Heimler’s Journey From Blind Spots to Business Clarity – A3logics Unleashes the Power of Live Intelligence

Discover More

Redefining the Future of Lending – Cred Fintech’s Monumental Transformation with A3logics

Discover More

Revolutionizing Credit Risk – How A3logics and Heimler Redefined Trust and Precision with Machine Learning

Discover More

Transforming Risk to Opportunity – A3logics and Heimler Revolutionize Credit Risk Modelling

Discover More

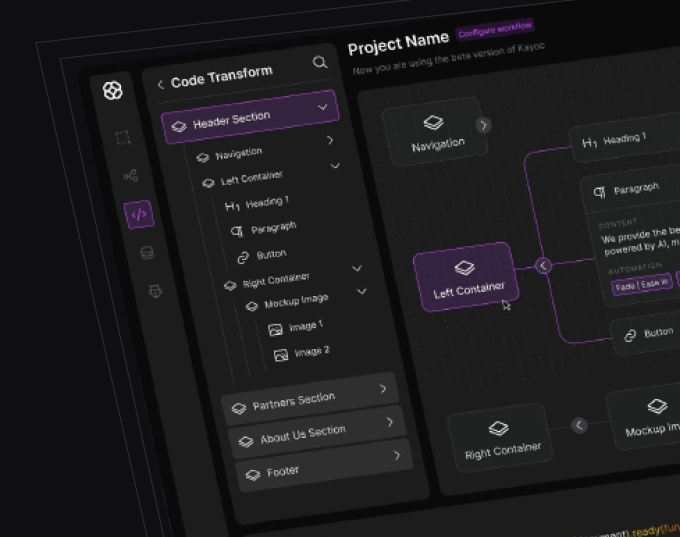

Operating for 2 decades, A3Logics has emerged as a preferred DeFi development company globally with smart contract experts. With deep proficiency in Ethereum and other blockchain frameworks, we construct highly scalable DeFi solutions aligned with business objectives. Whether crafting innovative yield aggregation DApps or lending protocols, our professional Defi development team leverages substantial experience to actualize even the most intricate visions.

We design tailored smart contracts powering core DeFi protocols, DApps and marketplaces. Our contracts are audited for security vulnerabilities and ensure the seamless, trustless execution of features like tokenomics, staking and liquidity provision.

Our platforms facilitate passive income generation through staking tokens to validate transactions and secure networks. Sophisticated reward allocation smart contracts distribute proceeds fairly according to amount/duration staked.

We create ERC-20 compliant utility and governance tokens driving network effects in DeFi economies. Tokenomics are carefully designed for equitable distribution and long-term value accrual. Advanced token functionalities may include staking, farming rewards, portfolio tracking and community governance.

Our non-custodial wallets securely store private keys while abstracting away cryptocurrency complexities. Users easily swap tokens, access liquidity pools and yield farms through connected DEXes and lending protocols. Wallet interfaces integrate seamlessly with browsers and dApps for a holistic DeFi experience.

Our interfaces empower participation in decentralized swap exchanges, lending markets and automated market making. Users swap tokens instantly and provide liquidity to earn fees. Borrowing and lending functionality accommodate flexible interest rates and collateral ratios. Analytics offer insights into yields and portfolio performance.

We architect regulated and decentralized exchanges for high-volume, low-slippage token swapping. Advanced liquidity optimization protocols like constant product market makers incentivize providers with trading fees. Security and scalability are top priorities to accommodate growing TVL and transaction volumes.

Our platforms optimize yields through multi-token vault strategies, liquidity mining rewards and accruing native governance tokens. Sophisticated strategies re-optimize allocations in response to market conditions. UX emphasizes transparency into underlying protocols, historical yields and risk metrics.

Our platforms facilitate peer-to-peer lending and borrowing with decentralized governance. Borrowers access instant, low-collateral loans while lenders earn interest by supplying capital. Credit delegation functionality mitigates default risk. UX focuses on usability, flexibility and transparency.

Our experts provide end-to-end guidance on blockchain strategy, product development and smart contract auditing. Whitepapers, economic models and pitch decks help clients raise funding. Ongoing support assists with business development, compliance and scaling decentralized applications and protocols.

Decentralized Finance (DeFi) is reshaping the financial landscape by offering a range of benefits that enhance accessibility, transparency, and efficiency. Here are some of the key advantages of DeFi development.

A3Logics is at the forefront of the DeFi revolution, offering unparalleled expertise and tailored solutions that empower businesses to thrive in this dynamic space. Here’s why you should choose A3Logics.

With a track record spanning of several projects since established, our extensive hands-on experience enacting diverse visions across distributed systems informs a holistic understanding of DeFi’s evolving paradigm.

By leveraging multi-year R&D efforts across core EVM chains, we envision bespoke options attuned to customers’ unique value propositions. Leveraging open financial protocols, we assemble tailored products aligned with long-term strategic priorities.

From concept deliberations and design-thinking workshops defining optimum systems architecture to testing, auditing and live deployment supervision, expect continuity throughout the project life cycle from a dedicated team.

Powering innovative initiatives worldwide, a history of on-time, on-budget deliveries of pioneering solutions underpins our capabilities. Client satisfaction remains the foremost yardstick validating our dedication to custom-crafted outcomes.

An iterative approach embracing adaptability facilitates incorporating market feedback to maximize value. Collaborative sprints optimize evolving needs amid technical progress with minimum revisions.

Our blockchain engineers author resilient, comprehensive and meticulously optimized smart contracts adhering to established best security practices tailored for auditing, operations and upgrades.

Decentralized protocols enable direct peer-to-peer lending through smart contracts, with borrowers depositing collateral to automatically unlock loans at variable, market-driven interest rates.

Blockchain-based IEO/ICO platforms leverage programmable crowdfunding to issue tokens through distribution smart contracts in a transparent, compliant manner.

Novel decentralized platforms facilitate parametric insurance, risk hedging instruments and pooled coverage through smart contract-based financial derivatives.

Sophisticated yield optimizers autonomously deploy provided liquidity across multiple DeFi assets through incentives, optimizing returns through compounding algorithms.

Decentralized trading of digital assets occurs directly on automated liquidity pools without intermediaries, enabling counterparties to exchange assets peer-to-peer at floating rates.

Digital funds automate algorithmic trading/portfolio rebalancing strategies while DeFi protocols optimize capitalization of yields through advanced frontier techniques like liquidity mining.

Through comprehensive consultation, we help define concrete objectives like user growth, monetization strategies or protocol adoption. Prioritization of features ensures ROI while technical evaluation assesses suitable infrastructure.

Iterative planning establishes KPIs, technical specifications, component architecture and third party integrations. Dependencies are mapped to orchestrate development stages. Risk assessment prepares contingencies to address complications.

Our team meticulously develops programmable, upgradable smart contracts adhering to ERC-20 standards, security best practices and gas optimization techniques. Modular design enables seamless integration of additional features.

Exhaustive testing on development and live networks simulates edge/error cases validating expected functionality and gas usage. Formal/informal security audits by independent firms identify vulnerabilities before mainnet deployment.

Applications are deployed on configurable networks like Ethereum, Polygon, Binance Smart Chain etc. Target networks are selected by balancing user needs with technical constraints. Comprehensive deployment pipelines facilitate App deployment.

Ongoing maintenance through periodic software upgrades enhances functionality and keeps pace with evolving blockchain ecosystems. 24/7 support mitigates issues to ensure optimal user experiences.

A3logics redesigned the logistics software of a mobile app solutions company’s end customer. The project included creating a comprehensive solution with reporting features, order tracking, and system updating.

“Their distinct flexibility and their strong communication were the project’s main assets.”

A construction technology company hired A3logics for custom software development. They created a construction digital platform that allows users to see project areas, distribute resources, and share data.

“Their software has proven essential in the construction sector.”

A3logics created and implemented a custom logistics software solution for a wealth management platform. This included developing features and integrating real-time tracking and data analytics functionalities.

“They ensured our collaboration went well by providing timely items and responding quickly to our requests.”

A3logics created and executed a personalized Generative AI system that featured chatbots for customer service, prediction algorithms, and AI-powered data analysis tools.

“Their technical expertise and reactivity were excellent.”

A3logics has developed an administrative management system for a health testing company. The product is designed to handle operations such as consultant matching, time reporting, and compensation management.

“The collaborative team we’ve worked with has shown great flexibility and excellent project integration.”

A transportation company hired A3logics to create a custom software program for freight activity tracking. The team also created invoicing tools and a driver-tracking system connected to a dispatch system.

“Their thorough inquiry and engagement with our team reflect their commitment to understanding our requirements.”

Remittance, insurance, lending, trade finance and more leverage DeFi’s advantages of disintermediation and enhanced financial inclusion.

Marketing Head & Engagement Manager