The world of financial technology, commonly termed FinTech, has evolved remarkably over the past decade. Now, it’s more than merely digitizing money matters. FinTech paves innovative avenues for individual users and businesses to oversee their finances. The best part? Mobile app ideas lead this revolution, offering money management at our fingertips, anyplace, anytime. Recently, we’ve seen an uptick in the number of apps like Dave in the FinTech sector. These cash advance apps like Dave offer users the advantage of accessing their earned wages before payday. Essentially, they’re a quick solution for those sudden financial pinches. Why their increasing fame? The answer lies in instant money access, user-friendly interfaces, and lightning-fast operation.

Table of Contents

Cash Advance Apps: What Are They?

Apps for cash advances come in a wide variety. Some simply provide you access to your already-earned money, while others offer interest-free loans (which usually have additional costs or a suggested tip). A cash advance app is, in any event, a means of obtaining a modest sum of money. Usually, payment is made immediately on your subsequent payday.

How does a Cash Advance App work?

You must first download and install the appropriate app like Brigit on your smartphone in order to get started. You can download a cash advance app like Brigit from the App Store (for iOS phones) or Google Play (for Android phones), depending on the operating system of your phone. When the app is installed, you can utilize it as needed.

A few cash advance applications only charge interest on the amount borrowed; there are no other fees associated with them. Some might charge a monthly subscription cost, which is also referred to as a membership fee. Certain cash advance apps like Brigit function similarly to internet lenders, while others are more akin to mobile banks. In addition to loans, they provide overdraft protection and other features. You must research the market and choose the app that best suits your demands.

User Registration

Users must download the app, register, and enter personal data, including bank account information. In order to evaluate your financial conduct, the cash advance apps like Brigit could also need access to your transaction history.

Linking a Bank Account

Users connect the app to their financial accounts. This enables the app to evaluate your spending patterns and calculate the maximum amount you can borrow without risking overdrawing your account.

Analyses of Finance

The program analyzes your income, forthcoming expenses, and spending habits using algorithms. It forecasts your cash flow and warns you if you run the risk of overdrawing your account before your next paycheck based on this research.

Cash Advances

The cash advance apps like Brigit offer you a cash advance to make up the difference if it thinks you could run out of money before your next payment. These advances are usually for modest sums, from $25 to several hundred dollars.

Payback

When your paycheck is deposited the following payday, the app often debits the borrowed money from your bank account along with a minor fee. In case it is not possible to repay the loan within the time-frame, there are apps available permitting extension of the repayment period. This however comes at a additional cost.

The Current Market Size and What Lies Ahead for Cash Advance Apps

Diving into financial sectors, cash advance apps certainly shine. These platforms have become favorites for individuals needing swift funds, bypassing traditional loan inconveniences. The demand for money loan apps like Dave has skyrocketed, particularly as people seek reliable and quick financial solutions during fluctuating economic periods. To shed some light, a survey by Cornerstone Advisors found approximately 14 million individuals turned to apps like Dave in 2020. Many are adopting these tools.

Peeking into the future, payday apps like Dave seem to have a promising trajectory. The rationale? The dynamics of how we manage and require funds are shifting. Getting money easily and having the tools to manage it makes cash advance apps super handy. And with more tech upgrades on the horizon, these apps will only get better and more popular.

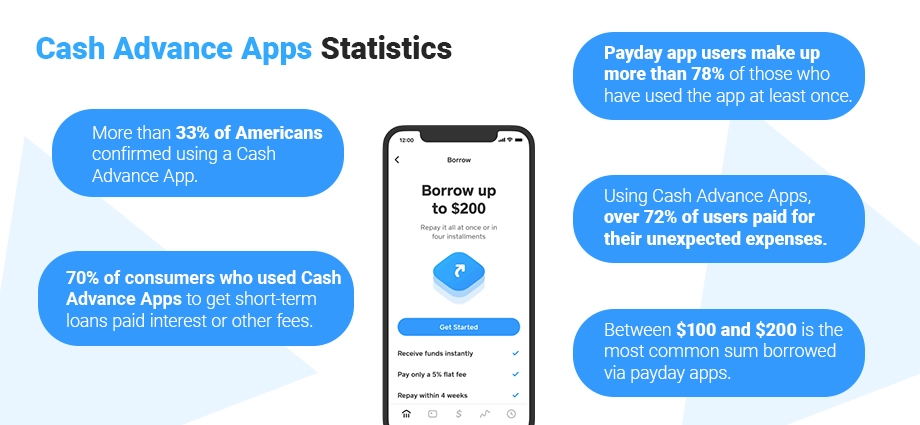

Latest Stats and Insights into Cash Advance Services

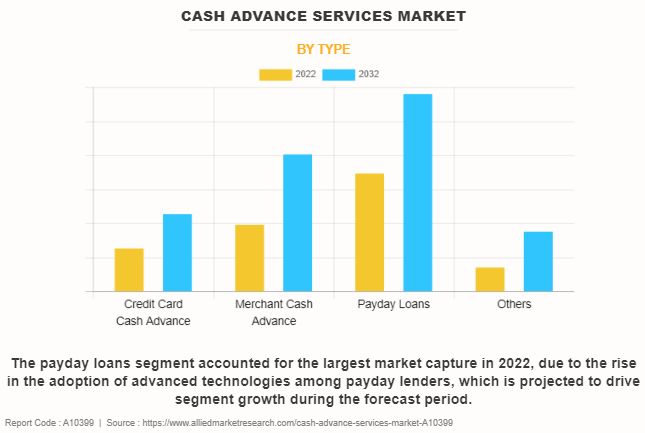

With more and more people looking to get quick cash – cash advance services are seeing rapid increase in popularity especially among younger generations. Owing to this growing popularity the global market for cash advance services was estimated at $73.7 billion in 2022 and is expected to increase at a CAGR of 6.6% from 2023 to 2032, reaching $138.5 billion.

A Consumer Financial Protection Bureau survey estimates that 12 million Americans take out payday loans yearly.

A Bureau of Labor Statistics report indicates that millennials are inclined to use mobile apps for financial transactions.

The average interest rate on a cash advance usually accounts for almost 25-30%.

Highlighting the Importance of Dave-like Apps

Discussing cash advance apps brings Dave to the spotlight. Dave has established itself as a prominent figure, recognized for delivering prompt, uncomplicated, and affordable short-term financial solutions. But there’s more to Dave—it acts as a financial buddy, aiding users in avoiding unwanted overdraft fees through minor cash assists. The best aspect? It operates on a simple fee structure: a $1 monthly charge with an optional thank-you tip during an advance, and here’s the kicker—absolutely no mandatory interest.

Dave and other apps like Dave have truly grasped user needs. Users appreciate the swift funds access, bypassing typical loan hurdles such as exorbitant interest or long approval waits. By blending technology and finance, this app ensures users smoothly navigate their monthly expenses without the anxiety of overdrafts or high loan rates.

How Dave-like Apps Shape Financial Management

Apps like Dave have become more than just services—they’re influential financial instruments. Their role isn’t confined to just advancing cash. They assist in monitoring expenses, tracking money flow, and even nudging about upcoming payments in Payment App Like Cash App. This comprehensive approach to financial management amplifies their worth.

Given the current fluctuating financial environment, is there an app that provides immediate monetary assistance and financial guidance? That’s a game-changer. Dave’s triumph underscores users’ pressing demand for such a dual feature, amalgamating instant financial aid with foresight tools.

Transform the way you do business with our cutting edge mobile app development services

Contact Us

Dave App Spotlight: Its Origin, Purpose, and Impact on Users

Stepping into the world of financial technology, Dave emerges as a beacon for those navigating their financial paths. Originating with the mission to change how we handle and loan money, Dave quickly established itself as a leader among the top money apps like Dave, providing users with a financial cushion. Since its introduction, it has reshaped the landscape of short-term loans and monetary planning, ensuring users access their well-deserved cash ahead of the usual payday.

Dave’s objective isn’t merely to provide loans. It’s centered around empowering users to take control of their financial future. The app made significant waves by aiding users with fast funds and resources to maintain a robust financial stance and avoid unexpected overdraft charges. This dual functionality makes Dave stand out, positioning it as more than just a loan platform but a comprehensive financial mentor.

How Dave Provides Financial Relief to Users

Delving into how loan apps like Dave operate, it becomes evident that they combine ease of use with technological intelligence, simplifying the process of funds retrieval. Dave’s primary focus is the financial prosperity of its users. It grants users early access to up to $100 from their earned income, assisting in unforeseen financial needs. Traditional loan obstacles, such as credit evaluations or interest charges, are bypassed, ensuring rapid cash availability.

Its added features set Dave apart from other iOS app development companies. These tools help users watch their spending and plan money-wise. Users get heads-ups for bills that are coming up, help with setting spending limits, and even options to rake in a bit more cash through side gigs. This all-around approach ensures users aren’t just getting money but are also armed with tools to boost their financial footing.

Who’s Using These Apps and How They Manage Their Money

If you’re an Android application development company stepping into cash advance apps, you’ve got to know your users. The main crowd that loves apps like Dave? People who sometimes run a bit short before their next paycheck. They’re after quick solutions that don’t come with all the hoops and paperwork of old-school loans.

Most users of apps like Dave are about here and now. They’re looking for an immediate fix for surprise bills or costs rather than thinking long-term. They love that an app like Dave is easy to use, clear-cut, and doesn’t come with sneaky extras. Simplicity is the key.

Ultimately, the typical user looking for “apps like Dave” wants them to be quick, clear, and dependable. Companies thinking about making a cash advance app should remember this. This understanding helps shape how the app works and how it’s promoted. It’s vital to ensure the app fits what users want and need.

Key Elements of Cash Advance Applications

Joining and User Verification: A Seamless, Secure Beginning

Initiating with cash apps like Dave, the first task for a user is typically registration and identity validation. Ensuring a smooth yet robust registration is crucial, particularly in the financial tech domain, where establishing user trust is paramount. Mobile app development companies in the USA and globally prioritize making this primary interaction user-friendly and exceptionally secure.

Registration typically involves users creating an account, providing essentials like their name and email, and occasionally linking their bank details. It’s crucial this phase is intuitive and straightforward to retain user interest. Verifying the user’s identity is imperative to shield the application from potential fraudulent activities. Verification might entail email confirmations, one-time passcodes, or bank account connections.

Swift Money Retrieval: Facilitating Rapid Financial Transactions

A big draw of payday loan apps like Dave is how fast and simply they can get users the money they need. Their main job? Helping people out during tight money times. So, the aim is to build a tool that lets users get their money quickly without jumping through too many hoops.

To make this quick money feature work, a user’s request for funds, the needed checks, and the actual money move must be fast and smooth. This means designing a clear, easy-to-use way for users to ask for money. And behind the scenes? Things like checking the request, making the money move, and ensuring users get their cash need to be solid and swift.

For money making apps, the key is to get money to users quickly, safely, and transparently. Offering this fast, reliable service makes users happy and builds trust. So, these are important areas to focus on for anyone thinking about starting a cash advance app.

Breaking Down Dave’s Business Approach

Understanding the Revenue Generators: Membership Costs, Voluntary Contributions, and Processing Fees

In the financial landscape, apps like Dave have carved a unique niche, offering people financial support while adeptly managing their revenue streams to ensure sustainable operations. The mechanism through which the app generates revenue is paramount. The goal is to provide stellar services to its users while maintaining operational efficiency.

Among instant cash apps like Dave, Dave stands out with its well-rounded earning model. It’s got different ways to bring in cash, which means it’s got a steady flow of income. A big chunk of their earnings comes from membership costs. Users pay a small monthly fee and, in return, get to use all the cool financial tools Dave has.

Additionally, there’s the aspect of voluntary user payments. Contrasting several money borrowing apps like Dave, this platform allows users to contribute an amount they deem fit. Instead of fixed interests or additional charges for cash advances, users have a say in their contribution, making the app’s revenue more user-centric.

Furthermore, minor transactional fees play a role, particularly during fund transfers to bank accounts. Although minimal per transaction, these fees accumulate over time, enabling Dave to consistently refine its services for its user base.

Endurance: Dave’s Strategy to Stay Profitable and User-Centric Simultaneously

In the competitive fintech sector, longevity is of utmost importance. For any custom mobile app development company contemplating crafting a solution akin to Dave, it’s pivotal to balance providing unparalleled user services and ensuring financial viability. Dave achieves this by delivering top-notch financial tools underpinned by a robust revenue model.

But Dave’s success isn’t just about making money. It’s also about the real benefits they give to users. Dave builds user trust by giving them ways to handle money troubles without heavy fees. They offer tools to help people spend smartly, avoid spending too much, and find ways to make more money.

Want to Build Cash Advance App ?

Inquire about App Development

Key Elements to Integrate in Apps Like Dave

User Experience: Designing a User-Centric and Simple App Layout

For instant cash advance apps like Dave, the user experience (UX) is pivotal in defining user interactions and perceptions. Crafting a straightforward and inviting UX is more than just aesthetics; it’s about creating an environment where even the non-tech savvy feel at ease.

The primary display should offer users an overview of their financial status, upcoming payments, and an uncomplicated route to request cash advances. Seamless navigation with clearly defined icons and an uncluttered design ensures users can effortlessly tap into various features. Moreover, the process for cash advance requests should be linear with clear instructions, minimizing steps for a hassle-free experience.

Protective Protocols: Ensuring Confidentiality of User Information and Transactions

Handling financial transactions and personal data demands paramount security. When custom Android app development services embark on creating platforms akin to Dave, embedding stellar security measures becomes non-negotiable. This encompasses adopting end-to-end encryption, which fortifies data traversing the app against potential cyber threats.

User validation mechanisms must be rigorous, employing multi-factor authentication (MFA) to ascertain that user profiles and financial activities remain inaccessible to unauthorized entities. This might involve techniques like biometric recognition, OTPs, or other secure login methods, enhancing security layers.

Furthermore, the app should have protective features alerting users about unusual account movements. This allows users to swiftly halt transactions if they detect any suspicious activities, coupled with support resources in case of security concerns.

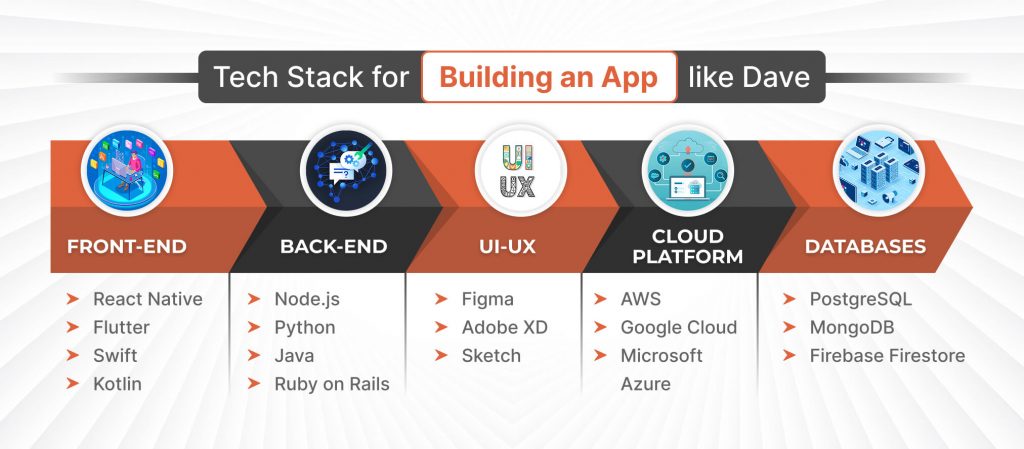

The Tech Foundation for Crafting Cash Advance Applications

Selecting the Ideal Technology Tools: Finalizing Coding Languages and Architectures

Embarking on the journey to develop money lending apps like Dave necessitates selecting optimal technological instruments. This encompasses finalizing the coding techniques, systems, and foundational tech elements delineating the app’s functionality, responsiveness, and quality of interaction. As custom iOS app development services tackle the creation of a cash advance platform, ensuring that their technological decisions pave the way for a resilient, expandable, and credible app is vital.

Coding languages like Swift for iOS and Kotlin for Android are often favored. The reasons? They offer stability, enjoy extensive community support, and synergize seamlessly with their platforms. When determining systems, databases, and pivotal tools, alignment with the app’s primary operations is imperative. This alignment facilitates instantaneous monetary transactions and efficient data management and delivers a premium user experience.

Core App Operations: Enabling Flawless Data Handling and Transactional Capabilities

The backbone of apps like Dave is fundamentally rooted in their core app operations. Here, critical functionalities come to life, such as user data management, financial transactions, and seamless interfacing with databases.

Data management entails the meticulous storage of user details, recording of financial transactions, and safeguarding of pivotal information, all while prioritizing speed and security. Utilizing databases known for data protection, consistency, and rapid retrievals becomes essential. This ensures real-time transaction handling and consistently updated user information.

Regarding financial transactions, exactitude is imperative. Within a fiscal platform, users anticipate prompt and accurate money transfers. This calls for integrating watertight payment systems, ensuring every transaction remains secure, and continuous user updates regarding their finances.

Understanding Rivals: Insights from Leading Apps

Surveying the Competition: A Glimpse into Brigit, Earnin, and MoneyLion

In the world of digital finance, especially when you talk about cash advance apps like Dave, knowing what the competition is up to is key. There are apps, for instance, Brigit, Earnin, and MoneyLion, each with its place in the market. They come with their own set of tools and answers for different financial situations people face.

- Brigit: This app offers a quick $250 without checking credit scores. It gives users a safety net against overdraft charges. If Brigit anticipates you might face a cash crunch before your next paycheck, it proactively offers advances.

- Earnin: With Earnin, users can instantly access their earned funds, eliminating the traditional payday wait. The app emphasizes obtaining advances devoid of hefty charges. If users are satisfied, they have the option to tip.

- MoneyLion: Beyond mere cash advances, MoneyLion is a comprehensive financial companion. Users can avail of advances up to $250, with perks like managed investing options, a reward program, and a no-fee account setup.

Distinct Features: What Sets Each App Apart?

Though these platforms might seemingly occupy the cash advance space, each has unique offerings distinguishing it from the rest. Consequently, users enjoy a plethora of options catering to diverse financial scenarios.

Brigit scores with its user-friendly interface, proactive cash advances, and supplementary tools. These features enable users to maintain financial stability and evade unexpected overdrafts.

Earnin’s appeal lies in its provision to access earnings as they accrue. Its optional tip model ensures users aren’t burdened with substantial charges. Additionally, they offer the Balance Shield to thwart potential overdrafts and a rewarding Cash Back Rewards initiative.

MoneyLion positions itself as an advanced portal and a holistic financial assistant. It empowers users with cash advances, an extensive suite of financial tools, investment avenues, and optimized spending strategies.

For those in the mobile application development consulting services, looking closely at competitors, spotting what makes each tick, and finding market gaps and chances are all super important. This isn’t just about knowing what users are after but about building an app that delivers, making sure it’s a hit in the app development market.

Legal and Moral Guidelines

Staying Within Financial Boundaries: Ensuring the App Meets Legal Norms

In financial apps, like lending apps like Dave, it’s vital to stick to well-known financial and legal rules. This isn’t just about ticking boxes for rules; it’s about gaining trust from users and keeping a solid reputation. On-demand app development companies in the USA must work hard to understand and follow many rules. They must protect user information, ensure all money matters are clear, and always respect user rights.

An app needs strong privacy measures to meet these financial rules. It’s a way to keep user information safe and private. Every money move in the app should be clear and follow financial laws. By doing this, users will always know about any possible fees.

Ethical Loan Practices: Advancing Strategies that Emphasize User’s Financial Well-being

Following laws is important, but it’s also key to have strong ethics, especially for financial apps. Apps should put users first, thinking about their financial health. This means clear, user-friendly solutions that users can trust for long.

Ethical lending means talking clearly with users about their money. Users need all the details, from the tiny print to extra fees. Plus, the app should help users make smart money choices. This might mean clear payback plans or tools to stop users from borrowing too much.

To sum up, lending apps need to respect both laws and ethics. They must understand and follow complex financial rules, keep user data safe, and always put the user’s money needs first. In an industry built on trust, meeting legal and ethical rules is necessary. Doing this shows the app is committed to following laws and being a reliable, user-first financial tool.

Promotion and User Growth Tactics

Understanding and Targeting the Ideal Users: Tailoring Precise Marketing Initiatives

In the dynamic world of financial applications, especially for apps like Cleo, identifying and reaching the perfect user segment is critical for fruitful marketing endeavors. By understanding your prospective users’ financial needs, behaviors, and preferences, you can design marketing strategies that resonate effectively.

For instance, if tech-savvy young adults and Gen Z are the main users of a cash app like Dave, marketing initiatives should zoom in on platforms they often visit. Leveraging social media campaigns, collaborating with influencers, and developing content that speaks to their financial challenges can boost the app’s presence and attract more users.

Furthermore, highlighting the app’s unique features and benefits can pique user curiosity and persuade them to take the next step.

User Engagement: Rolling Out Features and Incentives for Consistent App Interaction

Attracting users is just the starting point; retaining them demands thoughtful actions. Ensuring users stay committed, especially with apps like Dave, involves introducing compelling, user-friendly features and clever tactics that entice them to remain active.

Some effective strategies include:

- Rewards Programs: Launching initiatives that reward users for consistent app usage, referring pals, and other engagements.

- Personalized Offers: Using data-driven insights to curate special deals and financial solutions that cater to their distinct financial behaviors.

- Consistent Communication: Regularly connecting with users through financial insights, timely prompts, or updates that provide useful financial guidance or introduce new app features.

- Prompt Assistance: Guaranteeing users have access to swift, efficient help whenever needed, ensuring a seamless app experience.

In conclusion, promoting and retaining users in financial apps necessitates a deep understanding of user demographics, bespoke marketing endeavors, and strategies that draw in users and ensure their loyalty. Given the competitive landscape, the ability to tweak and refine these tactics in response to evolving user needs and market shifts is fundamental for sustained app success and stability.

Conclusion

Understanding what apps like Dave offer is key to making top-notch cash advance tools. You must watch the market’s top trending apps, add popular features, stress tight security and appealing layouts, and follow every legal and ethical rule. Studying competitors, smart marketing, engaging users, and addressing their issues can lead to a reliable, user-focused tool.

Building these tools goes beyond just coding skills. At its core, it’s about releasing an app that prioritizes users. It aims to support their financial health, give perfect service, and improve the user experience from start to finish.

Launching clear, reliable, and user-friendly cash advance tools is essential in today’s tech-driven world, where managing money online is routine. It’s more than just about money transfers. It’s about providing a platform that educates, helps, and supports users in financial planning. This means top security, user-friendliness, and promoting smart financial choices.

Your aim should be to design a cash advance app that focuses on user safety, financial health, and active involvement. A3logics can help you achieve it. Address problems directly, grab opportunities, and always think of the user. Maintain strong ethics and create a genuine, simple, and user-centered app.

FAQs

How Does Dave Safeguard User Information?

Data safety is paramount for apps like Dave, given the confidential nature of financial details. Dave relies on robust security mechanisms, like 256-bit encryption, ensuring user data remains intact. It abides by set standards and uses the secure sockets layer (SSL) to guarantee data remains encrypted during transmissions.

What’s Dave’s Income Strategy?

Apps like Dave tap into varied revenue channels. Dave, for instance, generates income through subscription fees, optional tips from its service user base, and transaction fees from its affiliated vendors. Such a varied earning strategy ensures consistent operations while rewarding its users.

How Can Apps Mix Ethical Lending and Profit?

To blend ethics with profit, apps must focus on their users’ financial wellness. This means clear pricing, sharing knowledge about money handling, and tools that guide users in making smart financial choices while keeping within legal and ethical limits.

What Do Users Want in Cash Advance Apps?

Mainly, users want fast access to money and strong security. They look for quick funds, fair charges, clear terms, strict security, and a platform that’s easy to use with financial tools.

What Should Developers Focus on for Smooth App Use?

For the best user experience, developers should prioritize simple designs, clear routes, and a user-first mindset. Fast sign-ups, quick money access, simple repayment options, and clear service and price details boost user happiness.

What Challenges Might Developers Encounter with Apps Like Dave?

When making apps like Dave, developers might face issues like setting up advanced data protection, understanding intricate financial rules, showcasing special app traits, and finding a spot in the crowded fintech space. Delivering top user services while staying profitable is another balancing act.