Forex trading, or foreign exchange trading, is the global market for purchasing and selling currencies. It serves as the cornerstone of global trade and investment and makes currency conversion between multiple countries easier.

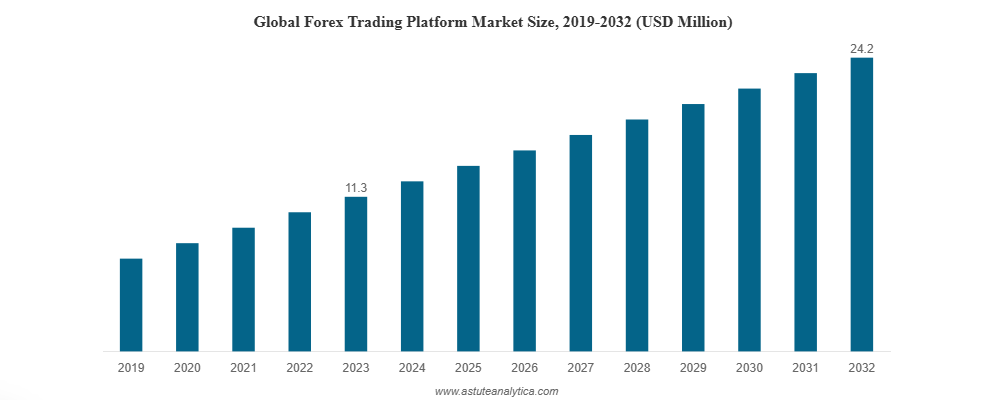

Technology has fundamentally transformed Forex trading in today’s interconnected world, making it a dynamic and highly efficient market. The significance of technology in today’s Forex trading cannot be overstated. The global forex trading platform market was valued at $11.3 billion in 2023 and is projected to surpass the valuation of $24.2 billion by 2032 at a CAGR of 8.86% during the forecasted period. It has simplified processes, providing traders with powerful tools for execution and analysis.

Table of Contents

What are Forex Trading Apps?

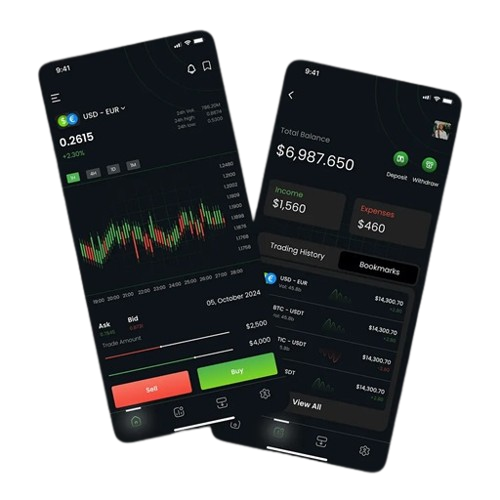

A forex trading app makes buying and selling foreign currencies easier on the international foreign exchange (Forex) market. These applications give traders instant access to news, charts, exchange rates, and analytical tools, enabling them to make well-informed decisions about when and how to trade currencies.

Because of its accessibility, ease of use, and capacity to execute transactions while on the road, forex trading applications are well-liked by both new and seasoned traders. They are a vital tool for anyone working in the Forex market since they frequently provide a variety of features like technical indicators, live market data, and the option to place and handle trades straight from a mobile device.

Why Invest in Forex Trading App Development – Key Statistics & Facts

Forex trading app development services investment is a promising venture fueled by the foreign exchange market’s large-scale growth and changing dynamics. The following are some major statistics and facts highlighting the prospects of this industry. The foreign exchange market is the biggest financial market worldwide. Almost $5.3 trillion dollars are traded every day in the forex market. Forex trading provides a host of trading instruments. The global forex trading market is worth $1.93 quadrillion.

Geopolitical tensions have increased currency market volatility, offering more trading opportunities. For example, in February 2025, CME Group announced a record month for currency futures and options trading with an average daily open interest of 3.25 million contracts, representing a notional value of $297 billion.

The growth of online platforms has opened Forex trading to a larger population. The spread of Forex trading apps has enabled individual investors to trade, leading to market expansion.

Financial institutions have witnessed handsome profits from Forex trading. Profit from trading G10 currencies is expected to rise by 7.3% in 2025, higher than profits from stock and bond trading.

With increasing global trade and investment activities, there is a greater need for currency exchange services, further strengthening the Forex market. This integration highlights the necessity of effective and easy-to-use trading platforms.

Top Forex Trading mobile app to inspire you to build one

Forex trading applications that we have mentioned below are prime examples of the incorporation of solid features, intuitive interfaces, and sophisticated trading tools, making them viable points of reference for the creation of a competitive Forex trading application development.

1. MetaTrader 4 (MT4)

MetaTrader 4, created by MetaQuotes Software, is a popular electronic trading platform for retail foreign exchange traders. Launched in 2005, it provides a client-server architecture, with the server portion controlled by brokers and the client application distributed to traders. The platform is available for Windows applications and has mobile applications for Android and iOS, enabling users to view live streaming prices, interactive charts, and control their accounts on the move.

2. MetaTrader 5 (MT5)

Being the upgrade of MT4, MetaTrader 5 has more features, such as additional timeframes, order types, and an in-built economic calendar. It accommodates trading in different financial markets, such as Forex, stocks, and commodities, with a full trading experience.

3. cTrader

cTrader has a user-friendly interface and sophisticated charting features. It has Level II prices, rapid order execution, and multiple order types, making it suitable for beginners and professionals alike. cTrader also provides support for algorithmic trading via cAlgo, enabling the creation of custom indicators and bots.

4. ThinkTrader

Previously called Trade Interceptor, ThinkTrader offers advanced trading tools such as 14 chart types, 160 intelligence indicators, and cloud-based notifications. It also has split-screen and quad-screen modes on tablets, allowing traders to track more than one market at a time.

5. OANDA fxTrade

OANDA’s mobile application features an intuitive user interface with enhanced charting capabilities, real-time information, and economic analysis. It has access to a broad variety of currency pairs and is fully compatible with OANDA’s web and desktop applications, offering a unified trading experience across platforms.

Key Features to Include In Forex Trading Apps Development

While every forex trading platform and app seeks to satisfy specific market niches, the most reliable forex trading app development services share the following characteristics.

User Profile

Keeping supplementary information in the user profile can be beneficial to users. A user profile may contain history, subscription plan data, personal and professional information, and more.

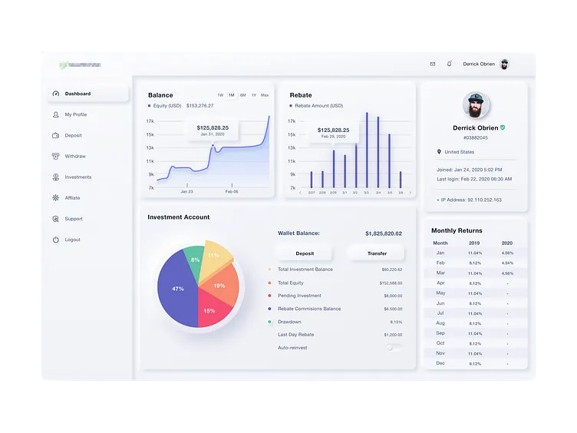

Role Based Dashboard

Viewing their investments, growth status, and navigation links to various areas of the app in one convenient location is preferred by users. This can be effectively accomplished with a well-designed control panel.

Forex Trading Tools

With a range of tools that enable traders to purchase and sell rapidly, you can encourage your users to be active in their trading activity.

Advanced Monitoring and Analytics

You can find the best currencies to purchase or sell that day with the aid of sophisticated analysis and tracking features in currency trading app development. To assist you in selecting too-short coins, you can alternatively choose an app.

Software-powered trade notifications, historical data, and setting alerts for currencies when they hit a specific price guarantee you’re making the proper choices. Investors never guess how they will spend their hard-earned cash.

Bank Account Connection

The most crucial step is to safely link your app to the user’s bank account. To carry out direct bank integration, there are technologies like an API.

Safe & Secure Transaction

We ensure that currency exchange software can handle and trace transactions with the use of advanced security measures.

Seamless Real-Time Updates

A currency’s value might fluctuate quickly, so you’ll need current value information as soon as possible to make the best trade feasible.

Before committing to the platform, be sure your preferred forex trading software can offer the streaming and trading speed you require to finish your forex trades by making a few short test trades.

Asset Deposit

Permit customers to deposit their assets at any time, maintaining the system’s connection to the business’s liquidity flow.

Easy Withdrawal

Give users easy access to all pertinent features so they can withdraw their assets quickly and securely whenever they choose.

Resources to Educate Users

Knowledge is power in a market that is always evolving. The top forex trading apps include information on the most recent global news and editorials in addition to the technical aspects of trading.

According to a company that offers mobile app development services, it teaches traders more about how to forecast which currencies will see price increases and decreases.

Functional for Beginners And Experts

Select forex trading app development services that work well for both novices and pros. Using the appropriate app guarantees that you are aware of what is happening while you trade, even if you are completely new to the forex market and don’t know where to begin.

It is more beneficial to use an app that guides you from the beginning of your journey than one that aims to blind you with technical terms and perplexing visuals. An app that is customer-focused is what you want if you are an advanced investor, thus it should work for both novice and seasoned traders.

Access a Wide Range of Assets

Because the forex trading software should provide a large selection of tradable assets, users should be able to participate in CFD, cryptocurrency, and FX trading.

Multi-lingual Support

Since a forex trading app will be used by people worldwide, it should support a variety of languages. The software will be used by traders worldwide in a variety of languages, including German, Chinese, and English.

Profit Calculator

To develop a forex trading app, a user must be able to track prices and confirm and compute the profitability of particular assets.

Economic Calender

An economic calendar, a component of fundamental analysis that displays significant world events that may have an impact on financial markets, is included in practically all online trading platforms.

Traders have the option to choose a timeframe, currency, time zone, and event importance. Additionally, when customers click on an event, they may view its specifics, such as the volatility ratio of a particular pair, the event’s history, or how it affected the market.

Advanced Features to Consider for Forex Trading Apps Development

Here are some advanced features to consider when you develop a Forex trading app. These features can significantly enhance user engagement and make your Forex trading app more competitive in the market.

- AI-Powered Trading Bots – Automate trade execution based on market trends and user-defined strategies.

- Predictive Analytics & Market Forecasting – Use AI and machine learning to provide data-driven insights and forecasts.

- Real-Time Price Alerts & Notifications – Enable instant alerts for currency pair fluctuations and trading signals.

- Multi-Account Management – Allow traders to manage multiple accounts from a single dashboard.

- Copy Trading & Social Trading – Let users replicate the trades of successful traders.

- Risk Management Tools – Implement stop-loss, take-profit, and margin call alerts for better risk control.

- Two-Factor Authentication (2FA) & Biometric Login – Enhance security with robust authentication methods.

- Automated Withdrawals & Deposits – Provide seamless fund transfers with multiple payment gateway options.

- Customizable Trading Dashboard – Offer a personalized interface with adjustable widgets and charts.

- Integration with Economic Calendars – Keep traders informed about global financial events and news.

- Multi-Language & Multi-Currency Support – Expand accessibility with support for diverse users.

- Blockchain-Based Security – Enhance transparency and security using blockchain technology.

- API Integration for Third-Party Tools – Connect with external trading tools, indicators, and analytics platforms.

- Dark Mode & UI Customization – Improve user experience with customizable themes and layouts.

- Live Streaming of Financial News – Keep traders updated with real-time market developments.

AI-enabled forex trading app development for a fantastic user experience

1. Predictive Analytics

Predictive analytics using AI examines past data and market trends to predict currency fluctuations. The functionality enables traders to make informed decisions and minimize risks.

2. AI Chatbots

AI chatbots provide 24/7 customer service, answering user questions instantly, processing trades, and making recommendations based on trading habits.

3. Tracking User Behavior

AI monitors user behavior and changes the app’s interface based on this, providing personalized notifications, alerts, and educational material to boost the trading experience.

4. Personalized Trading Strategies

AI-driven recommendation engines can create custom trading strategies based on a user’s risk tolerance, trading history, and market preferences.

5. Real-Time Risk Management & Alerts

AI monitors market volatility and trading patterns to provide instant risk assessments and alerts, helping traders minimize potential losses.

6. Predictive Analytics for Portfolio Optimization

AI evaluates multiple assets and market conditions to optimize a trader’s portfolio, balancing risk and maximizing potential returns.

7. Smart Trade Execution & Order Management

AI-driven trade execution optimizes order placement, reducing slippage and ensuring the best possible pricing for trades.

8. Voice & Chatbot Trading Assistance

AI-powered chatbots and voice assistants provide hands-free trading support, market updates, and instant trade execution through voice commands.

How to Monetize Your Forex Trading Mobile App?

Let’s take a look at some of the ways through which you can monetize your mobile forex trading app.

1. Freemium

The freemium concept is prevalent in forex trading app development. The basic software is free, but additional functions are kept behind a paywall. The goal is to make the free version valuable enough to attract users and encourage them to upgrade for a better experience. Advanced analytics, real-time market data, individualized investment advice, and ad-free usage are premium features. By offering enough value in the free version to attract a big user base, the freemium model can convert a percentage of these people into paying customers.

2. Subscription

Subscriptions generate steady revenue. Many forex trading app development companies can add monthly or annual app subscriptions. Premium financial research, real-time stock alerts, and expert charting tools are available via subscription. Apps with recurring subscriptions have a stable revenue stream. Additionally, updated features and content can keep customers engaged and enrolled, improving retention.

3. In-app purchases

Your Forex trading app can also make money through in-app purchases. This method involves selling app features or content. Users may buy more stock market courses, stock reports, or technical analysis tools. This method lets users pay for only the things they need and improves the user experience by targeting enhancements.

4. Ads

Ad integration is a frequent forex trading app development monetization method. App advertising can earn money depending on impressions or clicks. How often adverts displayed should not interfere with users’ enjoyment of the platform or website. If done right, ads may generate revenue without harming user satisfaction. Banner, interstitial, and native ads can boost revenue and stay out of the way.

4. Commission-Based Model

Your Forex trading app can also make money based on commission. The commission-based model is one of stock trading apps’ most widely used monetization strategies. It involves charging users a fixed or percentage-based fee on every trade that is executed through your forex trading app.

5. Margin Trading & Interest Fees

The margin trading model enables users to trade using borrowed money, amplifying their buying power. Stock trading apps charge interest on the borrowed money, earning revenue. Interest rates can be differentiated by loan size, frequency of trading, or market conditions, making this a profitable monetization model for trading platforms.

Tools and Tech Stack for Forex trading app development

Tech stack plays an important role in the success of any Forex trading app development. As a leading Forex trading app development company, we leverage the following technologies.

| Component | Technology/Tools |

| Frontend Development | React Native, Flutter, Swift (iOS), Kotlin (Android) |

| Backend Development | Node.js, Django, Ruby on Rails, Express.js |

| Database | PostgreSQL, MySQL, MongoDB, Firebase |

| Cloud Hosting | AWS, Google Cloud, Microsoft Azure |

| AI & Machine Learning | TensorFlow, OpenAI, PyTorch, Scikit-learn |

| Security & Authentication | OAuth 2.0, Firebase Authentication, JWT, Biometric Security |

| Payment Gateway | Stripe, PayPal, Razorpay, Square, Braintree |

| Real-Time Data Processing | WebSockets, Kafka, RabbitMQ |

| Trading API Integration | Alpha Vantage, Forex.com API, OANDA, Interactive Brokers API |

| Analytics & Reporting | Google Analytics, Mixpanel, Tableau |

Required Compliances for Forex Trading App Development

When dealing with compliances, it is important to ensure that the customer data and financial details are secure. As a forex trading app development company, we consider the following compliances.

| Compliance | Description |

| KYC (Know Your Customer) | Ensures user identity verification to prevent fraud and financial crimes. |

| AML (Anti-Money Laundering) | Monitors transactions to detect and prevent money laundering activities. |

| GDPR (General Data Protection Regulation) | Ensures data privacy and protection for users in the EU by regulating personal data handling. |

| SEC (Securities and Exchange Commission) Regulations | Ensures compliance with securities trading laws in the U.S. |

| FINRA (Financial Industry Regulatory Authority) | Regulates brokerage firms and Forex platforms to ensure fair trading practices. |

| PCI-DSS (Payment Card Industry Data Security Standard) | Ensures secure payment processing and protects sensitive financial information. |

Cost of Forex Trading App Development and its Breakdown

The development cost of a Forex trading app depends on features, complexity, technology stack, and compliance needs. On average, a simple Forex trading app development service can cost more than $30,000. An advanced AI-based platform with real-time analytics, predictive trading, and compliance integrations can cost more than $100,000.

Major Cost Breakdown:

UI/UX Design ($5,000 – $15,000) – A clean and intuitive design improves user experience, with smooth navigation.

Frontend & Backend Development ($20,000 – $80,000) – Includes coding, API integration, and backend infrastructure for robust performance.

AI & Predictive Analytics ($15,000 – $40,000) – Sophisticated AI-driven tools for automated trading, risk analysis, and behavior monitoring.

Security & Compliance ($10,000 – $30,000) – Includes AML, KYC, GDPR, and SEC compliances to secure trading operations.

Payment & Wallet Integration ($10,000 – $25,000) – Allows secure transactions with PCI-DSS compliance.

Market Data Feeds & APIs ($5,000 – $15,000) – Implements live price charts, forex market data, and trading signals.

Testing & QA ($5,000 – $20,000) – Validates bug-free, secure, and optimized app performance for launch.

Deployment & Maintenance ($10,000 – $30,000 per year) – Includes hosting, updates, and customer support for long-term viability.

Pricing can vary depending on the developer’s experience, location, and extra features like social trading, AI-based chatbots, and multi-currency support. Contact A3Logics to get a carefully drafted budget and cost-cutting strategies that can minimize expenditure while maintaining high-quality Forex trading software.

Cost Optimization when developing forex trading apps

Here are some ways to optimize forex trading app development cost:

- MVP Development – Begin with a Minimum Viable Product (MVP) to experiment in the market first before incorporating cutting-edge features.

- Outsourcing Development – It is possible to cut costs significantly by hiring an offshore development team.

- Open-Source Tools & Frameworks – Leverage open-source libraries and frameworks in order to minimize costs.

- Cloud-Based Infrastructure – Employ scalable cloud infrastructure such as AWS or Google Cloud to control costs.

- AI Automation – Leverage AI-driven automation to lower operational costs and enhance productivity.

Step-by-step process of Forex trading app development

A step by step trading app development process is important to ensure uniformity across apps, here are the steps we follow:

Step 1: Platform Selection

A platform is backend software that integrates forex market data, user transactions, and other operations into your app. Our currency data API can be used to construct your app.

You must code logic for each platform you cover, such as iOS, Android, and others. Every update requires platform-specific code changes.

Step 2: Mobile-Friendly Design

When building a mobile app’s UX and UI, consider a mobile user’s perspective. Create sample architecture to synchronize user transactions, currency data, and application functionalities. Avoid giant screen views on online or desktop apps by adjusting tabs and features to fit the screen.

Step 3: Forex Trading App Development

To develop a forex trading app includes coding, programming, and forex trading knowledge. All the features from the previous segment must be included. Testing follows app development.

Step 4: Forex Trading App Testing

Financial technology embraces easy-to-use, bug-free trading apps to assist traders invest. Testing is essential while creating a forex trading app. Your forex trading platforms’ popularity and profitability depend on user experience and algorithmic concerns, therefore test your app. You should also stress test your app amid significant market volatility to see how many users you can manage without delays.

Testing trading techniques involves backtesting, future testing, evaluating success in a live forex trading environment via a demo account, and assuring accurate trade execution. algorithms in their applications.

Step 5: Deploy and Maintain

Building your greatest FX trading app should follow public or enterprise app store standards and rules. Follow Google Play Store and Apple software Store guidelines to load your software faster. This phase also involves connecting the application to the production server to get it up and running for users.

Debugging is one forex trading platform maintenance. You can add features and update the program for the latest OS. Good practice: separate production and testing environments. Test new features in the test environment without real money and release them to users after assuring functionality.

Challenges of Developing Forex Trading mobile application

Forex trading application development involves numerous complexities, which demand technical knowledge, compliance handling, and security features. Following are some major challenges:

1. Regulatory Compliance

Forex trading is subject to strict regulations, and each jurisdiction has various laws. Complying with SEC, FINRA, GDPR, KYC, AML, and other financial regulations is necessary to stay away from legal problems and penalties.

2. Real-Time Market Data Integration

Forex markets are open 24/7, necessitating smooth integration of live market feeds, price charts, and trading signals. Ultra-low latency to support real-time trade execution is paramount.

3. Security & Fraud Prevention

Since financial transactions are involved, the app should have multi-factor authentication, data encryption, and anti-fraud controls to secure user money and neutralize cyber threats.

4. Scalability & Performance

Processing high-frequency orders and large user volumes without crashes calls for secure cloud infrastructure and load balancing for app stability.

5. AI & Algorithmic Trading Deployment

Adding complexity by integrating predictive analytics, machine learning algorithms, and trading robots necessitates cutting-edge AI talent and extensive testing.

6. Payment & Withdrawal Processing

Making secure, swift, and compliant transactions along with integrating more than one payment gateway is risky because banking rules are different by location.

7. User Interface & Experience Design

A cluttered UI will make traders feel bewildered. The task is designing an easy-to-use dashboard, trading features, and live analytics without cluttering the interface.

8. Higher Development & Maintenance Costs

Making a Forex app with many features entails serious investment in development, infrastructure, security, and regular updates, so cost optimization becomes essential.

Conclusion

Thanks to technological advancements, the global business world is accessible from your hands. Trading is becoming more flexible and profitable for individuals who wish to engage in it.

In any case, people can operate their forex trading app or website, increasing trading efficiency. You only need a stock trading app development company to get the perfect software that satisfies all your needs. The apps’ creative features make dealing with all currencies simple.

They retain a high degree of usefulness while upholding security and dependability. There isn’t much difference between the features of computer and phone apps. Generally speaking, the complexity and breadth of the project—which, in your words, are dictated by the demands of your company—determine the cost of developing a Forex platform. Ready to develop a Forex trading app? Contact A3Logics, a leading mobile app development company, and get started!