Mortgage

Software Development Company

Software Development Company

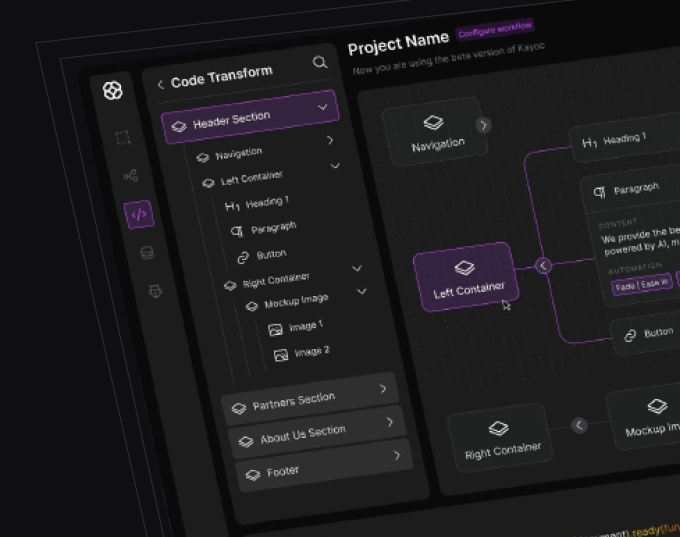

Heimler’s Journey From Blind Spots to Business Clarity – A3logics Unleashes the Power of Live Intelligence

Discover More

Redefining the Future of Lending – Cred Fintech’s Monumental Transformation with A3logics

Discover More

Revolutionizing Credit Risk – How A3logics and Heimler Redefined Trust and Precision with Machine Learning

Discover More

Transforming Risk to Opportunity – A3logics and Heimler Revolutionize Credit Risk Modelling

Discover More

In today’s fast-paced mortgage landscape, having efficient, user-friendly, and innovative software solutions is essential for success. At A3 Logics, we focus on developing custom mortgage software designed to meet specific requirements of your business.

We offer end-to-end mortgage software development services that cater to all aspects of the mortgage lifecycle. Combining our fintech experience with new-age technologies, our expert mortgage developers craft innovative mortgage software solutions that will completely change the way you manage mortgage processes.

We offer top-notch mortgage software development services at competitive rates, making it accessible for businesses to benefit from our advanced solutions. Whether you need a complete mortgage management system or specific functionalities integrated into existing software, we are here to support your goals.

With our mortgage software consulting services, we’ll analyze your current processes and tech stack to ensure optimized efficiency. We analyse your needs and problems using the best industry practices and create a comprehensive roadmap to maximize your ROI.

We build powerful mortgage solutions that facilitate quicker loan processing cycles, enhance user experience, and improve operational efficiency, ensuring that your software supports your unique workflows and goals.

If you want to switch from a legacy mortgage software to a modern solution, we help you migrate smoothly. We offer software migration services ensuring least disruption and optimum data integrity that enables your business to run smoothly during the upgrade.

We offer mortgage data integration services that connect your software with various third-party platforms. This integration provides a holistic view of your data, enhancing workflow efficiency and ensuring accurate, real-time information across your mortgage management systems.

We excel in performing software testing, ensuring the mortgage software solutions are trustworthy and secure. Our extensive quality assurance process comprises both functional, performance testing and security audits, helping spot issues earlier in the development cycle.

A3logics support services ensure optimal performance of your mortgage software and quickly address any issues that may arise. From updates to troubleshooting, our experienced team is here for you when needed.

We excel in creating mortgage management software that provides support to the whole loan lifecycle. Our solution helps in portfolio management, claims handling, interest calculations, insurance tracking, and detailed reporting, enhancing overall efficiency.

With our automated underwriting systems, we help businesses process loan request forms quickly and accurately. These systems reduce the manual errors, hence the approval process becomes considerably more efficient, thereby facilitating quick turnaround times for your clientele.

We provide the mortgage industry with scalable Robotic Process Automation (RPA) solutions. Our RPA systems automate repetitive tasks through intuitive rules-based engines, allowing for high-volume processing while maintaining accuracy and consistency, ultimately enhancing productivity and reducing operational costs.

Choosing A3logics for mortgage software development means partnering with an expert team committed to your business success. With deep industry knowledge paired with cutting-edge solutions, we tailor our services to your particular requirements so you get the software that optimizes growth and operational efficiency.

Our mortgage software development solutions offer significant advantages, including streamlined processes and enhanced efficiency. By leveraging advanced technology, we enable better decision-making and improved customer experiences that help your business grow and stay competitive.

Our mortgage software solutions help businesses optimize the entire workflow of loan processing, reducing process bottlenecks and manual intervention. This efficiency speeds up turnaround times, enabling organizations to solve customer queries quickly and ultimately providing better overall client satisfaction and retention.

We ensure that our software complies with industry regulations allowing companies to keep compliance without a hassle. Checks are automatically performed every time information is transferred into the system and reports can be easily generated ensuring that all processes align with current laws, minimizing the risk of penalty, as well as building trust with clients.

We provide customizable features in our software solutions as per the requirements of your business. This adaptability guarantees that your software grows with your needs, allowing you to make changes rapidly without compromising in the market.

A3logics mortgage software solutions minimises manual intervention by automating the routine processes. It both reduces the margin for error and helps staff to apply their energies on higher-value work, boosting productivity so your team can provide enhanced service to clients.

With our mortgage software solutions, businesses benefit from centralized data management, enabling easy access to critical information. This enhances decision-making capabilities, ensures data accuracy, and provides valuable insights that drive strategic initiatives and improve operational efficiency.

Our mortgage software solutions are designed to grow with your business. As your needs change or client base grows, our solutions can scale to handle increased demand and ensure that you keep it efficient and effective no matter how your business evolves.

At A3logics, we leverage cutting-edge technology to improve efficiency and user experience. By integrating innovative solutions, we streamline processes, improve data management, and provide insightful analytics, ensuring a seamless and responsive platform.

We have been one of the best mortgage software development companies in the business and below we have specified some of the reasons for the same

Our mortgage software developers bring rich industry knowledge and technical expertise to your project. This ensures the creation of customized solutions tailored to meet your specific needs, enabling better business outcomes.

With years of experience and a history of successful solutions, our developers excel at enhancing efficiency and driving tangible results for your mortgage software projects.

We offer adaptable engagement options that cater to your unique requirements. Whether you need complete project support or specific components, our developers integrate seamlessly into your team to ensure smooth collaboration.

Collaboration is central to our work philosophy. Our developers engage closely with your team, maintaining open communication to ensure alignment with your goals and expectations throughout the project lifecycle.

Our developers stay ahead of the curve by embracing the latest technologies and best practices. This commitment to continuous improvement ensures enhanced user experience, operational efficiency, and innovative solutions for your mortgage software.

Our mortgage software development process starts with an in-depth consultation to understand your business’s unique challenges. This helps us identify key pain points and create tailored solutions just for you.

We conduct a detailed requirement analysis to define key features, prioritize improvements, and align development with your goals.

In the design phase, our UI/UX experts create intuitive, user-friendly interfaces that ensure seamless navigation. We focus on delivering an effortless experience, enabling both your team and clients to interact smoothly with the software.

In this stage, our expert developers turn your ideas into robust mortgage software using modern technologies, ensuring security, scalability, and readiness for future growth.

Software testing is crucial to our process. We conduct thorough quality checks to identify and resolve issues, ensuring smooth functionality before launch.

Our support continues after launch. We offer ongoing maintenance to keep your software updated and performing optimally, with a dedicated team ready to assist and implement improvements.

A3logics redesigned the logistics software of a mobile app solutions company’s end customer. The project included creating a comprehensive solution with reporting features, order tracking, and system updating.

“Their distinct flexibility and their strong communication were the project’s main assets.”

A construction technology company hired A3logics for custom software development. They created a construction digital platform that allows users to see project areas, distribute resources, and share data.

“Their software has proven essential in the construction sector.”

A3logics created and implemented a custom logistics software solution for a wealth management platform. This included developing features and integrating real-time tracking and data analytics functionalities.

“They ensured our collaboration went well by providing timely items and responding quickly to our requests.”

A3logics created and executed a personalized Generative AI system that featured chatbots for customer service, prediction algorithms, and AI-powered data analysis tools.

“Their technical expertise and reactivity were excellent.”

A3logics has developed an administrative management system for a health testing company. The product is designed to handle operations such as consultant matching, time reporting, and compensation management.

“The collaborative team we’ve worked with has shown great flexibility and excellent project integration.”

A transportation company hired A3logics to create a custom software program for freight activity tracking. The team also created invoicing tools and a driver-tracking system connected to a dispatch system.

“Their thorough inquiry and engagement with our team reflect their commitment to understanding our requirements.”

Our loan origination software solution helps greatly reduce time spent on processing loans by automating and standardizing steps involved with loan form submission and approval process. With less manual tasks and processing times, your team can spend more time on high-value activities, while responding to the clients faster and increasing customer satisfaction rates.

Marketing Head & Engagement Manager