The insurance sector is growing at a great pace and all thanks to infusion of the different technologies in the respective sector. But, the biggest difference making factor has been in RPA in insurance. It has completely transformed the way this industry works and provides efficiency. This is why the demand for the RPA in insurance is growing as it leads to excellent customer experience.

To make it more clear, we are going to discuss in detail about the different use cases of RPA in the insurance industry and then proceed ahead with its role and benefits. Today, we all know how the insurance sector is one of the most complicated processes to manage. It brings strict regulations and a huge volume of data. So, when you get RPA in the insurance industry, it helps you have most of the tasks automated that enhances decision making and compliance.

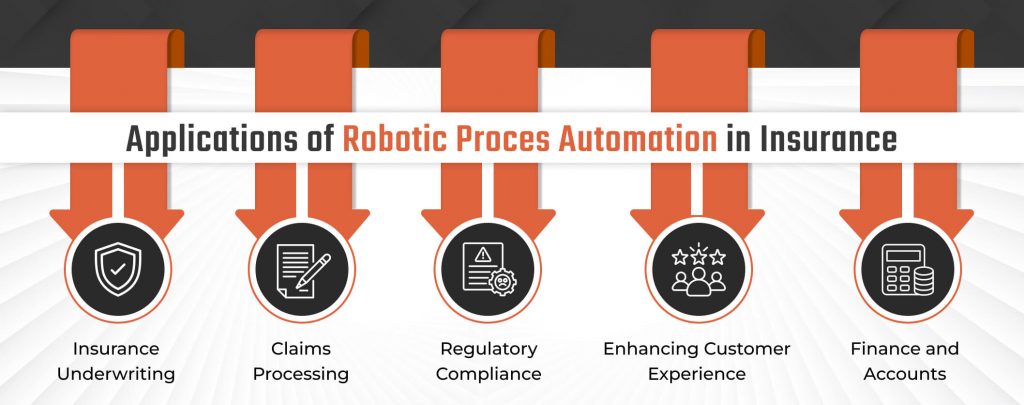

If you are thinking about how the respective sector is going to make the most out of inclusion of RPA, then below we are going to have it all covered about it.

Table of Contents

Role of RPA In Insurance Industry

The demand for RPA in insurance industry is growing as it completely automates repetitive tasks. Not only this, as the tasks are automated, it helps in boosting productivity and also curbs maximum errors. So, it leads to highly quality deliveries that leads to more work.

This shows how you must not hesitate and consider investing in RPA for the insurance sector as it makes it possible for your employees to take care of high-value tasks that include customer support and proper decision making. In this way all the productivity and customer delivery is improved.

To make it more clear below we are going to highlight the role of RPA in the insurance sector through essential numbers.

- The global RPA in the insurance market was valued at $98.6 million in 2021 and is projected to reach $1.2 billion by 2031.

- Up to 37% of tasks in the insurance industry can be automated, with RPA capable of processing claims up to 75% faster than humans.

- By 2025, automation is expected to impact up to 25% of insurance processes.

- RPA can decrease data processing time by 34%, significantly enhancing operational efficiency.

- The expected ROI from RPA adoption can range from 30% to 200% in the first year, with potential long-term ROI of up to 300%.

So, these are the numbers that show how RPA in insurance is going to be a game changer for the respective industry. This has led to the high demand of RPA in the insurance industry that can help them make the most out of their potential and eventually enhance operational efficiency significantly. To make it more clear, below we specify some of the essential benefits that come along with the respective investment robotic process automation in insurance industry.

Key Benefits of RPA in Insurance Industry

Now again we are in the primary section of the post where we are going to address the key benefits of RPA in the insurance industry to make it easy for you to proceed ahead.

- Cost Reduction: By automating manual tasks, insurers can significantly reduce operational costs and minimize errors.

- Improved Efficiency: RPA accelerates processes like claims processing and underwriting, leading to faster turnaround times and enhanced customer experience.

- Enhanced Compliance: RPA ensures adherence to regulatory requirements by automating compliance reporting and data validation, reducing the risk of fines and reputational damage.

- Data Analysis: RPA can process large volumes of data quickly, providing valuable insights that inform business decisions.

So, these are the essential benefits that come along with the investment of insurance automation. But, there is a lot more to it that comes along with the infusion of intelligent automation in the insurance sector. Below we have it all covered for you.

Business Benefits from Intelligent Automation in Insurance

The above specified benefits show how RPA can work for your insurance sector. Now lets understand how intelligent automation, including RPA in Insurance Industry can bring you several business benefits.

- Competitive Advantage: By automating routine tasks, insurers can focus on innovation and personalized services, setting them apart from competitors.

- Scalability: RPA allows insurers to handle increased volumes of data and transactions without proportional increases in staff, making it easier to scale operations.

- Customer Satisfaction: Faster processing times and reduced errors lead to higher customer satisfaction and loyalty.

So, these are the primary benefits that businesses will be making out of investment in RPA in insurance industry. If you are still thinking about how, then below we are going to discuss the different use cases of RPA in insurance industry to give you complete clarity and help you move ahead without any hesitation.

10 Use Cases Of RPA in Insurance Industry

Now we are in the primary section of the post where we are going to discuss the different use cases in detail to help you with all the clarity.

Claims Processing and Management

RPA in Insurance significantly enhances claims processing by automating tasks such as data extraction from claims forms, verification of claim details, and settlement processing. This automation reduces manual effort, speeds up claim resolution, and improves customer satisfaction. RPA can integrate data from various sources, automate claims verification, and identify potential fraudulent claims. By streamlining these processes, insurers can provide faster and more accurate claim settlements, leading to higher customer satisfaction and loyalty.

Policy Underwriting

RPA assists underwriters by automating data entry, analyzing customer histories, and evaluating risk factors. This streamlines the underwriting process, allowing for faster policy issuance and more accurate risk assessments. RPA can gather data from multiple sources, populate fields in internal systems, and generate reports to support underwriting decisions. By automating these tasks, underwriters can focus on complex risk evaluations and strategic decision-making, improving the overall efficiency and accuracy of the underwriting process.

Customer Onboarding

RPA can automate the collection and verification of customer data, ensuring seamless onboarding processes. This includes background checks and compliance checks, reducing the time and effort required for new customer acquisition. RPA can integrate with various systems to validate customer information, check for compliance with regulatory requirements, and update customer records. By automating these tasks, insurers can enhance customer experience by providing faster and more efficient onboarding, while also ensuring that all necessary checks are completed accurately and securely.

Policy Issuance and Administration

RPA automates policy issuance by filling out forms, updating policy details, and managing policy renewals. This reduces administrative burdens and ensures accurate policy records. RPA can navigate through different systems to gather necessary information, automate form filling, and update policy databases. By streamlining policy issuance and administration, insurers can reduce errors, improve efficiency, and enhance customer satisfaction by providing timely and accurate policy documents.

Customer Service and Support

RPA can handle routine customer inquiries, provide policy information, and assist with basic support tasks. This frees human customer service agents to focus on complex issues and personalized support. RPA can be integrated with chatbots or virtual assistants to provide immediate responses to common queries, such as policy status or claims updates. By automating routine customer service tasks, insurers can improve response times, reduce operational costs, and enhance overall customer experience.

Regulatory Compliance and Reporting

RPA ensures compliance with regulatory requirements by automating data validation, generating compliance reports, and managing security operations. This reduces the risk of non-compliance and associated penalties. RPA can automate tasks such as customer data validations, compliance report generation, and security audits, ensuring that all processes adhere to regulatory standards. By leveraging RPA for compliance, insurers can minimize the risk of errors and maintain a high level of regulatory adherence.

Policyholder Communication

RPA can automate communication with policyholders, including sending renewal notices, policy updates, and other relevant information. This ensures timely and consistent communication, improving customer engagement. RPA can integrate with CRM systems to personalize communications based on policyholder preferences and history. By automating routine communications, insurers can enhance customer satisfaction, reduce operational costs, and improve policy retention rates.

Policy Endorsement Processing

RPA streamlines the processing of policy endorsements by automating data updates and ensuring that changes are accurately reflected across all systems. RPA can navigate through different policy administration systems to update policy details, manage endorsements, and ensure data consistency. By automating these tasks, insurers can reduce manual errors, improve efficiency, and enhance customer satisfaction by providing accurate and timely policy updates.

Actuarial Data Processing

RPA assists in processing large volumes of actuarial data, providing insights that inform risk assessments and policy pricing strategies. RPA can automate data extraction from various sources, perform data validation, and assist in data analysis. By leveraging RPA for actuarial data processing, insurers can improve the accuracy and speed of risk assessments, enabling more informed decision-making and competitive pricing strategies.

Compliance with GDPR and Data Protection Laws

RPA helps ensure compliance with data protection laws like GDPR by automating data handling processes, ensuring data privacy, and managing consent records. RPA can automate tasks such as data validation, consent tracking, and data deletion, ensuring that all data processing activities comply with GDPR requirements. By leveraging RPA for GDPR compliance, insurers can minimize the risk of non-compliance, protect customer data, and maintain trust in their brand.

Challenges of RPA in Insurance Industry

While RPA in Insurance Industry offers numerous benefits, there are challenges to consider:

Integration Complexity

Integrating RPA in Insurance Industry with existing systems can be complex and requires careful planning. Many insurance companies still rely on legacy systems, which may not be compatible with modern RPA solutions. This integration challenge necessitates significant modifications to the IT infrastructure, which can be costly and time-consuming. However, future RPA solutions are focusing on seamless integration with legacy systems, allowing insurers to leverage their current infrastructure while automating processes. Effective integration planning and collaboration with experienced RPA implementation partners are crucial to overcome these challenges and ensure smooth automation.

Change Management

Change management is a significant challenge when implementing RPA in Insurance Industry. Employees may resist automation due to concerns about job security, fearing that RPA could replace their roles. This resistance can hinder the successful adoption of RPA. To address this, insurers should focus on effective communication and training, highlighting how RPA can enhance employee productivity by automating routine tasks and allowing them to focus on high-value activities. By engaging employees in the automation process and demonstrating its benefits, insurers can reduce resistance and foster a more supportive environment for RPA adoption.

Data Quality

The effectiveness of RPA in Insurance Industry is heavily dependent on the quality of the data it processes. Poor data quality can lead to errors and inefficiencies, undermining the benefits of automation. Insurers must ensure that data is accurate, complete, and consistent before automating processes. Implementing robust data validation and cleansing processes can help mitigate these risks. Additionally, ongoing monitoring and maintenance of data quality are essential to ensure that RPA continues to operate effectively and deliver the expected benefits. By prioritizing data quality, insurers can maximize the efficiency and accuracy of their RPA solutions.

So, these are the challenges that come along with the investment in use cases in insurance industry. But, to beat the same, it is important that you connect with the best RPA development services provider in the business. If you are thinking how, then the below section will help you with all the clarity.

Choosing the Best RPA Consulting Service: Key Factors to Consider

When selecting an RPA consulting service or an Enterprise RPA development company, consider the following factors:

- Experience in Insurance: Look for a provider with specific experience in the insurance sector.

- Technical Expertise: Ensure they have the technical capabilities to integrate RPA with your existing systems.

- Scalability: Choose a provider that can scale with your business needs.

So, these are the aspects that you need to check while looking for the top name in the business who can help you with all the benefits of RPA as specified above. This is where A3Logics can be the best option to consider as you get highly skilled professionals at service.