Tax filing apps are essential tools that can simplify the tax filing process, and offer speed efficiency, accuracy, and savings. They improve the overall tax filing process. All this is done by providing user-friendly interfaces as well as secure storage of documents. Also, they offer actual-time updates regarding the most recent tax laws.

A notable example of a reputable tax preparation software is TurboTax. It has come up with the best tax preparation process. This platform includes intuitive interface, rapid updates, and secure document storage capabilities. TurboTax is available at any place and provides comprehensive financial planning information. It also underscores the significance of this financial app.

Apart from financial planning and educational material, the application is a remarkable example of a strict adherence to security standards. It is a crucial factor that builds confidence in the users. TurboTax is therefore an efficient, reliable, and innovative tool. It plays an essential role in helping both businesses and individuals handle their tax obligations.

The enticement to these advantages has drawn the attention of stakeholders or investors. Many are deciding to invest in the development of tax filing apps such as TurboTax. But the issue is in estimating free tax filing apps development costs. The price of developing an app for tax preparation such as TurboTax covers a variety of aspects. This includes the complexity of features, the platform chosen as well as the technological stacks. It also includes complexity of design and much more.

This post provides in-depth details about TurboTax’s tax preparation app development expenses and features. Also, all the aspects that must be included as well as monetization strategies and other strategies to help you make the right decision. Before we dive into these specifics we’ll quickly examine the ways in which TurboTax application actually functions.

Table of Contents

What is TurboTax?

Before we get into the details of TurboTax Let’s address the question: What exactly is a tax preparation software? Tax preparation software permits users to prepare their own tax returns on the internet. Since taxes in several countries are quite complex, SaaS solutions for tax preparation are growing in popularity. TurboTax is one of them.

TurboTax is an application that is software as a Service (SaaS) software for tax preparation which allows US as well as Canadian users to file taxes electronically. It earns revenue from subscriptions to premium software and the expertise of specialists. The base app is accessible for download and all thanks to custom app development services.

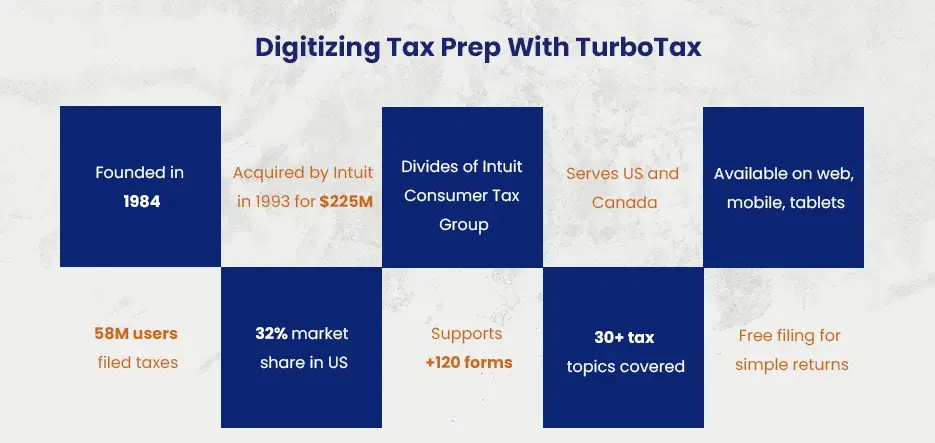

TurboTax lets users make tax returns within Canada and in the US. The tax-management software was developed by TurboTax in 1984. Intuit bought the software in 1993. As part of the acquisition, Intuit paid $225 million for TurboTax and its products.

TurboTax is a division of the Intuit Consumer Tax Group based in San Diego, California (Intuit is headquartered at Mountain View, California). It provides tax-preparation tools, including for investors, employees, landlords of rental properties, freelancers and small-scale business owners.

TurboTax provides a variety of free tools to help customers prepare their tax returns. They include calculators and reform information along with tips, as well as videos. TurboTax can be downloaded on CD and on the website of the company and also on mobile phone and tablet applications that are available on Android as well as iOS. The CD lets users complete their tax returns on their own, however, top apps in the USA like TurboTax require Internet access. At present, TurboTax is one of the top tax management applications for tax management in North America.

How Does a Tax Preparation App Like TurboTax Work?

Tax preparation apps such as TurboTax intend to streamline the process by providing a simple experience as opposed to the traditional method. Here’s a brief outline of their overall process as suggested by the top custom mobile app development company:

First step: User input financial information through interviews or on forms to allow for greater flexibility.

Step 2. The app functions in the role of a virtual helper providing users with relevant deducts as well as credits.

Step 3.The application calculates taxes automatically with advanced algorithms in order to maximize savings.

Fourth step: The user reviews, makes adjustments, and upload directly to the application for ease of use.

Which is the TurboTax Business Model?

TurboTax earns profits by charging the premium version of their software, as and by providing assistance from experts. The software runs on a freemium basis, meaning that the majority of its features are available for completely free. There are two primary reasons to this:

- Free functionality can encourage users to choose the premium version in order to gain access to more features in software for tax.

- The free option lets users become familiar with the software in order that, if their tax situation gets more complicated they have already had experience working with TurboTax.

- Alongside the no-cost version Three premium versions are available to purchase: Deluxe, Premier, and Self-Employed.

The customers pay a one-time cost for access to each of the 3 plans that are paid. Prices vary from $60 to $120. The cost is paid each time you file, so clients must be able to pay the cost each season of filing. Premium versions offer sophisticated features like reporting the investment income earned from stocks, bonds, cryptocurrency, bonds, and other assets.

If an individual requires the assistance of a professional and requires assistance, they can contact one of TurboTax’s experts. There are three different versions available for TurboTax that provide different levels of accessibility to experts. The TurboTax premium version features the option of speaking with a tax professional during the tax filing process, a graphical guide, and finally a review of tax filings.

Benefits of Building a Tax Preparation App Like TurboTax

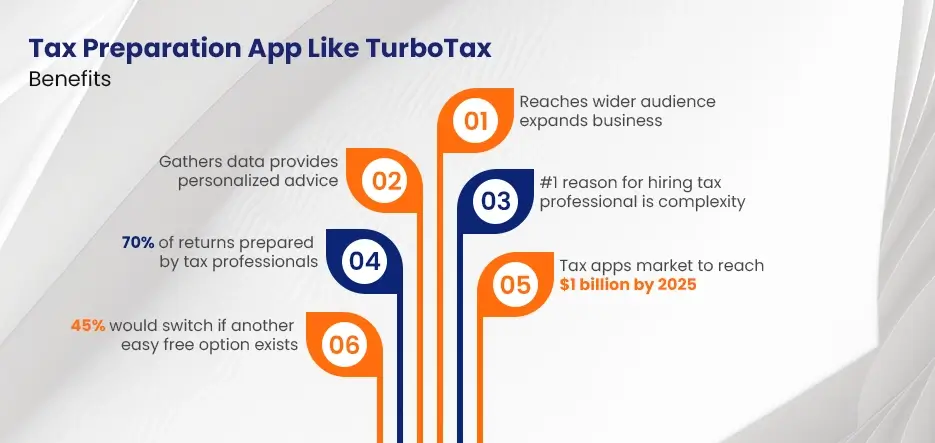

The demand for user-friendly, best app for filing taxes is on the rise. Making a tax-preparation app such as TurboTax will provide an array of advantages in today’s highly competitive world of fintech. There are a few benefits:

- A tax preparation application could make tax filing more accessible by providing a user-friendly system for people to handle their tax affairs on their own, reducing the cost of the cost of professional tax preparation.

- As compared to conventional methods, Tax apps provide a seamless and user-friendly experience. It guides users through the tax filing process by providing clear instructions and step-by step aid.

- Tax preparation software can automate repetitive tasks such as entering data and calculating which could reduce mistakes and streamlining the whole tax filing process.

- Tax apps can be used to be more accessible with traditional tax solutions, providing its functions to a greater audience and possibly expanding your business in a way that is effective.

- Tax apps are able to gather and analyse data from users in the course of time, providing specific tax strategies and personalized advice depending on the individual’s requirements and financial circumstances.

Steps to Create an App Like TurboTax

Development of tax preparation apps like TurboTax requires a number of steps to create a strong and user-friendly application. Here are the important steps to follow:

Market Research

It’s essential to conduct in-depth market research in the initial stages of tax application development. This requires understanding the target market to get a thorough understanding of their specific needs as well as their preferences and attitudes regarding tax preparation.

An extensive analysis of the competition for the tax preparation apps such as TurboTax is crucial to know the trends in the market and to identify market gaps and how the developers can modify the application.

Define Core Features and Functionalities

The next crucial step to build an application like TurboTax is to define functionalities and features that meet customer demands along with industry standards. Important features that ensure complete tax preparation include stringent error-checking procedures and secure document storage tax filing capabilities that can be electronically filed, precise computation algorithms and effortless data entry.

The app development outsourcing team that you have hired to develop your app will need to come up with new ideas to set the application apart from the market. Monitoring and enhancing more advanced features make the application distinctive and caters to the needs of its users. This might involve the use of cutting-edge technology, such as chatbots using artificial intelligence to offer specific tax advice, customized financial information and user-friendly interfaces.

Choose the Right Technology Stack

To create an application like TurboTax, it is essential to choose the appropriate technology stack. Top mobile app development companies in the USA should select carefully frameworks, programming languages, and databases that will satisfy the specific requirements of the app. This involves evaluating the app’s capacity to scale, ensuring that it is able to handle increasing demands on data and users. Security is essential and the chosen stack should have strong security features to protect confidential financial data.

It is also crucial to consider compatibility with platforms since the technology employed must permit the app to run on a variety of platforms, including internet, iOS, and Android. With these components in mind, mobile app development agencies can build an effective tax preparation app that is able to meet the stringent requirements of performance as well as security in addition to cross-platform access.

Ready to Transform your Tax Filing App Idea into Reality?

Design a User-Friendly Interface

Making sure that users have a smooth user experience is vital to the success of any tax preparation software. In order to create a seamless user experience, it demands a visually appealing and user-friendly design. With increasing numbers of users utilizing apps on different devices, it’s essential to focus on mobile responsiveness.

Through the implementation of user-centric design principles that facilitate navigation and a user-friendly UI/UX developers can enhance the overall user-friendliness and experience of the application which will result in greater engagement and retention of users.

Initiate Development Process

In the TurboTax app development stage where the work on coding gets more intense on two major aspects. First, complex coding is used in the backend systems in order to allow seamless computations, error-checking as well as data entry. This involves developing algorithms that can perform precise calculations as well as creating reliable error handling systems.

Then, frontend coding by an on demand app development company is focused on enhancing the user experience by making mobile and cross-platform accessibility an uppermost priority. When you hire mobile app developers to develop features, they will automatically update according to changes in tax codes, creating the capability of real-time adjustments.

Integration with Tax Regulations and Compliances

To create an application like TurboTax it is essential to adhere to tax regulations. The team responsible for developing the app ensures that the accuracy of all calculations is maintained by monitoring the continuously evolving tax laws and rules. The features have been carefully developed to enable automatic updates that automatically adjust to any changes in tax regulations, and keep the app up-to-date and in compliance.

The team of developers also address the terms of service and privacy policies, which focuses on legal issues. The team adheres to industry standards and the laws governing data protection, and present an app that is safe and reliable for the users.

Ensure Meticulous Testing

In order to ensure smooth operation of the software for tax preparation A careful approach is adopted when testing and during the quality assurance. By conducting a thorough testing procedure, it is possible to identify bugs and imperfections are discovered and rectified with the help of QA experts, which ensures an error-free and seamless user experience. Additionally, the usability test is vital to verify the usability and ease of use of the app’s layout.

A key element is the implementation of security testing for tax filing apps. It aims to secure user information and protect the app’s security against vulnerabilities. This thorough testing process emphasizes its security as well as the user’s experience, as well as practical aspects, making it an extremely reliable and powerful tool for tax planning.

Launch Your App

When your tax preparation app is tested and approved it is now possible to begin to launch your application on either the Apple App Store and Play Store. A well-planned launch strategy is crucial to creating awareness and attracting new customers. The app is designed specifically to each app store to ensure it meets their specifications and is always ahead of its competitors.

Important elements such as a compelling description of the app, attractive pictures, and user feedback are crucial to attracting the attention of potential publishing companies. App Store and Play Store optimization strategies must be employed to increase the app’s visibility. The initial phase of launch is designed to garner positive reviews and ratings as they greatly impact the app’s popularity as well as its ranking in the app store.

Continuous Maintenance and Updates

The ongoing maintenance phase is focused on being flexible and able to adapt to user needs and the latest technological advances. This means constant updates for the tax preparation software and ensuring its continual development. The app is constantly updated with new features to enhance the user experience, and also provide the best value.

In addition, proactive measures are taken to improve security measures and safeguard the user’s data from any new dangers. To ensure the app is up-to-date and up-to-date the team behind development closely is aware of any changes in tax laws, and then takes the appropriate actions. This continuous process also increases the app’s value and credibility in the constantly evolving tax administration industry, and demonstrates the commitment to continual improvement.

Must-Have Features of TurboTax-like App

The market share of Tax Software is predicted to be US$1 46.90 Billion in 2030. It is expected to increase at a rate of 10.6 percent from 2022 to 2030. The TurboTax application is well-known for its numerous features and user-friendly layout, which make tax preparation simpler. Here are a few most important features as specified by companies providing mobile app development services in USA that could significantly impact the development of tax preparation apps:

Creating and Managing User Accounts

This feature lets users access, close as well as manage accounts, while safeguarding the privacy and security of financial information personal to them.

Income, Credit, and Deduction Calculators

This feature provides sophisticated calculators that calculate credit, income, and deductions automatically, ensuring accurate and effective tax returns.

Data Entry and Import

Data Entry and Import feature reduces the chance of human error by allowing users to enter more data with confidence and then transfer financial data from various sources.

Error Checking and Validation Tools

This feature offers sophisticated tools for checking errors to identify and correct any errors quickly, ensuring the accuracy and consistency of tax returns.

Document Storage and Retrieval

Customers can post, save important tax-related documents using a secure cloud-based storage service at any time.

Integration with Financial Institutions

The feature of smooth integration allows the immediate import of financial information and speeds up the process of data input with financial institutions, banks as well as employers.

E-Filing and Safe Data Transfer

The users who make use of electronic filing, also known as “e-filing,” can safely submit tax returns with encryption and other security measures to protect sensitive information while they transmit it.

User Support

In the course of tax preparation, the tax preparation process provides clear and easy-to-understand information for better the experience of users and reducing the risk of. These include helpful tips for tax preparation as well as FAQs and customer assistance access.

Automated Race Mode

This new feature tracks the tax-filing process in real-time and encourages users to surpass their previous record of tax-filing.

AI Assistant Chatbot

TurboTax offers a 24/7 AI chatbot which assists with any tax-related queries.

Linked Accounts

This feature enables users to import quickly the previous purchase, making tax filing faster. process.

Current Tax Regulation Updates

This feature will ensure that the user is well-informed and that their tax calculations are current with the most current tax laws, by providing real-time updates regarding changes to tax laws.

Cross-Platform Compatibility

Users are able to access as well as manage tax data on a variety of devices, thanks to the mobile-friendly design and cross-platform support, enhancing the ease of use and flexibility.

Multi-State Filing

This feature lets users manage tax records of users across multiple states, ensuring exact and complete tax returns for taxpayers who have complicated residency issues.

The essential features listed above help TurboTax succeed in providing a user-friendly extensive, complete, and highly technologically sophisticated tax-preparation software.

Key Factors Affecting Development Costs

From the complexity of technology to the market demand, many elements and characteristics of tax preparation software affect the price of developing tax filing apps. Here’s a list of the most important elements that affect the development cost:

Feature Complexity

Complexity of the feature can impact the development cost. Basic features, such as deduction and income inputs are cheaper to develop, generally costing between $5,000 and $10,000. However, more advanced features, like AI-powered tax optimization or complicated calculation of forms, require more time and effort to develop and require special skills and can cost up to $50,000 or more. The decision between interview-based or forms-based filing can also impact the cost. Interview-based filing is a method of guiding users through the process of answering questions typically costs more to create, and can cost anywhere from $15,000-$25,000, in contrast to forms-based filing which could range from $10,000-$20,000.

Development Team Location

The location of your iOS and Android app development agency significantly influences the cost. Developers located in North America typically charge higher prices, which range between $100-$200 per hour, when compared with other regions. The costs for developers in Eastern Europe fall around $50 to $100 an hour, whereas rates in Asia could be less as India hires development specialists for between $20 and $50 an hour.

Technology Stack

The tech stack comprises frameworks, programming languages, and databases. Selecting the best tech stack is vital to performance, functionality and price. Native development, in which separate applications are developed specifically for the respective platforms (iOS as well as Android) typically costs more upfront, which ranges between $30,000 and $50,000 for each platform. But it is more efficient in terms of quality and experience for users. The cross-platform development process, which involves employing tools to develop one application for both platforms, may be more affordable, ranging from $20,000-$30,000, however it could have limitations on performance and customisation.

Security and Compliance

Security measures that are robust are crucial to safeguard the privacy of users, particularly sensitive financial data. Implementing robust encryption, access control, as well as regular security audits, can increase the cost of development that ranges between $5,000 and $15,000. Furthermore, compliance with the tax requirements is vital. Be aware of the latest changes to tax laws and making sure your application complies with applicable regulations could result in regular costs, like the legal consulting process and audits of compliance.

Third-party Integrations

Integration with other services such as the tax information providers and payment processors could improve the experience of users and increase efficiency. These integrations typically require additional fees which range from $2,000 up to $10,000, based on the service and its level of complexity.

Design and User Interface

An easy-to-use design and a properly-crafted User Interface (UI) are vital for any tax preparation application. Employing UI/UX developers and designers to develop an easy-to-use and intuitive experience can run anywhere from $10,000 to $20,000. But investing in a great design will significantly increase the user experience and decrease costs for support over the long term.

Estimating the Cost of Building a Tax Filing App

Making a tax preparation software such as TurboTax requires a number of key aspects of the tax filing apps development price which result in a fluctuating cost range. While the exact price will depend on the particular requirements of your specific project however, it is likely to be between $30,000 and $300,000.

Let’s get a better understanding and categorize them into basic intermediate, advanced, and basic application features:

Basic App

The Basic App includes essential features. This includes deduction and income input and basic tax calculations and a simple electronic filing. The app is designed for simplicity. It can offer interview filing or a simple and user-friendly form system. But it does not include features such as AI-driven optimizing or complicated formula calculations. The price range is between $30,000 and $50,000. This choice is for the ones who want simple, cost-effective solutions to their tax requirements.

Intermediate App

Medium is a Medium App enhances the tax preparation experience by adding additional features. It is priced between $50,000 and $100,000 . It goes far beyond the basics by providing assistance for different tax forms. Also, it covers state tax filing capabilities and integration with standard tax data suppliers. The user can select between an interview-based system or a more complete tax filing system that is based on forms. It must offer an adaptable yet powerful solution for taxpayers with more complex tax issues.

Advanced App

Custom-designed for people with intricate financial landscapes, this solution includes AI-powered tax optimization to help in the highest possible credit and deduction. It can handle complex calculations for forms specifically for tax-related scenarios like self-employment or investment, as well as seamlessly connects with tax data providers that are advanced as well as financial platforms. It is a complete interview-based tax filing system, with an estimated cost of $100-$100,000 It provides comprehensive assistance and support, offering an exceptional solution for people who are trying to navigate complex tax situations.

Why Must Entrepreneurs Invest in Building an App Like TurboTax?

Tax filing is usually regarded as difficult as well as time-consuming and prone to mistakes. This presents a massive opportunity for entrepreneurs to invest their money to develop a tax-preparation app that is user-friendly, such as TurboTax. Here are some convincing arguments for why:

Growing Market Demand

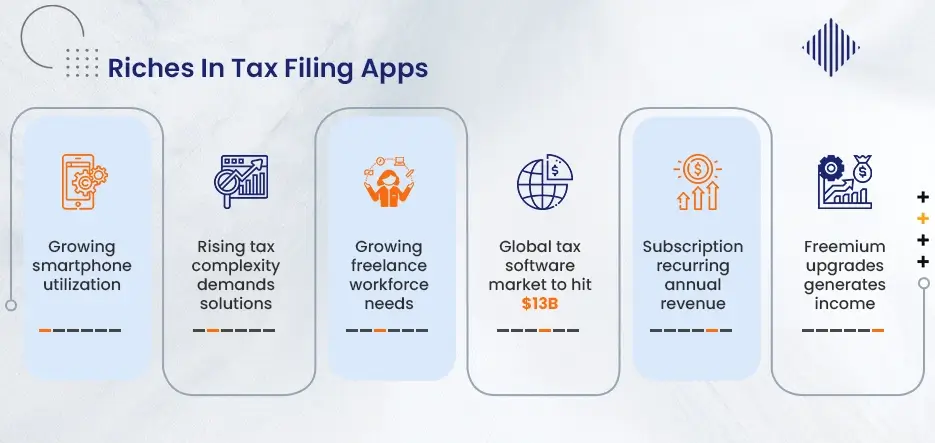

Increasing Smartphone Utilization

The rapid growth of smartphones has increased the demand for mobile-based solutions including tax filing apps development. People appreciate the benefits in accessibility, ease of use, and the simplicity of using these apps when compared to other techniques.

Rising Tax Complexity

Tax regulations can be a bit complicated and changing constantly which makes it difficult to understand the process on your own. Tax filing apps can make it easier by offering guidance automated, expert assistance.

Growing Self-Hired Populace

The growing freelance economy as well as remote working has led to an increase in self-employed workers. They often require help with tax filings that are specific to them and tax filings, which apps can attend to effectively.

Potential for Recurring Revenue

Subscription Model

Set up a subscription system in which the users pay an annual or monthly cost in order to use the app’s full capabilities. It could provide a regular revenue flow.

Freemium Version

The app will offer a no-cost basic version of the app, along with the possibility of upgrading to a premium version with additional capabilities such as assistance with audits or guidance for specific countries. It could attract a larger number of users and promote the development of new features to boost sales.

Value-Added Offerings

Develop an app similar to TurboTax that provides additional services like consultation with tax experts or personalised financial advice for additional cost. It could generate new revenue streams and also decorate user fees.

Competitive Advantages

Niche Focused On

Concentrate on a specific specialization, like investors, freelancers, or small businesses in order to meet their tax requirements and get an edge in.

Advanced Features

Develop new features that meet desires of your users that have not been addressed and differentiate your tax filing apps from the crowd of gamers. It could be as simple as the integration of accounting software and tax optimization tools powered by AI or gamification features to increase the user’s engagement.

Exceptional User Engagement

Make sure you prioritize user-friendliness, easy design, and clear communication to guarantee a simple tax filing, while fostering the loyalty of users and a great word-of-mouth marketing.

Building Brand Recognition and Trust

Educational Assets

Include academic resources in the app, or via external content material to establish your reputation as an authority in the tax field. This could attract customers looking for reliable information, and build trust in the capabilities of your app.

Strategic Partnerships

Work with companies that are relevant that include financial institutions or accounting firms for a larger audience and increase the current customers.

Community Constructing

Build an online community for your app by providing users board, hosting webinars or offering tax-related tips via social media. It will increase engagement of users as well as loyalty to the brand and feedback from users to improve the app.

How A3Logics Can Help You Build an App Like TurboTax?

This is the way to go! If you come up with an idea that relates to the best tax filing app, contact us now! We are experts in the development of customized tax filing software such as TurboTax. Our experienced team of developers can design efficient and user-friendly tax filing apps. The app is going to be ticking your particular needs.

Our expertise in the development of apps and our knowledge of tax laws ensure a smooth user experience. We ensure that it comes with accurate calculation. Do not hesitate to employ the top iOS app development companies like A3Logics to create Tax filing apps. We will simplify the tax preparation process for your clients.

Final Thoughts

Since the tax system keeps changing, the process of creating tax applications is getting more interesting. However, launching into the creation of one isn’t something you’d want to undertake blindly. You must think about your requirements and the resources you’ll have to work with. This is when choosing the leading mobile app development company to develop your tax app is essential. This is where we come in!

As the most reputable tax application development firm, A3Logics empowers businesses to harness technological power. All this to make tax filing easier for their clients. With our experience in the development of custom tax software, we can assist you with the complex tax process. We can bring your ideas to reality.

Let’s discuss your goals and transform your dream tax app into a reality. Contact us today for no-cost consultation!

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your App Journey Today!

FAQs

What are the rules of compliance for tax preparation apps?

Tax preparation apps must be compliant with numerous regulations. This includes data security standards along with tax legislation. It is vital to talk with tax and legal professionals to ensure that you are in compliance.

What’s the price to develop an app for tax preparation?

The cost of developing tax filing apps will vary based on many factors. However, an estimate of the cost could range from $30,000 to $300,000 or more.

What should I consider when choosing the most appropriate tax preparation application for me?

You need to consider your specific tax situation. Also you need to keep budget as well as the features in mind. You’ll need the security measures that the app is made with.

What are the challenges when building an app for tax preparation?

Keeping up with constantly changing tax laws, ensuring precise calculations, creating an app that is secure.

How long will it take to create a similar app to TurboTax ?

The time for tax filing apps development can vary between 6 months and 1 year, based on the complexity of your application as well as the number of people on your development team.