Table of Contents

IoT has significantly changed how people interact with technology. The integration of IoT into various sectors is becoming the norm, which is why the banking and finance sector isn’t an exception. However, the power of IoT is its versatility and it can be utilized in many different fields. The Internet of Things is believed to be a major force in streamlining processes and enabling the analysis of real-time data in financial services. IoT is transforming the finance and banking industries by improving operational efficiency and creating new customer experiences.

Many banks are using this new technology to provide their customers with better customer service and expand their business market. IoT offers a variety of fascinating and broad applications in the banking industry, and numerous innovations are yet to be seen. With IoT, banking has become more efficient and secure.

Want to know more about IoT in the banking sector? In this blog, we will discuss the use cases of IoT in the banking sector and its benefits. But before that, let’s understand what IoT in banking is.

So, let’s get started.

What Is IoT In Banking?

The banking industry is always seeking new avenues to expand. Key emerging trends are expected to make the most significant difference in the banking industry over the following years. The Internet of Things (IoT) is one of their most important. It isn’t just an emerging technology that could be the future but is also a crucial part of financial institutions’ swift progress toward complete digital change.

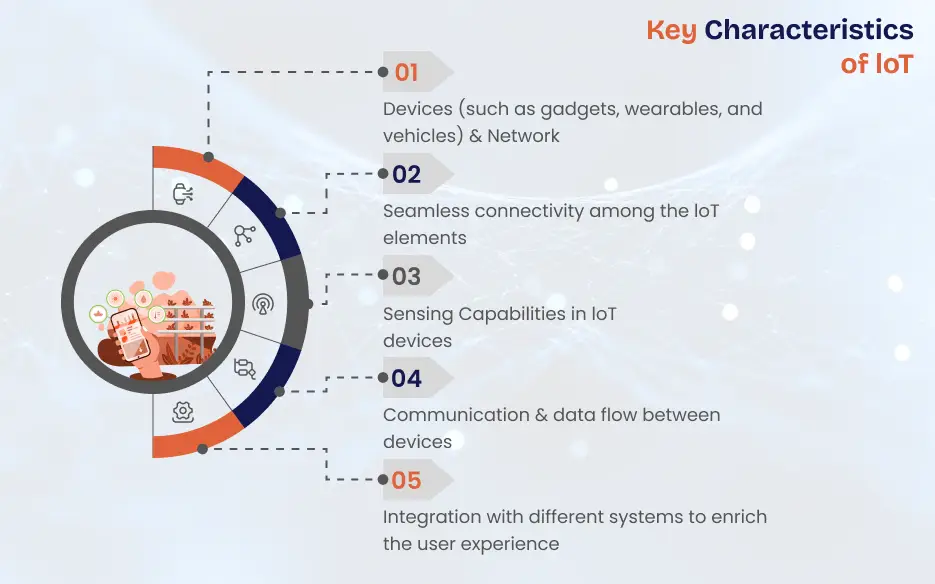

IoT in banking is the network of devices that collect information for banking and financial services. Because of their design, these devices and sensors are near the customer (think of smartphones digital doorbells, and fitness watches). This is why IoT technology is unique in its capability to monitor human activities across various settings. Connected objects can monitor in real-time actions to provide accurate, specific context information gathering. Modern banking utilizes IoT to achieve the same goals, emphasizing banking issues. It would be right to say that IoT helps to build a digital bridge between banks and their clients.

Key Stats About IoT In Banking

An increasing demand for enhanced service to clients and efficiency in operations drives the development of IoT within the financial and banking sectors. Organizations are using IoT technology to offer personalized, real-time service and automate their operations. This results in substantial savings on costs and improved quality of service.

- IoT in the fintech and banking market has seen a remarkable increase recently. It is projected to be $2.61 billion in 2024.

- With the growth of IoT payment systems and advances in smart branch technology, the market will reach a CAGR of approximately 50.10% from 2024 until 2031.

- According to Forbes, mobile IoT connections are predicted to increase by 3.5 billion by 2024.

- The IoT in the financial and banking services industry in the US is anticipated to increase at a rate of 9.1% between 2024 and 2030. In the US the drive to improve security and personal experience for customers within financial services is a major driver of IoT use.

Top 10 Use Cases Of IoT In Banking

The IoT-led digital transformation is taking shape as the financial software development services sector opens new possibilities for innovations that could alter the customer experience. The most common banking IoT applications are:

Smart ATMs With IoT Monitoring

ATMs are one of the many devices connected to the IoT that have helped banks become more efficient. Instant transactions that didn’t require waiting at the teller’s counter were an early breakthrough. Nowadays, technology like the IoT continues to enhance banking services. Earlier, smart ATMs contributed to reducing expenses by cutting the staff required to provide customer service at physically located branches.

IoT-enabled machines can perform simple maintenance tasks and automatically replenish cash. Additionally, some banks utilize IoT sensors to monitor people who walk by ATMs. The information gathered from banking could help determine the bank’s most suitable location or branch where customers visit more.

Smart Branching And Offices

IoT’s impact on smart offices and branches proves its ability to boost effectiveness and provide an eco-friendly setting. Smart lighting systems that IoT powers automatically regulate the intensity and time of light based on real-time occupancy statistics. The systems for environmental control that use IoT to keep track of temperature and air quality.

IoT sensors strategically placed inside the office or the branch will provide real-time information on occupancy patterns. This information can help optimize the seating arrangement, desk assignments, and the use of meeting rooms.

Security And Fraud Prevention

Thanks to IoT technology, companies can enhance their defenses and assure the security of financial and customer data transactions. Biometric authentication techniques that IoT enables, like fingerprint recognition, have brought about a brand new age of secure identity verification. They add an extra protection layer using distinct biological features that are virtually impossible to duplicate.

IoT devices equipped with cameras and sensors allow the monitoring of banks in real time and other crucial areas. When combined with sophisticated analysis, the data generated by IoT will reveal unusual patterns and behaviors that could indicate suspicious activities.

Digital Identity Verification

The increasing number of online transactions requires secure and reliable methods for confirming identity. IoT facial recognition technology analyzes distinctive facial characteristics to verify customers’ authenticity. This technique adds additional security, blocking unauthorized individuals from accessing accounts and making fraudulent transactions.

IoT devices with fingerprint scanners are a secure and easy method of authenticating users. Every person’s fingerprint is distinct, making it an efficient method of biometric authentication of identity.

Credit Risk Management

IoT allows banks to constantly observe customer and transactional behaviors to better control credit risk and ensure compliance with regulations. Automation facilitated through IoT assists in ensuring compliance. It improves the effectiveness of AML or anti-money laundering initiatives and guarantees compliance with regulatory standards using lower manual efforts.

Auditing and Accounting with IoT

Auditing is essential for banks in today’s banking environment. Most banks have adopted technology like IoT to enhance their auditing procedures. By installing branch sensors and connected devices, they can gather numerous data points to spot warning signs and avoid fraud. Sensors detecting an odd behavior could trigger an alarm that prompts an investigation.

Companies can also assure employees that they follow appropriate processes by monitoring employee card swipes with badges. The IoT can also monitor ATM cash amounts to ensure no cash shortage. Ultimately, the aim is to ensure that auditing is more efficient and productive while decreasing the chance of fraud.

Smart Collateral Management

IoT technology allows banks to manage better and control the assets that a mortgage customer owns, like cars. If this is the case, a customer can obtain small amounts of money in the short term by offering equipment or vehicles to use as collateral.

With the help of digital identities for individuals and items, the transfer of ownership for an asset may occur in a matter of moments. Banks can also instantly issue loans and keep track of collateral status without taking physical custody of assets such as vehicles.

Insurance

IoT devices monitor the condition of insured items and alert insurers about any issue or deformity so that they can take immediate action to reduce the risk. If a sensor detects unusual activity in manufacturing equipment, it can trigger an alert. This notification is sent to the insurer and policyholder before it gets completely damaged. This proactive approach minimizes the number of insurance claims and also prevents fraudulent claims.

Data generated with the help of IoT enables insurers to take protective measures and forecast what might happen in the future. By utilizing real-time monitoring through telematics, insurers can gather vital information about customer behavior and vehicle conditions to offer tailored insurance plans.

IoT sensors in cargo insurance monitor real-time conditions like temperature and humidity. The data helps in risk analysis and ensures timely interventions, protecting valuable shipments.

Benefits Of Implementing IoT In Banking

The banking industry is constantly under pressure to stay ahead in the changing tech landscape in the financial sector. To remain in the game, banks and financial institutions must adopt the latest technologies such as data sciences, AI and machine learning. Eventually, it will improve security, customer service, and management.

IoT allows data to be collected from different sources, aiding in making better decisions. It also facilitates the interplay between machines to automate procedures, eliminating human inefficiencies and mistakes.

We’ll take a deeper look at the potential benefits of IoT in the banking and financial industry.

Improved Customer Experience

Customer service is among the primary usage examples that can benefit from IoT technology. IoT gathers information about users and analyzes users’ various electronic habits. This information can be precious for providing customer service. Banks could use this data to offer personalized support to clients. This will be an account of the customer and their financial needs. Banks can utilize it to provide budgetary plans as well as others.

Real-Time Data Insights

IoT provides deep insight into customer behavior, such as ATM use patterns, branch visits, and digital interactions. These data allow banks to customize promotional offers to improve customer satisfaction. IoT devices can collect information on customers’ phones, mobile applications, and websites to give insight into their behavior. This will help banks better understand consumer preferences and habits and provide tailored services.

Real-Time Feedback

IoT devices can collect information about a bank’s users’ activities. This data could help managers determine the needs of various clients. A smart IoT system will automatically provide helpful alerts. IoT systems can alert users about their account balance. This process can work without human intervention.

Enhanced Risk Management

IoT use cases in banking have added a dimension to risk mitigation and assessment. Hence allowing financial institutions to make educated choices based on real-time data. IoT sensors gather and transmit real-time information. This helps financial institutions track market conditions and make quick choices. IoT technology can monitor geopolitical news and developments and provide early insight into potential risks that could influence investments or operations.

Personalized Financial Products

IoT solutions allow banks to gather data to create comprehensive profiles of their customers, including demographics, life-cycle events, and service preferences. By analyzing this data, banks can gain more information about their customers’ needs and requirements. This enables the banks to provide personalized solutions and products and offers relevant financial aid and budgeting programs.

Preventing And Detecting Fraud

Banks can collect and review vast amounts of information in real-time when they connect devices and systems to the internet. This data is used to detect fraudulent and unusual behavior patterns and, ultimately, help stop criminal activity.

IoT can also increase security in ATMs and bank branches. Making it much more difficult for criminals to conduct their criminal activities. As the banking sector continues to digitalize, IoT will be increasingly important in ensuring customers are secure from fraudulent activities.

Key Considerations In Implementing IoT In The Banking Sector

Although IoT provides numerous advantages for finance and banking, it can also pose issues. Let’s look at the key points to consider when implementing IoT in the banking sector.

Ensuring Data Privacy And Security

One of the main issues associated with IoT is data privacy and security. As IoT devices share sensitive personal and financial information, protecting this information is essential. Security breaches lead to economic losses and loss of confidence. So, banks need to use strong encryption and secure data transfer protocols.

Adherence To Regulatory Requirements

The banking sector is very controlled and has strict privacy, data protection, and security requirements. IoT applications must comply with regulations like GDPR, which impose stringent data handling and privacy regulations. Compliance becomes more difficult because IoT devices can increase the amount of data gathering and processing. This requires banks to ensure that the IoT applications comply with these legally enforceable standards.

Integration With The Existing System

Implementing IoT in finance requires integration with diverse platforms and devices. This adds difficulty to the current banking infrastructure and can create integration, management, and upkeep challenges. Banks require technical knowledge and resources to manage and maintain these intricate IoT devices to succeed.

Ensuring Proper Training And Support

Offer comprehensive education and training for bank employees on IoT secure practices, including fundamental security, understanding the potential dangers, and recognizing the importance of following security procedures.

How A3Logics Help In Providing Custom IoT Solutions for the Banking Industry?

The fintech sector has greatly adopted the Internet of Things (IoT) in the past few years, especially in processing payments and security. IoT allows customers to make payments from any location and can be a robust security instrument. Hence providing a secure method of processing and encrypting the information used to make payments.

Therefore, creating a robust solution that seamlessly integrates every feature of IoT technology requires a highly strategic approach and meticulous execution. We’re a leading IoT application development firm that helps you harness cutting-edge technologies to increase your company’s ROI. Our leading-edge IoT solutions can help you gain a competitive advantage through a data-driven customer experience and process automation.

Contact the A3Logics team today to learn how our IoT development services can help with your company’s growth.

Conclusion

The integration of IoT technology in the finance and banking sector has opened up a variety of possibilities. Banks must be open to embracing IoT technology to succeed in the new world of finance.

IoT helps to go beyond conventional banking. Its implementation has occurred in various ways and offers fresh solutions to enhance the effectiveness of operations.

With IoT, banks will move towards digitalization more quickly to boost their market share in the future. Competition is growing more intense, and customers’ expectations are evolving. Financial institutions that tap the potential of IoT will advance off the curve and gain an advantage over competitors.

FAQ

What are the future trends of IoT in banking?

The future trends of IoT promise to be exciting, with advances in edge technology, connectivity to 5G, AI integration, blockchain security, industry-specific solutions, sustainability, and improved data analytics. IoT has enormous potential to transform society and businesses in a connected, digital world.

What are the top technologies used for designing IoT apps for banking?

The key IoT technologies in developing IoT banking applications include sensors such as Wi-Fi and Bluetooth, IoT platforms, edge computing, cloud computing, AI/ML, and blockchain. These allow data collection and automated, secure transactions within the IoT ecosystem.

What is the role of IoT in transforming the banking sector?

IoT is creating various changes in the banking industry by improving security, offering personalized services, automating processes, and many more. It allows banks to develop customized solutions and products, enhancing customers’ experiences with digital banking and other factors.

How does IoT help in improving customer service in the banking sector?

IoT applications in banking improve the customer experience within banking by providing specific services customized to the individual’s habits and preferences. By using IoT-enabled devices or applications, banks can provide real-time announcements, local-specific offers, and smooth interactions across various channels, resulting in greater client satisfaction.