Small Business Group

Health Insurance

Health Insurance

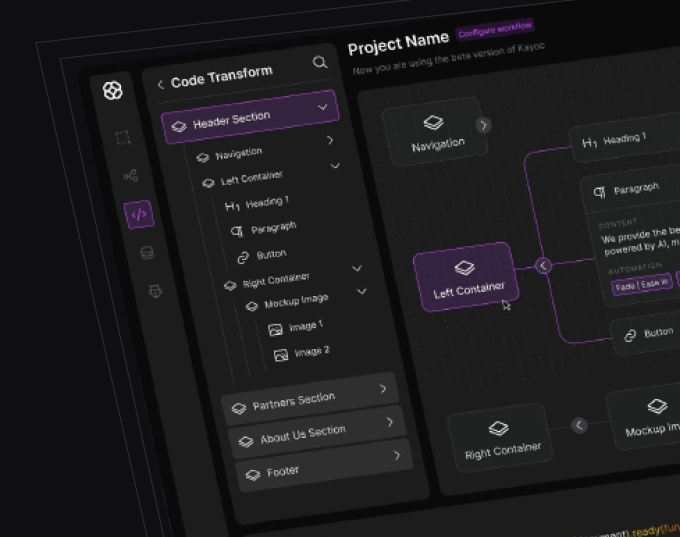

Heimler’s Journey From Blind Spots to Business Clarity – A3Logics Unleashes the Power of Live Intelligence

Discover More

Redefining the Future of Lending – Cred Fintech’s Monumental Transformation with A3Logics

Discover More

Revolutionizing Credit Risk – How A3Logics and Heimler Redefined Trust and Precision with Machine Learning

Discover More

Transforming Risk to Opportunity – A3Logics and Heimler Revolutionize Credit Risk Modelling

Discover More

Let our certified benefits advisors handle the complexity of choosing the right group health insurance plan options for your business.

The process of choosing the right health benefits plans that fit your company’s budget and employee needs doesn’t need to be complicated. That’s why we give you access to licensed agents who can help you set up the right group health insurance plan for your small or mid-sized business. By partnering with us, you get a range of services like:

We connect you with leading regional and national carriers for helping you choose the right group health insurance plan. You can also consult with our expert benefits advisors to receive a quote for your coverage option. Our consultants also help you with provider comparisons for.

Apart from assisting you in choosing a group health insurance plan, we also provide a complete HR solution that simplifies benefits administration in your business. Whether you’re just getting started with your benefits strategy or looking for better ways to streamline – A3Logics works for you! By using our Benefits administration software solution, you can:

You may not a part of Fortune 500 companies, but you can deliver enterprise-grade benefits to your workforce by outsourcing HR and benefits administration functions to us. Our consultants will take care of your benefits and workforce management needs while you focus on your business growth. We offer

Modern employees look to work for companies that offer attractive benefits and compensation packages. Offering a more competitive package lets you attract and retain top talent faster.

By offering satisfactory wellness and benefits perks, you can build a healthy and productive workforce easily. Group health insurance lets you create a healthy work environment.

Business health insurance is typically affordable than an individual policy. When more employees enroll in group health plans, the lower the health insurance costs for everyone.

A3Logics redesigned the logistics software of a mobile app solutions company’s end customer. The project included creating a comprehensive solution with reporting features, order tracking, and system updating.

“Their distinct flexibility and their strong communication were the project’s main assets.”

A construction technology company hired A3logics for custom software development. They created a construction digital platform that allows users to see project areas, distribute resources, and share data.

“Their software has proven essential in the construction sector.”

A3Logics created and implemented a custom logistics software solution for a wealth management platform. This included developing features and integrating real-time tracking and data analytics functionalities.

“They ensured our collaboration went well by providing timely items and responding quickly to our requests.”

A3Logics created and executed a personalized Generative AI system that featured chatbots for customer service, prediction algorithms, and AI-powered data analysis tools.

“Their technical expertise and reactivity were excellent.”

A3Logics has developed an administrative management system for a health testing company. The product is designed to handle operations such as consultant matching, time reporting, and compensation management.

“The collaborative team we’ve worked with has shown great flexibility and excellent project integration.”

A transportation company hired A3Logics to create a custom software program for freight activity tracking. The team also created invoicing tools and a driver-tracking system connected to a dispatch system.

“Their thorough inquiry and engagement with our team reflect their commitment to understanding our requirements.”

Small business group health plans typically cover medical, dental and vision care as well as prescription drug coverage, mental health services and maternity coverage. Some plans also may offer life, disability and long-term care policies as part of the package, exact coverage options and benefits provided depend upon which insurance provider and how well their plans meet the business and employees.

Small business owners can select an optimal group health insurance plan for their employees by considering factors like coverage options, cost and provider network as well as employee preferences and needs. They should consult insurance brokers/agents as well as compare plans from multiple providers before seeking feedback from employees to make an informed decision.

Key factors when selecting a small business group health insurance provider include cost and deductibles, coverage options available, customer service reputation and claims handling procedures, network of healthcare providers included within plan as well as any extra benefits or perks provided by provider.

Marketing Head & Engagement Manager