Table of Contents

The insurance industry is important to protect people and companies from losses and injuries. But as technology develops, consumers want more individualized and quick service, which traditional insurance systems are not able to meet.

However a promising solution in the form of blockchain has emerged. Blockchain in insurance enhances cost effectiveness, transparency, fraud prevention, compliance, and real-time data sharing across multiple parties is provided by blockchain technology. Blockchain can also facilitate the creation of new insurance procedures, resulting in faster services, more inventive goods, and larger markets. In the insurance industry, some of the most important use cases of blockchain technology are cutting expenses. It also includes enhancing claim settlements, satisfying client requests, and encouraging innovation.

In this blog, let’s dive in to learn more about blockchain use cases in insurance, challenges and advantages.

What is Blockchain?

Transform Your Business With Our Custom Blockchain Solutions

Blockchain is “a distributed database that keeps an ever-expanding list of ordered records, called blocks.” Cryptography is used to bind these blocks together. Each block has transaction data, a timestamp, and a cryptographic hash of the block before it. A blockchain is a distributed, public, decentralized digital ledger that records transactions across numerous computers. Its purpose is to prevent record tampering without affecting all following blocks and network consensus.

Market Statistics and Facts You Should Know About Blockchain in Insurance

Blockchain technology is disrupting the insurance industry. And, for good!

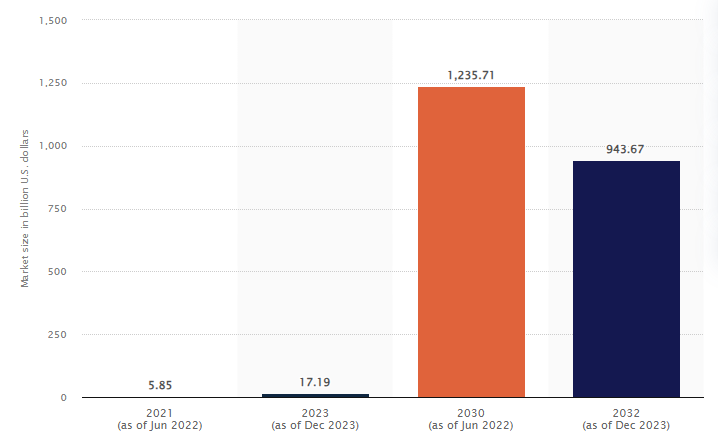

Blockchain technology cloud market size worldwide in 2021, with a forecast for 2030

- According to a study by Statista, the global market for blockchain insurance is predicted to grow to 943 billion U.S. dollars in 2032 with a CAGR of 56.%.

- Blockchain technology will increase significantly in the insurance industry in future years. According to Gartner, blockchain was projected to be more widely adopted by insurance companies in 2023 and is expected to have a $3.1 trillion business value for new businesses in 2030.

- $40 billion annually across the US is the total cost of insurance fraud (non-health insurance). (FBI)

Top 20 Blockchain Use Cases and Applications in Insurance Industry

Blockchain technology is a promising solution that increases efficiency in cost and transparency, compliance, fraud prevention, and real-time data sharing between diverse parties. It can also enable the creation of new insurance practices that result in innovative products, quicker services, and more markets. The most important uses of blockchain in insurance are cutting costs, enhancing claims settlement, meeting customer requirements, and promoting new ideas.

Here are top 20 examples of blockchain use cases in insurance industry.

1. Blockchain Helps with Fraud Prevention

Insurance companies can use blockchain to prevent frauds. Blockchain is a technology meant to create immutable ledgers that store the transactions in a secure place and are unable to be edited or altered. Once put on a blockchain, the data becomes inaccessible for alteration or erasure. Insurance companies have a traceable audit trail of all transactions. This lets them identify any patterns, anomalies, or discrepancies indicative of fraud, like multiple claims relating to the same event.

In turn, insurance companies build trust between their customers and their clients: Insurance companies get a robust device to validate the authenticity of claims, and customers are given more information when settling claims.

2. Automation of Claims Processing using Blockchain

Claims management involves identifying and assessing claims’ resolution. Using blockchain to process insurance claims simplifies the process by establishing an electronic ledger distributed across the globe that records every transaction. The ledger can monitor claims from initiation or FNOL until they are resolved by a court or negotiated with an insurance provider. This makes it simpler for everyone to track the progress made through each phase in the procedure.

3. Simplify Policy Management through Blockchain

Blockchain significantly boosts operational efficiency because it allows for complete automated workflows for managing policies. Furthermore, the blockchain system allows a complete record of all user actions within insurance policies and contracts. This can instantly identify illegal or malicious actions.

4. Blockchain-based Parametric Insurance

Blockchain-based parametric insurance may help address certain needs, as it automatically distributes pay-outs by specific circumstances (rather than through a manual, unreliable claims process). Advances in blockchain technology make parametric insurance solutions offered by specialized providers less expensive to operate, quicker, and more affordable for the social good.

5. Risk Assessment & Underwriting through Blockchain

In the context of underwriting, blockchain facilitates aggregating data about customers and documents from various sources, allowing for a quick and accurate assessment of the customer’s risk. Additionally, blockchain can help remove the manual task of calculating insurance premiums and guarantee an accurate and transparent premium calculation.

6. Simplify Reinsurance Process through Blockchain

Reinsurance is a technique for transferring risk among two or more insurance firms. It is a method to limit risk and boost capacity and is an option to spread risk among multiple insurance companies. Blockchain is a technology used in insurance that could simplify reinsurance by allowing customers to claim in the same way as they do under traditional insurance policies, but on an immutable ledger that has no chance of changing after being recorded by the blockchain.

7. Streamline Subrogation with Blockchain

Blockchain helps streamline the subrogation process by enabling secure, automated transactions between insurance companies. Businesses like State Farm and USAA have already embraced blockchain for subrogation, greatly decreasing manual processes and increasing reconciliation speed.

8. Encode Peer-to-Peer Insurance with blockchain based smart contracts

Peer-to-peer insurance is an insurance plan in which people. These can be family members, friends, or business partners. They pool resources to protect everyone in the group against certain circumstances. Individuals can encode P2P insurance conditions and terms into smart contracts, which will automatically be executed when one files an insurance claim.

9. Improved Safety for Usage-Based Insurance

Use cases of blockchain in insurance include that it can safely store and share data about driving through IoT devices, providing secure, transparent records for UBI. Insurers can access real-time driver information and adjust premiums based on the use patterns, offering accurate and dynamic prices.

10. Blockchain in the Sharing economy

Blockchain could make it easier to create decentralized platforms to track and manage policies on assets in the shared economy (e.g., short-term rentals of cars or properties). It ensures usage transparency, decreases risk, and provides micro-insurance solutions.

11. Micro-insurance in Emerging Markets

Instead of an all-encompassing insurance plan, microinsurance is a way to protect yourself against a specific risk of regular premiums much lower than traditional insurance policies. Microinsurance policies earn returns only when they are distributed in large quantities. However, microinsurance policies do not gain the recognition they deserve due to a lower profit margin and the high distribution cost despite their immediate advantages.

12. Impact of Anti-Money Laundering & Know Your Customer Compliance

Banks, insurance companies, and various other financial services providers don’t exchange KYC data. This is because of concerns about regulatory compliance. These compliances force customers to enter the same information multiple times. In the end, institutions waste time on work already completed and create differences in data between them.

Blockchain in insurance could solve these problems by allowing insurers who are partners to share KYC and AML data in an encrypted blockchain. So, customers can enter information only once, and it’s secure to share within a secure blockchain-based database. On the other hand, insurance companies do not have to invest excessive money in processing customer information because the blockchain permanently stores it.

13. Impact of Blockchain on Life Insurance

This kind of insurance is characterized by the insurer committing to pay an amount in a lump sum when there is a death of the person the policyholder selects. It’s a complicated procedure for the person who has lost their relatives or friends. However, they need to submit the claim as soon as possible so that insurance companies can confirm the facts, obtain the death certificate issued by the government, and verify the claim.

If you think about the variety of people who may be involved after a person dies, from hospitals to care workplaces and homes to commercial companies, confirming the facts of a demise can be difficult.

Smart contracts and blockchain technology, specifically, can speed up the process by coordinating claim registration and giving all parties the same source of information regarding the events that took place.

14. Role of blockchain in auto insurance

Blockchain can improve trust and transparency between manufacturers, insurers, and drivers by securely storing car information and driving records, which can help resolve the liability of autonomous vehicle-related accidents.

15. Impact of blockchain in Crop Insurance

Blockchain allows for transparency for insurers, farmers, and others, and it improves the management of crop insurance claims. Smart contracts automate paying out according to predefined conditions, such as weather or yield.

16. Smart Contracts for Renters Insurance

One use case of blockchain in insurance is that it can help automate renters’ insurance with smart contracts that trigger payments in accordance with agreed-upon terms. It eliminates the requirement for intermediaries and provides prompt, transparent pay-outs in case of an incident.

17. Blockchain-Enabled Digital Insurance Wallet

A wallet enabled with blockchain allows customers to securely keep and manage several insurance policies in one place. It also increases the customers’ experience by facilitating access to documents related to policy renewals, claims, and policy documents.

18. Secure Medical Record Verification with Blockchain

Blockchain is a secure way to keep and validate medical records, ensuring that only authorized individuals can access them. This helps insurers verify claims more quickly while protecting patient privacy.

19. Travel Insurance on Blockchain

Claims are always a nagging issue for travelers, and consumers are often dissatisfied with the requirement for proof of their claim and the length of time it takes to receive a reply. For the insurance company, investigating and proving the legitimacy of claims is usually not easy since they have to coordinate evidence gathering with various parties.

Blockchain technology can enhance the whole process by providing an immutable, secure ledger for everyone to search for and trust. If the information related to the specific claim is obtained through APIs, smart contracts are a great way to accelerate or completely automatize pay-outs.

20. Impact of blockchain in property and casualty insurance

Auto, commercial, and home insurance make up the majority of property and casualty insurance. There was a possibility of human error because the process required manual entry. This issue can be resolved by issuing new policies or claiming current policies through the use of shared ledgers and smart contracts. This will also expedite, improve, and lower the cost of the new insurance issue or claim procedure.

Read More – Top Blockchain development companies in USA

Get Innovative Blockchain Technology Tailored For Your Business!

7 Benefits of Blockchain in Insurance

Blockchain has many benefits to offer when it comes to insurance. Let’s take a look at some of the benefits of blockchain technology implementation of blockchain in insurance industry.

1. Streamlined Claims Processing with blockchain

Insurers can streamline the entire process of processing insurance claims by utilizing blockchain. The smart contract can reduce expenses for managing claims, cut down on the risk of fraud in claims, and automate the process of verifying claims.

2. Enhanced Transparency utilizing blockchain technology

By utilizing blockchain in insurance industry, companies can increase transparency throughout the insurance process. Blockchain functions as a shared, immutable ledger documenting every transaction. Anyone with stakes can access and verify transactions and contracts.

3. Reduced Insurance Costs

Blockchain technology can lower insurance costs by facilitating a more efficient distribution of information and payment. This is because it permits real-time tracking of insurance claims normally handled manually. This also eliminates the need for intermediaries and other third parties involved in handling insurance claims.

4. Fraud Detection with the help of blockchain

It is becoming increasingly widespread for insurance companies to employ blockchain to aid in security and fraud detection. Blockchain offers a safe and secure method for businesses large and small to validate documents like health records, insurance policies, and so on. Using blockchain to detect insurance fraud will ensure you receive exact information regarding your customer or policyholder, protecting you from fraud or any actions made by the insurance company (like fraud on your personal information).

5. Empowers Automation in Insurance Industry

Smart contracts facilitate the insurance process and transparent transactions. The entire process of claiming insurance runs smoothly because the blockchain executes according to the terms of the smart contract.

Even more thrilling is that blockchain can do it automatically, making it a major benefit for insurance businesses. By reducing administrative costs, blockchain can ultimately save time, effort, and money for insurance companies.

6. Data Integrity

Blockchain has several ways through which data integrity can be ensured for insurers. For example, it can be related to ensuring claims legitimacy. This is one major area that should always be ensured. Especially for insurance firms who depend on a significant volume of data to understand the risk profile of the customers.

7. Enhanced Customer Experience

Blockchain will enable insurance benefits to be delivered to the customers in a better manner. It allows them to store the information about the policy holder, claims history, premiums paid, awards received, etc. in an encryptable and trackable manner. Also, the insurance companies can receive real-time information about their customers’ behavior for bettering their services to the customers.

Overcoming Adoption Challenges of Blockchain by Insurance Industry

Blockchain technology can be a boon to an insurance company, but its integration raises a whole lot of problems. These vary from technological challenges to compliance and regulatory issues and the issue of standardization and cooperation across the industry.

The ability to grasp and solve these problems would, therefore, be key to the success of the implementation of blockchain technology in the insurance industry.

Regulatory and Compliance Issues

Blockchains usage in the insurance industry also comes with compliance and regulatory issues. The insurance sector is largely regulated, and any new technology needs to be designed compatible with the law and regulations present.

The decentralized nature of blockchain poses unique regulatory challenges since it doesn’t fit into the standard frameworks that regulators use. Moreover, the universal scope of blockchain raises issues about jurisdiction as various countries have different regulatory frameworks.

Navigation of the regulatory landscape is very time-consuming and always requires communication with the regulators.

Industry-Wide Collaboration and Standards

For blockchain technology to succeed in the insurance sector, collaboration is required across the industry to create a common standard. Blockchain networks are the most efficient when multiple parties share information.

It requires cooperation and trust among various parties, including insurance companies and technology providers, regulators, nearshore outsourcing companies, and customers.

Developing an agreement on the industry standards for blockchain technology in insurance is also vital. The standards will guarantee compatibility, consistency, and security among various blockchain implementations in the insurance industry.

Technological Barriers

The largest hurdles for establishing blockchain in insurance are technological ones. Much of the infrastructure already undertaken by many insurance companies may not be fully adapted for such an application of blockchain technology.

Blockchain integration requires major upgrades to existing systems, which could be costly and difficult. In addition, there is the issue of interoperability. Blockchain systems must be able to effectively communicate with conventional systems and newer technologies.

Data privacy and security on the blockchain, which is completely transparent, is yet another technological obstacle, particularly for sensitive personal data commonly used by insurance companies.

Examples of Blockchain in the Insurance Industry

The insurance industry is filled with amazing start-ups and platforms that are leveraging blockchain technology to tremendously benefit the industry. Let’s take a look at some impressive blockchain applications in insurance with examples.

Lemonade

Lemonade blends AI with DLT to provide insurance for homeowners and renters. The Lemonade program is fascinating. It demands a set amount from each participant every month and uses the remainder to fund future claims.

It aims to eliminate bias when submitting claims by dividing customers according to the charity they select upon signing up. Lemonade is based on AI-based algorithms that establish the credibility of claims.

B3i

B3i, incorporated in 2018, assists the insurance industry by providing great solutions for the end consumer through easier access to insurance and fewer administrative expenses.

Etherisc

Etherisc provides outstanding blockchain-based solutions that make insurance easier to access. What is it? Through its decentralized insurance protocol, it can collectively create insurance products. The insurance policy they offer for flight delays is the most well-known product. It covers:

- Hurricane protection

- Crypto wallet insurance

- Protection of collateral for loans backed by crypto

In addition, they have also developed a prototype of crop insurance as well as social insurance.

Fidentiax

Fidentiax is a blockchain-based market for insurance policy trading. In 2018, it introduced its digital ledger product (ISLEY) specifically for insurance policies. The product helps consumers become insurance partners.

It lets users store, view, and even receive notifications about their insurance portfolios. What’s more?

The portfolios may be shared with selected loved ones via the ledger to facilitate beneficiary payments in case of death.

Black

Black is an insurance company that is digitally based and built on the blockchain, which empowers MGAs and brokers and allows the centralization of the insurance market to be centralized through crowdsourcing.

Create A Strong Blockchain Insurance Solutions with A3Logics

Blockchain technology in insurance could be a game changer. It could revolutionize how physical assets are managed, tracked, and insured digitally. At A3logics, our highly experienced experts will not only help you get into the realm of distributed solutions but also assist you in dealing with the complexities of your journey.

We provide a range of crypto and blockchain development services for the insurance industry that provide flexibility, transparency, and security to your company. We also assist insurance companies worldwide in discovering how blockchain applications in insurance can change how they conduct business. Blockchain app developers from our team experts will assist you in understanding the fundamentals of encrypted and distributed ledgers and ensure that you create successful solutions for your business.

Contact us if you want to create strong and scalable solutions in the blockchain space for insurance companies or know more about use cases of blockchain in insurance.

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your Software Journey Today!

Conclusion

Blockchain technology is just beginning to take off. However, there are already numerous uses and use cases of blockchain in insurance industry. Blockchain technology provides security, accuracy, speed, and other benefits to the insurance sector. It is important to recognize that insurance firms who adopt blockchain technology must adhere to ethical guidelines.

Blockchain applications in insurance could be a game changer. There are numerous compelling uses for blockchain technology, and it has the potential to transform the way physical assets are handled, tracked, and backed digitally.

Offering incredible benefits, like increased cost efficiency, less risk, and so on, its high time blockchain to partner with a blockchain app development company to build a top-notch solution. Blockchain will be a constant part of the insurance industry.

While it’s still developing, given the market’s willingness to adopt the latest models and protocols, blockchain is in the future!

FAQs

What is blockchain technology in insurance?

The insurance industry leverages blockchain, a distributed immutable ledger that safely keeps and validates information across several parties. It improves transparency, decreases the risk of fraud, and allows for accurate information sharing between clients, insurers, and other third parties, facilitating claims handling and managing policies.

What is the impact of blockchain on handling claims?

Blockchain can make claims processing streamlined and automated by providing security and real-time confirmation about claims and policies. Smart contracts enable automatic working processes for claims processing, thus reducing delays, errors, and fraud and developing more transparency and customer confidence in the entire submission process for claims.

Why do insurance companies need blockchain technology?

Insurance companies require blockchain technology to make their operations more efficient, minimize fraud, and enhance security with regard to data. Blockchain allows for seamless data sharing among parties, and its intelligent contracts can automatically process the protocols involved in claims processing and policy issuance.

Can blockchain make insurance operations cheaper?

With blockchain, the costs of manual operations are minimized on the execution of procedures, removal of intermediaries, and errors in inputting the data. In addition, claims processing and policy management become easier for smart contracts, further reducing the administrative cost. The higher transparency also minimizes the disputes and fraud incidences.

What privacy concerns arise in connection with blockchain in insurance?

Blockchain security issues arise from its open and unchangeable nature. If there is personal data about customers, without encryption or securing it, this could be considered as not secured. Complying with laws such as GDPR and using private or permissible blockchains would certainly resolve most of these concerns.

Are there any limitations in using blockchain for insurance?

Insurance blockchain limitations also include problems with scalability, high set-up costs, and the difficulty of integrating the new system with legacy systems. Further, uncertainty about regulations can be an impediment to its adoption; and maintaining the confidentiality of data has been a challenge.

What are some future prospects of blockchain in insurance sector?

The adoption of blockchain in insurance sector is promising, as it increases the automation of claims and fraud detection, along with safe data sharing within the insurance industry. Therefore, with its further extension, blockchain would bring the insurance process more to a transparent, efficient, and customer-centric pattern, hence building the way for industry-wide innovation and collaboration.