Are you thinking about investing in real estate tokenization? It has certainly changed the way the industry can move ahead in terms of managing their assets and also investing in the same as well. Not only this, it will help you have an innovative approach that will convert ownership rights into digital tokens. This will not only enhance transparency and liquidity but also pave the way for more transparency.

So, if you are thinking about working on the ins and outs of the world of real estate tokenization then this post is here to help you with the same. Below we are going to discuss all the aspects in detail in terms of its types of tokens, benefits, and even limitations. So, let’s dive and get started with the same.

Table of Contents

What is Real Estate Tokenization?

Real Estate Tokenization is the process of creating digital tokens that represent ownership stakes in real estate assets. These tokens can be either fungible or non-fungible, depending on the nature of the property and the desired level of ownership. For instance, multiple investors can use fungible tokens for fractional ownership, allowing them to own parts of a single property, while people use non-fungible tokens (NFTs) to represent unique properties or assets.

How Does Real Estate Tokenization Work?

The process typically begins when a property owner or developer decides to tokenize their asset. To move forward, they partner with a blockchain real estate tokenization platform, which helps create digital tokens representing ownership shares. Once the tokens are created, the platform then lists them for sale, thereby allowing investors to purchase them using cryptocurrencies. Moreover, the use of blockchain technology ensures that all transactions remain secure, transparent, and immutable throughout the process.

- Asset Selection: Property owners choose assets for tokenization, considering market value and legal compliance.

- Legal Structure: Organizations may create a Special Purpose Vehicle (SPV) to isolate financial risks.

- Token Creation: Developers create tokens to represent fractional ownership using blockchain platforms like Ethereum or Polygon.

- Smart Contracts: These automate transactions, ensuring security and regulatory compliance.

- Token Listing: Tokens are listed on digital marketplaces for purchase and trading.

- Investor Participation: Investors buy tokens using cryptocurrencies, gaining fractional ownership.

- Ongoing Management: Includes profit distribution and compliance monitoring.

Tokenized Real Estate: Market Overview

The market for tokenized real estate is rapidly expanding, offering new investment opportunities and increasing liquidity in traditionally illiquid assets. As of recent years, the market cap of tokenized real estate has shown significant growth, indicating a strong interest in this innovative investment vehicle.

- The global Real Estate Tokenization Market reached a valuation of approximately $3.5 billion in 2024 and is projected to grow to $19.4 billion by 2033.

- By 2030, the global market for tokenized real estate is expected to reach up to $3 trillion, representing about 15% of all real estate under management.

- 12% of real estate firms globally were using tokenization solutions, while another 46% were testing pilot programs

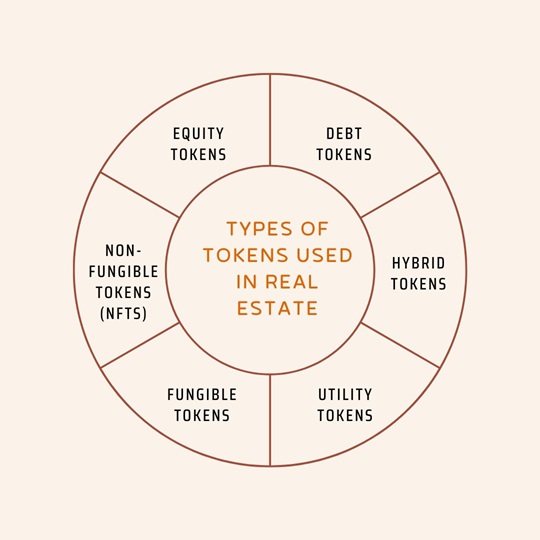

Tokenization of Real Estate – Types of Tokens Used in Real Estate

Below, we list some of the different types of tokens you can use in the real estate world to maximize its potential.

Equity Tokens

These tokens represent ownership shares in properties or projects, providing investors with claims on future profits or dividends. This allows for fractional ownership and potential long-term appreciation in property value. Investors benefit from capital gains and dividend distributions.

Debt Tokens

Debt tokens essentially function as loans to property developers or owners, offering investors regular interest payments without granting ownership rights. These tokens typically generate a stable income stream and are secured by the property itself.

Hybrid Tokens

Hybrid tokens combine elements of equity and debt tokens, offering both ownership shares and regular income streams. This hybrid approach allows investors to benefit from both capital appreciation and regular interest payments.

Utility Tokens

These tokens grant access to specific services or amenities related to the property, such as parking or gym memberships. These tokens are often used in commercial or residential complexes to enhance user experience.

Fungible Tokens

Fungible tokens are interchangeable tokens used for fractional ownership, allowing multiple investors to own parts of a property. This facilitates liquidity and ease of trading among investors, as each token represents an identical share.

Non-Fungible Tokens (NFTs)

NFTs represent unique tokens representing entire properties or assets, not interchangeable with others. NFTs are used for distinct or high-value properties, providing exclusive ownership rights to the buyer.

Key Benefits of Blockchain Real Estate Tokenization

There are several benefits that come along with the investment in blockchain for real estate tokenization. Check it out and get started with the same right away.

- Increased Liquidity: Tokens can be traded on secondary markets, making it easier to buy and sell real estate assets.

- Fractional Ownership: Investors can own fractions of properties, reducing the financial barrier to entry.

- Transparency & Security: Blockchain technology ensures that transactions are transparent and secure.

- Global Investment Opportunities: Investors worldwide can participate in real estate markets.

- Lower Investment Thresholds: Smaller investments are possible due to fractional ownership.

- Lower Transaction Costs: Traditional intermediaries are reduced, lowering costs.

- Asset Class Diversification: Investors can diversify their portfolios with real estate assets.

Exploring the Limitations of Tokenized Real Estate

Despite its benefits, tokenized real estate faces several challenges:

Regulatory Uncertainty

Regulatory uncertainty is a significant challenge for tokenized real estate. Clear and consistent regulations are still evolving, leading to confusion and compliance issues. Different jurisdictions have varying rules, making it difficult for issuers and investors to navigate the legal landscape. This uncertainty can lead to legal risks and penalties if not managed properly.

Blockchain Complexity

Blockchain complexity requires specialized technical knowledge to navigate effectively. Understanding blockchain platforms and smart contracts is essential for successful tokenization. However, this complexity can deter potential participants who lack the necessary expertise.

Cybersecurity Threats

Cybersecurity threats pose significant risks to tokenized real estate. Digital transactions are vulnerable to hacking and data breaches, which can compromise investor data and assets. Implementing robust security measures is crucial to mitigate these risks.

Integration with Existing Systems

Integrating tokenized real estate with traditional systems is challenging. Existing infrastructure may not be compatible with blockchain technology, requiring significant updates or new systems to ensure seamless integration.

Cross-Border Issues

Cross-border transactions in tokenized real estate face legal complexities. Different jurisdictions have varying laws and regulations, complicating international transactions and requiring careful legal analysis to ensure compliance.

Smart Contract Execution

Smart contract execution is critical for tokenized real estate. Well-written smart contracts are essential to ensure the integrity and automation of transactions. However, errors or vulnerabilities in these contracts can lead to significant issues, including financial losses and legal disputes.

Legal and Regulatory Aspects of Tokenizing Real Estate

It is important that you take complete care of the legal and regulatory aspects of the tokenization real estate aspect. To make it easy for you below we highlight all about the same in detail. Check it out.

- Securities Regulations: Tokens may be classified as securities, requiring compliance with relevant laws.

- Tax Implications: Tax laws vary by jurisdiction and can impact tokenized real estate investments.

- AML Compliance: Anti-money laundering regulations apply to token sales.

- Investor Accreditation Requirements: Some jurisdictions require investors to meet specific criteria.

- Enforceability of Smart Contracts: Legal enforceability of smart contracts can vary.

How to Get Started with Real Estate Tokenization?

Below are the essential ways that you need to consider working on to get started with the real estate tokenization. Check it out.

- Choose a Property: Select a property suitable for tokenization.

- Consult Legal Experts: Ensure compliance with legal and regulatory requirements.

- Select a Tokenization Platform: Partner with a reputable platform for token creation and distribution.

- Create and Distribute Tokens: List tokens for sale on the chosen platform.

- Market and Sell Tokens: Promote the token offering to attract investors.

Hopefully this will make it easy for you to get started with the real estate tokenization process and below we highlight how blockchain can make a difference.

The Role of Blockchain in Real Estate Tokenization

Blockchain technology is the backbone of blockchain real estate tokenization, providing a secure, transparent, and immutable ledger for transactions. It enables the creation and management of digital tokens, ensuring that ownership rights are accurately represented and transferred. Companies specializing in Blockchain Consulting Services and Blockchain Development Companies can help navigate this technology. Here are some key benefits:

- Blockchain ensures that transactions are tamper-proof, reducing fraud risks and providing a secure environment for real estate investments.

- Automates processes, reducing reliance on intermediaries and lowering transaction costs through smart contracts.

- Enables global investors to participate in real estate markets, increasing liquidity and diversifying investment portfolios.

- Provides a transparent ledger for all transactions, enhancing trust among investors and stakeholders.

So, these are the role of blockchain technology in the world of real estate tokenization. It is important that you connect with the experts in the business to get complete clarity on how you make the most out of it and make the experience hassle-free. To make it more clear below we discuss how tokenization is going to change real estate investment and then why it is important for you to connect with the experts in the business.

How Tokenization is Changing Real Estate Investment?

Tokenization is transforming the real estate investment landscape by making it more accessible, liquid, and efficient. It allows for fractional ownership, reduces transaction costs, and opens up global investment opportunities. For developers, it offers a new way to raise capital without traditional intermediaries, similar to how a Smart Contract Development Company can streamline processes.

- Enables small investors to participate in high-value real estate markets through fractional ownership.

- Allows for quick buying and selling of tokens on blockchain platforms, improving asset liquidity.

- Opens up real estate investment opportunities to a global pool of investors, diversifying portfolios.

- Minimizes transaction costs by automating processes and eliminating intermediaries.

- Ensures transparent and secure transactions through blockchain technology

These aspects show how tokenization has taken real estate investment by storm. It is important that you have the right experts by your side to help you make the most out of it. As the future of the respective domain is quite strong, below we discuss all the respective trends that can come along in the respective industry.

Future of Real Estate Tokenization

The future of Real Estate Tokenization looks promising, with potential for significant growth as more investors and developers adopt this technology. As regulatory frameworks become clearer and blockchain technology advances, we can expect to see increased adoption and innovation in this space.

- Tokenization allows for the quick buying and selling of real estate assets, reducing the traditional long wait times.

- Investors worldwide can participate in real estate markets, fostering a diverse and global investor base.

- Enables investors to purchase fractions of properties, making high-value assets more accessible.

- Blockchain technology ensures secure and transparent transactions, reducing fraud risks.

- Automates processes, reducing the need for intermediaries and associated costs.

So, these are the future trends that can make a difference in the world of real estate tokenization. But, to make the most out of it, you must have the best and most reliable blockchain development company in the world to get all the support you need. So, do not hesitate to connect with the professionals now and give yourself the best chance to succeed in the field of real estate tokenization.

A3Logics: Your Partner in Real Estate Tokenization Development

When you are looking for a reliable expert to help you blockchain consulting services, then you can connect with the A3Logics. We are here to help you with all the assistance in terms of navigating the complexities of real estate tokenization development. There are many more reasons that make us one of the best names in the business when it comes to providing expertise in blockchain integration and smart contract development. Check it out.

- We provide seamless integration of blockchain technology to enhance security and transparency in real estate transactions.

- Our team specializes in crafting robust smart contracts to automate processes and ensure compliance with regulatory requirements.

- We offer tailored tokenization platforms that cater to specific business needs, ensuring flexibility and scalability.

- We design our solutions to meet evolving regulatory standards, ensuring legal and financial security for both investors and property owners.

- We facilitate global investment opportunities by creating platforms that connect investors worldwide with tokenized real estate assets.

These aspects show how you can make the most out of real estate tokenization. It is important that you connect with the best in our team and experience the difference!

Final Take

Hopefully you are clear about how real estate tokenization has become one of the major breakthroughs in real estate investment. It is important that you make use of the respective technology with blockchain facilities as it helps you with increased liquidity and even fractal ownership. Not only this, you also gain access to global investment opportunities when you invest in real estate tokenization.

But, the first essential step you need to take is to connect with the experts at A3Logics, who will guide you through real estate tokenization development. They understand every aspect of the process and ensure its delivery in a way that overcomes all the mentioned challenges while providing you with the associated benefits. Good luck!