobile, landline, etc. from within the app using a unified interface brings unparalleled convenience. Advanced APIs aid rapid integration of multiple billers and recurring payment automations.

Customer Support

Top-notch customer assistance is mandatory to overcome any technical issues or queries smoothly.

24/7 Support through Live Chat or Call

Multi-channel engagement and instant responses build trust and prevent unnecessary customer churn. Using AI and bots, advanced queries still land with an executive rapidly. Live tracking delivers transparency into resolution timelines.

Option to Raise and Track Support Tickets

Well-structured ticketing systems maintain issue logs transparently. Users appreciate order tracking, notification updates, and escalation management. Self-service features aid resolution in the background as well.

Knowledge Base and FAQs for Quick Resolution

A comprehensive help center should be accessible for common guidelines, answers, troubleshooting steps, and product/KYC documentation. Updating knowledge articles periodically avoids repetitive communications. Expert responses provide swift clarity through multiple mediums.

User-friendly Registration

Streamlined sign up processes encourage higher first-time adoption and retention rates according to cross platform app development services experts.

Seamless Integration

Pre-filled KYC forms leveraging linked profiles on social platforms/banks accelerate registration. Users appreciate personalized experiences despite the speed. Consents and document uploads become simple procedures.

Automated Verification

Documents undergo sophisticated verification via face recognition, e-signatures, OTP match, reference checks etc. Users feel validated instantly without tedious monitoring. Pre-signup mobile and email verifications imply a secure onboarding.

User-Friendly Design

Forms with minimal fields presented in a self-explanatory manner aid quick sign ups. Descriptive label tags, logical placeholders and tones of voice guide users aptly even without reading all text.

Analytical Dashboards

Real-time business and user insights enable fact-based optimizations.

Personalized Dashboards

Role-specific customized widgets, shortcuts and filters empower users per their objectives. Aggregated views simplify tracking key areas at a glance.

Real-Time Analytics

Powerful analytics engines inform hyper-specific performance levers. Filters isolate trends, drilling down to each customer cohort, location, device and more.

Customizable Reports

Tailoring reports as per changing needs improves decision making. Teams export customizable reports at ease in standard formats like Excel, CSV, PDF etc. Scheduling recurring snapshots aids ongoing evaluations too.

E-wallet developers should design user-friendly admin dashboards that prioritize key metrics, ensuring swift identification of anomalies through real-time notifications.

Frictionless Self-Registration

One of the main advantages in an eWallet app is its self-registration feature. It should be easy, swift, quick, and easy to allow users to quickly and easily sign-up to the application. This is possible through the implementation of these sub-features.

Seamless Integration

The first step to creating an effortless self-registration procedure is to integrate the app into prominent social media platforms like Facebook, Google, and LinkedIn. It allows users to sign up to the app with their existing social media logins. This eases the process for users and accelerates the sign-up process.

Automated Verification

Another option to make self-registration easier within this process of developing the NFT Marketplace method is to establish an automatic verification procedure. Once a user is signed up, the application will instantly verify their data and verify their identity. This can reduce the amount of manual work needed and makes sure that signing up is simple and quick.

User-Friendly Design

The self-registration process must be developed with the user’s needs in mind. It should be simple to comprehend and navigate with clear directions and simple language. The process must also be optimized for mobile and desktop devices, so that users can sign up any time.

Analytical Dashboards

Another crucial aspect of an eWallet app is a collection of dashboards with analytic capabilities that provide users with a comprehensive view of how they spend their money as well as their financial situation. This is possible by implementing the sub-features listed below as specified by Outsource App Development experts.

Personalized Dashboards

The first step to create an efficient analytical dashboard to aid in the cryptocurrency wallet application development process is to personalize the dashboards for each user. The dashboards need to be tailored to the individual’s financial situation and spending habits as well as objectives. It allows users to view their financial data in a way that’s relevant and relevant for their needs.

Real-Time Analytics

To provide users with a complete and current overview of their financial position the dashboards should offer live analytics. The dashboards must be updated on a regular basis whenever users make purchases or alter their financial situation. This allows users to keep track of their financial situation and make educated choices.

Customizable Reports

The dashboards for analytical analysis can be customized and allow users to select what information to display and how it’s presented. This lets users focus on the most crucial information and makes the dashboards as useful and valuable as they can be.

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your App Journey Today!

Final Thoughts

The most essential elements needed for an eWallet or blockchain development services to succeed include user-friendly interfaces with secure transactions, various payment options reward and incentive programs, budget tracking, reminders for bills as well as sharing and dividing expenses. With these attributes with an eye on the future, an app for eWallet is a great device for those who need to control their financial affairs.

Regarding Innovations in mobile app development and how eWallet technology will evolve in the coming years, apps technological advancements, the technology is predicted to evolve with the advancements in blockchain technology and artificial intelligence. As people become more conscious of the security and convenience of eWallets, demands for these services will rise.

In general, eWallet apps are changing how we manage our money and provide a platform that’s easy to use, secure and accessible. The main features discussed in this blog offer an outline for developers who want to develop an eWallet app that’s both popular and a success. If you are looking to hire mobile app developers for ewallet apps, then you can knock on the doors of A3Logics now!

Frequently Asked Questions (FAQs)

What is an e-wallet? How does it function?

The e-wallet service provider processes the transaction, and money is transferred into the retailer. E-wallets are created to offer an easy as well as secure substitute for traditional methods of payment and are typically connected to mobile devices for convenient use while on the move.

Is eWallet connected to the bank account?

An e-Wallet is linked to the bank account of the user through net banking, credit card, and debit card. Connecting a bank account with an eWallet gives users an easy and secure method of managing finances.

How do I transfer money via E-Wallet?

To access the digital wallet, the user must open the wallet app by using fingerprint recognition, facial recognition or a PIN code before selecting the payment method stored in their wallet that they would like to make use of.

Does eWallet offer mobile banking?

Yes, an eWallet application can be considered an example or mobile bank. It is a convenient and easy option to conventional banking.

How do I withdraw funds from an electronic wallet?

- Log into your E-Wallet.

- Click My Account > Bank Accounts.

- Click “Add New Account”

- Follow the instructions and complete the information for your bank account.

- There will be two tiny deposits that need to be confirmed by you, confirming the bank account you have legitimate.