Most of the businesses today are investing in digital transformation and why not as this is helping them gain a competitive edge. Not only this, making investment in digital transformation has made the world of managing financial transactions also very hassle-free. In this, EDI ACH, and EFT are playing an essential role in terms of completely streamlining the payment process.

If you are thinking about proceeding ahead with the same, then below we have it all covered for you. Read on in terms of what is EDI payment and how it differs from ACH and EFT.

Table of Contents

What is EDI Payment?

The broader idea of Electronic Data Interchange (EDI) has to be understood, first if we are to respond to the query, “what is EDI payment?” Using agreed-upon standards, EDI is a standardized way to exchange commercial documents electronically between companies. EDI payments, then, are the safe electronic transfer of payment-related data—including invoices, remittance advice, and payment instructions—between trading partners.

EDI payments are not a transaction technique but rather a means of safely and effectively transmitting payment data. This difference is important: EDI allows the organized, automated transfer of financial and remittance data supporting ACH and EFT even if they move money. Below are some of the primary features of EDI Payments

- Standardized digital format for payment information

- Secure, encrypted transmission between organizations

- Automation of payment-related document exchange

- Supports various financial documents (invoices, remittance, purchase orders)

EDI Payments Definition

When talking about what is an EDI payment, it is best characterized as the electronic exchange of payment-related data between organizations utilizing established EDI formats. This approach guarantees correct, timely, and safe payment information, decreases manual involvement, and removes paper-based records.

So, what exactly the EDI Payment? It is enabling smooth, automated communication between trading partners and their financial institutions; they form the digital backbone of current B2B financial transactions.

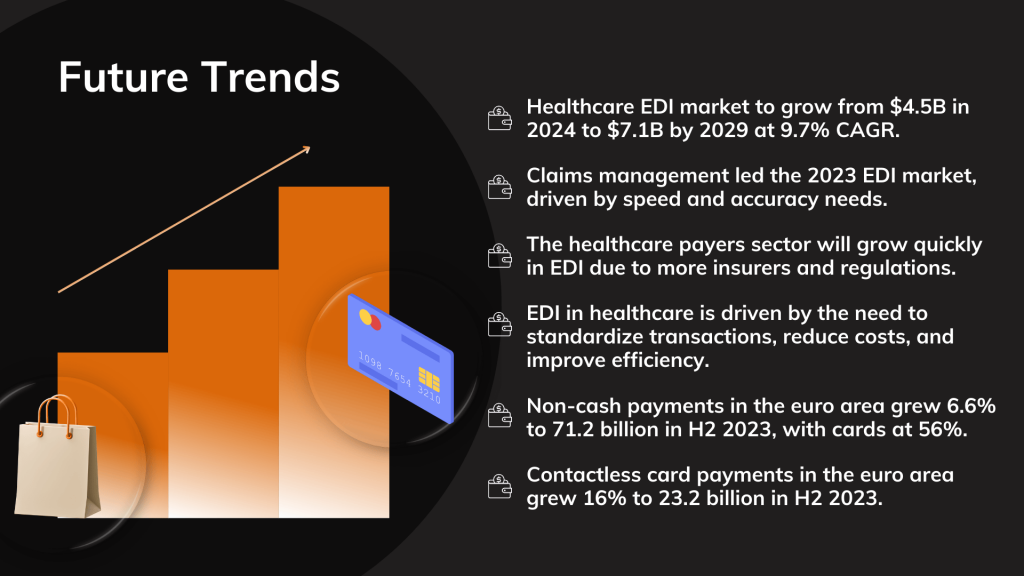

Key Statistics

- Growing at a compound annual growth rate (CAGR) of 9.7% between 2024 and 2029, the worldwide healthcare EDI market is expected to be $7.1 billion by 2029, up from $4.5 billion in 2024.

- Driven by the need for quicker data transmission, mistake reduction, and enhanced financial performance among healthcare providers, claims management software made up the largest portion of the healthcare EDI market in 2023.

- Driven by rising numbers of private insurers and regulatory standards for electronic claims processing, the healthcare payers sector is projected to develop the quickest in the healthcare EDI market.

- The desire to standardize electronic transactions, lower costs, and improve administrative efficiency drives EDI in healthcare mostly.

- Total non-cash payment transactions in the euro area increased by 6.6% to 71.2 billion in the second half of 2023, with card payments comprising 56%, credit transfers 21%, and direct debits 15% of all transactions.

- Reflecting the fast development of digital and electronic payment systems, the number of contactless card payments in the euro area rose by 16% to 23.2 billion in the second half of 2023.

What is ACH (Automated Clearing House)?

The Automated Clearing House (ACH) is an electronic funds-transfer system managed by the National Automated Clearing House Association (Nacha) in the United States. ACH enables the batch processing of electronic credit and debit transactions, such as payroll, bill payments, and direct deposits. Below are the key characteristics of ACH:

- Processes large volumes of transactions in batches

- Used for direct deposits, bill payments, tax refunds, and more

- Operates primarily within the United States

- Transactions may take one or more business days to settle, though same-day ACH is increasingly common

- Regulated and standardized by Nacha

ACH is a specific type of electronic funds transfer (EFT), and is widely used for both consumer and business transactions.

What is EFT (Electronic Funds Transfer)?

Electronic Funds Transfer (EFT) is a broad term encompassing all forms of digital money movement between bank accounts. EFT includes various payment methods such as ACH transfers, wire transfers, credit card payments, and EDI-based payments. Below are the key characteristics of EFT:

- Encompasses all types of electronic payments

- Used for both personal and business transactions

- Includes ACH, wire transfers, credit/debit card payments, and more

- Focuses on the movement of funds, often with limited remittance data

How Does EDI Payment Processing Work?

Understanding how EDI payment processing works is essential for businesses considering adoption. Here’s a step-by-step breakdown:

1. Setting Up EDI Services: Businesses establish secure EDI connections with trading partners, often with the help of EDI Consulting Services or EDI 834 Services for specialized needs.

2. Generating Electronic Documents: Payment-related documents (invoices, remittance advice, etc.) are created in standardized EDI formats.

3. Transmitting Data: These documents are transmitted electronically to trading partners via secure EDI networks or Value Added Networks (VANs).

4. Receiving and Processing: The recipient’s system automatically receives and processes the EDI payment data, updating accounts payable/receivable systems.

5. Authorizing and Confirming Payments: Payments are authorized and confirmed electronically, with transaction confirmations sent via EDI.

6. Reconciliation: Both parties reconcile their accounts using the detailed, structured data provided by EDI, ensuring accuracy and reducing discrepancies.

Types of EDI Payments

EDI payments can be categorized based on the method of data exchange and the business context:

1. Direct Payments (Point-to-Point)

Direct Payments, also known as point-to-point EDI payments, establish a secure and dedicated connection between two business partners for the exchange of payment data. This method offers maximum control and data security, as transactions bypass third-party intermediaries and flow directly between the involved parties’ systems. Large enterprises often prefer this approach because it allows for customized integration, robust validation protocols, and the ability to handle high transaction volumes efficiently. By eliminating manual intervention and paper-based processes, direct payments streamline cash flow, reduce errors, and accelerate reconciliation for both sender and receiver.

2. Web EDI

Web EDI enables businesses to conduct EDI transactions through browser-based interfaces, often provided by third-party or SaaS vendors. This approach is particularly advantageous for small and mid-sized businesses that may not have the resources to invest in complex EDI infrastructure. Users can send and receive payment documents, invoices, and remittance information directly from their web browsers, making the process accessible and cost-effective. Web EDI simplifies onboarding, reduces IT overhead, and allows companies to participate in digital payment ecosystems without significant upfront investment, while still benefiting from the automation and accuracy of EDI payment processes.

3. Mobile Payments

Mobile EDI payments leverage mobile applications to facilitate secure, real-time EDI transactions from smartphones and tablets. This innovation empowers businesses to manage payment workflows and approve transactions from virtually anywhere, enhancing agility and responsiveness. Mobile EDI is particularly valuable for field teams, remote workers, and executives who need to authorize payments or monitor cash flow on the go. By integrating mobile capabilities with EDI systems, organizations can ensure continuous operations, reduce approval bottlenecks, and maintain oversight of financial transactions regardless of location.

4. Value Added Network (VAN)

A Value Added Network (VAN) acts as a third-party intermediary that securely transmits, translates, and monitors EDI payment data between trading partners. VANs offer additional services such as data encryption, message validation, and transaction tracking, ensuring reliable and compliant communication. This model is ideal for businesses seeking to outsource the complexities of EDI integration and maintenance while benefiting from robust security and support. VANs simplify partner onboarding, centralize data exchange, and provide audit trails, making them a popular choice for organizations with diverse trading networks or limited in-house IT resources.

Why Should You Use EDI Payments?

Adopting EDI payments offers significant advantages for organizations of all sizes:

1. Efficiency

EDI payments automate the entire payment lifecycle—from invoice generation to remittance and reconciliation—eliminating manual data entry and repetitive administrative tasks. This automation drastically reduces processing times, minimizes human intervention, and accelerates the movement of funds between trading partners. By streamlining workflows, organizations can handle higher transaction volumes with the same or fewer resources, enabling staff to focus on strategic activities rather than routine paperwork. Ultimately, EDI payments help businesses operate faster and more efficiently, leading to improved productivity and reduced operational bottlenecks.

2. Accuracy

Utilizing standardized EDI formats ensures that payment data is consistent, complete, and validated before transmission. Automated checks and validation protocols catch discrepancies and errors—such as mismatched invoice numbers or incorrect payment amounts—before they reach the recipient. This precision reduces costly mistakes, chargebacks, and disputes, while enabling seamless integration with accounting and ERP systems. Accurate data exchange also supports detailed reconciliation, making it easier to match payments with invoices and maintain clean financial records.

3. Security

EDI payments are transmitted over encrypted, secure channels, significantly reducing the risk of data breaches, interception, or unauthorized access. Unlike paper checks or unencrypted emails, EDI transactions are protected by robust authentication and validation mechanisms. This heightened security is especially critical for sensitive financial information, helping businesses comply with regulatory requirements and industry standards. By safeguarding payment data and providing detailed audit trails, EDI payments foster trust among trading partners and protect organizations from fraud and cyber threats.

4. Cost Savings

By eliminating paper documents, postage, manual processing, and data entry, EDI payments substantially lower administrative and operational expenses. Automation reduces the need for additional staffing and minimizes errors that could lead to costly corrections or penalties. Additionally, faster payment cycles can improve cash flow and reduce the financial impact of delayed receivables. Over time, these efficiencies translate into significant cost savings, making EDI payments a financially attractive option for organizations of all sizes.

5. Speed

EDI payments accelerate the entire transaction process, from invoice submission to payment settlement. Digital transmission enables near-instantaneous delivery of payment information, allowing businesses to receive funds and update records much faster than with traditional methods. This speed not only improves cash flow but also enhances supplier relationships by ensuring timely payments. Faster processing means organizations can respond more quickly to business needs, capitalize on early payment discounts, and reduce days sales outstanding (DSO).

Key Differences between EDI, ACH, and EFT

While EDI, ACH, and EFT are often mentioned together, they serve different purposes in the payment ecosystem. The following table summarizes their key differences

| Feature | EDI Payment | ACH (Automated Clearing House) | EFT (Electronic Funds Transfer) |

| Definition | Standardized electronic exchange of payment data | Batch processing of electronic payments | Any electronic transfer of funds |

| Function | Transmits payment info & remittance data | Moves funds between banks | Moves funds electronically |

| Scope | Global, B2B-focused | Primarily U.S., consumer & business | Global, personal & business |

| Settlement | Instant or scheduled, via private networks | Batch, can be same-day or next-day | Varies by method (ACH, wire, card, etc.) |

| Remittance Data | Detailed, standardized | Limited, unless using EDI addenda | Varies; often limited |

| Security | High, with encryption and validation | Regulated, secure | Varies by method |

| Automation | High, supports end-to-end automation | Partial, requires some manual steps | Varies |

EDI vs. ACH

- EDI is a method for exchanging business documents, including payment instructions, while ACH is a network for transferring funds electronically.

- ACH payments can include EDI-formatted remittance data, but ACH itself is not an EDI process.

EDI vs. EFT

- EFT is a broad category that includes all types of electronic fund transfers, including ACH and wire transfers.

- EDI payments focus on the structured, automated exchange of payment information, supporting reconciliation and automation.

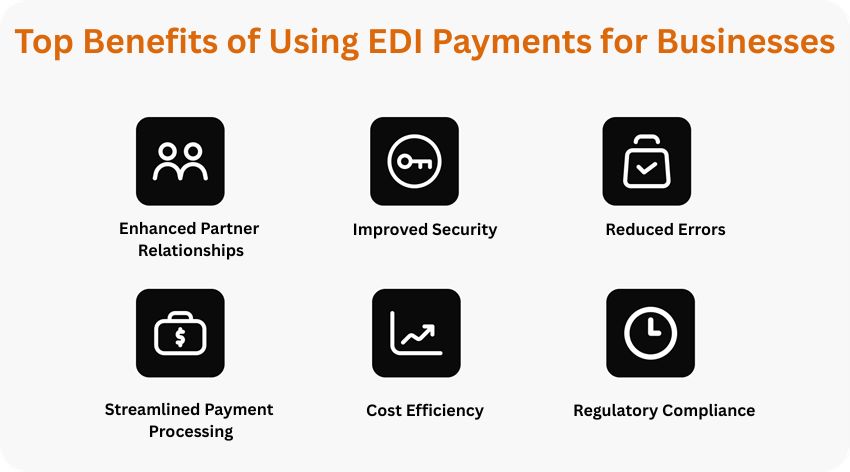

Top Benefits of Using EDI Payments for Businesses

Implementing EDI payments brings a host of tangible benefits:

1. Streamlined Payment Processing

Implementing EDI payments transforms traditional payment workflows by automating the exchange of financial documents such as invoices, purchase orders, and remittance advice. This automation eliminates manual data entry and the need for paper-based processes, allowing transactions to move instantly between business systems and trading partners. As a result, accounts payable and receivable cycles are significantly shortened, reducing processing delays and accelerating cash flow. Businesses experience faster time-to-trade, improved supply chain efficiency, and the ability to handle higher transaction volumes without increasing administrative resources, positioning them for scalable growth and enhanced operational agility.

2. Reduced Errors

EDI payments leverage standardized data formats and automated validation protocols to ensure that all transmitted information is accurate and consistent. By removing manual intervention from the payment process, the likelihood of human errors—such as duplicate entries, miskeyed amounts, or lost documents—is drastically reduced. Automated compliance checks further minimize discrepancies and payment disputes, resulting in fewer chargebacks, returns, and costly corrections. This heightened accuracy not only saves time and resources but also builds trust between trading partners, as both parties can rely on the integrity of their financial data.

3. Improved Security

With EDI payments, sensitive financial data is transmitted through secure, encrypted channels, significantly reducing the risk of unauthorized access, data breaches, or fraud. Unlike paper checks, which can be lost or tampered with, EDI transactions are protected by robust security protocols and audit trails that track every stage of the payment process. These features ensure that only authorized parties can access or modify payment information, providing peace of mind for businesses and their partners. Enhanced security also supports regulatory compliance, reducing legal and reputational risks associated with payment processing.

4. Cost Efficiency

EDI payments offer substantial cost savings by eliminating the expenses associated with paper, postage, manual labor, and administrative oversight. Automated workflows reduce the need for staff to handle repetitive data entry or document processing, allowing employees to focus on higher-value tasks. Fewer errors and compliance violations mean less money spent on corrections, penalties, or chargebacks. Over time, these efficiencies translate into measurable reductions in operational costs and a stronger bottom line, making EDI a financially attractive solution for organizations of all sizes.

5. Enhanced Partner Relationships

Reliable, timely payments are crucial for maintaining strong business relationships. EDI payments ensure that transactions are processed accurately and on schedule, reducing payment delays and disputes. Automated, transparent workflows make it easier to meet service level agreements (SLAs) and foster trust between trading partners. This reliability enhances collaboration, streamlines onboarding of new partners, and helps businesses respond quickly to market demands. Ultimately, EDI payments create a foundation for long-term, mutually beneficial relationships in the supply chain and beyond.

6. Regulatory Compliance

EDI payments are designed to support industry and government standards for data security, privacy, and reporting. Automated compliance checks and audit trails ensure that all transactions meet regulatory requirements, reducing the risk of non-compliance penalties. EDI solutions can adapt to evolving legal frameworks, making it easier for businesses to operate across borders and in highly regulated industries. By maintaining accurate, standardized records, organizations can quickly respond to audits or information requests, further strengthening their compliance posture and reputation.

Why are EDI Payments a Great Alternative to Manual Process?

EDI payments automate document exchange, eliminating manual processing delays. Transactions that took days via paper checks now complete in hours. This improves cash flow and enabling faster vendor payments or customer collections. Real-time data validation ensures immediate processing without human bottlenecks.

Reduce Administrative Overhead

By removing paper checks, manual data entry, and physical mail, EDI slashes labor costs. Staff can reallocate time from repetitive tasks to strategic activities. This shows how automated reconciliation reduces the need for error-checking and dispute resolution.

Minimize Risk of Lost/Misdirected Payments

EDI’s encrypted digital transmission prevents physical loss or mail delays. Standardized formats ensure payments route accurately to intended recipients, with audit trails tracking every transaction stage.

Ensure Accurate, Auditable Records

EDI enforces data validation rules, reducing typos and mismatched invoices. Every transaction generates timestamped digital records, simplifying compliance and financial audits.

Scale Payment Operations Efficiently

EDI handles growing transaction volumes without additional staff. Cloud-based EDI Services allow seamless global expansion, maintaining speed and accuracy as business partnerships multiply.

Practical Examples of EDI Payment Transactions

Defined by certain EDI transaction sets, EDI payments enable a broad spectrum of transaction kinds. Here are a few useful examples:

- EDI 139 (Student Loan Guarantee): It is used by guarantee agencies to inform lenders or schools about the status of a student loan. This also includes approval or denial conditions f the respective lenders.

- EDI 812 (Credit/Debit Adjustment): Communicates adjustments to invoices, such as credits or debits, between trading partners.

- EDI 820 (Payment Order/Remittance Advice): Used to transmit payment instructions and remittance details, facilitating automated reconciliation.

- EDI 828 (Debit Authorization): Authorizes debit transactions, ensuring secure and accurate fund transfers.

These transaction sets belong to the larger EDI Services ecosystem, which could also contain particular services including EDI 834 Services for benefits enrollment and EDI Consulting Services for deployment and optimization.

How A3Logics can Help to Implement EDI Payments in Businesses

Using EDI payments calls for technical knowledge and a thorough knowledge of corporate procedures. As an EDI service provider, A3Logics may help companies by

- Reviewing present payment systems and spotting automation possibilities.

- Offering professional advice on choosing, setting up, and integrating EDI solutions.

- Customizing EDI systems to meet particular company needs, including assistance for EDI 834 Services and other specialized transaction sets.

- Making sure systems are kept up for best performance and staff members trained.

- Maximizing efficiency and compliance by means of constant monitoring and enhancement of EDI procedures.

Final Thought

Hopefully you are clear about all the aspects related to EDI payments and how it is going to represent a changing leap that can help businesses to get their financial transactions done to perfection. In fact, this will certainly take out the trouble of any kind of security related issues as it will automate all the payment process and eventually help businesses achieve great efficiency and accuracy all the way through.

But, if you still desire to know more about what is EDI payment and how it differs from ACH and EFT, then you must hesitate and connect with the experts at A3Logics now. You get all the assistance and support from the best in the business.