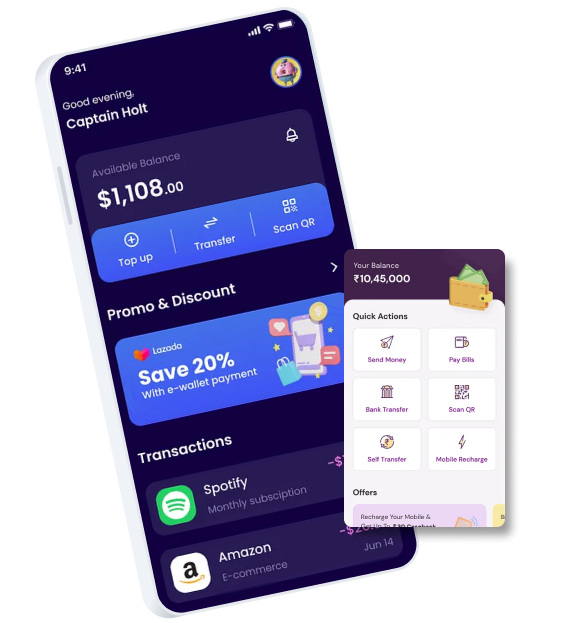

Launch Your eWallet App Development Today!

Get a custom-built eWallet app solution tailored to your business needs.

Connect with us

Spearhead the digital payments industry with A3Logics e-wallet app development services. Save costs and accelerate launch with a digital wallet app built on the pre-developed FinTech Platform by a team of dedicated financial software developers.

We develop custom eWallet apps with cutting-edge features, smooth user experiences, and top-notch security. Our offerings encompass custom UI/UX design, secure APIs, and full backend development to enable businesses to launch competitive digital wallet products.

A3Logics builds mobile wallet applications for both – iOS and Android operating systems. The apps enable contactless transactions, in-app purchases, bill payments, and strong security features. This is important to ensure convenient financial transactions and high device compatibility.

We build secure, blockchain-based cryptocurrency wallets for multiple digital currencies. Our features include private key management, backup features for wallets, and connectivity with prominent blockchain networks to allow secure crypto storage and hassle-free transactions.

We incorporate secure payment gateways such as – PayPal, Stripe, and Razorpay in eWallet applications. This provides secure, instant, and compliant payment processing. Especially for credit cards, debit cards, net banking, and other major digital payment options.

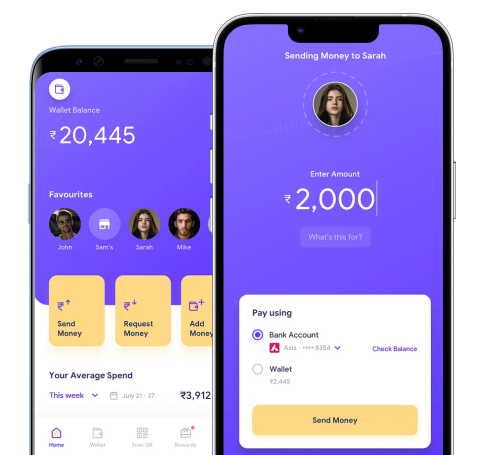

We create peer-to-peer (P2P) payment apps facilitating instant money transfer between users. The features include contact syncing, transaction history, split payment, and real-time notifications, making it an easy experience for sending and receiving money.

We employ AI and machine learning algorithms. They are used to identify fraud trends, reduce risks, and provide safe transactions. Our smart systems track – real-time transactions, highlight anomalies, and fortify your app’s resistance against money-related threats.

We embed blockchain and smart contracts within eWallet applications. This helps to provide greater transparency, security, and automation. This gives – assured tamper-proof transactions, decentralized processing, and trustless operations. Thus enhancing reliability for financial ecosystems.

Our eWallet offerings facilitate multi-currency payment processing and cross-border payments. Companies can provide global users with – seamless currency conversions, international regulation compliance, and lower transaction costs. This is all within an assured and user-friendly environment.

We create NFC and QR code payment functionalities, allowing users to make fast, contactless payments. Our solutions improve convenience for in-store payments, ticketing, and digital payments while ensuring high security.

Get a custom-built eWallet app solution tailored to your business needs.

Connect with usTell us what inspires your eWallet app development idea, and let’s develop an app that is over and above your expectations.

We’re inspired by our clients, who motivated us to develop secure digital wallet apps allowing individuals to send and receive payments, buy things online, and hold money worldwide. The solution features seamless checkout, invoicing, and advanced fraud protection features for individual and business use.

We develop apps such as Cash App providing P2P payments, direct deposits, and investment services. The app facilitates instant money transfers, Bitcoin trading, and even debit card issuance, giving a convenient financial platform for individuals and small enterprises.

Similar Coinbase, we can create cryptocurrency wallet applications. This apps offer support for multiple coins, secure trade, and wallet management. Customers can easily buy, sell, and hold cryptocurrencies, with live price monitoring, KYC/AML adherence, and robust security measures.

We can build apps like Binance with crypto trading capabilities. Other functionalities are – spot and futures trading, staking, lending, multi-level security, and AI-based market analysis. Such apps provide a robust cryptocurrency platform and exchange.

We can build fintech apps that are similar to Revolut. These apps provide – banking, exchange of currencies, budgeting, and trading cryptocurrencies. Users have the ability to control – multi-currency accounts, monitor spending, and indulge in global spending without being charged extraneous fees or subjected to excessive exchange rates.

We create quick P2P payment apps such as Zelle, emphasizing immediate money transfers from bank accounts. The app allows for smooth transactions through mobile numbers or email addresses, with industry-leading encryption and support for top banks.

The admin panel features we offer

The end to end user app features are:

The merchant ewallet features we follow are:

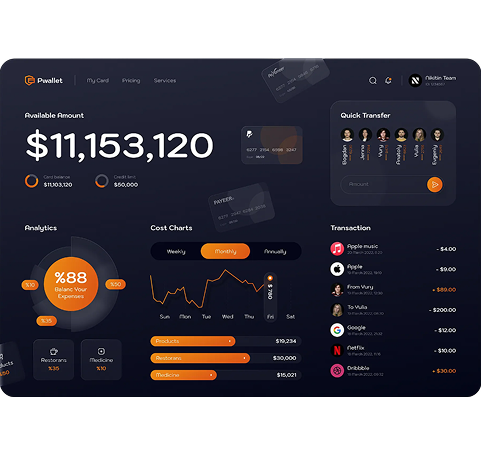

Explore key advanced features in eWallet app development, including AI-powered recommendations, real-time tracking, smart inventory management, and seamless payments.

Our E-wallet app development services feature AI fraud detection systems that monitor transactions in real time, identifying and preventing suspicious activities.

Enable users to generate secure, temporary virtual cards for online purchases, adding an extra layer of protection by masking actual card details.

Facilitate quick and secure contactless payments using technologies like NFC and QR codes, enabling you to make purchases with a simple tap or scan.

Implement robust authentication methods, including biometric scans, PIN codes, and multi-factor authentication. This ensures that only authorized users can access their E-wallet.

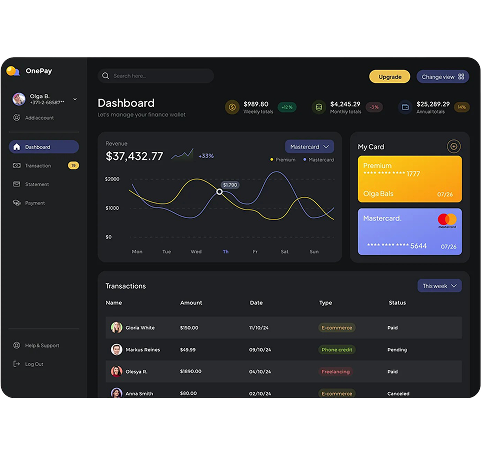

Provide detailed real-time insights to a business into user behavior, transaction history, and financial metrics through an intuitive dashboard.

Using AI, implement AI chatbots or live support for complaints that may have to do with the account, transactions, or troubleshooting.

It allows users to hold, transfer, and transact in more than one currency. This makes the E-wallet application versatile and very easy to use globally.

Allows users to scan or generate QR codes for seamless payments. QR code integration provides a way to complete transactions without card details.

Offer integrated loyalty programs that reward users for their spending habits, increasing customer retention and engagement and adding value to their experience.

Enhance the app’s utility and give users the ability to invest in stocks, mutual funds, or cryptocurrencies directly within the app, creating a one-stop financial platform.

Our digital E-wallet development services have multiple layers of security, including encryption, tokenization, and biometric authentication, to protect user data and transactions.

As a leading grocery delivery app development company we implement the latest technologies to ensure that your business is always prepared for growth.

We leverage AI to create personalized experiences for users, from intelligent transaction insights to predictive spending patterns. AI enhances fraud detection and prevention, ensuring a secure and seamless payment experience that adapts to new contents.

Incorporate blockchain technology for an unparalleled level of security and transparency in transactions. Blockchain’s decentralized nature ensures tamper-proof records, safeguarding user data and streamlining transactions with secure, verifiable payment processes .

By integrating IoT technology, we connect with smart devices to enable instant, location-based payments and secure transactions. This connectivity fosters greater convenience, allowing users to perform transactions through wearables and other IoT-enabled gadgets.

Maximize your business potential by adopting the latest in technology and innovation for your E-wallet app development needs. Our team integrates AI, IoT, Blockchain, and BI to ensure that your app stays ahead of the curve.

We add the Payment Card Industry Data Security Standard wherein all the transactions take place strictly in line with industry standards.

Advanced encryption protocols guard data during transactions. Sensitive information such as financial details or personal data is secure.

Being compliant with GDPR or CCPA, protects the personal data of its users, helps businesses avoid heavy fines and maintains a good reputation.

It is complementary security through additional authentication, such as verification with SMS codes or from bio-scan, reducing the chance of unauthorized access.

Sensitive data is replaced with tokens for enhanced security, making it difficult for attackers to access actual user information adding another layer of security.

Discover the key revenue streams of eWallet apps, from transaction fees to premium features

Charge fees for each transaction processed. By implementing per-transaction fees, percentage-based fees, or tiered pricing.

Consider offering premium features or benefits to users who subscribe to a paid plan including exclusive features, or discounts and rewards.

With in-app advertising, you can display targeted ads to your users, partner with ad networks, or offer promotional partnerships with brands.

You can offer exclusive deals and discounts to your users, or charge merchants a fee for accepting payments through your E-wallet.

We follow a structured process for eWallet app development to ensure consistency throughout.

A3Logics utilizes the latest technologies to build innovative, feature-rich e-wallet apps, ensuring your solution stays ahead in the fast-evolving digital payments landscape.

We focus on intuitive, user-friendly designs that enhance customer experience, driving engagement and making it easy for users to manage transactions with minimal effort.

Our e-wallet solutions are built with top-tier security features and adhere to regulatory standards, ensuring data protection and safeguarding user transactions from fraud or breaches.

Experience our e-wallet app solutions before fully committing with our flexible try-and-buy model, allowing you to assess the app’s capabilities and performance risk-free.

We ensure smooth integration with a wide range of payment gateways, providing users with multiple, reliable options for making secure payments in real-time.

A3Logics provides continuous support and maintenance to keep your app running smoothly, offering timely updates and swift issue resolution to maintain optimal performance.

The features, team experience, and complexity that go into digital wallet app development affect its price. Making a digital wallet app from scratch might cost tens to hundreds of thousands of dollars.

Marketing Head & Engagement Manager