Heimler’s Journey From Blind Spots to Business Clarity – A3logics Unleashes the Power of Live Intelligence

Discover More

Redefining the Future of Lending – Cred Fintech’s Monumental Transformation with A3logics

Discover More

Revolutionizing Credit Risk – How A3logics and Heimler Redefined Trust and Precision with Machine Learning

Discover More

Transforming Risk to Opportunity – A3logics and Heimler Revolutionize Credit Risk Modelling

Discover More

Choose A3Logics as your insurance software development company to empower your insurance business with our innovative software solutions that are feature-rich and designed to enhance efficiency, ensure compliance, and deliver unparalleled customer experiences. We leverage the power of AI, Blockchain, and IoT to ensure your business is ready for the future.

Revolutionize internal operations in the insurance industry with AI agents and chatbots designed to automate repetitive tasks, improve workflow efficiency, and enhance communication. These intelligent solutions empower employees and streamline processes.

Transform the insurance customer experience with AI-powered voice bots that offer real-time assistance, seamless communication, and enhanced accessibility. These advanced voice solutions ensure quicker resolutions, personalized interactions, and operational efficiency.

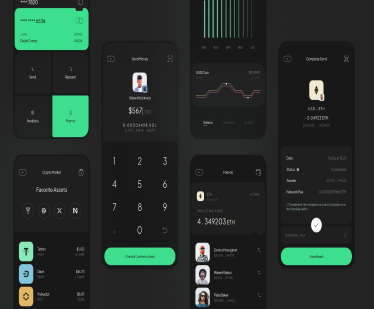

Develop dynamic insurance apps tailored to customer needs, offering features for managing policies, claims, and payments with intuitive interfaces. These apps simplify interactions, boost customer satisfaction, and foster brand loyalty.

Leverage blockchain to develop smart contracts that automate insurance processes, enhance trust, and ensure compliance. These services improve transparency, reduce fraud, and streamline transactions.

Empower insurance providers with AI-driven tools that analyze risks, predict outcomes, and optimize decision-making. These solutions ensure better underwriting, claims processing, and overall risk mitigation.

Utilize our digitization services and knowledge to create bespoke insurance software to increase organizational efficiency, decrease costs, and guarantee a first-rate user experience.

Our consulting services can help you achieve success. Our unbiased advice on buy vs. build, solution implementation, and project roadmaps is backed by our decades-long, extensive domain, industry, and technical knowledge.

Modernizing outdated systems is essential to remaining competitive in today’s fast-paced corporate world. Let our professionals improve your critical software by incorporating cutting-edge web or mobile solutions, upgrading your infrastructure, and introducing essential improvements.

We build underwriting software that automates the process of processing insurance applications, evaluating risks, and calculating premiums. Based on analytics, it can also achieve optimal insurance pricing.

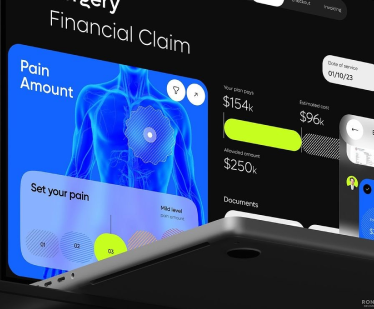

We develop automated claims processing software that handles all aspects of claim management, including data intake, settlement, and reporting. This software, powered by AI, allows for damage assessment, fraud detection, and claim validation.

Our actuarial software development solutions offer a full suite of tools for managing and designing insurance risk models. This system can automate insurance pricing, actuarial calculations, and disclosure reporting.

We deliver comprehensive compliance management services to simplify adherence to regulatory requirements. Our software services ensure accuracy, maintain audit trails, and mitigate legal risks for insurance companies operating in complex environments.

One of the leading providers of EDI services, we offer services that simplify and streamline the insurance sector. Here’s a breakdown of the services we offer for improved inter-organizational collaboration:

RPA has been playing a key role in the insurance industry. It has revolutionized how insurance works by streamlining the workflow, boosting ROI, and improving the overall customer experience.

By implementing AI into our insurance software development services, our experienced developers ensure that your insurance operations are simplified, elevating the various aspects of your business for both policyholders and insurance providers.

Business Intelligence is a powerful tool that allows insurers to do their job better and faster. A3Logics has years of experience implementing BI-driven insurance services across various aspects, improving the overall business performance.

With blockchain technology, we help various insurance companies to create smart contracts to track insurance claims, automate outdated paperwork processes, and safeguard their data, ensuring the best customer service.

We develop specialized software to streamline insurance agency operations. These systems handle client management, policy tracking, sales automation, and commission management, empowering agents with tools to improve productivity and customer relationships.

Policy administration software automates the entire policy lifecycle, from issuance and endorsements to renewals and cancellations. It ensures accuracy, compliance, and efficiency in managing customer policies while reducing administrative overhead.

Insurance billing software simplifies premium collection and payment processes. It supports various payment methods, generates invoices, tracks payment history, and automates reminders, enhancing insurance providers’ financial efficiency.

Insurance portals provide a self-service platform for customers, agents, and brokers. They enable easy access to policy details, claims status, premium payments, and customer support, improving engagement and user satisfaction.

Customer Relationship Management (CRM) software tailored for insurance agents helps manage leads, track customer interactions, and automate follow-ups. It ensures better customer engagement, leading to higher retention and sales conversions.

Specialized accounting software for the insurance industry automates financial transactions, premium calculations, and expense tracking. It ensures compliance with financial regulations and provides accurate insights for better decision-making.

Develop platforms where customers can compare policies from various insurers. These marketplaces simplify buying by providing transparent information, personalized recommendations, and easy enrollment options.

Enterprise Resource Planning (ERP) software integrates multiple insurance business processes into one system. It streamlines operations, enhances data accuracy, and provides comprehensive insights into organizational performance.

Develop CRM systems tailored for the insurance industry to handle customer data, automate workflows, and improve lead conversion rates. These systems ensure a personalized customer experience and enable agents to focus on core selling activities.

Document management software digitizes and organizes insurance documents, such as policies, claims, and contracts. It enables easy retrieval, secure sharing, and compliance with legal and industry regulations, reducing administrative burdens.

We design custom insurance software development solutions for various insurance industry sectors.

Our services for agents and brokers include CRM systems, commission-tracking platforms, and customer engagement tools. These services help streamline client interactions, improve sales processes, and provide real-time insights for informed decision-making.

We empower InsurTech startups with scalable, innovative services designed to disrupt traditional insurance models. From AI-driven underwriting platforms to seamless digital claims processing systems, we help startups launch products faster, reduce costs, and gain a competitive edge.

We deliver advanced policy administration systems, claims management platforms, and CRM services for established insurance providers. These tools enable automation, improve efficiency, and ensure compliance with evolving industry standards while enhancing customer satisfaction.

We offer enterprise-grade insurance management services that help corporate clients efficiently manage employee benefit programs, liability insurance, and risk management policies. Our tailored software ensures streamlined workflows and real-time analytics for better decision-making.

Our services for healthcare providers include insurance billing systems, patient eligibility verification platforms, and claims adjudication tools. These systems simplify insurer interactions, reduce administrative overhead, and ensure timely reimbursements.

We develop custom insurance software for government agencies managing public insurance programs. Our services, which include robust claims processing systems and compliance and reporting tools, ensure transparency, scalability, and efficiency in delivering public insurance services.

We offer advanced risk modeling, data analytics, and portfolio management services for reinsurance companies. Our software supports seamless collaboration with primary insurers, enabling accurate risk assessment and optimized reinsurance agreements.

A3Logics utilizes advanced technologies such as AI, blockchain, and IoT to deliver next-gen insurance software services. We empower insurers with tools for automated claims processing, risk analysis, and seamless policy administration to stay ahead in a competitive market.

We focus on designing intuitive, user-friendly interfaces to enhance agent and customer experiences. Our services simplify complex insurance processes, driving engagement and operational efficiency for insurers and their clients.

Our insurance software services have industry-leading security features, ensuring data protection and adherence to regulatory standards such as HIPAA, GDPR, and PCI DSS. This reduces the risk of breaches and maintains compliance.

Experience the capabilities of our insurance software development services with our flexible try-and-buy model. Test-drive our solutions risk-free to evaluate their performance, scalability, and alignment with your business goals before committing fully.

We ensure effortless integration with existing systems, such as CRM, ERP, underwriting platforms, and third-party APIs, creating a unified platform for efficient operations, data management, and enhanced decision-making.

A3Logics provides comprehensive support and maintenance services to ensure your insurance software remains reliable, up-to-date, and optimized. From regular updates to quick issue resolution, we keep your systems performing at their best.

A3logics redesigned the logistics software of a mobile app solutions company’s end customer. The project included creating a comprehensive solution with reporting features, order tracking, and system updating.

“Their distinct flexibility and their strong communication were the project’s main assets.”

A construction technology company hired A3logics for custom software development. They created a construction digital platform that allows users to see project areas, distribute resources, and share data.

“Their software has proven essential in the construction sector.”

A3logics created and implemented a custom logistics software solution for a wealth management platform. This included developing features and integrating real-time tracking and data analytics functionalities.

“They ensured our collaboration went well by providing timely items and responding quickly to our requests.”

A3logics created and executed a personalized Generative AI system that featured chatbots for customer service, prediction algorithms, and AI-powered data analysis tools.

“Their technical expertise and reactivity were excellent.”

A3logics has developed an administrative management system for a health testing company. The product is designed to handle operations such as consultant matching, time reporting, and compensation management.

“The collaborative team we’ve worked with has shown great flexibility and excellent project integration.”

A transportation company hired A3logics to create a custom software program for freight activity tracking. The team also created invoicing tools and a driver-tracking system connected to a dispatch system.

“Their thorough inquiry and engagement with our team reflect their commitment to understanding our requirements.”

Marketing Head & Engagement Manager