Table of Contents

Trading stocks has become one of the most popular forms of investment worldwide. With the growth of smartphone usage and the advancement of technology, stock trading has moved from traditional desktop platforms to mobile apps. It is estimated that over 30 million Americans actively traded stocks through their mobile devices.

Fintech companies across the globe are inventing time and money to create a stock trading app to insure certain market share. Tech companies are bringing more and more innovations to build a stock trading app that revolutionize current payment system.

Some key stats:

- Over 80% of online brokerage trades globally now happen on mobile devices.

- The stock trading app market is thriving, with a combined user base of around 117 million people utilizing these platforms as of 2023

So, if you are thinking of investing in stock trading mobile app development, then we have all the answers for you covered below. Read on.

Stock Trading: How It Has Evolved

The Evolution of Stock Trading: A Visual History

- Desktop websites 2000s

- Early mobile apps 2010s

- 90% trades now on mobile

- 10 million Robinhood users

- 50% trading volume from apps

- 3x growth in millennial traders

Traditional stock trading involved researching companies, placing orders through brokers over phone.

The real transformation began in the 2000s with smartphones. Pioneering apps like TD Ameritrade Mobile and E*TRADE Mobile launched allowing basic functions like checking prices and portfolios on-the-go. However, full-fledged trading required connecting to broker websites.

In the 2010s, native apps with advanced features became mainstream. Apps by Robinhood, Webull etc. emerged providing intuitive interfaces for real-time quotes, news, charts, and most importantly, on-app trading. They streamlined the brokerage experience to be as simple as swiping and tapping.

Major brokers also revamped their mobile offerings. Features like push notifications, integrated watchlists, easy deposits/withdrawals through various payment methods attracted many users. Geolocation tools enabled accessing account details anywhere seamlessly.

Today, brokerages are focusing on personalization, social features, analytical tools and faster order execution on apps. Advanced charts, scanning capabilities, paper trading and even cryptocurrency trading are now common on top apps. This made mobile the primary platform for most retail investors.

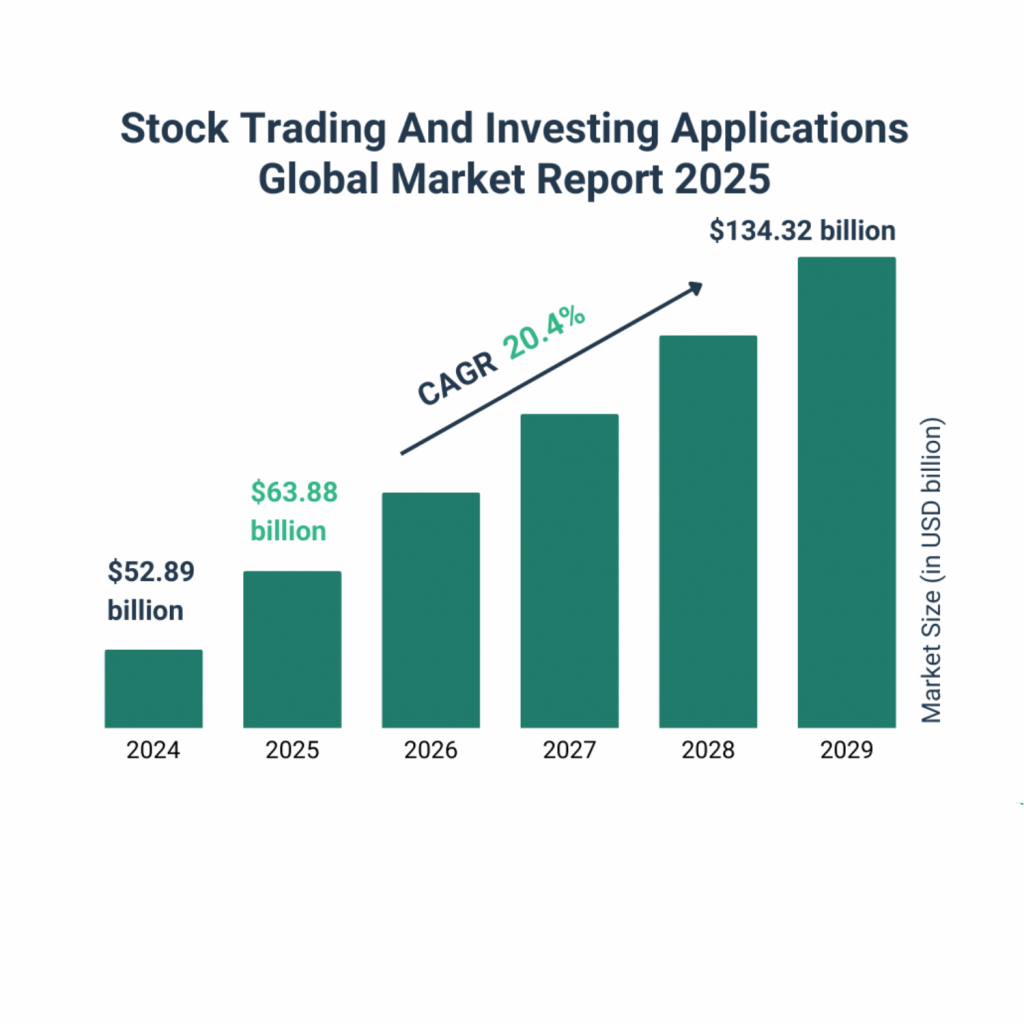

Why invest in building a Stock Trading App? Market Size and Statistics

The stock trading industry has transformed tremendously in recent years with the rise of mobile apps. As of 2022, over 50% of all retail stock trading is executed on mobile apps. This growing demand has opened up massive opportunities for startups and entrepreneurs to build trading apps. Some key stats that make a case for investing in a stock trading app:

- Global stock trading app market size is projected to reach $36 billion by 2028, growing at a CAGR of 11.7% from 2022 to 2028. This growing market leaves ample room for new app launches.

- There are over 25 million daily active traders in the US alone conducting over $200 billion in trades daily. However, only 7% of US households currently invest in stocks, leaving a huge untapped market.

- Mobile trading volume accounted for 54% of global equities trading in 2020, up from just 37% in 2016. This upward trend highlights how mobile is increasingly becoming the primary platform for stock investing.

- Over 10 million new brokerage accounts were opened in the US in 2020 alone as zero-commission apps boosted retail participation. This points towards ongoing demand growth.

- Top trading apps like Robinhood and Webull boast of user bases exceeding 10 million each, suggesting there’s space for several other mid-sized players as well.

- Millennials and Gen Z are more active investors than previous generations, embracing digital-first experiences through apps. This young demographic will continue driving app usage.

- Major brokers are enhancing their app offerings aggressively but independent innovative apps can still gain traction by addressing needs better through unique features and services.

When building a stock trading app, tapping into these secular industry trends through a targeted product can potentially yield high rewards considering the size of this growing market.

Read More – Top fintech app development companies across globe

Top Apps to Inspire You to Build a Stock Trading App

Robinhood

- Pioneered commission-free investing model attracting millions of new investors since 2013 launch.

- Sleek UI optimized for mobile-first experience enabled easy access for novices.

- In-app newsfeeds, integrated charts/analytics, fractional trading enhanced user engagement.

- First to enable cryptocurrency investing growing user base outside stock/ETF investments.

- Accelerated peer-to-peer learning through social features and communities on the app.

Webull

- Attractive option for advanced traders with powerful charting tools, screening & analytics.

- Futures and forex trading facility expanded offerings beyond stocks/ETFs.

- Customizable dashboard & paper trading for practice prior to live investments.

- First mobile app supporting pre-market & after-hours session crucial for short-term traders.

- Eye on Asia expansion amid growing global interest in China stocks from their platform.

These inspire how a well-crafted mobile experience optimized for contemporary needs of retail investors can hugely boost user engagement. Drawing upon learnings from top platforms’ functionalities, challenger apps can succeed with differentiated features addressing specific niches.

How the Stock Trading Mobile App Works

Work Behind the Scenes: Key Numbers

- Under 10 seconds to register

- Milliseconds trade execution

- Over 500 securities supported

- 99.9% uptime through redundancies

- Hours of daily content updated

- 24/7/365 multi-channel support

- Millions of daily API calls handled

A trading app works by connecting users to the brokerage backend via API integrations. The key components are:

1. Registration

The registration process is the first interaction a user has with the trading app. It involves collecting basic KYC details like name, email, password, address etc. to build their profile within the parameters required to build a stock trading app.

2. Dashboard

The dashboard is the home screen seen after login, giving users a consolidated view of their trading activity and accounts. Careful thought must go into crafting an informative yet clutter-free dashboard when building a stock trading app.

3. Watchlists

A powerful aspect to build and create a stock trading app is intuitive watchlist functionality where users can save stocks of interest. Developers must lay the groundwork for hassle-free watchlist creation, management and organization.

4. Quotes and Charts

Access to real-time stock quotes and intuitive charts is essential for any powerful trading application. When building a stock trading app, developers integrate reliable market data SDKs that facilitate quick updating of current price, volume, and other ticker details for thousands of securities.

5. News and Filings

Sourcing vetted news and company updates aids decision-making when creating a stock trading app. Developers incorporate feeds and alert systems optimized for speed and relevance. Customization by sector, keyword allows filtering noise to extract nuggets.

6. Trading

The pinnacle of any stock trading mobile app is enabling seamless trades. This involves laying plumbing for placing secure buy/sell orders within fractions of a second. Intuitive order windows configured to support limit, stop-limit, and other advanced order types using the app’s architecture.

7. Positions

Manageability of open/closed positions forms the crux of accountability within the trading app. Record-keeping presents net P&L along with trade-wise details like entry price, quantity, and commissions to evaluate performance over time when building a stock trading app.

8. Performance

Ongoing assessment of trading outcomes is vital for both users and creators of a stock trading app. Developing intuitive performance dashboards and reports strengthens this. Dynamic charts portraying the performance of current selected stocks/ ETFs or portfolios over days, month,s and years keep performance top of mind.

9. Funding

Convenient funding mechanisms that facilitate quick fund transfers streamline the trading experience within an invested stock market app. Integration of popular account-to-account payment modes expedites deposits at low/no charges.

10. Customer Support

Top-grade customer services influence positive perception of any app, more so for matters as significant as finance. Building a stock trading app necessitates setting up responsive assistance accessible 24×7. Dedicated mobile-friendly help pages hosting FAQs resolve minor issues independently.

Legal Challenges and Compliance to Build a Stock Trading App

Building a stock trading platform involves complying with regulations to create a stock trading app legally. Some key considerations:

- Registering as a broker-dealer with FINRA and SEC is required in the US if facilitating trading unlike platforms solely providing market data/research.

- KYC/AML regulations must be followed requiring user verification to build a stock trading app legally. EU’s MiFID II and GDPR also govern data privacy and protection.

- App icons, texts and advertising materials need SEC/FINRA approval avoiding unsubstantiated claims that could mislead traders when creating a stock trading app.

- State-level money transmitter and broker licenses may be required depending on supported jurisdictions when facilitating currency exchanges.

- Stringent data security standards and operational resiliency processes have to be implemented. Regular audits ensure regulators’ guidelines are followed.

- Accessibility regulations like Dodd-Frank Act provisions and offering standardized options/futures contracts involve additional legal planning.

- Intellectual property filings like patents for proprietary features and trademarks protect the brand when building a stock trading app.

- Contracts with 3rd party APIs/vendors require review by compliance experts when creating a stock trading app to avoid legal issues.

Adhering to country-specific laws is mandatory, requiring legal expertise alongside the technical buildout. Non-compliance could derail businesses with hefty fines or shutdown notices.

What are the Benefits of Building a Stock Trading App for Your Business?

- Large addressable market allows scaling profitably: With over 50% stock trades on mobile, massive demand exists serve when creating a stock trading app.

- Boost brand visibility online: The app listing generates awareness attracting new traders and retaining old users when building a stock trading app.

- Data monetization opportunities: Aggregated anonymized user data on trends can be licensed to brokers when creating a stock trading app.

- Acquire customers at lower costs than websites: App user acquisition costs roughly 30-50% lower than sites creating cost benefits.

- Increase engagement and loyalty: Push notifications, sharing integrations keep users hooked building customer lifetime value.

- Upsell/cross-sell premium services: Advanced tools, courses, research drive higher ARPU through the app when creating a stock trading app.

- Facilitate remote workforce: App-based operations require fewer physical offices reducing overhead costs.

- Global expansion without high expenses: Apps scale cross-borders minimizing localization complications when creating a stock trading app.

- Early mover advantages: First apps establishing brand loyalty in a nascent space secure larger market shares before competition during early monetization.

For businesses, stock trading apps bring in new revenue streams augmenting core offerings apart from building a stock trading app profitably at lower costs. Strong engagement and monetization models also fetch higher firm valuations.

Steps To Build a Stock Trading App

Below are the essential steps to build stock trading mobile app that ticks all the boxes:

1. Choose Platform

One of the most important decisions when aiming to build a stock trading app is choosing the right platform – iOS, Android, or both. Considering this app will involve financial transactions, a multi-platform approach expanding reach optimizes potential. However, this significantly increases the development cost to build a stock trading app for different ecosystems.

2. Interface Design

Careful interface design sets the foundation to create an intuitive stock trading app. Developers study the interfaces of popular brokerage apps to decide on UI elements, flows, and wireframes. Paper prototyping valuable features ensures iterative testing before development.

3. Technology Selection

Prudent technology choices enable secure yet performant apps. Based on the chosen platform, developers evaluate top cross-platform frameworks like React Native, Flutter or native Swift/Java to determine the codebase to build a stock trading app.

4. App Development

The core development phase involves coding all envisaged features and UIs of the stock trading app as per designs and integrations with broker APIs. Modular structure supports scaling. Server-side code manages user operations while clients retrieve/display data.

5. Quality Assurance

Testing is vital to create robust yet error-free stock trading apps. Non-QA can drastically increase the cost to build a stock trading app in the long term. Along with unit/integration testing during development, standalone testing teams perform multi-dimensional testing – usability on various devices, networks, security vulnerability assessment, load/stress testing to simulate high users.

6. Publishing

Once developed as per standards, stock trading apps can be submitted to app stores after necessary store-specific configurations to be distributed to end customers. This involves attaching screenshots, videos, filling store forms etc to publish the apps. The app stores carefully review submissions against policies before making the app available.

7. Maintenance

Even robustly tested apps need timely upgrades and fixes to sustain engagement especially for stock trading apps dealing with financial data integration. Dedicated efforts are essential to conduct maintenance activities like monitoring app performance, responding to user feedback, releasing upgrades aligned with market and technology changes which can elevate user experiences over a period of time.

8. Marketing

Aggressive marketing campaigns spread awareness and drive new users and engagement for any stock trading application. Carefully curated creative assets highlight key benefits. Discovery ads on app stores and financial websites target relevant audiences. Contests, referral programs fuel virality helpful early on.

9. Monetization

Though valuable, stock trading apps require monetization to create sustained revenue streams justifying initial cost to build a stock trading app infrastructure. Alternative avenues include charging nominal subscription plans for advanced features or a percentage commission on executed trades within the app environment.

10. Customer Service

Top-notch customer support strengthens user satisfaction and experience which are critical success factors for any stock trading app. Maintaining multiple assistance channels like in-app ticketing, emails, telephonic lines, communities, and proactive communication handles user issues as they arise. Customer obsession entails promptly addressing even minuscule bugs or doubts. Rich FAQs and help sections self-service basic queries.

Features To Include In a Stock Trading Mobile App

Below are the essential features you must keep in consideration:

> Intuitive Registration and Login

When building a stock trading app, developers integrate robust authentication solutions like biometric, PIN, and password login along with facial recognition, making sign-ups and login instant and secure. This reduces the cost to build a stock trading app by providing a seamless user experience. Authentication ensures compliance with financial regulations.

> Customizable Dashboard

The dashboard is critical for any investing app. Allowing users to configure widgets, rearrange market insights according to their objectives reduces the cost to build a stock trading app by boosting user experience. Customization unleashes productivity and helps users optimize decisions.

> Real-time Market Data

Reliable streaming market data is crucial for timely decisions on any stock trading platform. When developing such an app, integrating real-time stock price quotes along with trading volumes and company profiles keeps users informed. Back-tested historical data aids pattern analysis.

> Advanced Charting Tools

Sophisticated technical analysis fuels informed trading strategies on any investing platform. When building such an application, developing customized charts involving versatile indicators, drawing tools and algorithms aids exploring different perspectives of market and sector movements.

> Intuitive Watchlists

Seamless screen customization elevates market monitoring. When developing stock trading apps, careful design facilitates easy creation, editing, arrangement and sharing of color-coded personal watchlists. Different list-types and real-time alerts on predefined thresholds keep track of markets efficiently.

> One-tap Trading

Quick order execution underscores any investing platform. Incorporating seamless one-tap trading integration reduces cost and complexities to build a stock trading app. Developers implement buy/sell order windows supporting advanced trade styles like limit, market, OCO within a few clicks.

> Tracking Positions

Tactical portfolio overviews aid consistency. When developing such a platform, custom-coded net worth statements and interactive tables monitoring P&L for each held position on a real-time basis impart accountability. Filters arranged by market cap, sector or analysts’ ratings enhance analytical comparisons.

> Customizable Portfolio Views

The ability to create custom portfolio hierarchies enables granular benchmarking when building a stock trading application. Such analysis exhibits return across diverse user-defined segments over multiple intervals.

> Social Trading

Collaboration sparks creativity and cultivates peer learning within any investing community. When creating such apps, incorporating social features like encrypted discussion boards, ability to follow influencers, and hash-tag based conversations dissect trends enrich the experience.

> Trading Ideas

Premium strategic inputs guide portfolio construction. Key elements involve curated playbooks from verified professional analysts available within the platform itself. Categorized trade baskets empower emulation after vetting. Interactive custom reports spotlight detailed, actionable ideas along with performance trends for reference.

> Robust Support

Superior customer satisfaction bolsters retention on any investing platform. Key considerations involve multi-channel help address via in-app ticketing, call/chat support and community forums. Interactive help menus and shortcut commands covers every app aspect. Video demonstrations exhibit functionalities for easier adoption.

How to Monetize Your Stock Trading App?

Below are some of the effective ways you can have your stock trading app monetized. Take a look.

1. Trading Commissions

- Robust order routing, integrating with multiple broker,s enables charging based on order amounts

- Tiered plans linking commissions to trading frequency/volumes can boost revenue

- Offering exclusive commission-free ETFs/stocks listing generates new order flow revenue

2. Premium Features

- Advanced analytics, level 2 market data, streaming news clips behind paywalls

- In-depth research tools, alert suites, encrypted messaging boost utility

- Paid newsletter/courses by experts monetize premium financial education

3. Advertisements

- Unobtrusive app store/newsfeed ads alongside content bring passive income

- Sponsoring top lists, charts recognizing partner firms’ contributions

- Performance incentives for clicking through to brokers’ platforms

4. Referral Fees

- Affiliate revenue from new brokerage account signups using the referral link

- Commission kickbacks each time referred users trade through the platform

- Contests awarding existing traders for the most referrals activated

5. Market Data Fees

- Licensing fee-based bulk delayed quotes, and financial databases resold

- Feed subscriptions for premium real-time data, Level 2 order books

- White labeling pro widgets to other fintechs monetizing infrastructure

6. Custom Services

- Tailored algo/quant strategies developed as Subscription products

- Managed portfolios, baskets launched on a marketplace model

- Sponsored research publications, online courses for topic-specific communities

Multiple monetization streams especially via premium tools and BigData access lay robust foundations for profitable businesses over the long-run.

How Much Does It Cost to Build a Stock Trading App?

Building a fully functional stock trading app involves a significant investment but delivers high rewards. Indicative costs are:

- App Design and Wireframing: $2,000-$5,000

- Development for 1 Platform (iOS/Android): $15,000 – $50,000

- Development for both platforms: $30,000 – $100,000

- Security Auditing: $5,000 – $10,000

- Backend/API Integration: $10,000 – $30,000

- Third Party Security/Financial SDKs: $5,000 – $15,000

- Ongoing Maintenance per year: $10,000 – $30,000

- Marketing Budget: $5,000 – $20,000 per month

- Server Costs: $500 – $2,000 per month

- Compliance & Regulatory: $10,000 – $15,000 annually

total cost to create a stock trading app can range from $80,000 – $250,000 based on complexity and customizations. It may pay off with high download numbers and trading volume/commissions.

How A3logics Can Assist You in Building a Stock Trading App?

A3logics is an award-winning app development company with deep expertise in creating over 100+ trading/fintech applications. We adopt an end-to-end approach for stock trading app development with:

1. Consulting

- Feasibility studies identifying key priorities/USPs

- Competitive analysis validating technical approach

- Roadmap planning to launch in reduced cycles

2. Design

- Feasibility studies identifying key priorities/USPs

- Competitive analysis validating technical approach

- Roadmap planning to launch in reduced cycles

3. Development

- Cross-platform React Native for native-like functionality

- Integration of advanced charts, screening, order entry

- Rigorous testing for reliability, performance, security

4. Deployment

- Docker containers for scalability on container platforms

- Auto-scaling architecture with load balancing

- 99.9% uptime SLA on major Cloud platforms

5. Augmentation

- ML/AI model development for hyper-personalization

- Big data warehousing and business reporting

- Integration with third-party tools expanding capabilities

6. Support

- Dedicated success team for ongoing maintenance

- Actionable insights through usage analytics

- Regular updates/upgrades aligned with trends

This process crafted over a decade delivers top-rated applications on time and within budgets. Our award-winning work includes prominent FinTech startups and Forbes-rated brokers. Let our expertise streamline all aspects saving you 50-70% costs versus in-house development when building a stock trading app.

Final Thoughts

With the growing digitization of finances, stock trading apps address the need for seamless access to markets on mobiles. Harnessing new technologies effectively, including NFT Marketplace Development Services, will help players acquire and retain customers in this competitive industry. Success lies in understanding trader personas and crafting frictionless experiences tailored to their needs.

FAQs