Technology and the digital revolution have long made our lives easier and saved us time and effort in a variety of ways. Payments are less stressful now than they were in the past since mobile wallets and payment apps have made the procedure easier. According to the Allied Market Research analysis, the mobile payment market was estimated to be worth over $9,097.06 billion by 2030. This indicates that a significant portion of the global population has faith in mobile payment platforms.

Digital payments are heavily dependent on P2P (Peer-to-Peer) payment apps due to their essential role in providing effortless money-sharing options for people. Individuals use these apps to make transactions that include bill payments, money transfers, and other service fees.

The P2P payment app development process is simple, yet it is a bit time-consuming. The following guide presents insights into vital app success factors and all the cost-related aspects of development. This guide provides complete support to business owners and entrepreneurs who want to launch their apps.

Table of Contents

Understanding P2P Payment and the Role of P2P Payment App Development

By leveraging bank accounts or card-based monetary value as the foundation of funds, a peer-to-peer payment app enables two users to send money to one another through in-app money transfers. Peers are directly connected by these user-friendly apps, facilitating quicker and easier transactions. All kinds of transactions are comfortable, whether it’s the small amount of $5 for coffee or the rent for an apartment.

Person-to-person payments facilitate smooth processing between the payer and the payee. The payer enters the precise amount they want to send as well as the payee’s phone number or unique UPI ID. Within seconds, the money is sent directly to the payee’s P2P account from the payer’s bank account, debit card, or credit card.

The application transfers the funds using a number of different techniques. Few peer payment programs, such as PayPal and Venmo, use ACH transfers to move funds between linked bank accounts. The precise way your employer deposits your pay into your bank account is through an ACH transfer. The Venmo account will show the transaction right away. Real-time payment networks like Zelle and Square Cash are used by other P2P payment systems. These apps allow for fast transactions, although there may be platform fees involved.

The payment is made from the payer’s account to the platform’s account, taking into account every scenario. The funds are subsequently sent to the payee’s account by the app. The procedure provides immediate assistance and takes place behind the scenes.

Here are some stats that you need to know about P2P payment:

- 30% of the population of the USA prefers to use P2P payment apps for mobile payment.

- More than 5,195 million users will be transacting with P2P payment apps in 2026.

- Peer-to-peer (P2P) payments are increasing significantly in the US, driven by tremendous growth from Zelle and Venmo.

- Today, more than 8 in 10 (84%) consumers say they’ve used a P2P service.

Who Needs to Invest in P2P Payment App Development?

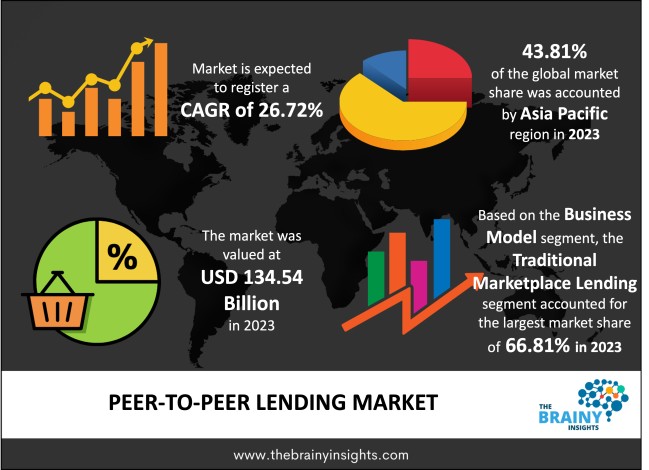

With the global peer-to-peer (P2P) lending market expected to increase at a CAGR of 26.72% from its 2023 valuation of $134.54 billion to $1.436 trillion by 2033. There is a wide scope for growth and the investment in P2P payment app development is beneficial for quite a lot of sectors. From large enterprises looking to further capitalization to individuals with a unique startup idea around digital payment, anyone can leverage benefits by smartly investing in it. As cashless transactions are gradually becoming a norm, those who can attain profit from it include;

Fintech Startups

Entrepreneurs and new businesses who want to revolutionize the financial sector can invest in P2P payment apps. By offering innovative solutions instead of traditional banking, they can quickly get a place in the smartphones of a larger society.

Small and Medium Enterprises (SMEs)

The SMEs can also invest in P2P payment mobile app development to minimize their dependency on the traditional banking system. These apps can offer greater customer convenience and indirectly retain them.

E-commerce Platforms

Online retail platforms can also smartly devise payment apps to minimize third-party integration. This can bag them a secondary profit scope and escape the need to pay to a third-party payment app for payment integration.

Large Corporations

Corporate giants or established organizations can diversify their business by investing in the development of their own P2P apps. This can further add value to their loyal customers and revenue model.

Freelances and Gig Economy Workers

Even independent individuals can choose a fast and cost-effective way of receiving payments and contract money through this. This is a convenient way for freelance artists and workers to get payments without waiting to encash a check.

Benefits of P2P Payment App Development

P2P payment app development has several benefits to offer both for businesses and consumers alike. For businesses, it can open up new revenue collection opportunities while offering individuals a secure and convenient banking experience. Below are some of the key benefits that you must know before heading onward;

Convenience

The best benefit of developing or using P2P apps is the convenience that you get from them. They offer instant money transfer facilities anytime, anywhere, at your will.

Operational and Cost Efficiency

P2P payment apps can give greater operational efficiency through faster, more reliable, and more efficient transaction facilities. Moreover, they are a cheaper alternative to traditional banking methods with zero or negligible transaction charges.

Security

With multi-factor authentication as well as end-to-end encryption facilities, these apps offer a sense of security to consumers. They can thus trust and rely with an open heart, which further enhances their popularity.

Global Reach

With a scalable P2P app with multi-currency support, you can make it globally recognizable and acceptable. Additionally, it can make international payments simple as well as cost-effective.

Real-Time Transactions

Lastly, one huge advantage of P2P payment apps is that they offer on-time transaction facilities. You don’t have to stand in a queue or wait for the bank to process your payment request here.

Apps that Inspire your P2P Payment App Development Idea

Before getting in touch with a P2P payment App development company for building your own custom P2P payment app, take a look at the ones already in the market. Considering their existing inspiring features and loopholes then you can smartly design your app.

Apple Pay

All Apple users, may it be iPhones, iPads, or even Apple Watch users, can send or receive money to each other using this. Even one can use it to pay for in-store purchases along with online ones.

Features

- Send money to friends, family, and known members using iMessage

- Faster, smoother, contactless payments with the NFC technology

- Secure authentication with Face ID, Touch ID, as well as passcode entry for payment

PayPal

PayPal is the most trustworthy P2P platform for US adults as it enjoys a massive 45% of the market share. Also with fast and secure cross-border payment facilities, it makes international money transfers easy.

Features

- Offers protection for buyers as well as sellers

- One of the oldest and most secure payment gateway with national and international money transfer facility

- Supports multiple payment methods for fund transactions

Zelle

To use Zelle, users need to create their account using the app or link it with their respective bank accounts. After setting up, they can easily send or receive money by simply entering their email ID or phone number. If you’re looking to develop an app like Zelle, you can create a seamless and secure digital payment solution for hassle-free transactions.

Features

- A completely free platform for money transfer

- Instant domestic bank transfers without any intermediary

- Integration with major banks and credit unions in the USA

Venmo

Venmo also offers free and secure payment facilities by linking to your bank account. However, for payments using credit cards, it will charge you a sharp 3% fee.

Features

- Allows users to split bills among them and share the transaction details

- Offers free instant bank transfers even for the smallest amounts

- Keep records of your previous transactions, categorizing and searching ease

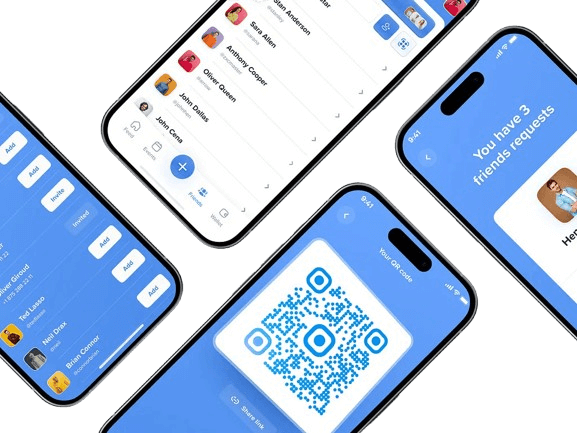

Must-have P2P Payment App Development Features

While developing a P2P Payment App, it must be ensured that the process is hassle-free, comfortable, and secure. An app that is designed well should be well structured and should include required P2P payment app development features to satisfy the user as well as business needs. Features mentioned below are those which you must give top priority while developing your P2P Payment Mobile App.

User Registration & Authentication

Easy sign-up processes must be available, and customers must be able to sign up using phone numbers, email addresses, or social media handles. Also, you must provide strong authentication options such as two-factor authentication (2FA) or biometric authentication (fingerprint/Face ID) for security and defence against unauthorized use.

Send and Receive Money

This core ability would allow users to receive and make real-time payments via their phone numbers if it is linked to their bank accounts. Receiving real-time payments will make the apps more convenient for customers. Also, providing an easy but well-verified bank account and card linking will make the fund transactions secure.

Transaction History and Statements

Users should be able to view the complete transaction history along with the date/time, amount, and sender/receiver manner. Downloading or exporting statements is a fantastic feature through which users can be able to trace their transactions.

Bank Account and Card Integration

The app should be capable of providing debit/credit card linking and account linking in a way that it can transfer money. The linking process should be convenient and easy for users so that they can easily transfer and receive money from their bank account.

Multi-Currency Support

Cross-border payments with multi-currency support enables the users to receive and send money across different currencies. The feature alone expands the application’s reach towards the international market by smoothly supporting cross-border payment requirements.

Request Money Functionality

Request your mobile app developers to integrate the request money feature in your P2P payment app. The feature is handy where bill splitting, payment raise, or debt pay-off takes place. With this feature, your app will become more cohesive.

QR Code Payment

QR Code Payment enables one to scan the recipient’s code and make payments on the spot. Additionally, contactless and instant QR payment avoids the entering of account information and is easy to attain anytime.

Push Notifications and Alerts

Push notifications provide users with ongoing updates on transaction status, payment requests, and security notifications. Instant payment notification of successful payment, received amount, or suspicion is, therefore, one of the most essential features of P2P apps.

Instant Payments

For a smooth user experience, the app must be able to make instant payments where money is transferred instantly without delay. This functionality makes these apps stand out for users who require monetary transfers to happen instantly.

Security Features

Security should be your top priority while developing a payment app like this. For ensuring maximum security you will be incorporating end-to-end encryptions, fraud detection algorithms, two-factor authentications, etc. Additional security checks for each transaction are also equally important here.

Expense Categorization

Cost categorization allows users to monitor and categorize their spending. With this feature, users can have transactions categorized automatically into categories like entertainment, dining, and utilities, providing users with useful insights into spending.

User Profile Management

Ownership and authority over one’s own personal information, profile images, and payment method is a hugely significant feature of P2P payment apps. It adds to the user experience by personalizing their payment preferences and lets them have a simple upkeep of their own money.

Peer-to-Peer Chat Functionality

Adding the peer-to-peer chat facility within the P2P payment app development gives the user the convenience of messaging via the app itself. They can use it for bargaining about payments, payment modes, or even giving others reminders.

Bill Splitting

The Bill Split feature enables one to split bills with buddies, e.g., dinner bills or party bills. Payment apps with this feature make it easy to proportionally split a regular amount and also demand money from other individuals.

Fee Management

Fee Disclosure enables the user to see whether there is a charge for a particular transaction, e.g., instant transfer or currency conversion. This simple transparency helps to keep the user’s confidence and satisfaction intact.

Contactless Payments

Contactless settlement of transactions through retail stores is being increasingly enabled. With the inclusion of NFC technology, shoppers can perform fast, secure transactions without inserting or swiping a card. This feature provides flexibility in addition to the improved user experience.

Transaction Limits & Controls

The limit of transactions enables users to manage expenditures and attain a sense of security through the issuance of limits both on a daily and monthly basis. The admins can also give some limits to certain kinds of transactions, for instance, cross-border transactions, for enhanced control and risk prevention.

Customer Support Integration

Effective customer care must be implemented in order to effectively address problems that can arise. Live chat support, email support, or AI-powered chatbots are effective in providing instant assistance regarding technical problems, payment problems, or account inquiries.

Cross-Platform Compatibility

A good P2P Payment App Development should be cross-platform, i.e., it should be deployable on multiple platforms such as iOS, Android, and web. It should be of a nature that allows the customer to use his/her account and make transactions through any platform, and that would make the app more popular and it would be utilized more.

Rewards/Referral Programs

Reward and referral schemes encourage user uptake and induce new users to the system. Offering incentives, rewards, cashback facilities as well as loyalty bonuses can motivate your existing users to spread your app link to their friends and family.

Steps for P2P Payment App Development

If you are gaining interest by now to contact a mobile app development company for making a unique P2P payment app for you, know the exact stages of development you will be going through. Here are the steps;

Research

Before anything, conduct thorough research on your own. Know what your competitors offer and how you can differ in your approach from them.

Define Features

Ponder on which features from the above you want in your P2P app. Also, brainstorm on what new and innovative features you can ask your app developer to include.

Front-end and Back-end Development

This is the actual step when all your planning will come into action. Make sure the front-end development seems easy to use while the back-end gets backed up by strong, secure, and scalable data storage capacity and coding efficiency.

Testing

Run multiple tests as soon as the beta version of your P2P app is ready. This can be technological tests as well as compatibility tests by selected members to fix last-minute glitches and issues.

Launching, Marketing, and Further Modifications

Launch your app both on iOS and Android for greater reach. Spend on effective marketing, while keeping on updating the app for better performance.

How Much Does It Cost to Develop a P2P Payment App?

It will roughly cost you around $50,000 to $250,000 to develop a P2P payment app. The difference between the minimum and maximum P2P payment app development cost is simply due to the variations of complexities in features, developing platform charges, and the hourly rates of the developing company.

Tech Stack for P2P Payment App

Choosing the exact compatible tech stack often single-handedly decides the success of an app. Here are the list of tech stacks that you may include;

| Tech Stacks | Purpose |

| Flutter, Kotlin, React Native, Swift | Front-end |

| Python, Java, Ruby on Rails, Node.js | Back-end |

| Firebase, MongoDB, PostgreSQL | Database |

| SSL/TLS encryption, OAuth2 | Security |

How Can A3Logics Help in P2P Payment App Development?

Among the top mobile app development services in the USA, A3Logics is a prominent name, whom you can trust for developing your P2P payment app. With more than two decades of experience in providing software solutions, they have the right set of knowledge and skills to meet your unique demands. So, whether you want a custom P2P payment app or want its seamless integration into your existing system, feel free to take the help of the experts.

Conclusion

P2P networks are probably more dependable and speedier. In terms of installation and upkeep, they are also easy and reasonably priced. Developers can benefit from P2P networks in a safe and dependable way with the aid of Blockchain technology. Furthermore, this advanced security contributes to increased application user trust.

Some online marketplaces accept payments made using blockchain technology, enabling users to buy and sell goods as well as buy food, home goods, and other commodities. With Blockchain Development Services, businesses can leverage secure and transparent payment solutions. When it comes to using blockchain technology for payment transactions and potentially innovative and novel applications, the possibilities are endless.

Peer-to-peer payment app development is becoming more and more popular among both people and financial institutions. This app is a powerful and dependable money transfer solution that can grow your business by creating a new revenue stream.